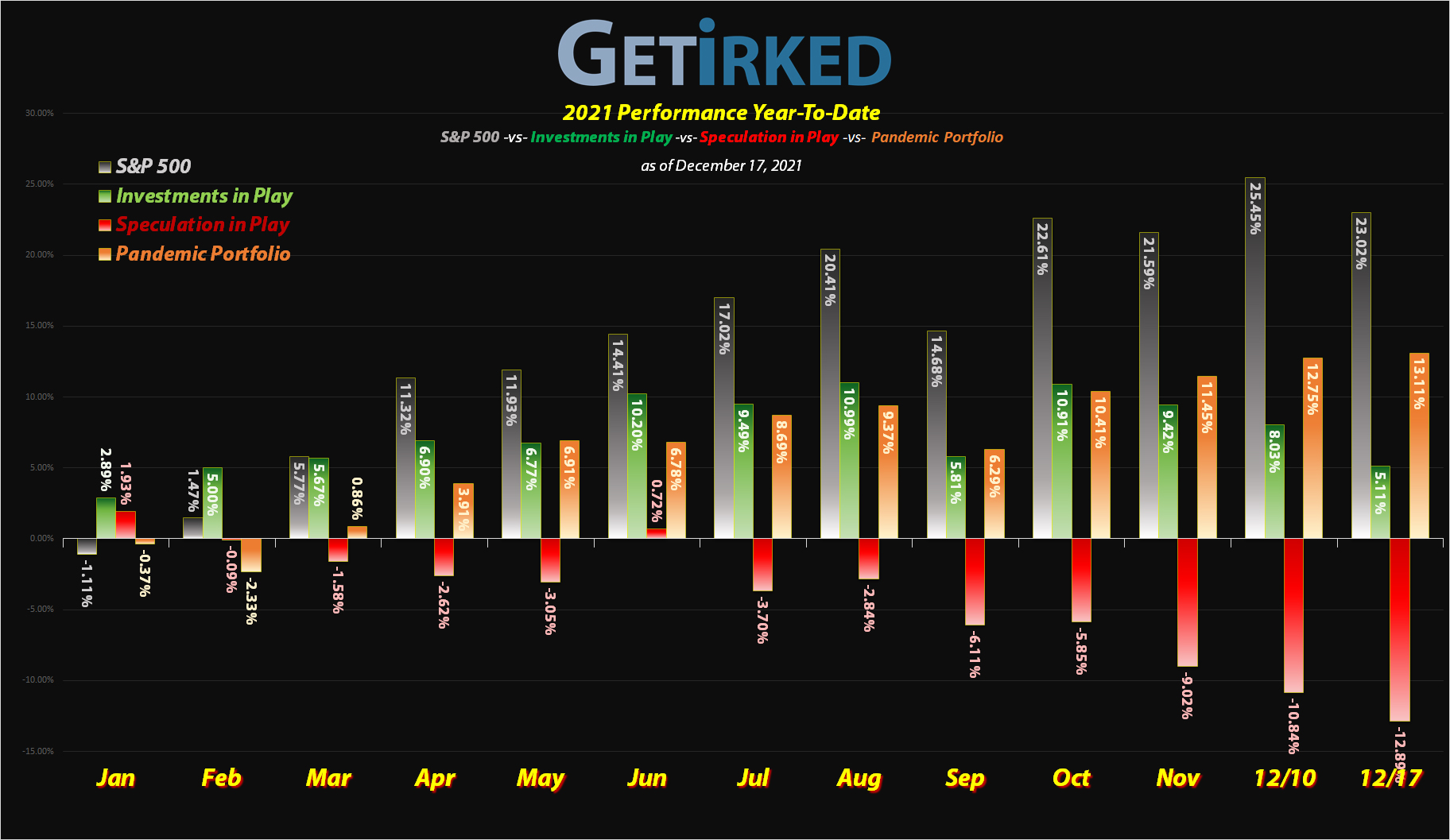

December 17, 2021

The Week’s Biggest Winner & Loser

Take Two Interactive (TTWO)

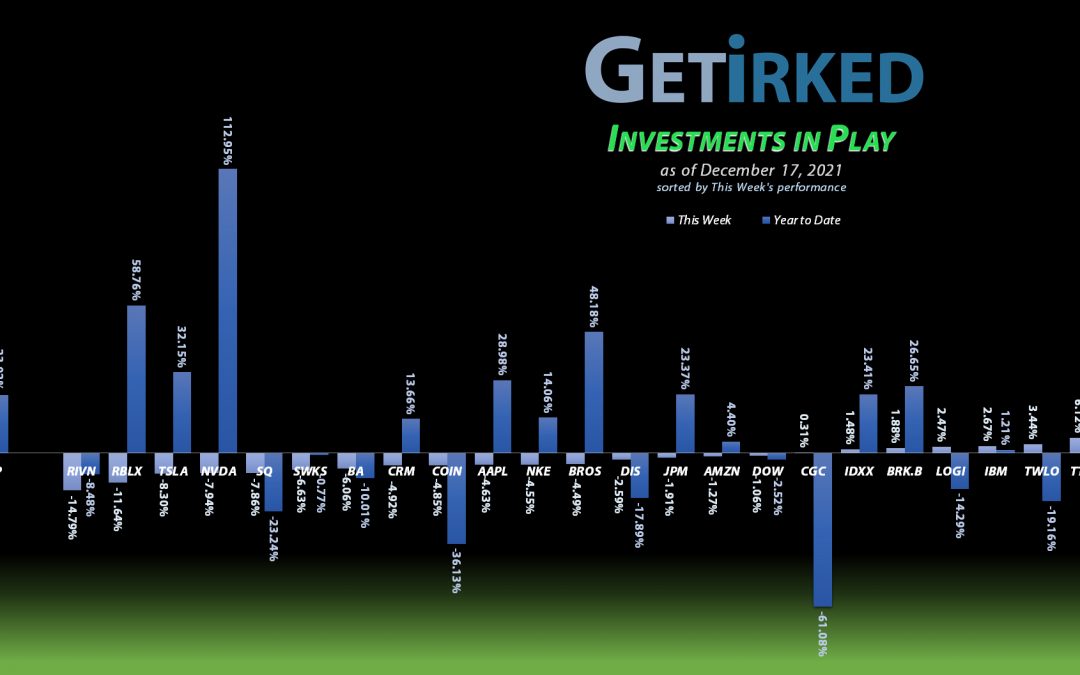

When the world’s headed back into lockdown, it’s time to hide out in video games, am I right? Take Two Interactive (TTWO) won the week with a +6.12% gain, getting the high score as the Week’s Biggest Winner.

Rivian (RIVN)

What goes up must come down and Rivian (RIVN) reported a stinker quarter like no other. Sure, everyone knew this new EV IPO wasn’t going to bring the heat when it came to earnings, but its downright dismal forward-looking guidance brought down the house… all around it. Rivian, already under weakness, dropped an additional -14.79%, easily earning itself the infamous title of Week’s Biggest Winner.

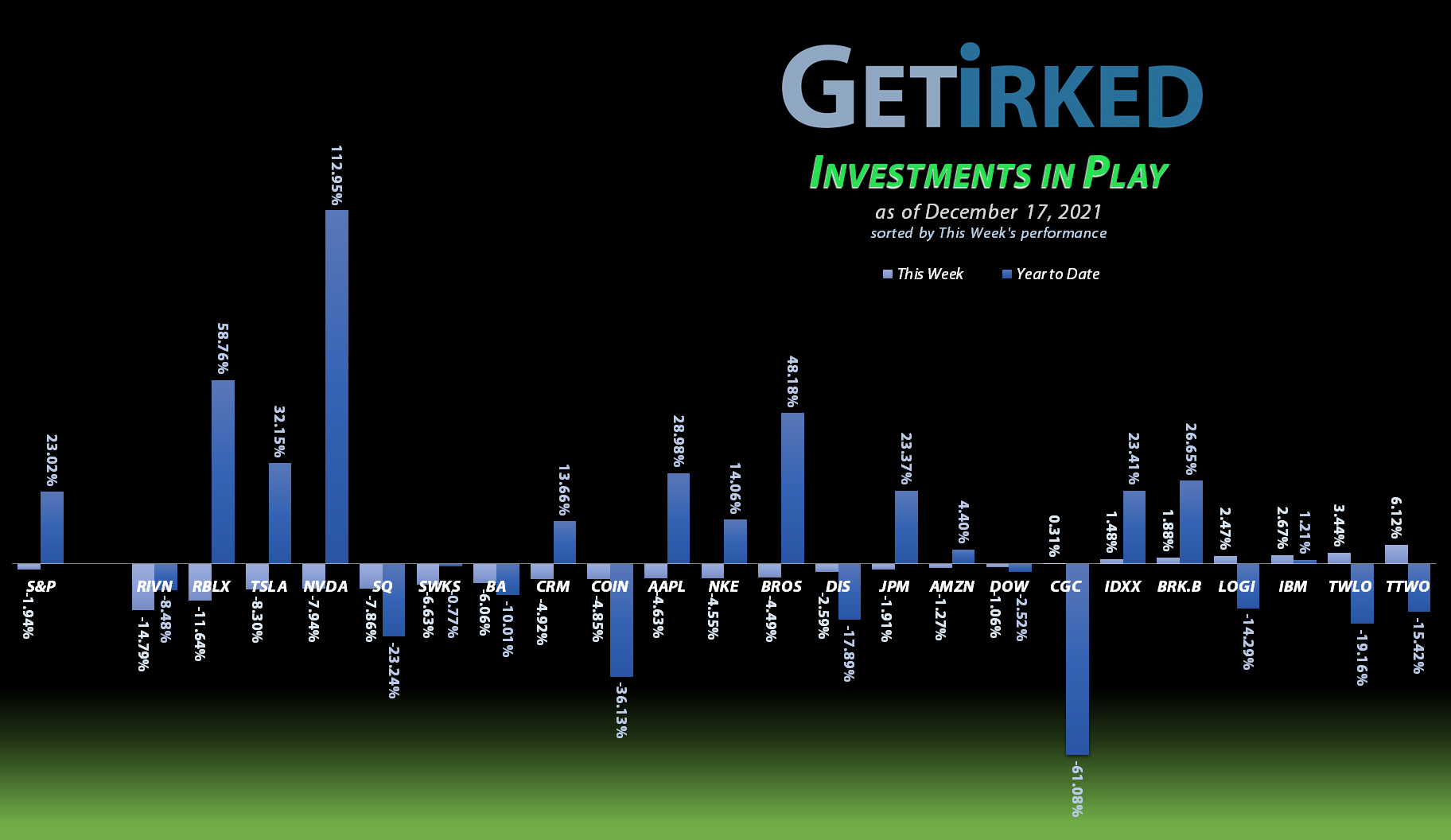

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of ten (10) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

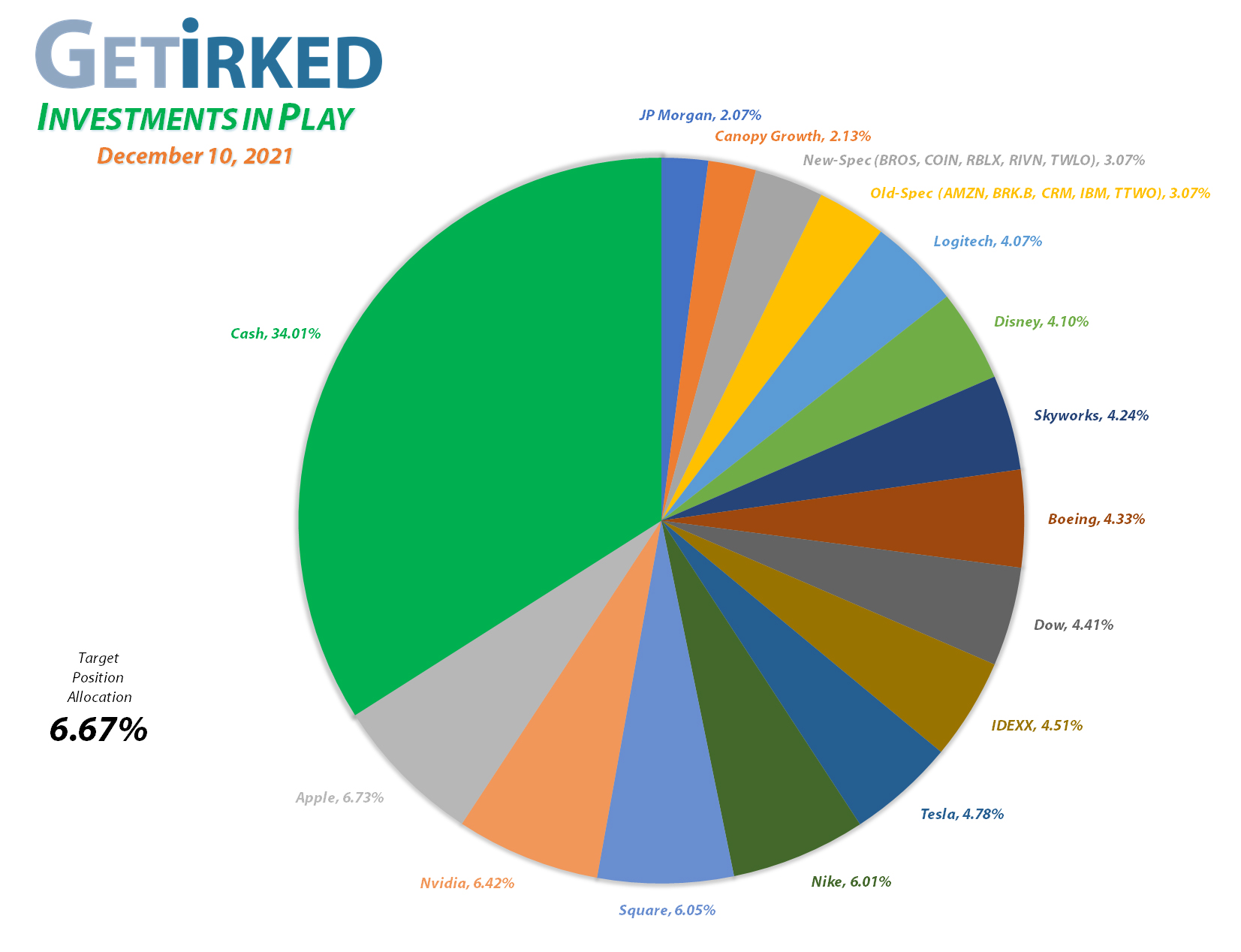

Current Position Performance

Nvidia (NVDA)

+998.41%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$51.40)*

Apple (AAPL)

+897.87%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$40.27)*

Square (SQ)

+847.05%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$116.15)*

Tesla (TSLA)

+785.61%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Logitech (LOGI)

+699.51%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Boeing (BA)

+643.74%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Nike (NKE)

+596.59%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+550.58%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$76.83)*

Skyworks (SWKS)

+499.89%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

Disney (DIS)

+451.99%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $26.95

Take Two (TTWO)

+444.26%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+321.55%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+223.19%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+148.70%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+140.48%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Roblox (RLBX)

+70.67%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.00

Berkshire (BRK.B)

+60.58%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+50.33%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

IBM (IBM)

+38.21%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $92.18

Canopy (CGC)

+37.02%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Dutch Bros (BROS)

+18.62%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Rivian (RIVN)

-23.07%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $127.00

Coinbase (COIN)

-36.70%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Boeing (BA): Added to Position

Boeing (BA) retested its recent low on Friday, triggering a buy order I had in place that filled at $188.98. The order locks in a -48.88% discount on some of the shares I sold throughout 2018-2019 for an average price of $369.67. The buy raised my per-share cost +$20.09 from -$212.89 to -$192.80 (a negative share price indicates no capital in the position and each share instead adds $192.80 to the portfolio’s bottom line in addition to the share’s current value).

From here, my next buy target is $166.40, slightly below the 150-Month Moving Average and right in the middle of a key support range. My next sell target is $344.05, a key area of resistance and also a point where BA will substantially exceeded its target allocation for the portfolio.

BA closed the week at $192.63, up +1.93% from where I added Friday.

Skyworks Solutions (SWKS): **Negative News Event**

On Thursday, Skyworks Solutions’ (SWKS) biggest client, Apple (AAPL), announced that it would continue to evolve from developing its own Central Processing Units (CPUs) to also developing modems and wireless chipsets, as well. Apple is Skyworks’ biggest customer and Skyworks develops… modems and wireless chipsets.

Sure, Apple has a mixed track record when it comes to experimenting with new approaches, however, given I had a more than +80% profit in Skyworks going into the news event, I don’t want to risk Apple’s success and potential devastation of Skyworks’ stock.

Accordingly, I sold enough SWKS on Friday to remove all of the capital from the position with a buy order that filled at $144.59. The buy locked in +72.74% in gains on the shares I sold which had an average price of $83.70.

The sale lowered my per-share cost -$150.67% from my initial buy at $113.60 on January 13, 2020 to -$57.56 (a negative per-share price indicates all capital has been removed from the position and each share now adds +$57.56 to the portfolio’s bottom line in addition to the share’s current value).

By taking this somewhat defensive tactic, if Apple doesn’t succeed or if Skyworks pivots, I won’t miss the upside, but if Apple does succeed and Skyworks’ stock price plummets, only my profits are at risk. Also, for the moment, I have no buy target for Skyworks. Until we hear more from the company about its future plans, I have absolutely no reason to add to SWKS given its future uncertainty.

I do have a sell target, however, for if Skyworks exceeds its reduced allocation size as part of the Speculative Basket, at $228.80, above its all-time high.

How this affects the Investments in Play portfolio…

Skyworks will no longer occupy its own allocation in the portfolio, instead being rolled into the speculative basket see above. Because of this change, the target allocation increases from 6.67% to 7.14% which also adjusts the profit-taking targets for the portfolio’s largest positions, allowing them to run “hotter” than they have lately.

I have also now adjusted all of the profit-taking price targets for the portfolio’s largest positions: Apple (AAPL), Nvidia (NVDA), Nike (NKE), Block/Square (SQ), and Tesla (TSLA).

SWKS closed the week at $151.70, up +4.92% from where I sold Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.