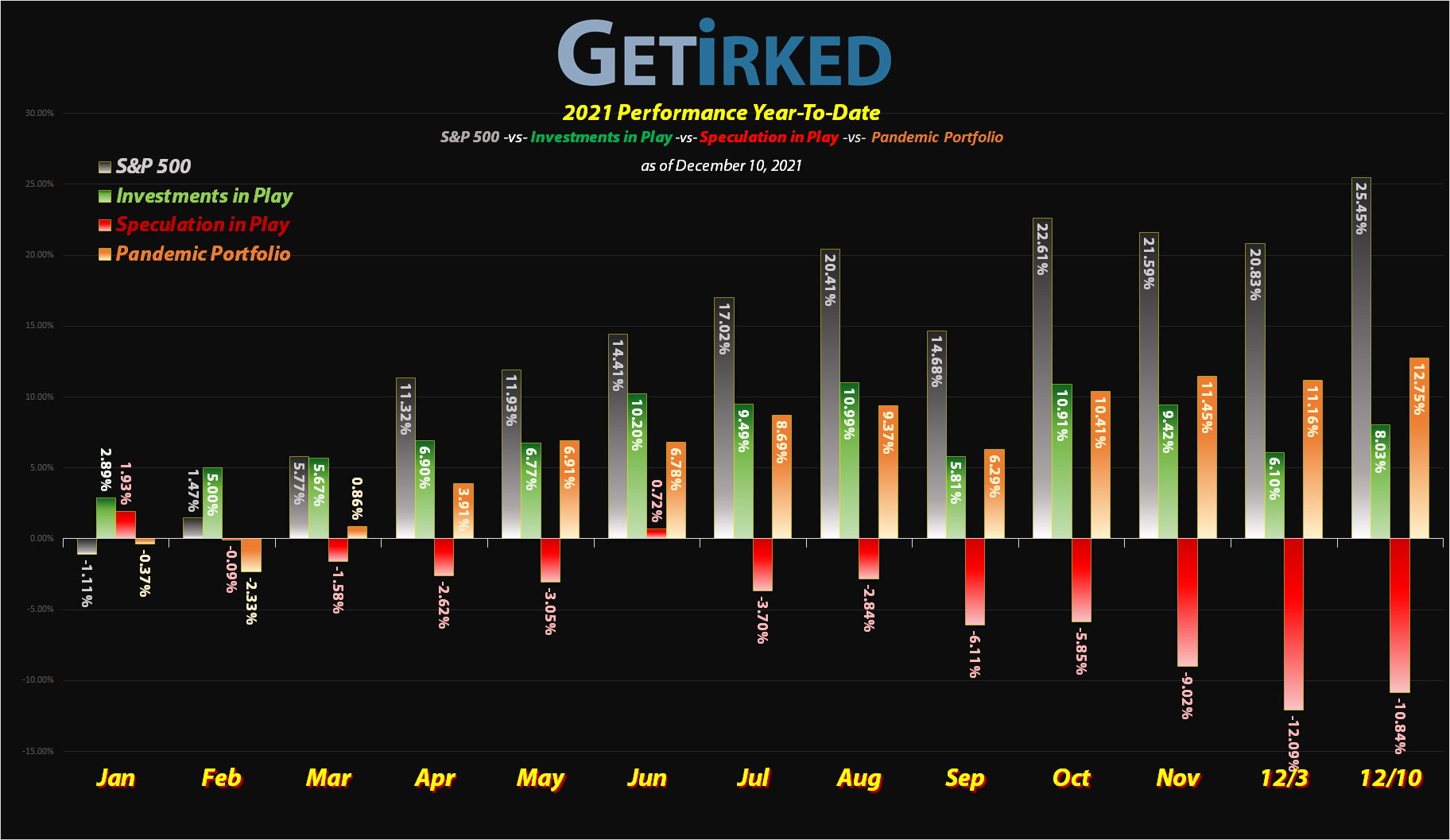

December 10, 2021

The Week’s Biggest Winner & Loser

Apple (AAPL)

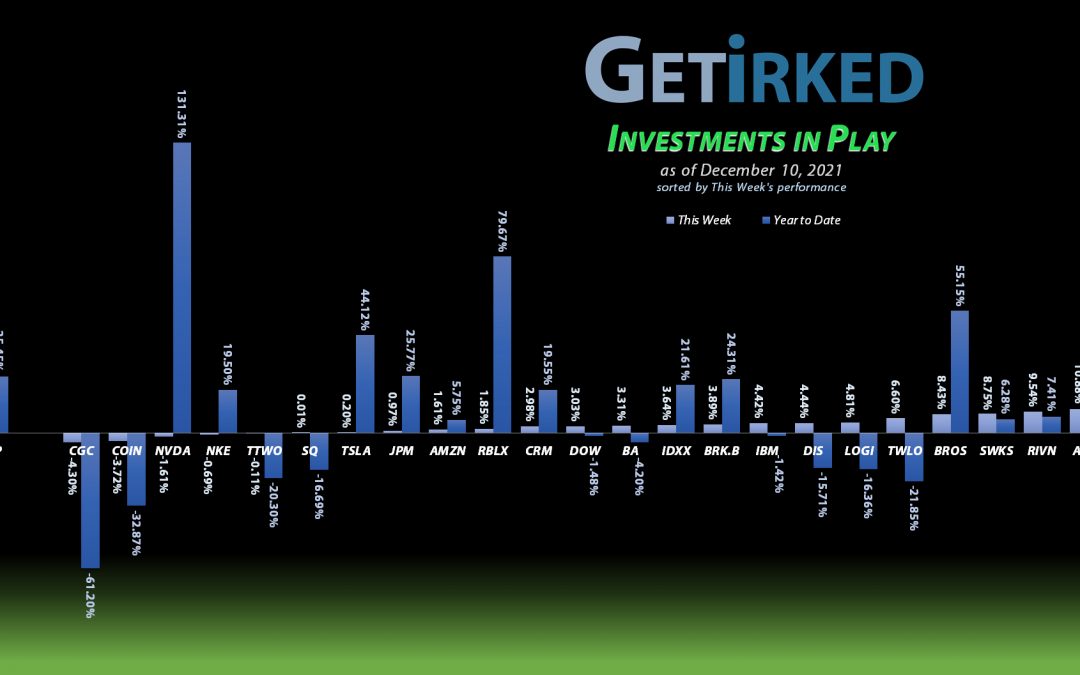

It’s strange days, indeed, when the biggest company with the biggest market cap continues to be the biggest outperformer. Yes, ladies and gentlemen, Apple (AAPL), the big Mamma-Jamma, just popped +10.88% this week to earn itself the spot of the Week’s Biggest Winner.

Insane? Maybe. An indicator that we’re potentially at a market top? Potentially.

Canopy Growth Corp (CGC)

This was predictable, wasn’t it? After popping on the potential passage of the SAFE Banking Act which would permit cannabis providers to open bank accounts and accept credit cards instead of dealing entirely with cash (I know, right?!) last week, Canopy Growth Corporation (CGC) dropped with the rest of the cannabis sector this week when Congress removed the act from the defense budget bill.

While political pundits expect the SAFE Banking Bill to pass in 2022, this week’s setback caused Canopy to drop -4.30%, earning CGC the spot of the Week’s Biggest Loser.

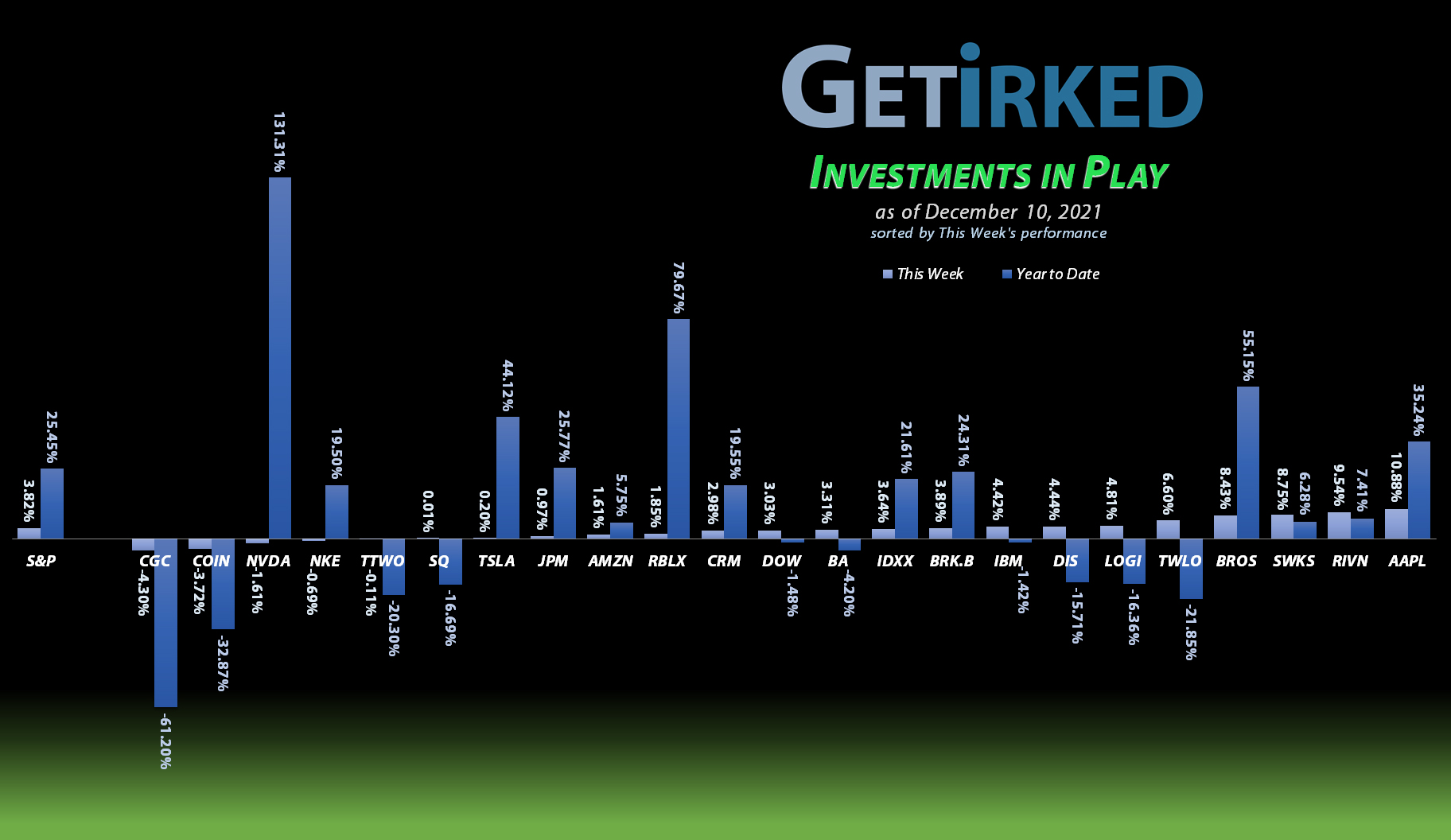

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

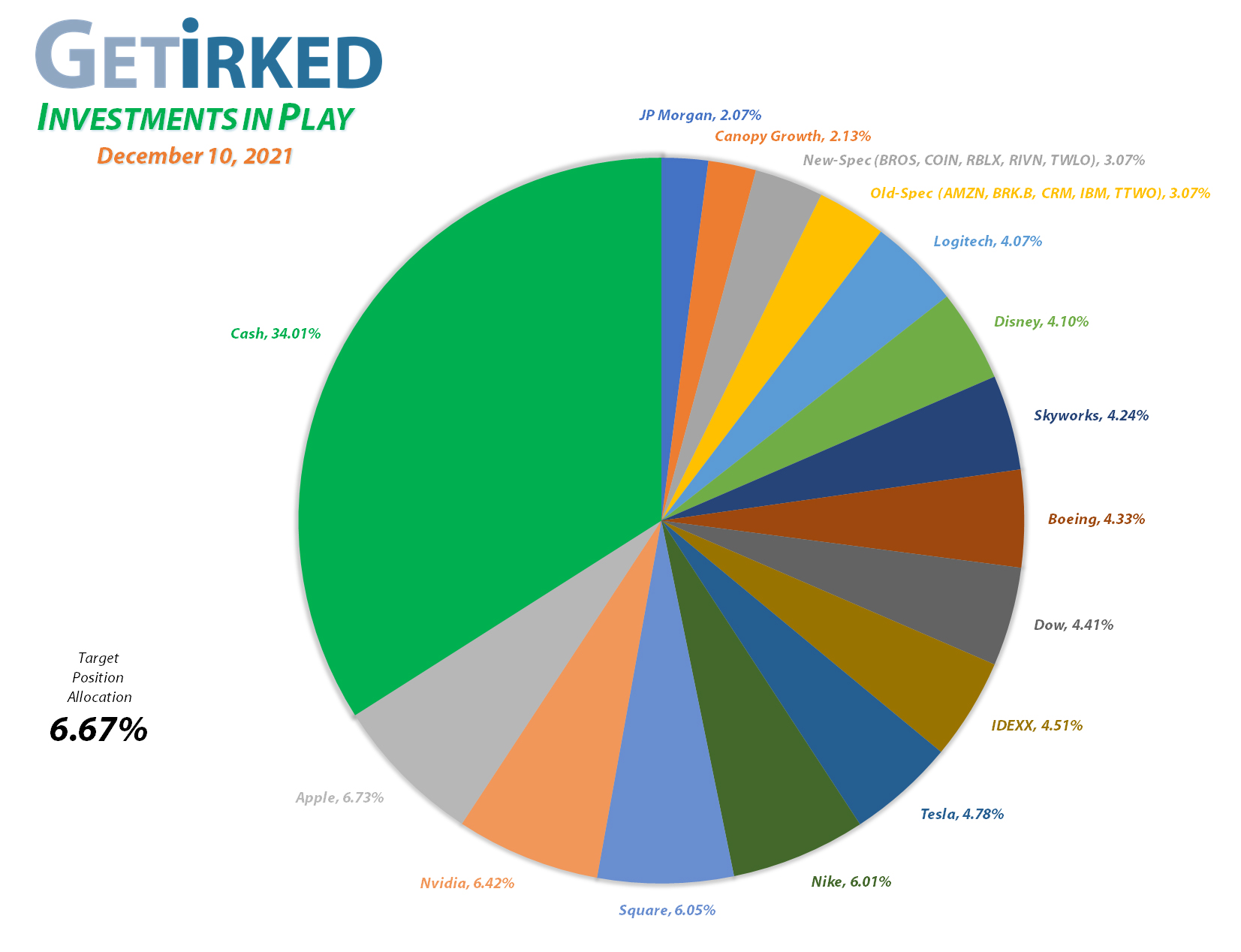

Current Position Performance

Nvidia (NVDA)

+1071.06%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$51.40)*

Apple (AAPL)

+933.16%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$40.27)*

Square (SQ)

+889.70%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$116.15)*

Tesla (TSLA)

+849.74%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Logitech (LOGI)

+680.97%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Boeing (BA)

+663.16%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$212.89)*

Nike (NKE)

+622.08%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+543.45%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$76.83)*

Disney (DIS)

+466.65%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $26.95

Take Two (TTWO)

+418.63%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+343.38%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+212.45%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+153.56%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+141.88%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Roblox (RLBX)

+93.15%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.00

Skyworks (SWKS)

+82.77%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.90

Berkshire (BRK.B)

+57.61%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+50.01%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $36.45

Canopy (CGC)

+36.59%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

IBM (IBM)

+33.07%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $93.25

Dutch Bros (BROS)

+24.20%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Rivian (RIVN)

-9.72%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $127.00

Coinbase (COIN)

-33.47%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Profit-Taking

Just like Nvidia (NVDA) a few weeks ago, I absolutely hate taking profits in Apple (AAPL). This long-term outperformer is almost certainly heading higher from here, basically being anointed a “safety play” by the markets.

However, when any position dramatically exceeds the target allocation size for my portfolio, discipline trumps conviction and it’s time to take profits. This happened for Apple (AAPL) on Friday when a sell order filled at $177.30. In fact, even after taking profits, Apple is still exceeding the allocation target for the portfolio by making up. 6.725% versus the target 6.67%.

The sale locked in +27.39% in gains on shares I bought just a little over two months ago for $139.18 on October 4. The order lowered my per-share “cost” -18.44% from -$34.00 to -$40.27 (a negative per-share price indicates there is no capital in the position and each share instead adds $40.27 to the portfolio’s bottom line in addition to the value of each share).

From here, my next sell target is slightly above $200 (I’m going to let the position run a little hot and exceed the target allocation by quite a margin), and my next buy target is $158.21, slightly above a very recent point of support.

AAPL closed the week at $179.45, up +1.21% from where I took profits.

Canopy Growth Corp (CGC): Added to Position

After watching Canopy Growth Corporation (CGC) find support above $9.50/shr last week, I decided to raise my target and had my order fill for Canopy on Friday down at $9.69.

The order raised my per-share cost +4.48% from $6.70 to $7.00. From here, given how volatile the cannabis space is, I’m holding off until Canopy drops below my new per-share cost before adding more.

My next buy target is at $6.55, right around a past point of support, and my next sell target is around $35.00 where I will pull all capital out of the position.

CGC closed the week at $9.56, down -1.34% from where I added Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.