March 25, 2022

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

What has been the one limitation holding back the recreational cannabis sector? Federal Legalization.

What bill is Congress looking at signing next week? One that could be a huge step toward full Federal Legalization.

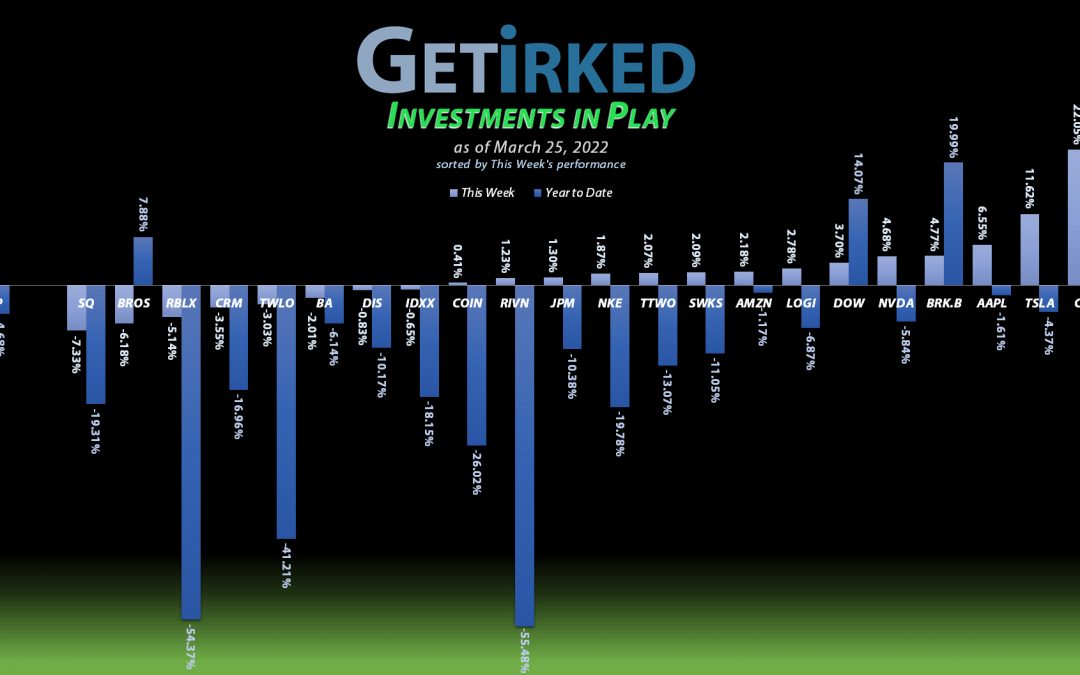

Yeah, the pot stocks got high this week. I don’t even care how cliché a pun that is. Canopy Growth Corporation (CGC), the position in this portfolio that covers that sector, rocketed +22.05% this week, almost breaking even for the year, and easily owning the Week’s Biggest Winner recognition.

Block (SQ)

Block (SQ) has been riding high the past few weeks so it was no surprise when it pulled back this week. “How high?,” you ask? Even after this week’s -7.33% selloff, Block is still up more than +57% from this year’s lows. So, yeah, SQ might earn the spot of this Week’s Biggest Loser, but I’d hardly call it a loser for anyone who got in near its lows.

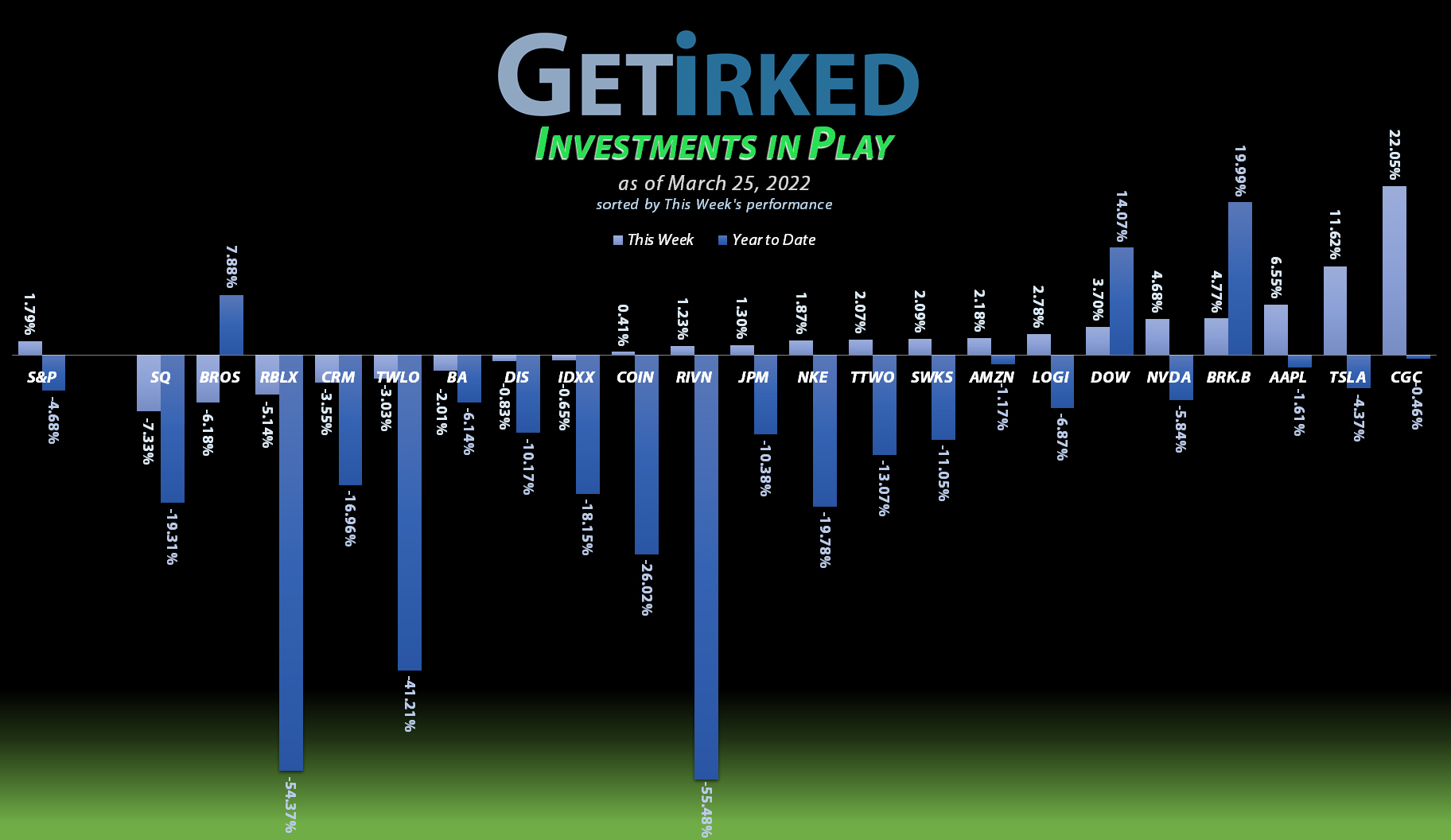

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of 11 positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Meta (FB), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

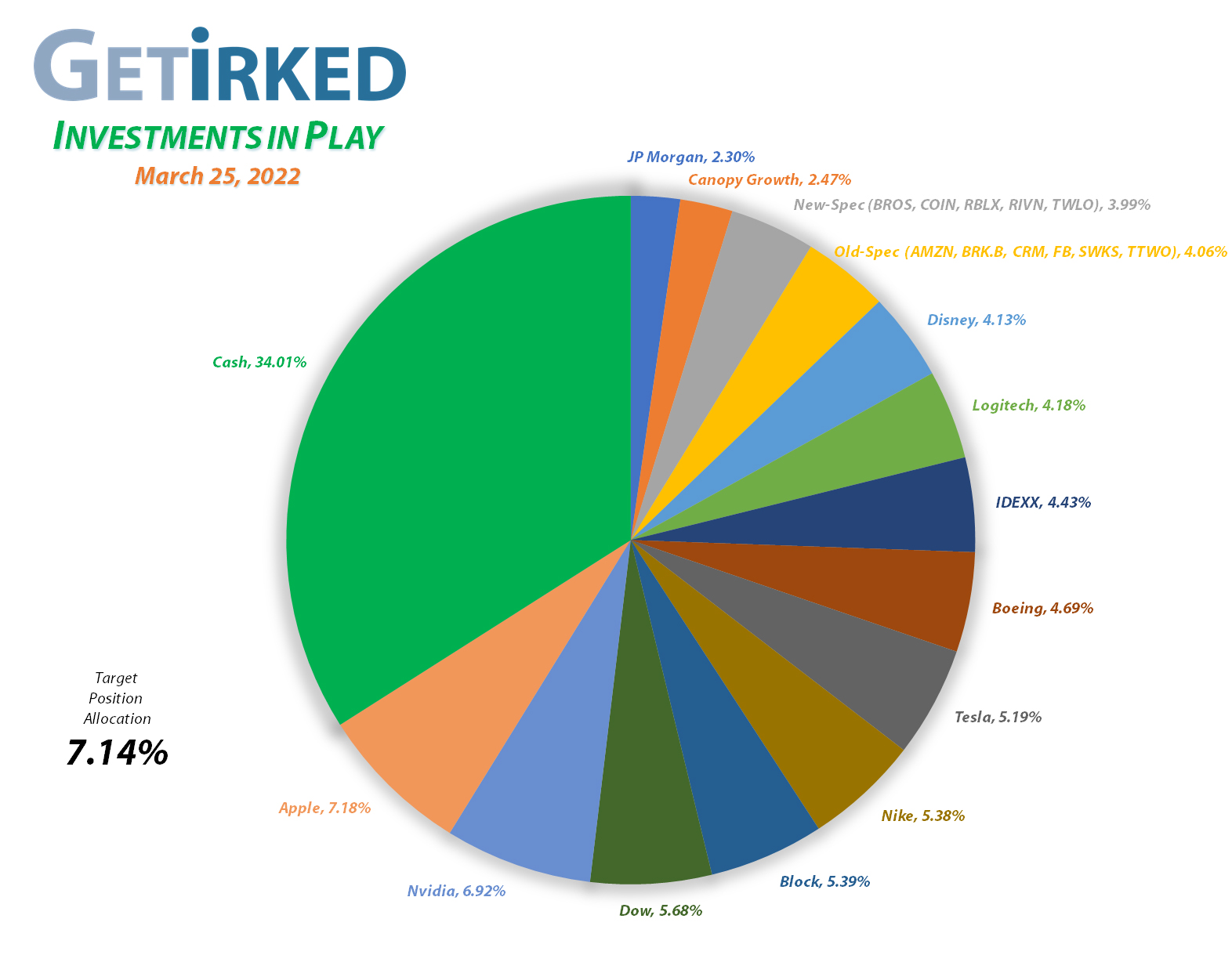

Current Position Performance

Nvidia (NVDA)

+1,002.37%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$22.45)*

Apple (AAPL)

+916.57%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Tesla (TSLA)

+849.16%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Block (SQ)

+746.99%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Logitech (LOGI)

+641.05%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Boeing (BA)

+638.95%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$175.40)*

Nike (NKE)

+504.80%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$9.61)*

IDEXX Labs (IDXX)

+488.80%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+462.33%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.31)*

Amazon (AMZN)

+350.23%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $731.95

Disney (DIS)

+345.75%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $31.21

Take Two (TTWO)

+204.37%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Salesforce (CRM)

+114.78%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $98.25

Berkshire (BRK.B)

+96.18%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+92.17%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $73.85

Dow (DOW)

+81.85%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.58

Meta (FB)

+79.91%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Dutch Bros (BROS)

+35.60%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Canopy (CGC)

+27.81%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.80

Twilio (TWLO)

+26.87%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $122.03

Roblox (RLBX)

-13.47%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $54.40

Coinbase (COIN)

-36.37%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $293.43

Rivian (RIVN)

-38.33%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $74.85

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

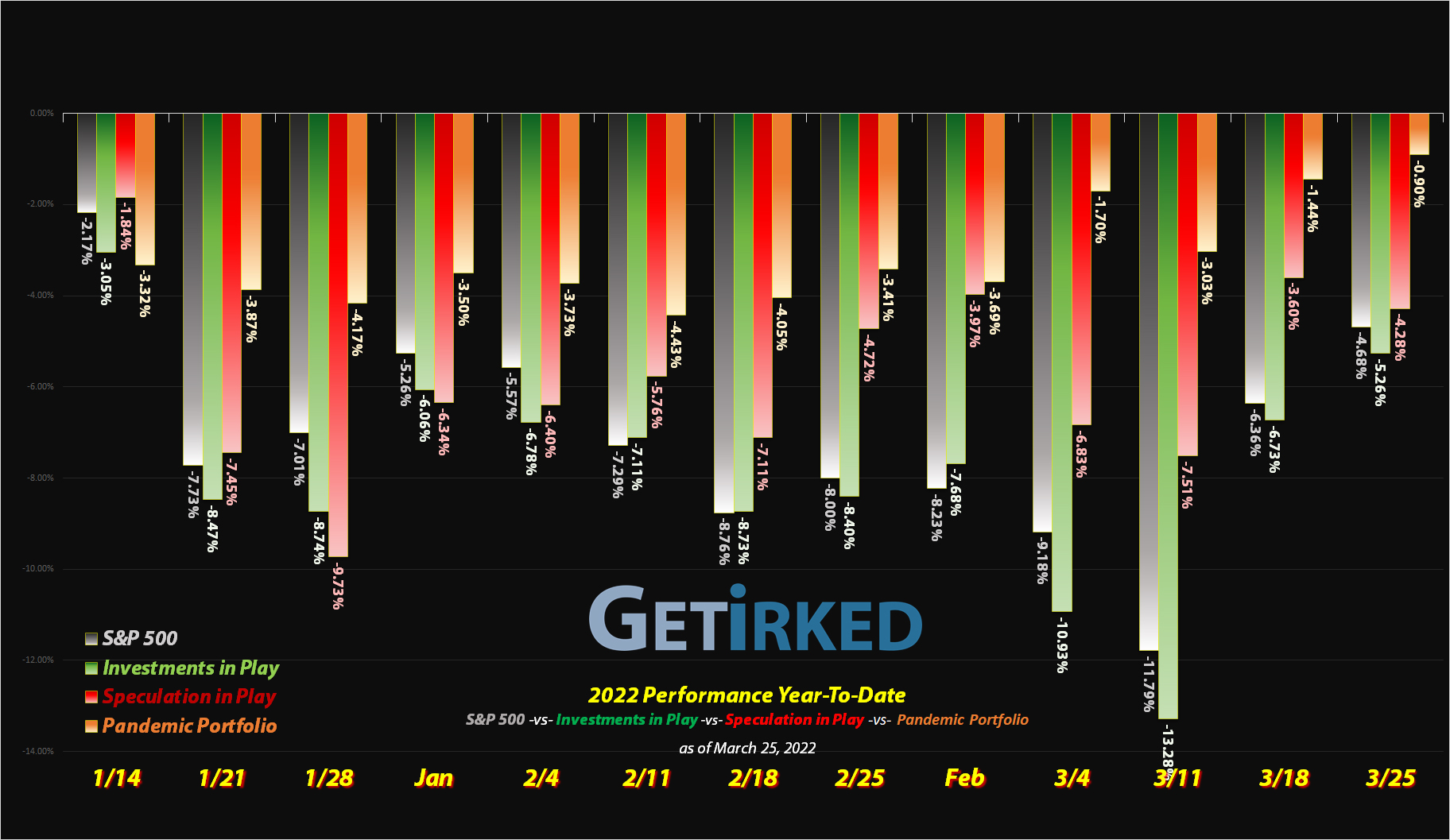

The market is in limbo… for the moment…

Bull markets are predictable. Bear markets are predictable. The trickiest part for any long-term investor is where the market is… right now. The market has had an incredible bounce off its lows on no real positive catalyst.

Sure, the markets were extremely oversold, but they had reason to be – out-of-control inflation, the worst war Europe has seen potentially since World War 2, and so many unknowns. So, what’s an investor to do?

Simple. Nothing.

Never forget that taking no action at all is, in itself, an action. If you don’t know what to do, the best thing to do is to do nothing. The market has exited Buying Season, however, across the board it’s not near Selling Season, either.

A few of the positions in the Investments in Play portfolio (Apple, Nvidia, etc.) may be reaching profit-taking points, but they’re not there, yet. So, instead of trying to force a move, during stock market cycles like this, the best thing to do is to ignore price action; wait for the market’s next big move so we can figure out what to do next.

In other words, take a break. Go watch a movie. Go for a hike. Ignore the markets. At least, for now.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.