April 22, 2022

The Week’s Biggest Winner & Loser

Dow Chemical (DOW)

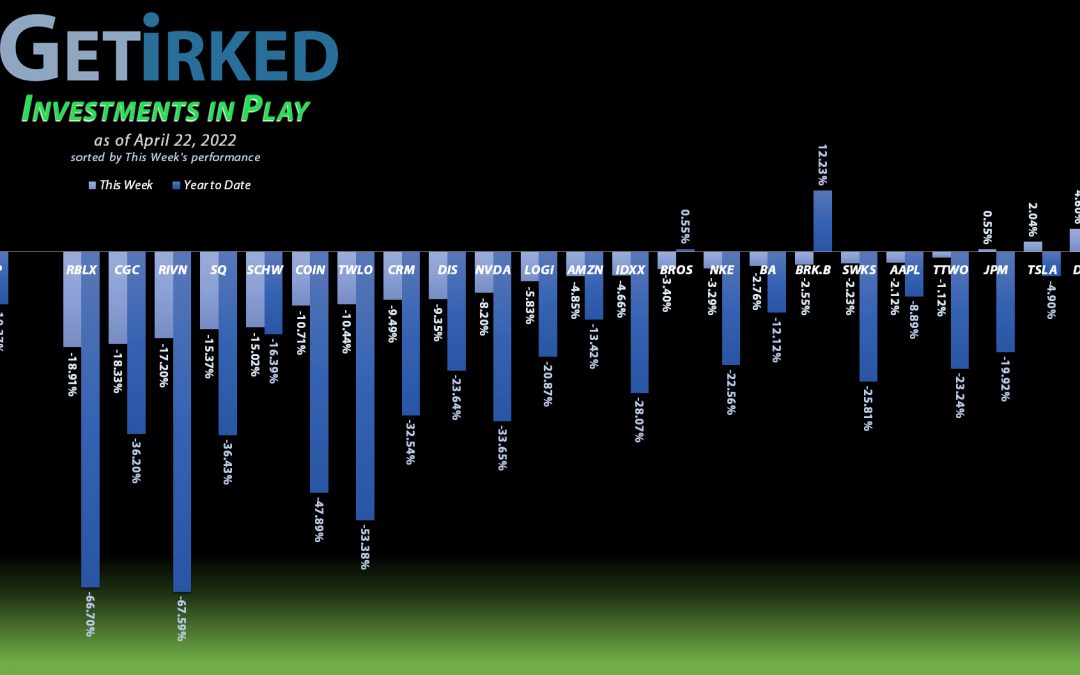

In an absolute sea of red, Dow Chemical (DOW) really took the time to shine this week with a blowout earnings report. Despite the rest of the market selling off in a big, bad way, DOW cruised through the week to finish it up +4.60%, earning it the spot of the Week’s Biggest Winner… no small feat!

Roblox (RBLX)

When the market sells off across the board, the most speculative plays tend to get hit the hardest, and there are few more speculative than the metaverse-play Roblox (RBLX). RBLX dropped a whopping -18.91%, easily snagging the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+859.95%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Tesla (TSLA)

+844.80%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Nvidia (NVDA)

+728.63%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$12.60)*

Block (SQ)

+650.47%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Boeing (BA)

+617.86%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$175.40)*

Logitech (LOGI)

+532.26%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Nike (NKE)

+489.49%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$9.59)*

IDEXX Labs (IDXX)

+434.81%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+394.41%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.85)*

Amazon (AMZN)

+294.43%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $731.95

Disney (DIS)

+242.43%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $34.55

Take Two (TTWO)

+180.44%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Dow (DOW)

+100.00%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $34.25

Berkshire (BRK.B)

+83.49%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Meta (FB)

+74.10%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

JP Morgan (JPM)

+71.71%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $73.85

Salesforce (CRM)

+49.39%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Dutch Bros (BROS)

+26.40%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Twilio (TWLO)

+0.62%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $122.03

Schwab (SCHW)

-7.84%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $76.30

Canopy (CGC)

-15.60%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.60

Roblox (RLBX)

-33.49%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $51.65

Coinbase (COIN)

-51.46%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $270.95

Rivian (RIVN)

-52.49%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $70.75

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

The Financials Basket: *Added Schwab (SCHW) to the Portfolio*

I’ve been wanting more exposure to the financials sector ever since I closed Citibank (C) back in 2020. Banks and the financials tend to outperform during both inflationary and recessionary environments, two possible scenarios that may be likely now.

Rather than give another entire allocation in my portfolio to the sector, I decided to roll my existing JP Morgan (JPM) position in with some additional companies that offer exposure to the financial sector, but not as money-center banks.

The first newcomer to the Financials Basket is Schwab (SCHW), the investment management and brokerage firm (which also happens to be one of my primary brokers). In addition to being the best-in-breed in the space, SCHW pays out a $0.80/shr annual dividend which works out to a 1.05% yield from my opening price.

SCHW disappointed on Monday, causing a pretty substantial selloff in the stock and triggering my first small buy order which filled at $76.30. From here, my next price target is $67.40, above a past point of support, and I will continue adding to the position over time.

The third player in the basket will be a credit card provider. I’m currently eyeing American Express (AXP), Mastercard (MA), and Visa (V), and I’m leaning toward Visa since it’s my own favorite credit card provider. Finally, the fourth stock will be an investment bank and I’m looking at Morgan Stanley (MS). JP Morgan might be the best-in-breed money-center bank, but Morgan Stanley has been rising to the top when it comes to the investment bank sector.

SCHW closed the week at $70.32, down -7.84% from where I opened the position.

Canopy Growth Corporation (CGC): Added to Position

Canopy Growth Corporation (CGC) broke down with the rest of the cannabis sector this week, testing its 2022 low of $5.62 on Friday which triggered a buy order of mine that filled at $5.64.

The buy lowered my per-share cost -2.94% from $6.80 to $6.60. From here, my next buy target is $4.90, a past point of support, and my next sell target is $21.26, just under a past point of resistance.

CGC closed the week at $5.57, down -1.24% from where I added on Friday.

Coinbase (COIN): Added to Position

Despite Bitcoin holding up remarkably well during the week’s selloff, crypto-related stocks like Coinbase (COIN) did not fare so well. On Friday, COIN triggered my next buy order which filled at $136.10 and lowered my per-share cost -7.66% from $293.43 to $270.95.

From here, my next buy target is $116.15, a price determined using the Fibonacci Retracement method, and my next sell target is $344.15, below COIN’s high from its last bull rally in late 2021.

COIN closed the week at $131.52, down -3.37% from where I added on Friday.

Disney (DIS): Added to Position

After Netflix’s (NFLX) disastrous quarter, the rest of the media companies with streaming-sector exposure sold off in a big way, too. Disney (DIS) broke through my next price target with a buy order that filled at $118.36 on Friday.

The order raises my per-share cost +$3.34 from $31.21 to $34.55, still a -17.48% reduction from my initial buy at $41.70 back on February 14, 2012. From here, my next buy price target is $102.40, above a past point of support, and my next sell target is $175.30, just under a significant point of resistance.

DIS closed the week at $118.27, down -$0.09 from where I added on Friday.

Dow Chemical (DOW): Profit-Taking

Dow Chemical (DOW) continued its rally this week, triggering a sell order which filled on Wednesday at $67.74. The order locked in +17.66% in gains on shares I bought for $57.56 back on November 22, 2021, and also lowered my position’s per-share cost -1.28% from $35.20 to $34.75.

On Thursday, DOW reported another blowout earnings quarter, causing the stock to pop above my next sell target which filled at $70.39, locking in +25.45% in gains on shares I bought for $56.11 on November 22, 2021 and lowering my per-share cost another -1.44% from $34.75 to $34.25.

In the portfolio, DOW remains the position with the most original capital in it, so I have plans to take additional profits if it continues higher with my next sell target around $73.00, calculated using the Fibonacci Retracement method. My next buy target is $52.35, above DOW’s last selloff low in December 2021.

DOW closed the week at $68.50, down -0.83% from my average $69.07 selling price.

Nvidia (NVDA): Added to Position

The entire gaming sector got positively slammed this week following Corsair Gaming’s (CRSR) negative outlook on the space. Nvidia (NVDA) broke through its 2022 lows on Friday, triggering a buy order of mine which filled at $195.45.

The buy raised my per-share “cost” +$9.85 from -$22.45 to -$12.60 (a negative per-share cost indicates all capital has been removed from the position in addition to $12.60 per share which adds to the portfolio’s bottom line).

From here, my next buy target is $155.10, above a past point of support, and my next sell target is $288.50, slightly below NVDA’s last 2022 high.

NVDA closed the week at $195.15, down -0.15% from where I added on Friday.

Rivian (RIVN): Added to Position

After reporting supply-chain concerns that might not be alleviated until late 2022 or even later, Rivian (RIVN) and the rest of the Electric Vehicle (EV) sector sold off throughout the week with RIVN triggering a buy order I had in place at $33.85 on Thursday, slightly above its all-time low.

The buy lowered my per-share cost -5.48% from $74.85 to $70.75. From here, my next buy target is $27.30, a price forecasted using Fibonacci Retracement method, and my next sell target is $104.50, slightly below a past point of support.

RIVN closed the week at $33.61, down -0.71% from where I added Thursday.

Roblox (RBLX): Added to Position

Roblox (RBLX) continued to retreat this week with the rest of the more speculative names from 2021, dropping near its all-time low at $36.04 and triggering a buy order on Wednesday at $36.52. The buy lowered my per-share cost -5.05% from $54.40 to $51.65.

From here, my next buy target is $30.30, above the psychological support of the $30.00 mark, and my next sell target is $102.65, just under a past point of resistance.

RBLX closed the week at $34.35, down -5.94% from where I added on Wednesday.

Salesforce (CRM): Added to Position

Salesforce (CRM) broke down with the rest of tech on Thursday, breaking through its 2022 lows and triggering a buy order of mine which filled at $180.73. The buy raises my per-share cost +$16.50 from $98.25 to $114.75, still a -15.24% reduction from my initial buy in the stock at $134.05 back on June 11, 2018.

From here, my next buy target is $135.75, a past point of support, and I don’t intend to take profits in this high-flyer until it makes an attempt at its $311.75 all-time high.

CRM closed the week at $171.43, down -5.15% from where I added on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.