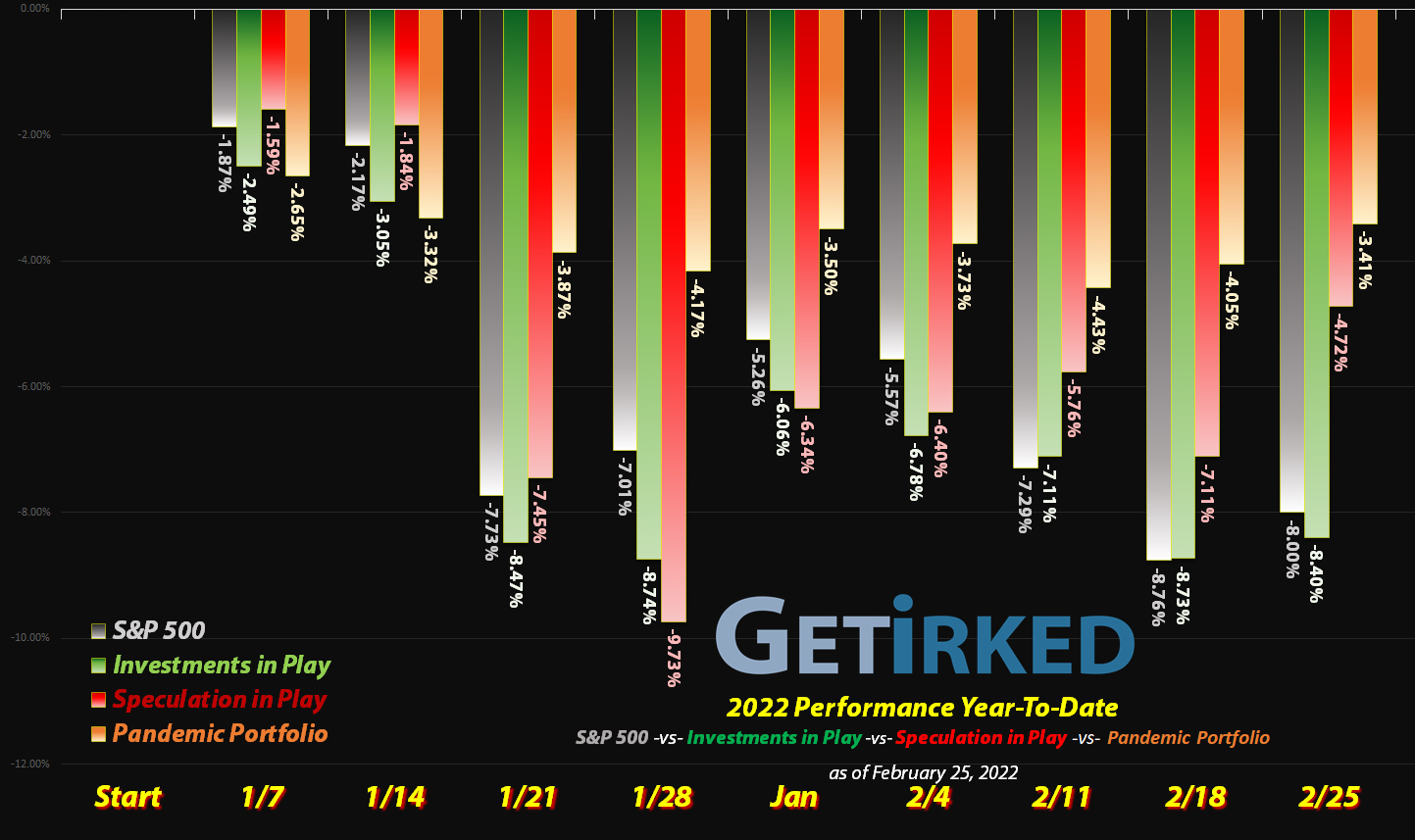

February 25, 2022

The Week’s Biggest Winner & Loser

Block (SQ)

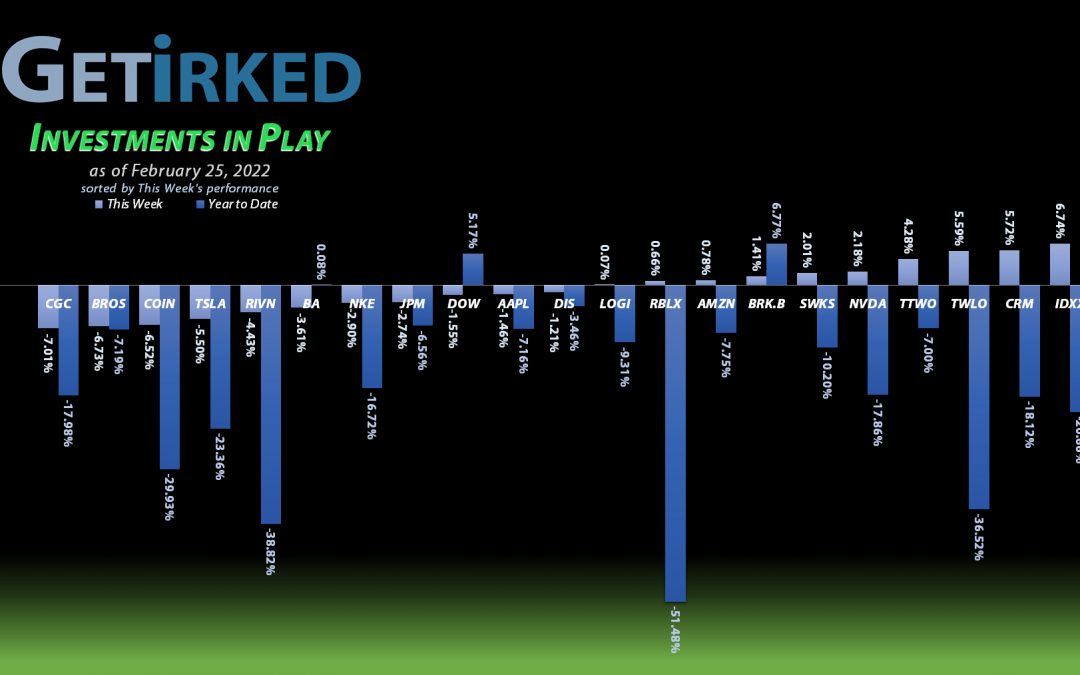

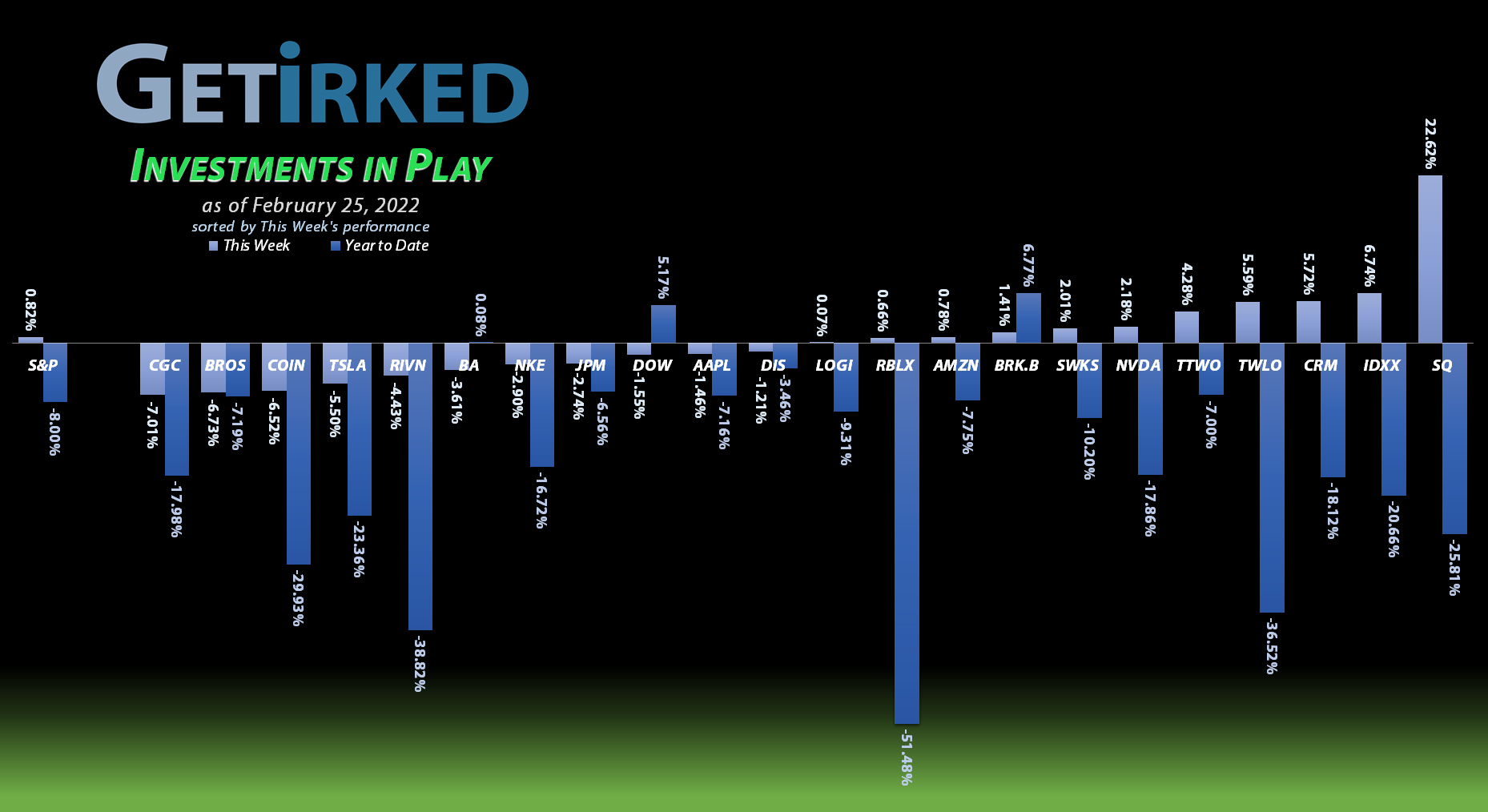

After being beaten down more than -71% from its $289 all-time high to its low below $83 this week, Block (SQ) shocked analysts by reporting a blowout earnings quarter. The result? Block popped more than +43% in a single day, finishing a dismal week with an outstanding +22.62% gain and locking in the spot of the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

It’s one step forward, two steps back for the recreational cannabis space as the entire sector got slammed once more this week. Canopy Growth Corp (CGC) got hit for another -7.01% drop, crashing in as the Week’s Biggest Loser.

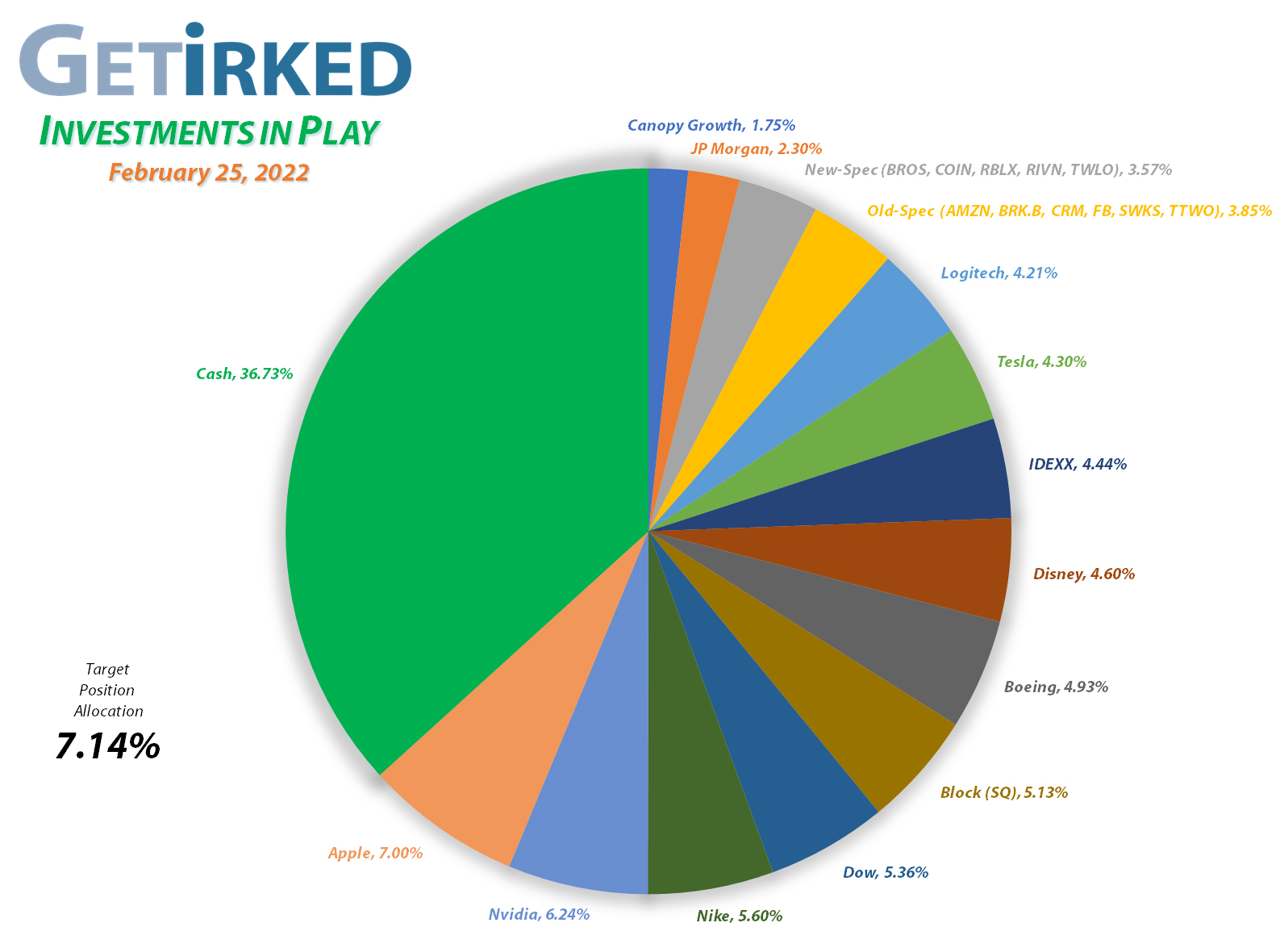

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of 11 positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Meta (FB), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Nvidia (NVDA)

+884.01%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$22.45)*

Apple (AAPL)

+873.35%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Amazon (AMZN)

+765.14%**

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $34.77

Block (SQ)

+710.31%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Tesla (TSLA)

+692.62%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Boeing (BA)

+658.52%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Logitech (LOGI)

+622.10%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Nike (NKE)

+521.55%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$13.75)*

IDEXX Labs (IDXX)

+475.17%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+464.40%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

Disney (DIS)

+379.04%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $31.21

Take Two (TTWO)

+329.05%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $50.23

JP Morgan (JPM)

+112.69%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $69.57

Salesforce (CRM)

+111.79%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $98.25

Meta (FB)

+78.18%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Berkshire (BRK.B)

+74.57%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+65.75%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

Twilio (TWLO)

+41.68%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $118.00

Dutch Bros (BROS)

+16.67%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Canopy (CGC)

+2.30%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Roblox (RLBX)

-15.67%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $59.35

Rivian (RIVN)

-36.44%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $99.80

Coinbase (COIN)

-39.74%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $293.43

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position x 2

The selling didn’t stop in the financial technology (“fintech”) space even before Russia invaded Ukraine with Block (SQ) reaching new lows on Wednesday where it triggered a buy order that filled at $92.85. Then, on Thursday, the selloff from the invasion news caused Block to collapse further, triggering a second buy order at $83.00, giving me an average buying price of $87.93. The orders locked in a -42.53% discount on shares I sold for $153.00 back on August 5, 2020.

The combined orders raised my per-share “cost” +10.40 from -$94.15 to -$83.75 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $83.75 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $72.70, above a past point of support, and my next sell target is just under $240.00, a past point of resistance.

SQ closed the week at $119.82, up +-36.27% from my $87.93 average buy price.

Logitech (LOGI): Added to Position

Despite having little to no presence in Russia or Ukraine, the selloff left no stock untouched, smacking even work-from-home/e-gaming play Logitech (LOGI) down substantially on Thursday through my next price target with my buy order filling at $70.00.

The order locked in a -25.33% discount on some of the shares I sold at $93.74 back on November 5, 20202 and raised my per-share cost +$1.36 from $7.45 to $8.81. From here, my next buy target is $62.40, above a past point of support, and my next sell target is around $135.00 where I’ll pull all capital out of the position.

LOGI closed the week at $74.80, up +6.86% from where I added Thursday.

Tesla (TSLA): Added to Position x 2

When the market sold off on Tuesday, Tesla (TSLA) collapsed through the $800s, approaching its low from January, so I added to my position with a small buy order that filled at $815.80 on Tuesday. On Thursday, Tesla got smacked down even harder, leading me to make a second buy which filled at $717.22, giving me an average buying price of $763.32.

The orders raised my per-share “cost” +$15.51 from -$93.94 to -$78.43 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $78.43 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $601.90, above a past point of support, and my next sell target is around the $2,000 price target many of the more bullish analysts continue to have for the stock.

TSLA closed the week at $809.87, up +6.10% from my $763.32 average buy price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.