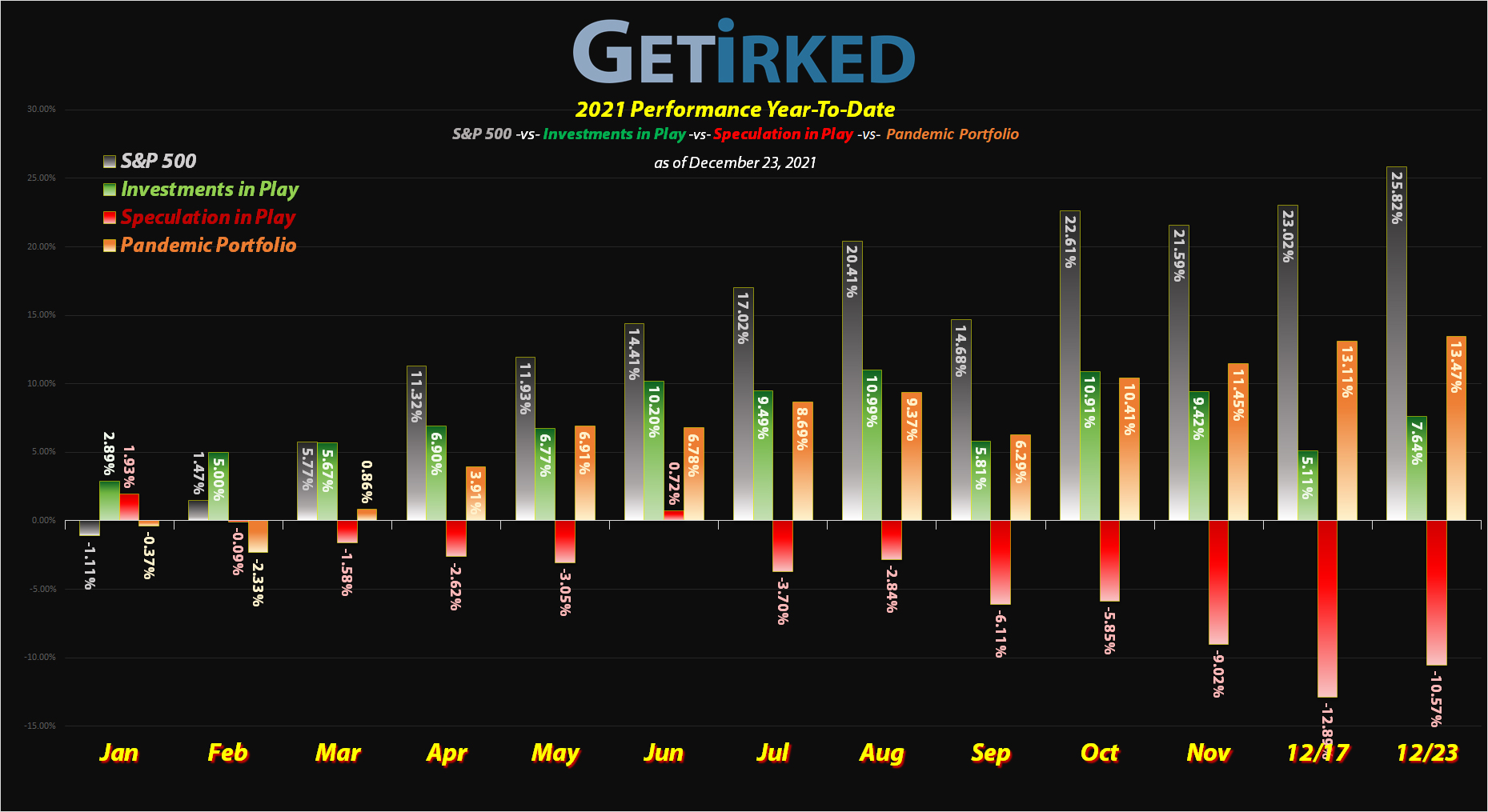

December 23, 2021

The Week’s Biggest Winner & Loser

Tesla (TSLA)

After making a very public spectacle of his need to sell a significant amount of stock in Tesla (TSLA), CEO Elon Musk finally finished his sales in TSLA this week, marking a bottom for the selloff. From that point, Tesla bounced +14.42% this week, locking in its spot as the Week’s Biggest Winner.

Twilio (TWLO)

Ever since the Federal Reserve turned hawkish on its economic policy, high-flying growth stocks like Twilio (TWLO) have been taking the brunt of the market rotation into stocks with earnings. This week was no different with Twilio (TWLO), cloud data and app services company, finished the week in the red in a market of mostly green. TWLO dropped -2.36%, landing itself as the Biggest Loser.

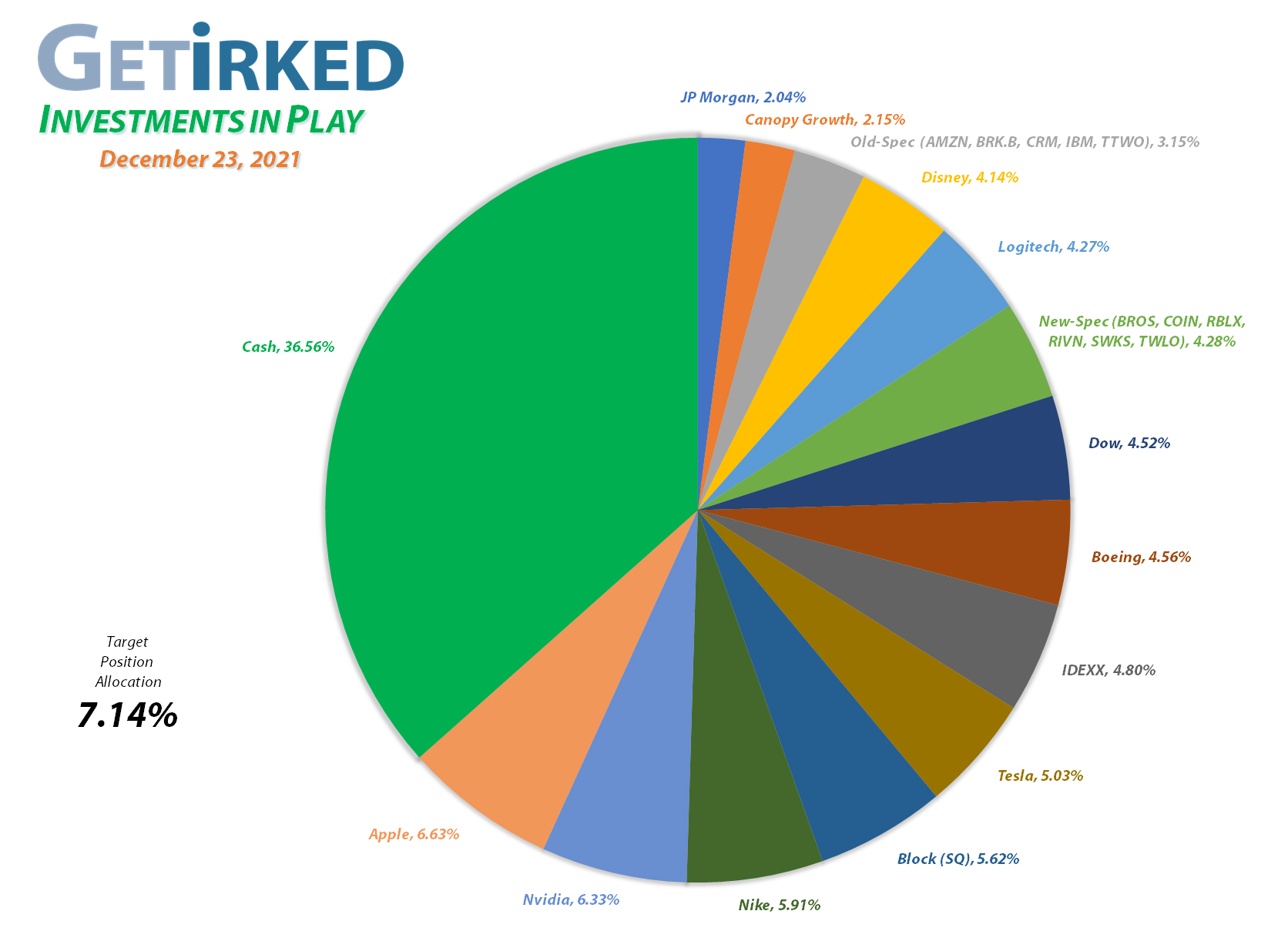

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of ten (10) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

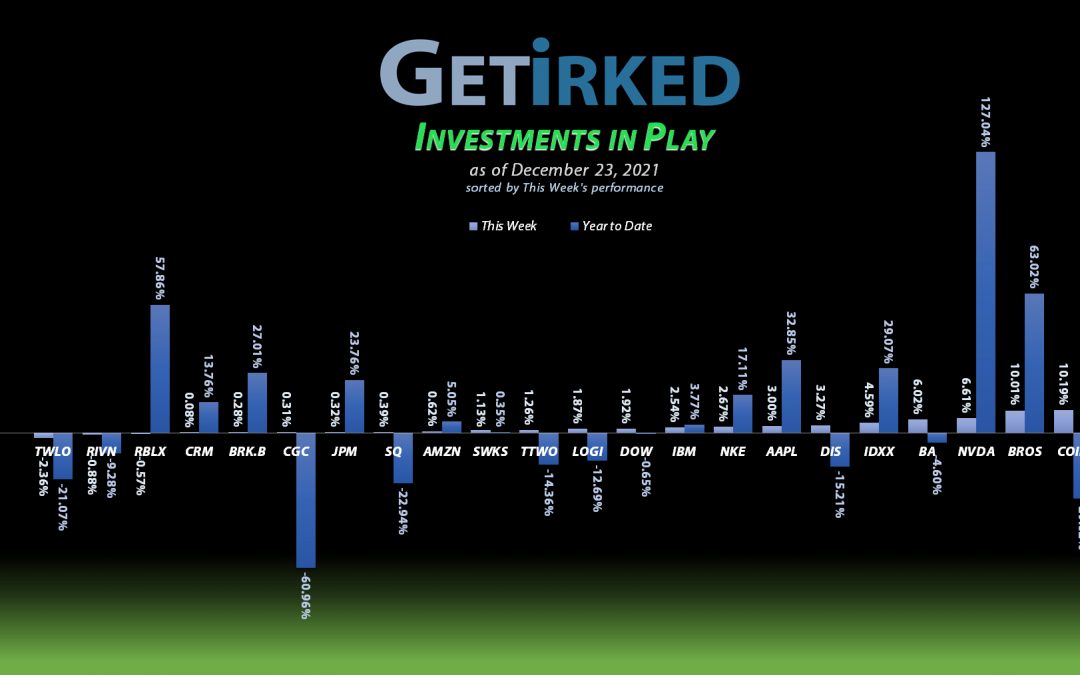

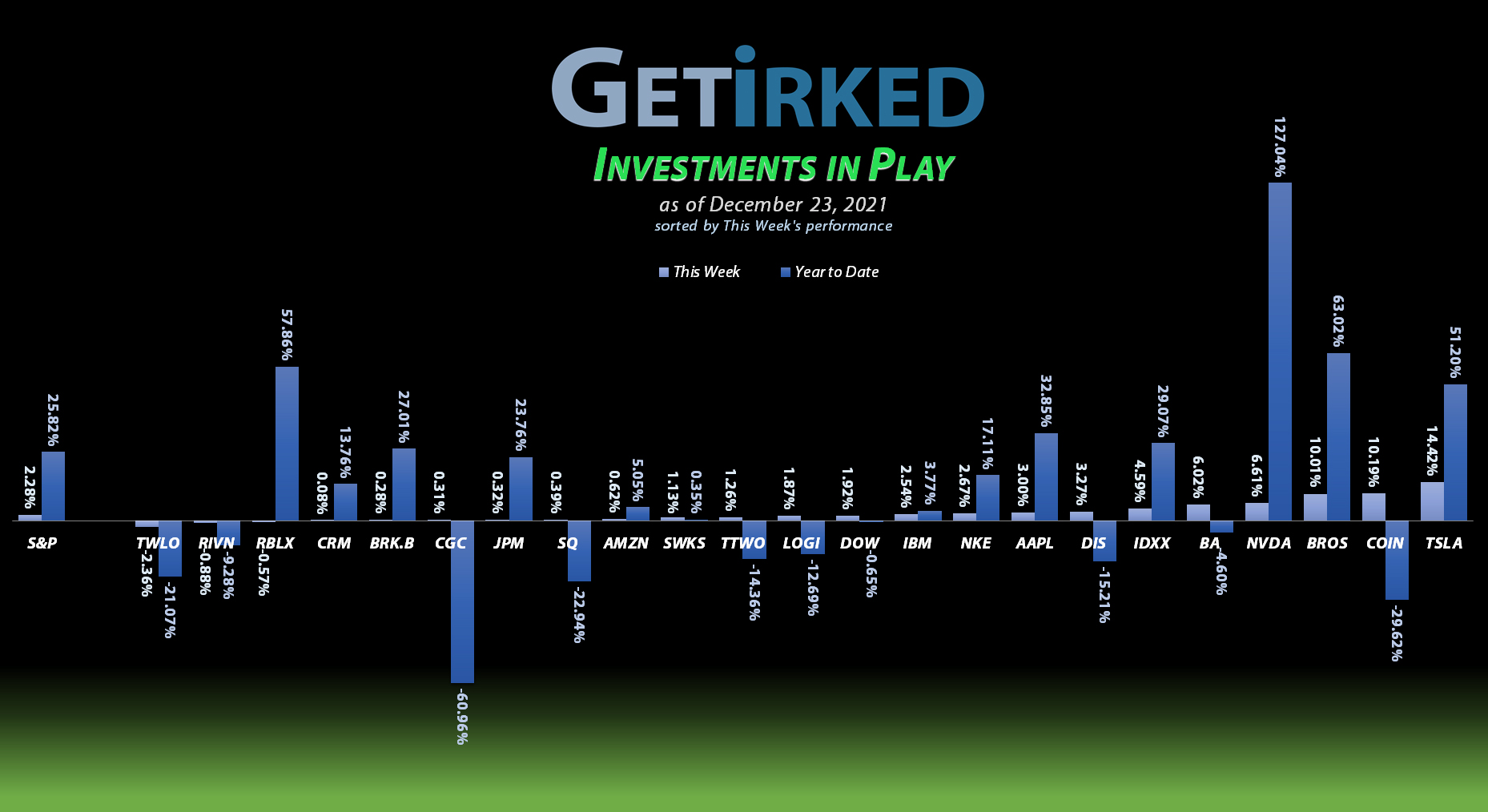

Current Position Performance

Nvidia (NVDA)

+1054.14%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$51.40)*

Apple (AAPL)

+919.69%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$40.27)*

Tesla (TSLA)

+887.68%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Block (SQ)

+848.99%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$116.15)*

Logitech (LOGI)

+714.45%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Boeing (BA)

+663.10%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Nike (NKE)

+610.86%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+573.03%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$76.83)*

Skyworks (SWKS)

+504.97%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

Disney (DIS)

+470.06%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $26.95

Take Two (TTWO)

+449.98%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+321.90%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+215.90%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+149.50%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+141.15%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Roblox (RLBX)

+69.70%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.00

Berkshire (BRK.B)

+61.03%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+53.22%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

IBM (IBM)

+41.72%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $92.18

Canopy (CGC)

+37.59%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Dutch Bros (BROS)

+30.32%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Rivian (RIVN)

-16.34%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $115.75

Coinbase (COIN)

-30.25%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Rivian (RIVN): Added to Position

Rivian (RIVN) has truly fallen from grace after appearing to become the next Electric Vehicle (EV) darling only to collapse nearly -50% from its $179.47 all-time high just set only a few weeks ago.

On Monday, RIVN retested its lows from last week where I added to my position with a buy order that filled at $93.25, a discount of -26.57% from my initial buy at $127.00. Additionally, the order lowered my per-share cost -8.86% from my initial buy at $127.00 to $115.75.

I’m playing the very slow game with this one both in terms of buy quantities but also ranges between my buys. My next buy target is $85.55, around one of RIVN’s rumored IPO prices and my next sell target is $375.75, a potential high-price estimated using a combination of reverse Fibonacci Retracement and other methods (plus, this is a long-term investment).

RIVN closed the week at $96.84, up +3.85% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.