June 17, 2022

The Week’s Biggest Winner & Loser

Boeing (BA)

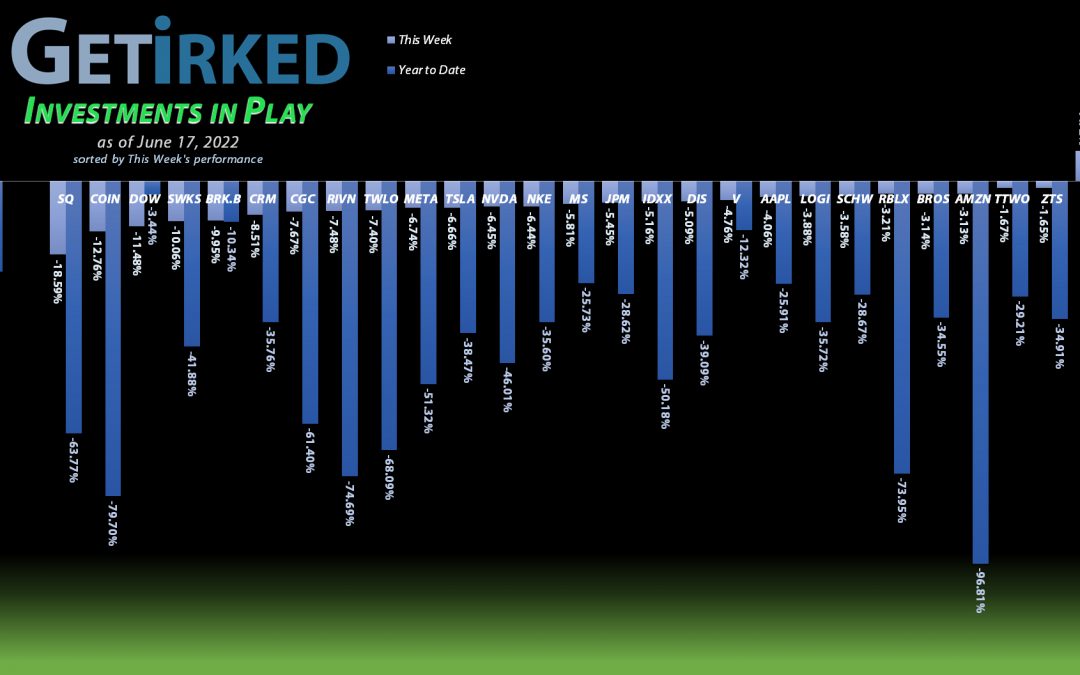

Both the Investments in Play and Speculation in Play portfolios had the same type of winner this week – a quirky, little weirdo of a stock that had been underperforming for weeks which suddenly decided to pick a week of red to turn green. In this case, it was Boeing (BA) which jumped +7.72% this week on news that China might start flying the 787-Max again. This easily gave Boeing the spot of the Week’s Biggest Winner as the stock in second spot, newcomer Zoetis (ZTS), finished the week down -1.45%… and that was second place.

Block (SQ)

Fintech’s been in trouble for weeks and with Bitcoin getting slammed down nearly -30%, any stock with exposure to the crypto got hit, too. So, it was no surprise that Block (SQ), a fintech company with Bitcoin exposure, took the brunt of the week’s beatings, finishing the week down -18.59% and locking in the spot of the Week’s Biggest Loser.

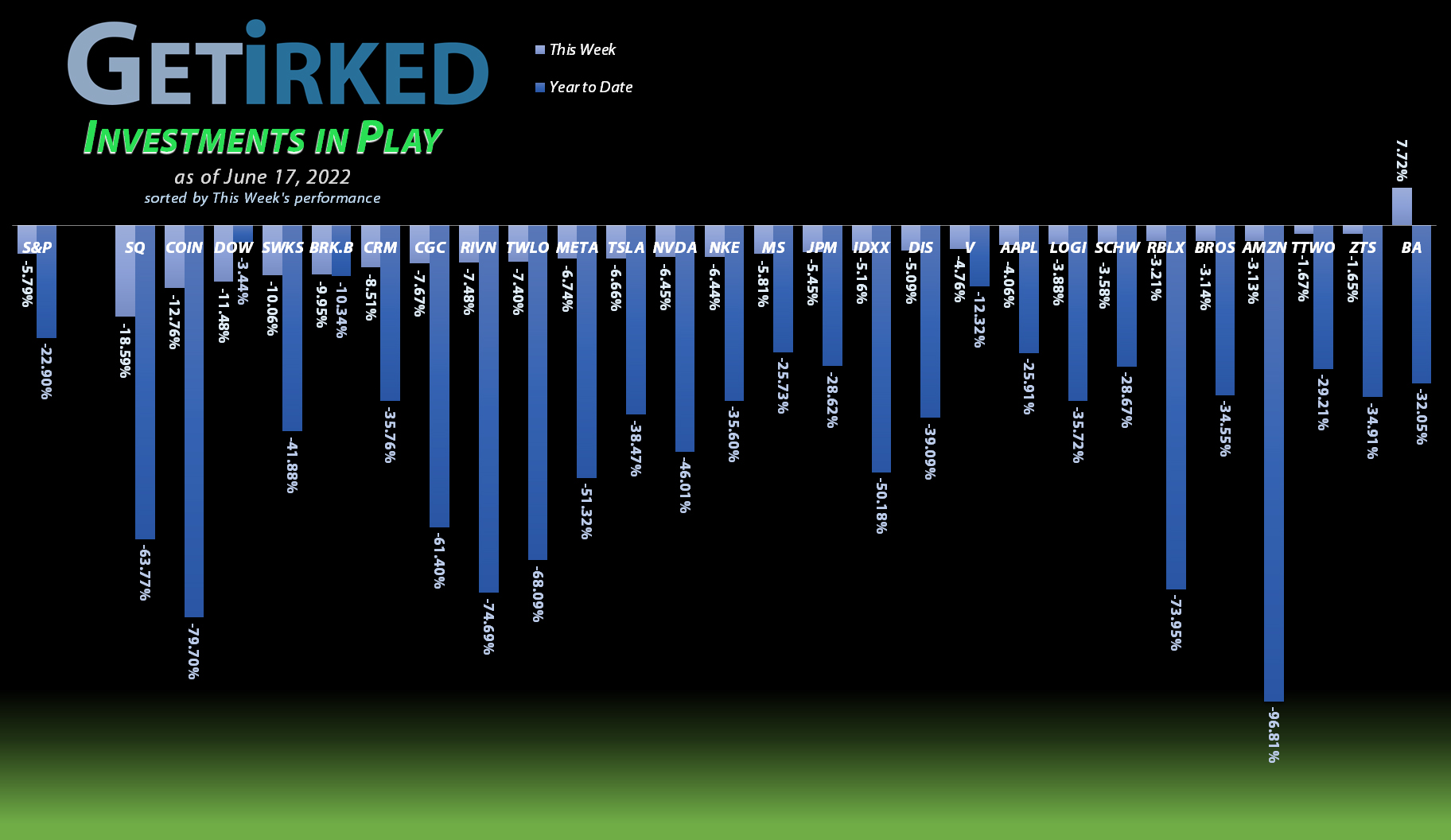

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

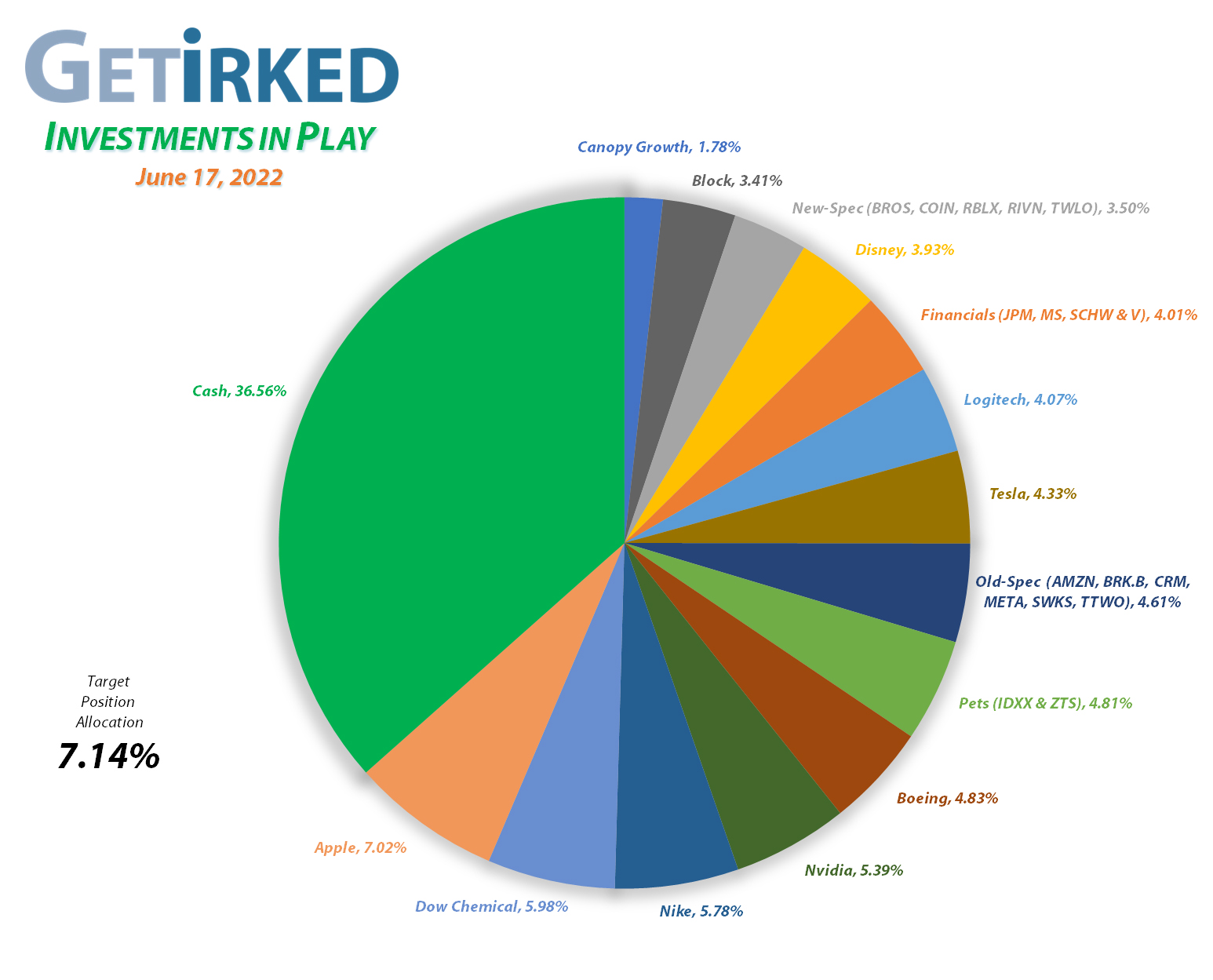

Current Position Performance

Apple (AAPL)

+731.09%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.15)*

Nvidia (NVDA)

+601.14%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$12.60)*

Tesla (TSLA)

+568.18%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Boeing (BA)

+547.68%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+492.35%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+412.22%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.10)*

Logitech (LOGI)

+317.48%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.70

Skyworks (SWKS)

+313.40%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

IDEXX Labs (IDXX)

+312.44%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Disney (DIS)

+155.32%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Amazon (AMZN)

+79.28%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+70.60%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+66.42%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Dow (DOW)

+64.21%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.35

JP Morgan (JPM)

+48.53%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Berkshire (BRK.B)

+46.59%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Salesforce (CRM)

+42.28%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Zoetis (ZTS)

+0.81%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.55

Visa (V)

-0.17%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $190.33

Morgan Stan (MS)

-9.16%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $80.25

Dutch Bros (BROS)

-11.61%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Schwab (SCHW)

-17.87%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.04

Twilio (TWLO)

-28.00%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Roblox (RLBX)

-41.28%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Canopy (CGC)

-46.07%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.25

Rivian (RIVN)

-55.82%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-75.88%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position

Block (SQ) continued selling off after Monday’s rout, dropping through its 2022 lows on Tuesday and triggering my next buy order which filled at $61.75. The buy locked in a -51.87% discount on shares I sold for $128.30 on July 7, 2020 and raised my per-share “cost” +$3.60 from -$75.05 to -$71.45 (a negative per-share cost indicates all capital has been taken out of the position in addition to $71.45 of profit per-share which is added to the portfolio’s bottom line).

From here, my next buy price target is $53.35, above a past point of support, and my next sell target is $145.00, below the high of its 2022 bull rally and far above the point where the position will exceed the target allocation size for the portfolio.

SQ closed the week at $58.51, down -5.25% from where I added on Tuesday.

Logitech (LOGI): Added to Position

Logitech (LOGI) got hit particularly hard during this week’s selloff, falling through my next buy price target which filled at $51.90 on Monday. The buy locked in a -44.63% discount replacing some of the shares I sold on November 5, 2020 for $93.74, and raised my per-share cost +$0.80 from $11.90 to $12.70.

From here, my next buy target is $45.85, above a past point of support, and my next sell target is $105.80, below a past point of resistance, and also a point where the position will have far outgrown the target allocation size for the portfolio.

LOGI closed the week at $53.02, up +2.16% from where I added on Monday.

Meta Networks (META): Added to Position

I have been slow rebuilding my position in Meta (META) (formerly Facebook (FB)) with my first buy since 2017 made back on February 10, 2022. On Monday, META broke through to new 2022 lows, triggering my next buy which filled at $166.05.

The buy raised my per-share “cost” +$230.65 from -$295.25 to -$64.60 (a negative per-share cost indicates all capital has been taken out of the position in addition to $64.60 of profit per-share which is added to the portfolio’s bottom line).

From, here my next buy target is $129.20, and my next sell target is $380.80, just under Meta’s all-time high.

META closed the week at $163.74, down -1.39% from where I added on Monday.

Morgan Stanley (MS): Added to Position

Morgan Stanley (MS) sold off with the rest of the financial sector on Thursday following the Fed’s rate hike, triggering my next buy order which filled at $72.86. The buy lowered my per-share cost -1.50% from $81.47 to $80.25.

From here, my next buy target is $67.00, above a past point of support, and my next sell target is just under $109.00, below MS’s current $109.73 all-time high.

MS closed the week at $72.90, up +$0.04 from where I added on Thursday.

Visa (V): Added to Position

Visa (V) held up remarkably well during much of this week’s selloff, then lost support on Friday when, oddly enough, the rest of the market bounced higher. V triggered my next buy order which filled at $187.00 and lowered my per-share cost – 1.71% from $193.65 to $190.33.

From here, my next buy target is $170.15, above a past point of support, and I have no sell targets for this position at this time since it is still small relative to the rest of the financial basket as I want to approach this sector cautiously given the current macroeconomic climate.

V closed the week at $190.01, up +1.61% from where I added on Friday.

Zoetis (ZTS): *New Position*

During Monday’s selloff, it was time to add a new position to the Investments in Play portfolio – Zoetis (ZTS), a pet pharmaceutical and treatment play. Long-time readers may find this one odd since I have held IDEXX Labs (IDXX), a similar play on the space, since 2017. However, I wanted more exposure to the space, and since one of my key rules is never turn a winner into a loser, I knew I wouldn’t have the opportunity to add enough to IDXX to make it a full allocation.

Additionally, Zoetis (ZTS) brings it with an O.K. dividend yield around 0.8%, something IDXX does not have, so I wanted to bring this Best-in-Breed into the portfolio as a part of a new basket, the Pets Basket, which will obviously comprise both IDXX and ZTS.

I opened my position in ZTS at $157.55 on Monday, down -36.80% from its $249.27 all-time high set just in December 2021.. From here, my next buy target is $141.65, above a past point of support, and I have no sell targets at this time.

ZTS closed the week at $158.83, up +0.81% from where I opened it Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.