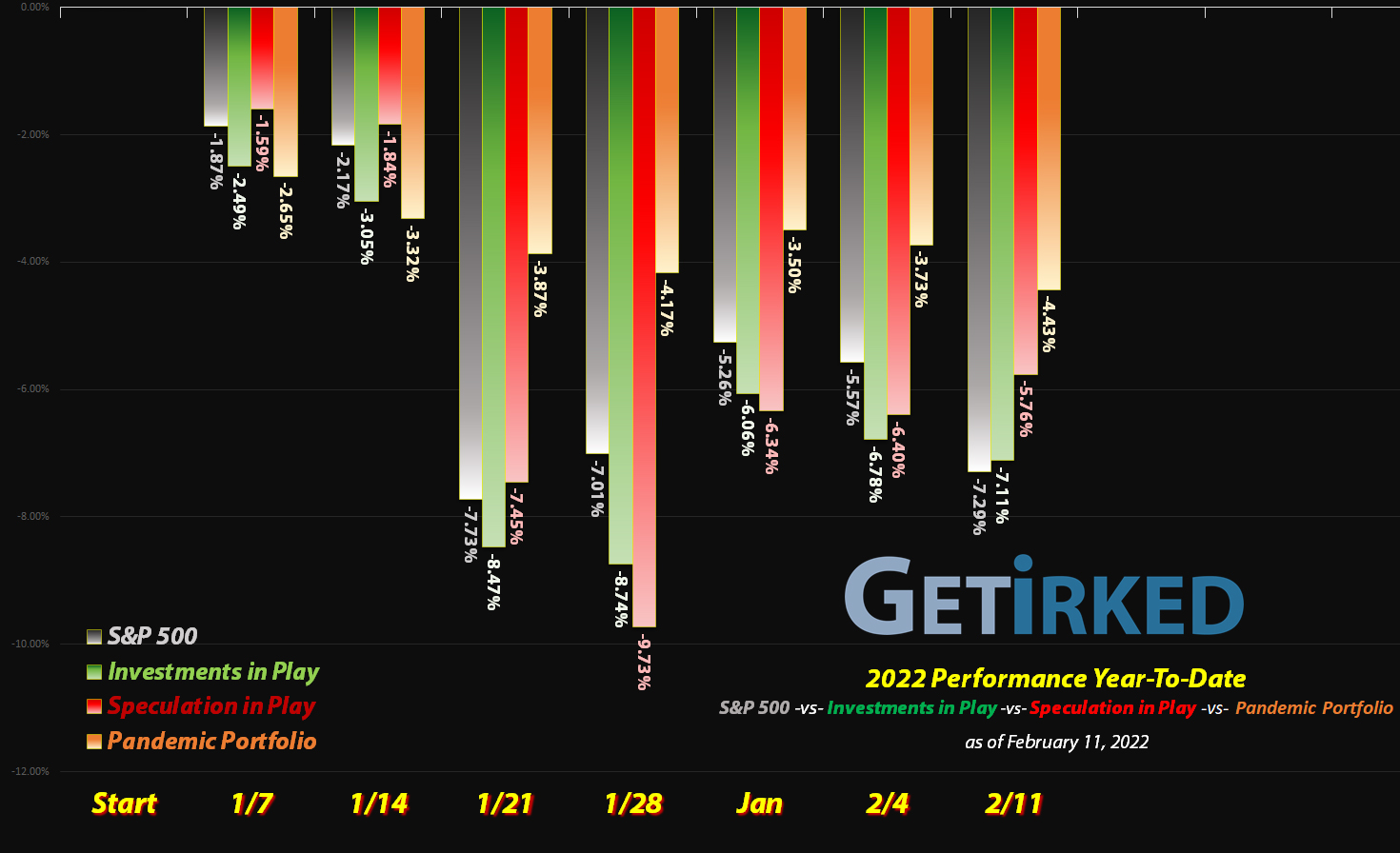

February 11, 2022

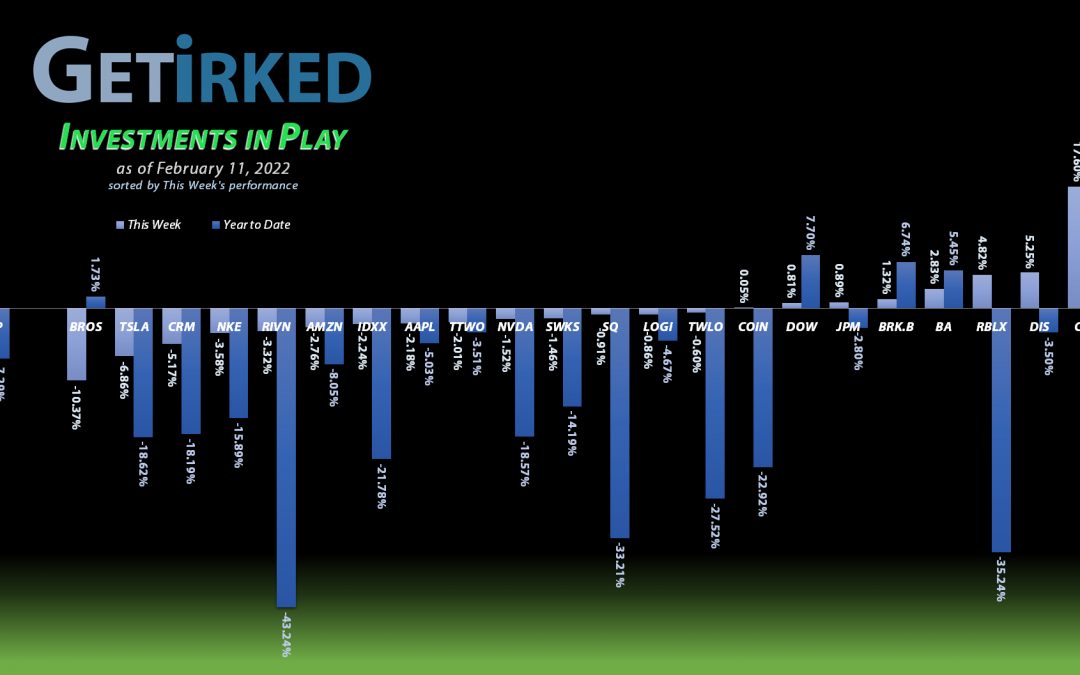

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

After what has seemed like an eternity in a cold, hard winter, Canopy Growth Corp (CGC) and the rest of the cannabis sector finally caught a slight buzz this week. While still a continent away from its all-time high, CGC’s +17.60% gain is nothing to sneeze at and easily earned it the honor of the Week’s Biggest Winner in a sea of red.

Dutch Bros (BROS)

What goes up must come down, and Dutch Bros (BROS), one of the most volatile positions in the entire portfolio, that means a pullback, especially in a down market. BROS spilled -10.37% all over the floor this week and landed itself the spot of the Week’s Biggest Loser.

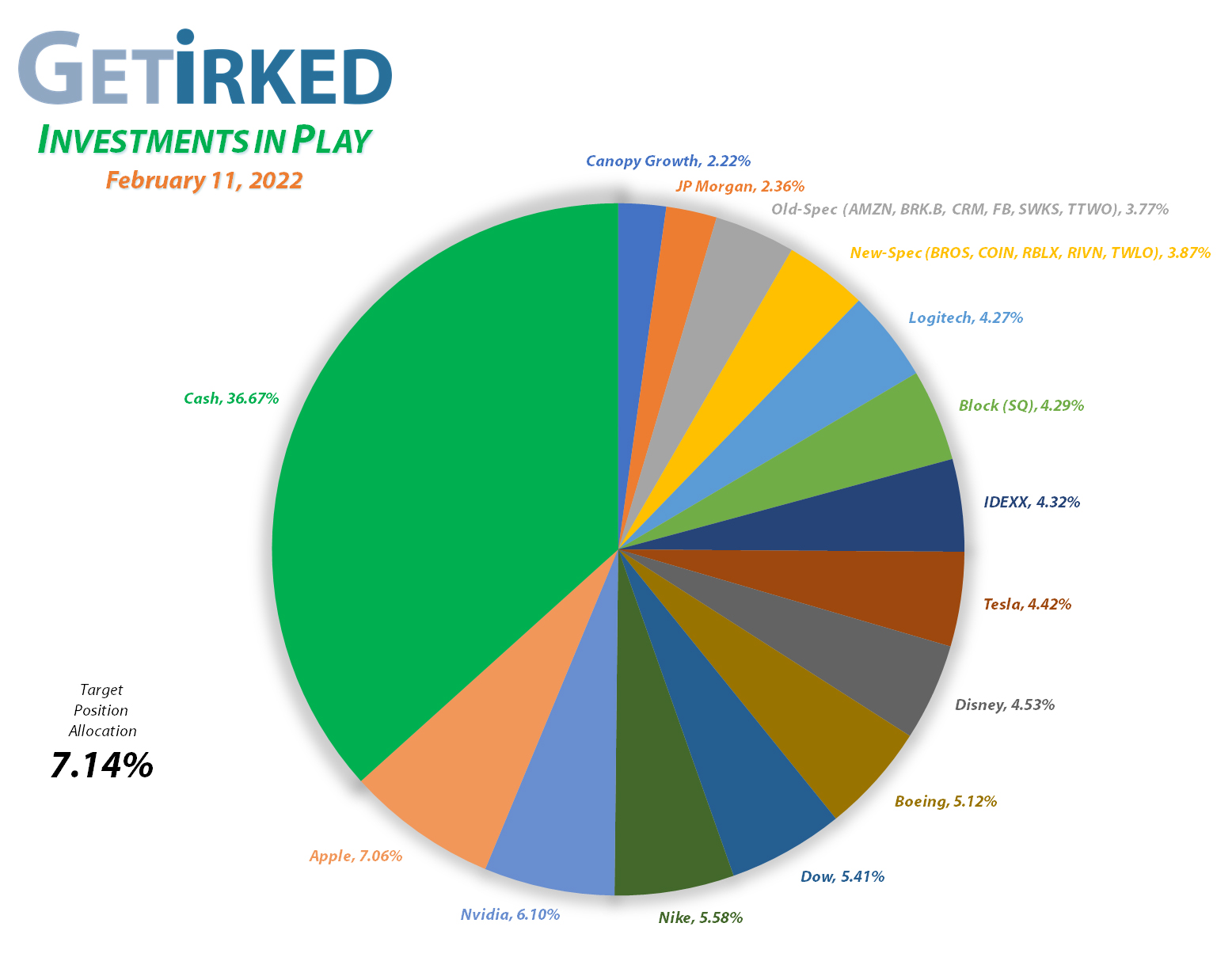

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of 11 positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Meta (FB), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Apple (AAPL)

+889.00%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Nvidia (NVDA)

+877.05%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$22.45)*

Amazon (AMZN)

+762.36%**

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $34.77

Tesla (TSLA)

+730.34%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$93.94)*

Boeing (BA)

+676.59%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Block (SQ)

+664.67%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$94.15)*

Logitech (LOGI)

+656.44%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Nike (NKE)

+526.27%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$13.75)*

IDEXX Labs (IDXX)

+469.05%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+446.66%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

Disney (DIS)

+378.84%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $31.21

Take Two (TTWO)

+341.40%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $50.23

JP Morgan (JPM)

+121.24%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $69.57

Salesforce (CRM)

+111.59%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $98.25

Meta (FB)

+79.58%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Berkshire (BRK.B)

+74.51%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+69.75%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

Twilio (TWLO)

+61.76%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $118.00

Canopy (CGC)

+31.73%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Dutch Bros (BROS)

+27.88%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Roblox (RLBX)

+9.88%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.80

Coinbase (COIN)

-33.70%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $293.43

Rivian (RIVN)

-41.03%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $99.80

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position

On Monday, Block (SQ) pulled back from last week’s rally and triggered my price target which filled with a buy order at $102.65. The order locked in a -32.69% discount on shares I sold back on August 20, 2020 for $152.50 and raised my per-share “cost” +$6.15 from -$100.30 to -$94.15 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $94.15 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy price target for Block is $94.55, a past point of support, and my next sell target is $237.05, just under a past point of resistance.

SQ closed the week at $107.88, up +5.09% from where I added on Monday.

Meta [Facebook] (FB): *Position Reopened*

I decided to reopen a position in Meta (FB), the artist formerly known as Facebook. Even long-time readers may not remember that I did hold a position in Meta previously, however I closed it entirely only a few weeks after I started Get Irked with my final sale order at $178.20 on August 27, 2018.

Since I have no exposure to the social media space in this portfolio and Meta has become unbelievably cheap both on a relative basis to itself, but also in its Price-to-Earnings (P/E) ratio, I decided that I wanted some exposure once again, but this time it will be part of the speculative basket, not its own allocation, joining the ranks of the Old-Spec half of the basket along with Amazon (AMZN), Berkshire-Hathaway (BRK.B), Salesforce (CRM), Skyworks Solutions (SWKS), and Take Two Interactive (TTWO).

Thanks to reporting an absolutely dismal quarter, Meta is now more than -40% off its all-time high, so I decided to reopen a position this week with my first buy order going through on Thursday at $227.00. Thanks to the previous profits taken from Meta, that gives me a starting per-share price of -$295.25 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $295.25 to the portfolio’s bottom line in addition to the value of each share).

From here, my next price target to add to the stock is $185.65, a price determined using reverse Fibonacci Retracement.

FB closed the week at $219.55, down -3.28% from where I opened it on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.