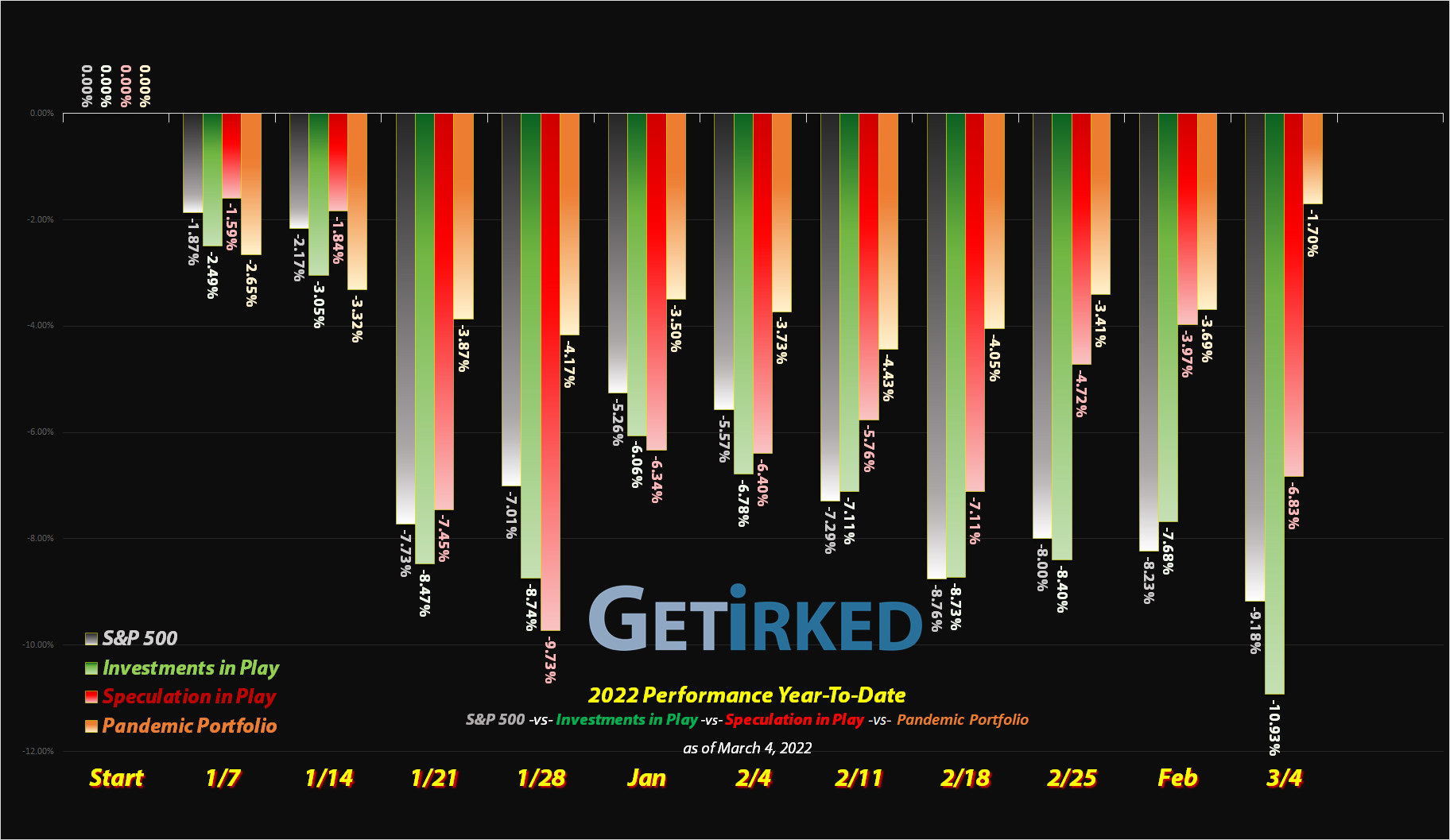

March 4, 2022

The Week’s Biggest Winner & Loser

Dutch Bros (BROS)

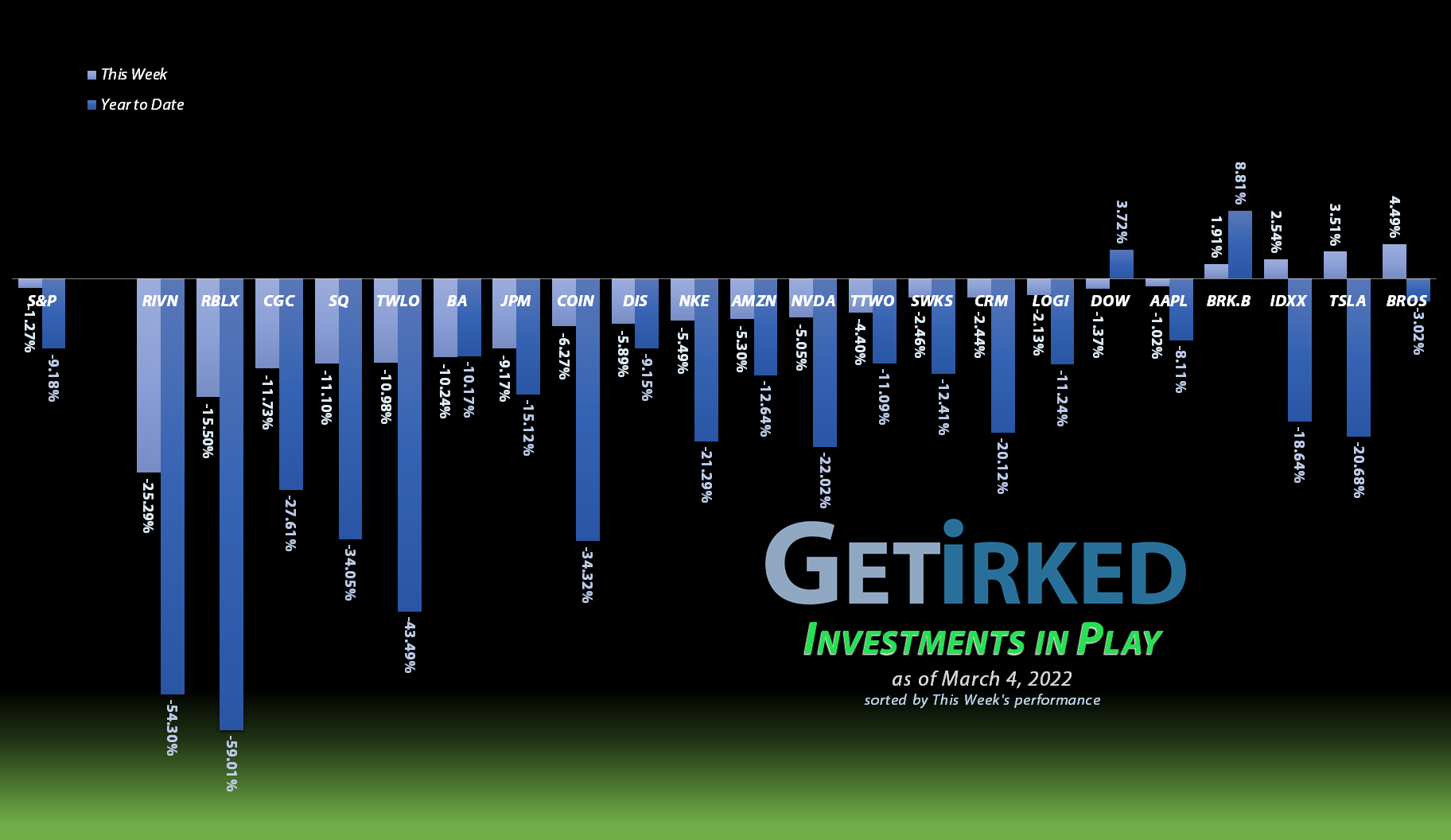

Sometimes, even the market appreciates a nice caffeinated beverage, and, this week, Dutch Bros (BROS) was the coffee treat, rising +4.49% in an otherwise crappy week to earn the spot of the Week’s Biggest Winner.

Rivian (RIVN)

There are more details below about what happened to Rivian (RIVN) this week, but the TLDR is this – when you tell people who preordered your product that you’ll be raising the price 17-20% higher than what was initially agreed-upon, you’re bound to piss people off… a lot. RIVN crashed -25.29% this week alone, easily earning itself the spot of the Week’s Biggest Loser.

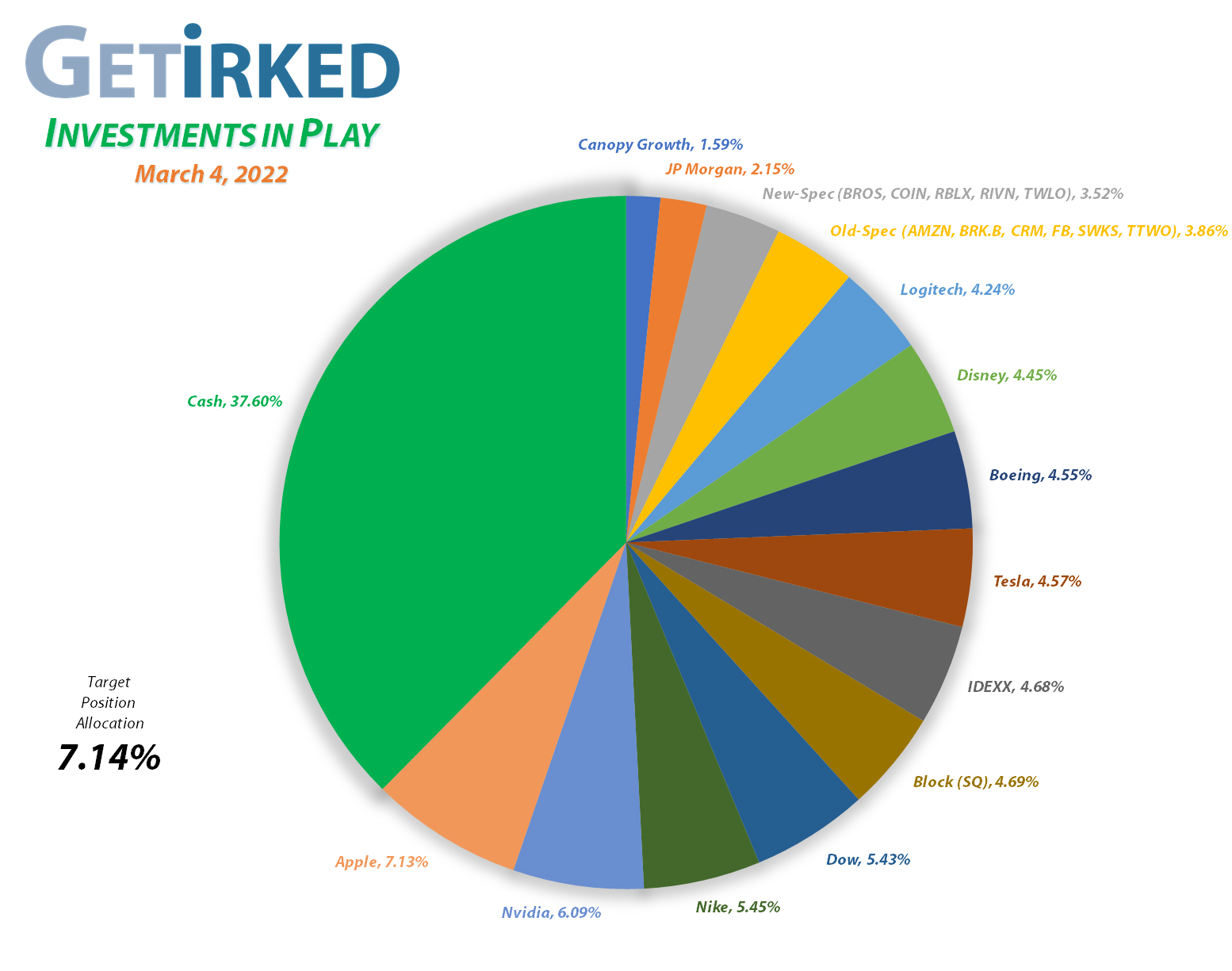

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of 11 positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Meta (FB), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Apple (AAPL)

+865.99%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Nvidia (NVDA)

+843.14%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$22.45)*

Amazon (AMZN)

+719.31%**

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $34.77

Tesla (TSLA)

+714.77%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Block (SQ)

+663.91%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Boeing (BA)

+624.05%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Logitech (LOGI)

+607.49%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Nike (NKE)

+495.50%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$13.75)*

IDEXX Labs (IDXX)

+486.14%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+454.57%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

Disney (DIS)

+350.81%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $31.21

Take Two (TTWO)

+314.58%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $50.23

Salesforce (CRM)

+106.62%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $98.25

JP Morgan (JPM)

+93.18%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $69.57

Berkshire (BRK.B)

+77.90%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Meta (FB)

+76.57%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Dow (DOW)

+63.47%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

Twilio (TWLO)

+26.12%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $118.00

Dutch Bros (BROS)

+21.90%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Canopy (CGC)

-9.70%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Roblox (RLBX)

-26.58%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $57.60

Coinbase (COIN)

-43.51%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $293.43

Rivian (RIVN)

-44.38%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $85.20

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Rivian (RIVN): Added to Position x 2

Rivian (RIVN) sold off once more this week after a disastrous PR fiasco where, on Tuesday, the company tried to raise the prices of more than 70,000 existing preorders by 17-20% across the board, and then backpedaled the move on Thursday. In addition to damaging consumer faith in the company, the sheer amount of the price hike, claimed by management to be needed due to inflation, brings the financials of the company into close consideration.

The resulting selloff triggered two different buy orders for me – one on Thursday at $50.60 and a second on Friday at $46.80, giving me an average buy price of $48.70. As always, it’s important to note that this position is part of the Speculative Basket meaning the quantities are very small and the overall allocation for the position is closely managed as the potential for complete bankruptcy is higher in RIVN than in more-established long-term plays.

The combined orders lowered my per-share cost -14.63% from $99.80 to $85.20. From here, my next buy target is $41.60, determined using Fibonacci Retracement methods, and my next sell target is near RIVN’s all-time at $179.47.

RIVN closed the week at $47.39, down -2.69% from my $46.80 average buy price.

Roblox (RBLX): Added to Position

After briefly recovering over the past few weeks, Roblox (RBLX) once again came under selling pressure and dropped through my next price target with a buy order filling at $43.60 on Friday.

The buy lowered my per-share cost -2.95% from $59.35 to $57.60. From here, my next buy price target is $40.10, near a potential point of support calculated using the Fibonacci Retracement method, and my next sell target is around $137, just under RBLX’s all-time high of $141.60.

RBLX closed the week at $42.29, down -3.00% from where I added on Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.