April 1, 2022

The Week’s Biggest Winner & Loser

Twilio (TWLO)

The markets remembered that cloud computing companies don’t have to worry about supply chains this week, with many popping. However, the one that truly made it airborne was Twilio (TWLO), popping +9.48% to be this Week’s Biggest Winner. The victory is somewhat bittersweet, of course, since even after this week’s popped, TWLO is still down -35.63% Year-to-Date (YTD). Ouch!

Canopy Growth Corp (CGC)

How quickly the mighty have fallen. Canopy Growth Corp (CGC) and the rest of the recreational cannabis sector were the big winners last week after hopes that Congress might pass the MORE Act to legalize the greenie treats. The bloom fell off the weed this week, however, with Canopy dropping -15.19%, puffing up the Week’s Biggest Loser stogey.

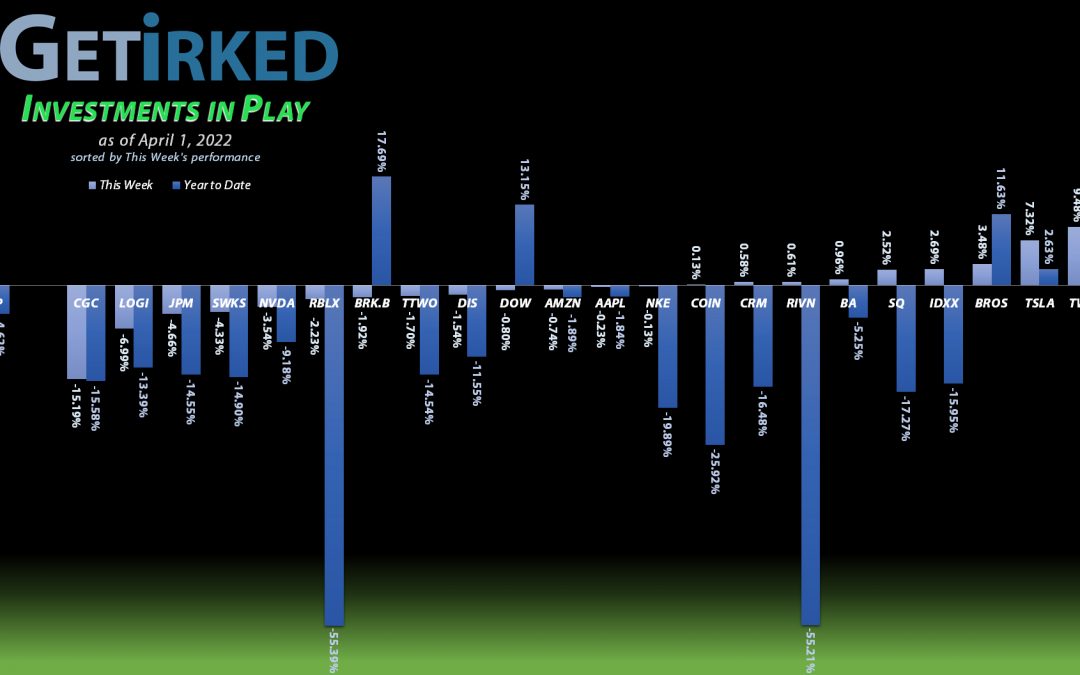

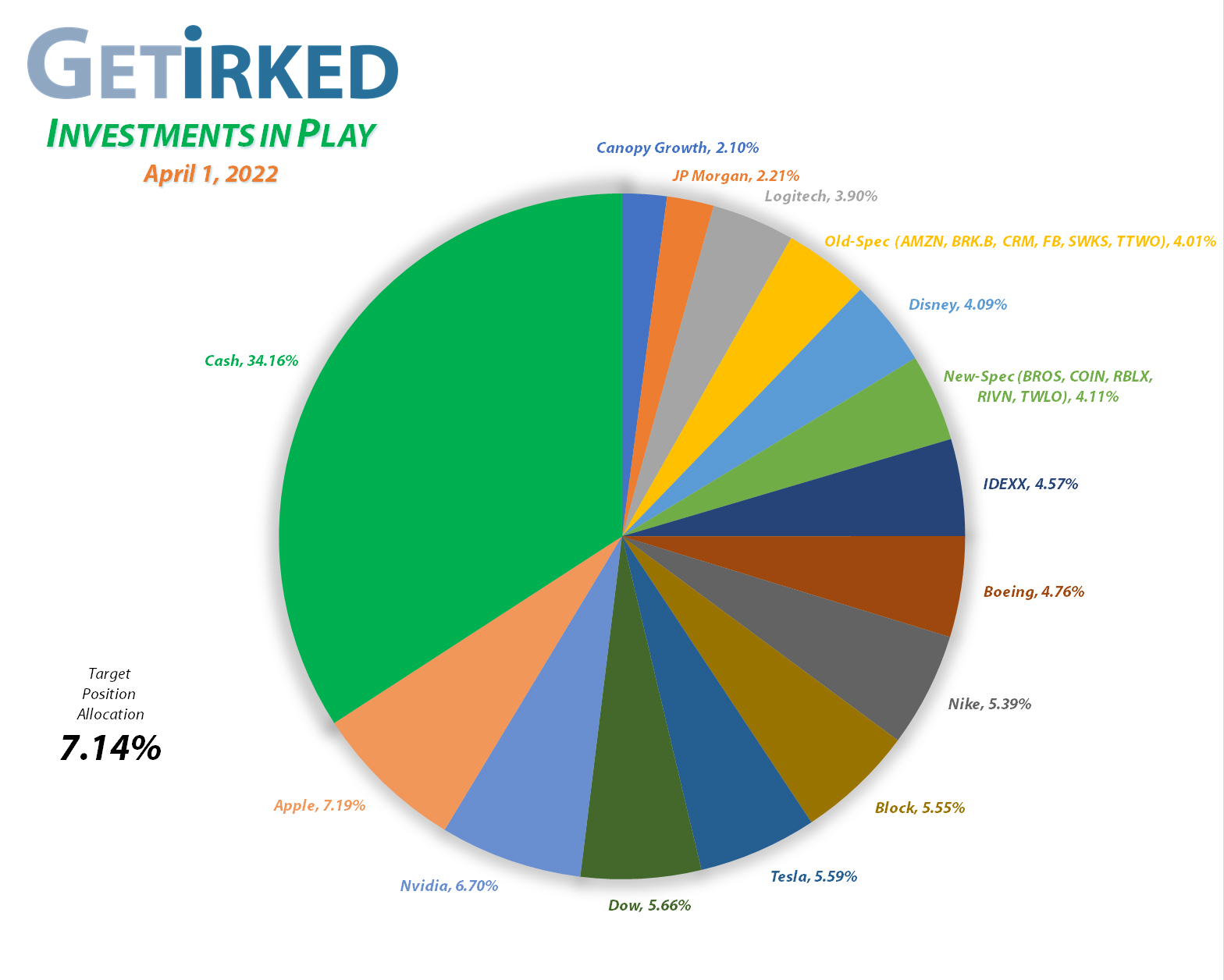

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of 11 positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Meta (FB), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Nvidia (NVDA)

+969.69%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$22.45)*

Apple (AAPL)

+914.77%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Tesla (TSLA)

+906.82%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Block (SQ)

+758.47%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Boeing (BA)

+642.13%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$175.40)*

Logitech (LOGI)

+590.43%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Nike (NKE)

+504.16%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$9.61)*

IDEXX Labs (IDXX)

+500.79%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+445.14%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.31)*

Amazon (AMZN)

+346.92%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $731.95

Disney (DIS)

+338.90%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $31.21

Take Two (TTWO)

+200.90%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Salesforce (CRM)

+116.02%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $98.25

Berkshire (BRK.B)

+92.42%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+83.22%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $73.85

Meta (FB)

+80.40%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Dow (DOW)

+80.39%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.58

Dutch Bros (BROS)

+40.32%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Twilio (TWLO)

+38.90%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $122.03

Canopy (CGC)

+8.25%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.80

Roblox (RLBX)

-15.40%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $54.40

Coinbase (COIN)

-36.28%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $293.43

Rivian (RIVN)

-37.96%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $74.85

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Don’t second-guess yourself… and avoid greed at all costs!

Another week with no moves in the Investments in Play portfolio left me kicking myself after I raised my sell target on Apple (AAPL). Apple had exhibited such strength last week (and through much of this week) that I thought it would test its all-time high, even though my price target was $179.41 where my discipline dictated I needed to reduce its allocation size in the portfolio.

Well, on Wednesday, Apple would have triggered my sell order at $179.41 and then reversed direction just $0.20 later, hitting a high of $179.61 before pulling back for the rest of the week. Had I just stuck with my initial plan and kept to my discipline instead of getting greedy, I would have locked in a 15%+ gain on shares I bought less than two months ago.

Instead, now I have to plan for a more extreme pullback. Turns out long-term investing is a lot like taking the SATs: you should always trust your first instinct.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.