January 14, 2022

The Week’s Biggest Winner & Loser

Logitech (LOGI)

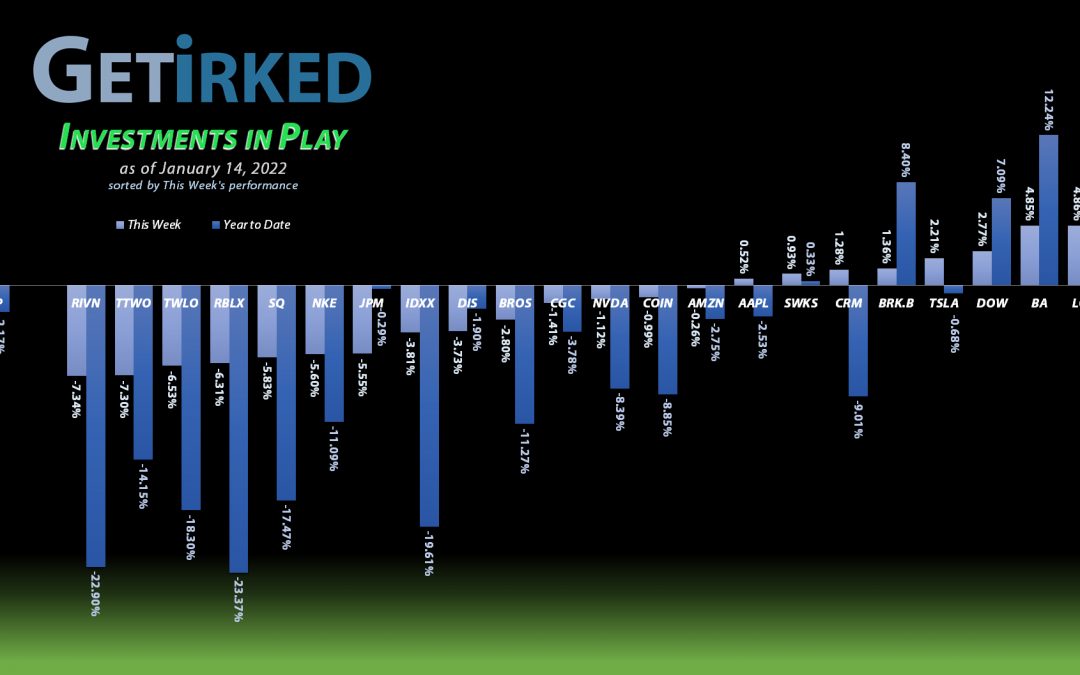

Slow, silent, and steady, Logitech (LOGI) popped this week when almost every other tech play got smacked down. LOGI landed a +4.86% gain, just barely edging out Boeing (BA) (yes, Boeing!) to become the Week’s Biggest Winner.

Rivian (RIVN)

The Electric Vehicle (EV) space just isn’t as hot as it used to be with all the (non-Tesla) EV makers getting hit this week. RIVN took the brunt of it, dropping -7.34% and coming in hot as the Week’s Biggest Loser.

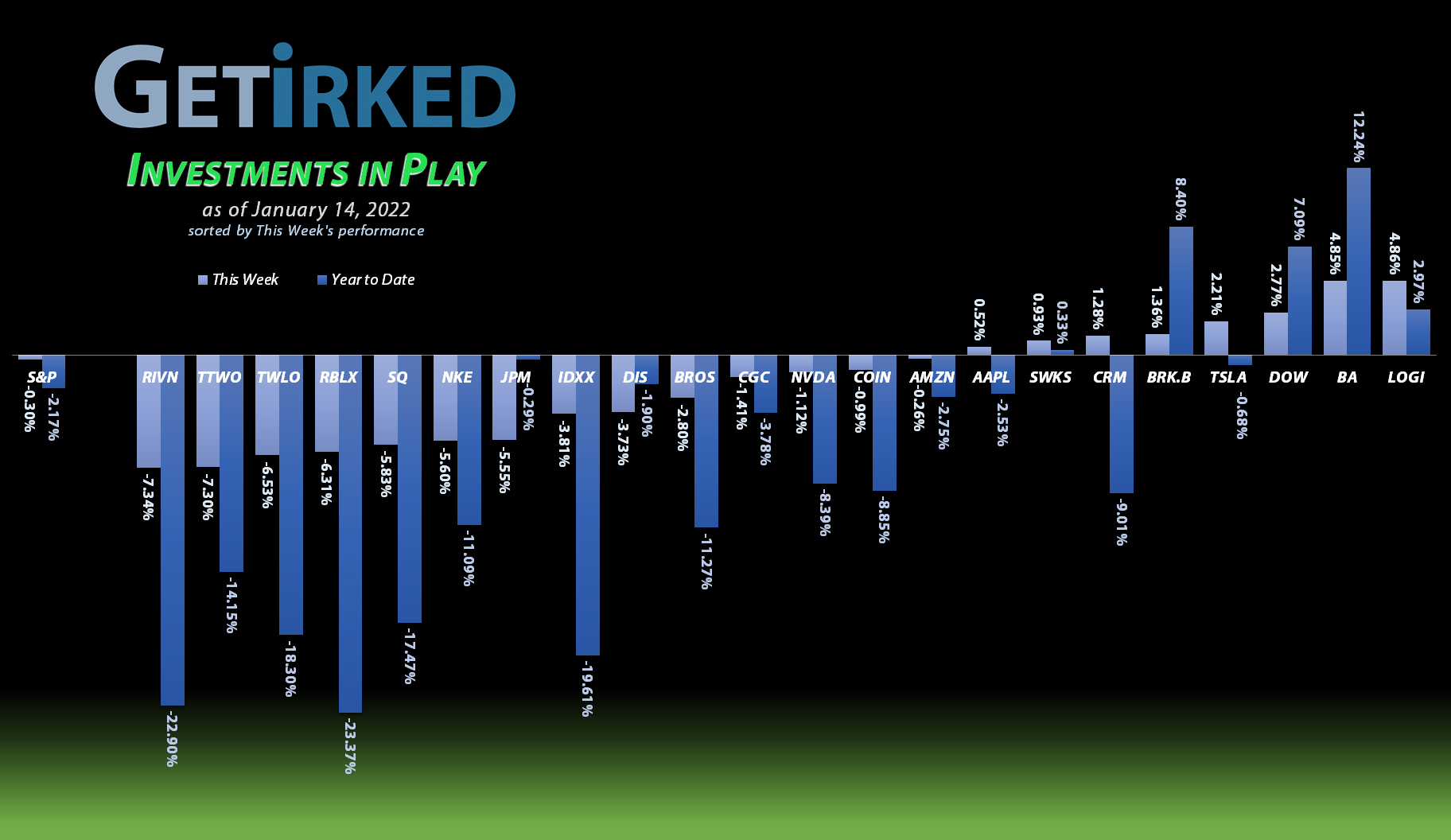

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

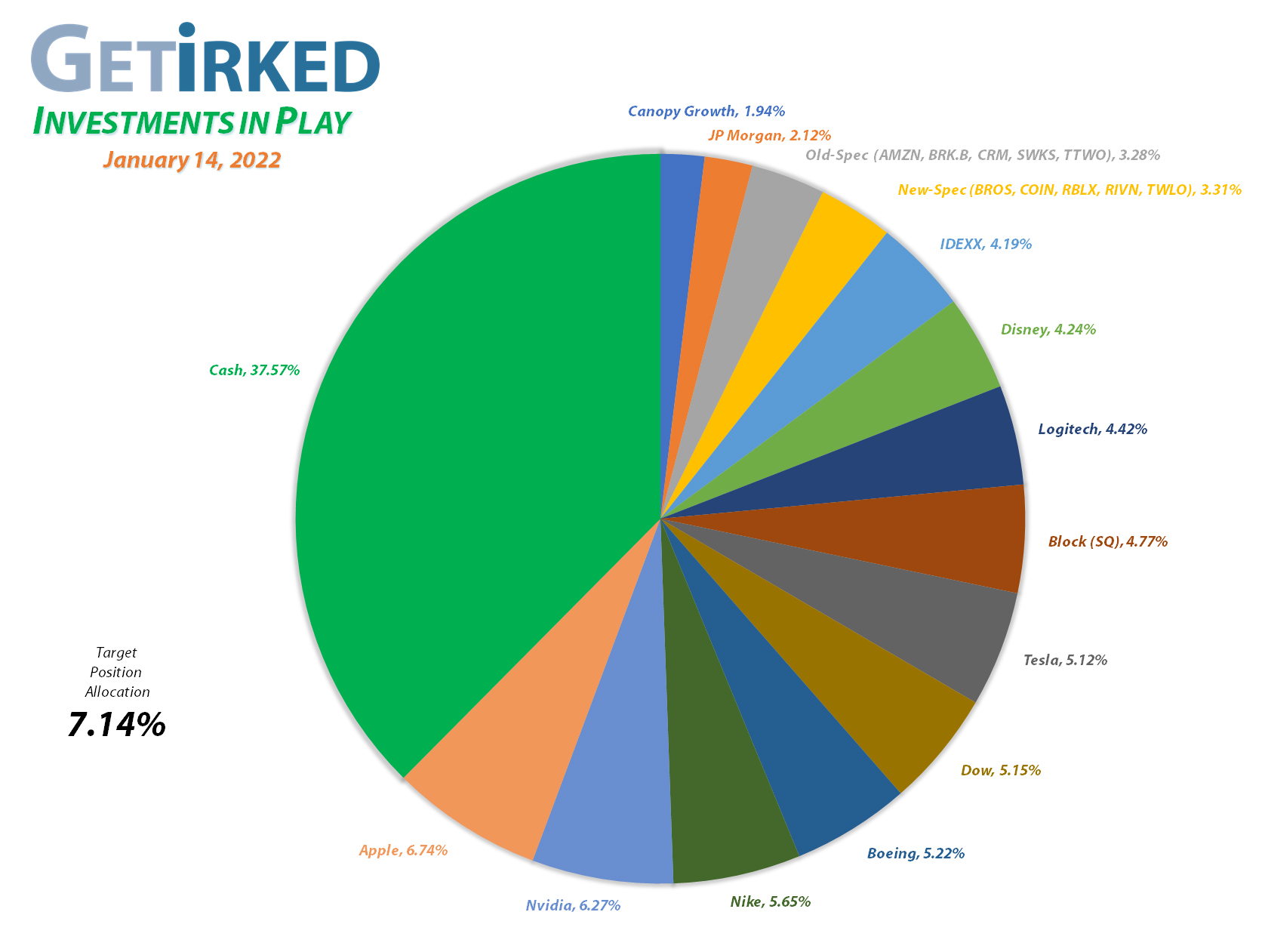

Current Position Performance

Nvidia (NVDA)

+971.67%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$35.20)*

Apple (AAPL)

+906.06%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$40.27)*

Tesla (TSLA)

+874.48%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Block (SQ)

+744.18%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$107.50)*

Logitech (LOGI)

+714.54%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Boeing (BA)

+699.41%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Nike (NKE)

+553.62%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$13.75)*

Skyworks (SWKS)

+511.22%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

IDEXX Labs (IDXX)

+480.37%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$60.26)*

Disney (DIS)

+463.79%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $26.95

Take Two (TTWO)

+303.77%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $50.23

Salesforce (CRM)

+285.38%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

JP Morgan (JPM)

+150.50%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+109.41%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($185.15)*

Twilio (TWLO)

+82.34%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $118.00

Berkshire (BRK.B)

+77.24%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+68.78%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

Roblox (RLBX)

+31.75%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.00

Canopy (CGC)

+20.02%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Dutch Bros (BROS)

+11.53%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Rivian (RIVN)

-25.80%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $107.75

Coinbase (COIN)

-33.63%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $346.60

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Added to Position

The Big Tech behemoths finally started getting slammed this week with Amazon (AMZN) dropping through a buy target of mine on Monday which filled at $3,148.73. The order raises my per-share “cost” from – $995.54 to -$185.15 (a negative per-share cost indicates all capital has been removed from the position and each share now adds $13.75 to the portfolio’s bottom line in addition to the value of each share).

From here, my next price target is $2,911.90 and I have no sell targets at this time since I continue to rebuild this position after closing AMZN right before it tripled in January 2020.

AMZN closed the week at $3,242.76, up +2.99% from where I added Monday.

Nike (NKE): Added to Position

Nike (NKE) triggered a buy order on Monday when it sold off with the rest of the market. The order filled at $150.50 and raised my per-share “cost” +$5.13 from -$18.88 to -$13.75 (a negative per-share cost indicates all capital has been removed from the position and each share now adds $13.75 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $130.85 and my next sell target is around $192 when Nike will have exceeded the allocation size for the portfolio.

NKE closed the week at $148.18, down -1.54% from where I added on Monday.

Take Two Interactive (TTWO): Added to Position

Despite the announcement that Take Two Interactive (TTWO) would be buying Zynga (ZNGA), TTWO still sold off dramatically with the rest of the market on Monday. TTWO triggered a buy order I had in place which filled at $143.19, raising my per-share cost +$10.67 from $39.56 to $50.23, and locking in a -19.28% discount replacing some of the shares I sold for $177.39 back on November 6, 2020.

From here, my next buy target is $127.90 and my next sell target is $213.60, just under TTWO’s all-time high.

TTWO closed the week at $152.58, up +6.56% from where I added Monday.

Twilio (TWLO): Added to Position

Given how hard the tech stocks have been hit, it was no surprise that high-flying cloud data app servicer, Twilio (TWLO), would get smacked. On Monday, TWLO got hit so hard that it triggered a buy order that filled at $218.00. The order raised my per-share cost +$33.33 from $84.67 to $118.00, still a -6.13% reduction from my first buy at $125.71 back on August 8, 2019.

From here, my next buy target is $153.00, above a past point of key support, and my next sell target is $472.00, slightly above TWLO’s all-time high where I will pull all capital out of the position.

TWLO closed the week at $215.16, down -1.30% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.