May 27, 2022

The Week’s Biggest Winner & Loser

Dutch Bros (BROS)

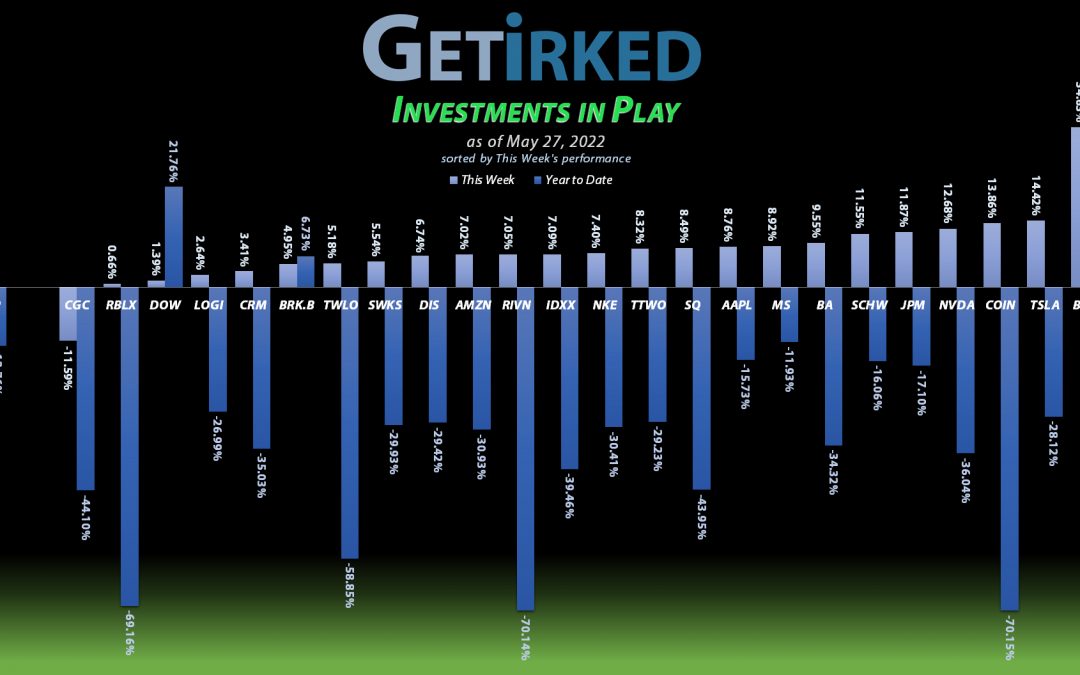

Sometimes, a stock will pop on no news and, even in an up market, the pop can be extraordinary. This week, it was Dutch Bros (BROS) turn, and I guess the market had far too severely punished this coffee stock because it positively exploded +34.63%. Even in a face-ripping bear market rally, that figure was so big that BROS easily won the spot of the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

Just in case you may have forgotten, Canopy Growth Corp (CGC) reminded everyone during their earnings call that the U.S. still hasn’t legalized recreational cannabis on the Federal level. The earnings were so bad that even in an unbelievable rally, CGC turned south and finished the week down another -11.59% to earn itself the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

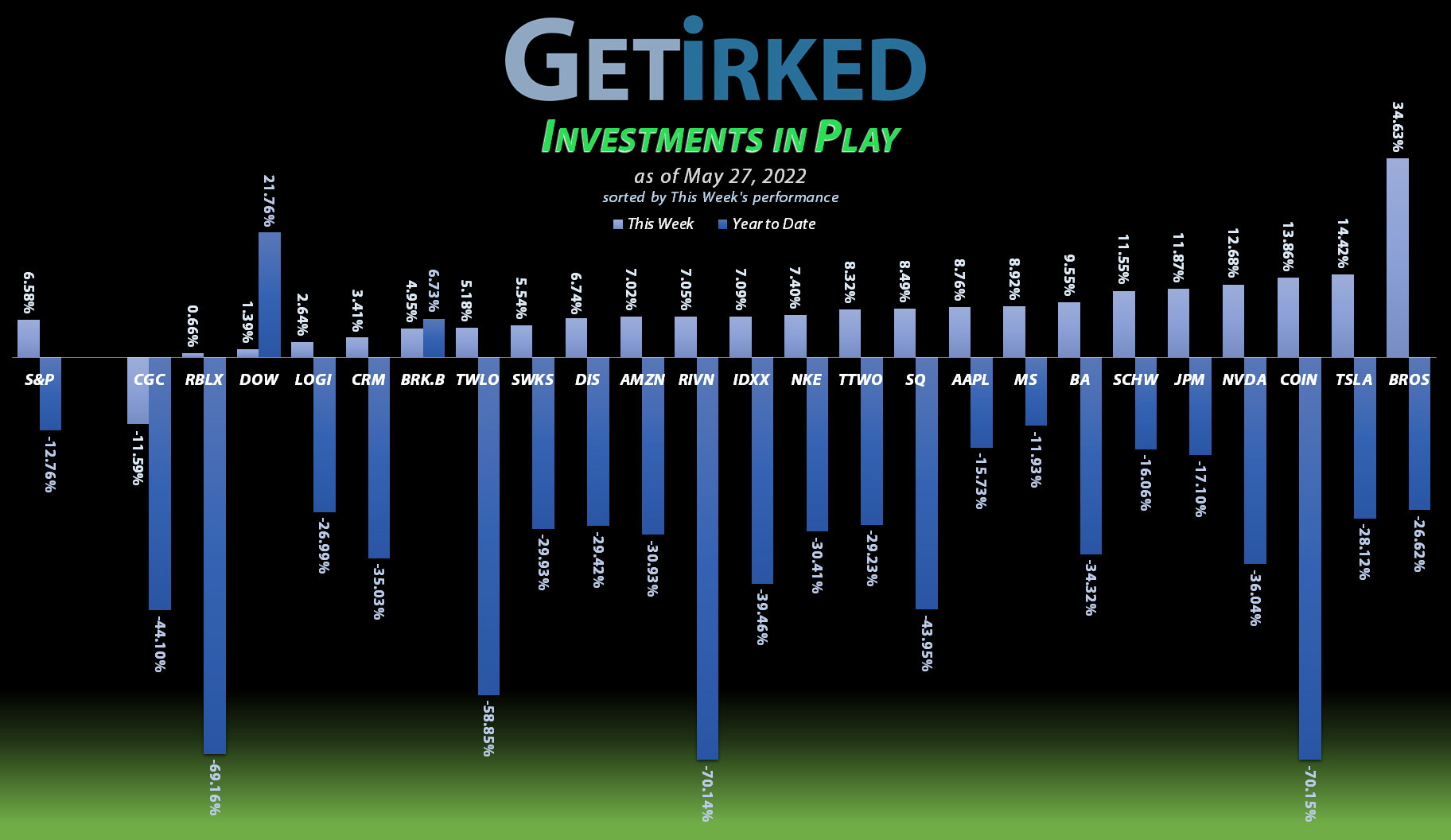

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+810.38%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.15)*

Nvidia (NVDA)

+703.94%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$12.60)*

Tesla (TSLA)

+653.44%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Block (SQ)

+610.75%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.05)*

Boeing (BA)

+538.90%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Logitech (LOGI)

+484.87%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.95

Nike (NKE)

+443.65%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.10)*

Skyworks (SWKS)

+373.20%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.85)*

IDEXX Labs (IDXX)

+372.41%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Disney (DIS)

+195.86%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Take Two (TTWO)

+166.38%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Dow (DOW)

+104.62%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.75

Amazon (AMZN)

+94.35%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $1,184.96

Meta (FB)

+75.80%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Berkshire (BRK.B)

+74.50%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+72.50%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Salesforce (CRM)

+43.88%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Visa (V)

+9.73%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $194.00

Morgan Stan (MS)

+6.11%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $81.47

Dutch Bros (BROS)

-0.89%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Schwab (SCHW)

-3.63%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.25

Twilio (TWLO)

-7.14%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Canopy (CGC)

-26.05%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.60

Roblox (RLBX)

-31.00%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Rivian (RIVN)

-47.88%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-64.53%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

The Serenity in Patience… and Buying in Stages

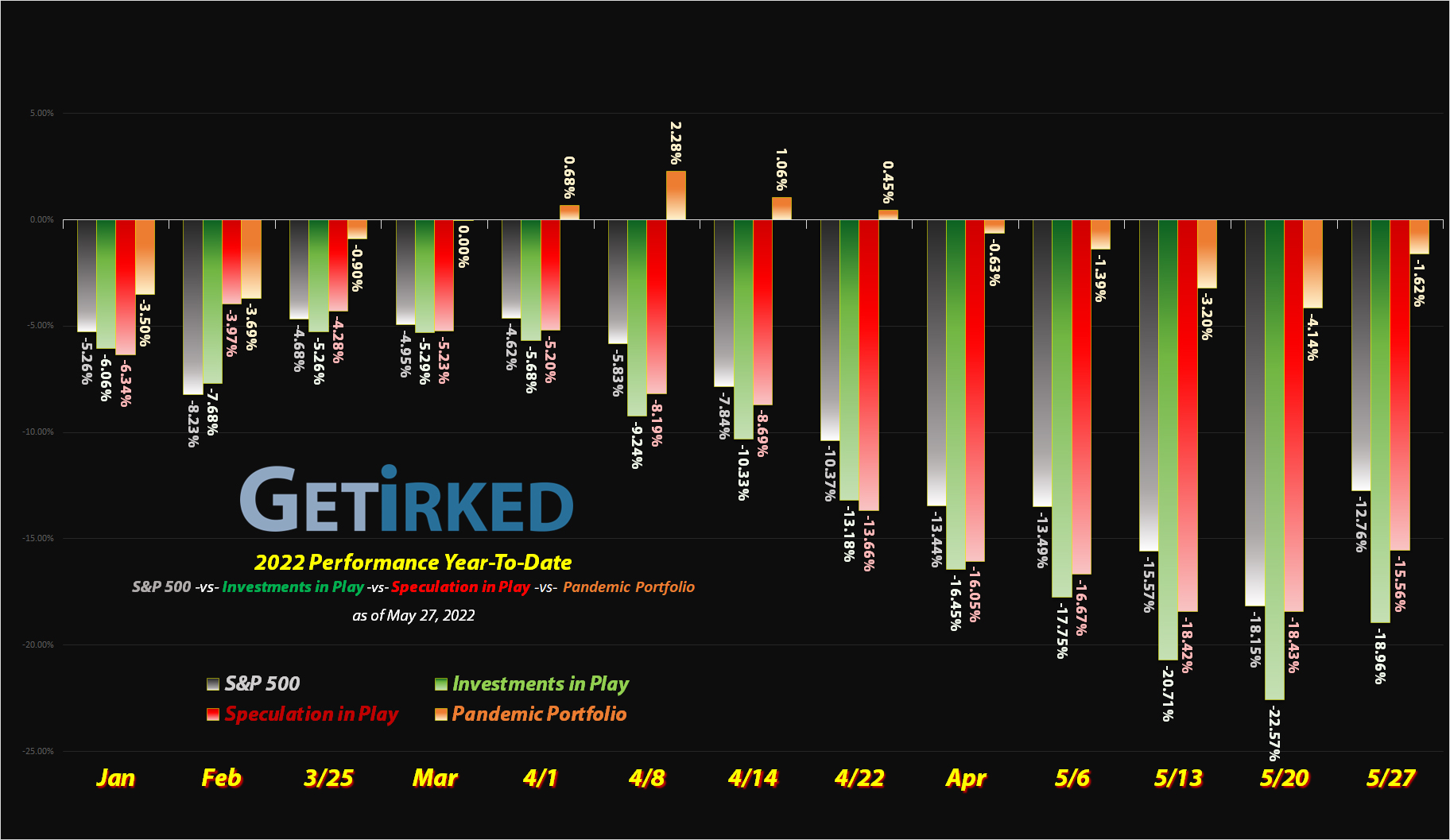

When the market took off like a scalded cat on Thursday, I could sense all of the FOMO buying (Fear Of Missing Out) as the DOW hopped more than 1.5%, the S&P 500 popped more than 2%, the NASDAQ jumped more than 3% at their highs during a single session.

These are unheard-of moves. At least, they were before the pandemic. Now, these kinds of moves are nearly commonplace both headed higher and dropping lower.

I sat back and watched as investors who had panic-sold during last week’s rout flipped to panic-buying during this week’s rally, and I can’t help but think, “Man, am I glad I Buy in Stages rather than buying all at once.”

If this really marks the bottom and we don’t test the 2022 lows, sure, I missed buying near the bottom in some of my positions. However, I still added to nearly all of my positions at some point during 2022. Plus, I have plenty of cash on the sidelines to add more just in case this really isn’t the bottom of this bear market.

By being patient, watching price action, making a plan, and Buying in Stages instead of all at once, I enjoy the luxury of not feeling the need to buy during panic rallies like Thursday because I already have established-positions. Additionally, I also get to avoid the terrifying need to cut my losses during panic selloffs because I’ve already taken profits at higher levels, and, instead I get to look for opportunities to replace the shares I sold at much higher prices.

There are a myriad of day-traders out there who thrive on the dramatic emotions these kinds of volatile swings can bring, but, for me, with my 20+ year time horizon, I’d prefer to grab a bag of popcorn and simply be entertained by the market’s moves.

No fear of missing out. No panicky need to protect my capital. Just entertainment on the day-to-day with success over the long-term.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.