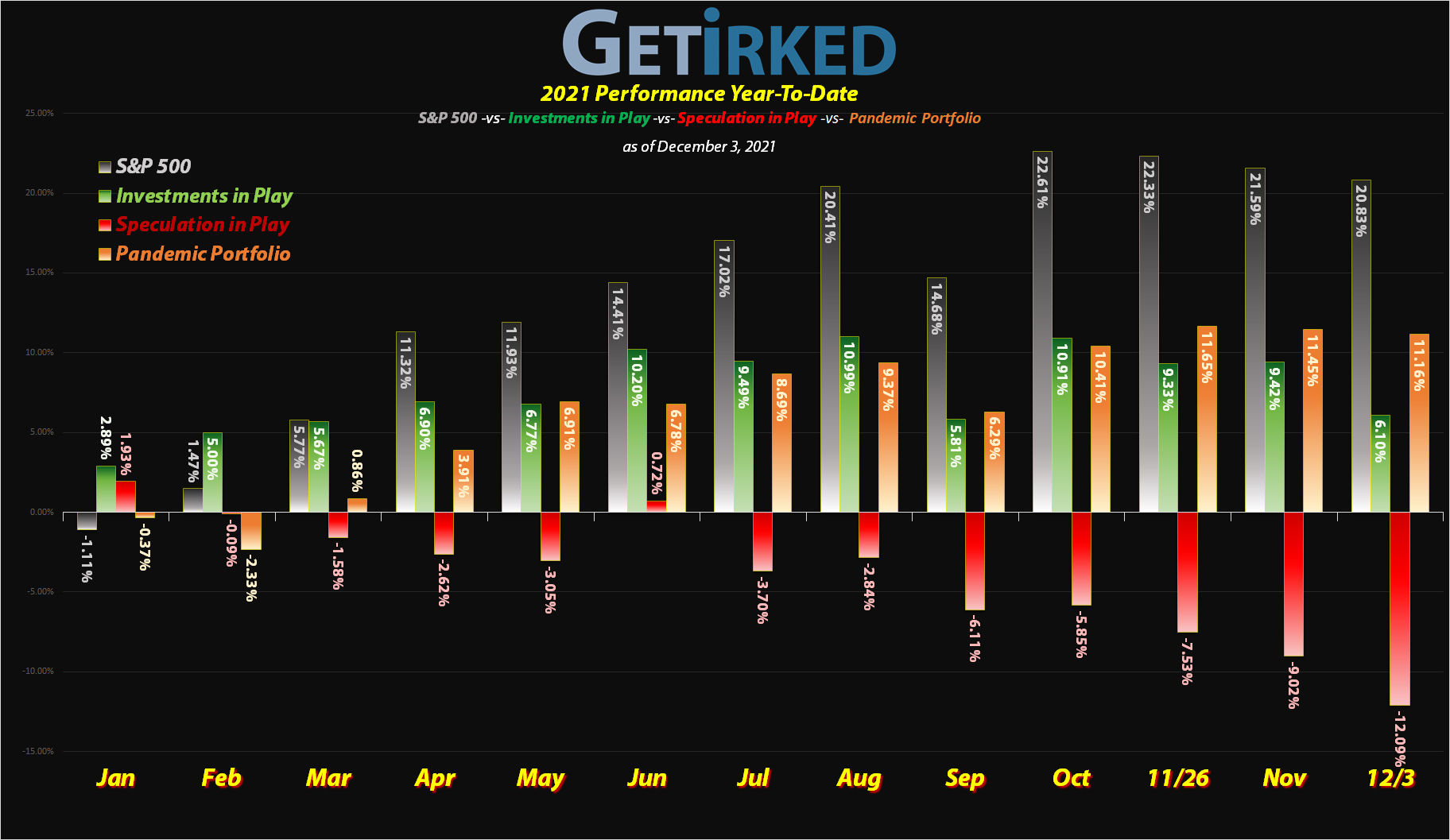

December 3, 2021

The Week’s Biggest Winner & Loser

Apple (AAPL)

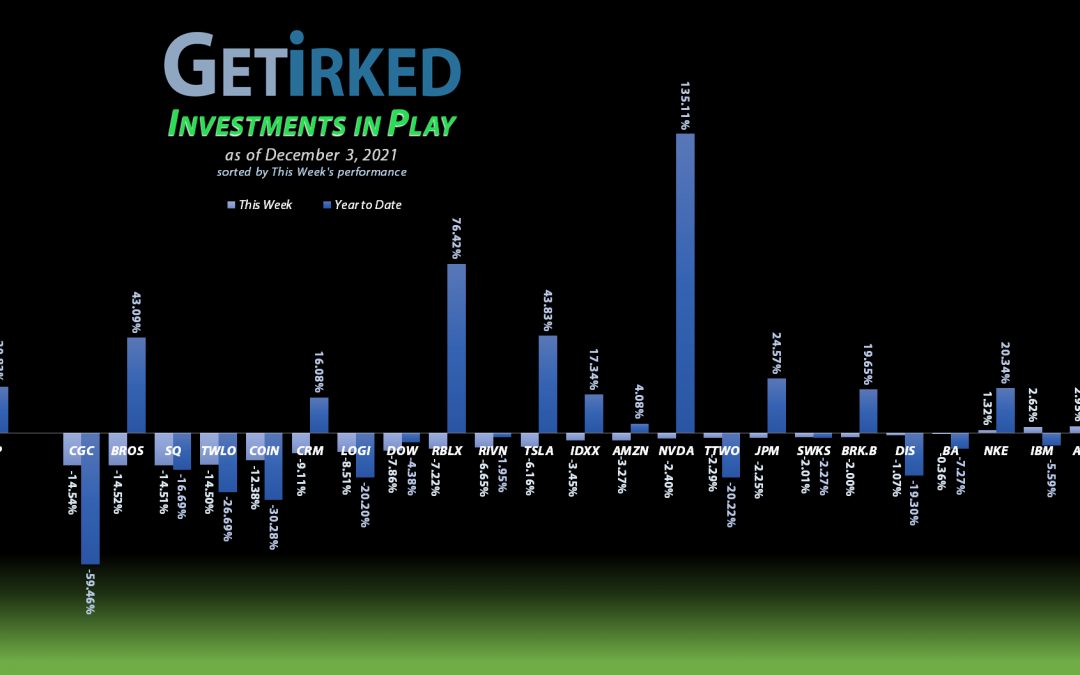

When everyone is panic-selling into a marketwide selloff, where do you turn? Apple (AAPL), apparently, because that’s where all the money went. Despite rumors of iPhone demand waning, Apple (AAPL) still finished the week up +2.95%, earning itself the spot of the Week’s Biggest Loser in a sea of red.

Canopy Growth Corp (CGC)

There seems to be absolutely no end in sight for selling in the recreational cannabis sector as Canopy Growth Corp (CGC) plummeted to its doom once more. CGC’s -14.54% weekly drop gives it a YTD death spiral of -59.46% and lands it the spot of the Week’s Biggest Loser.

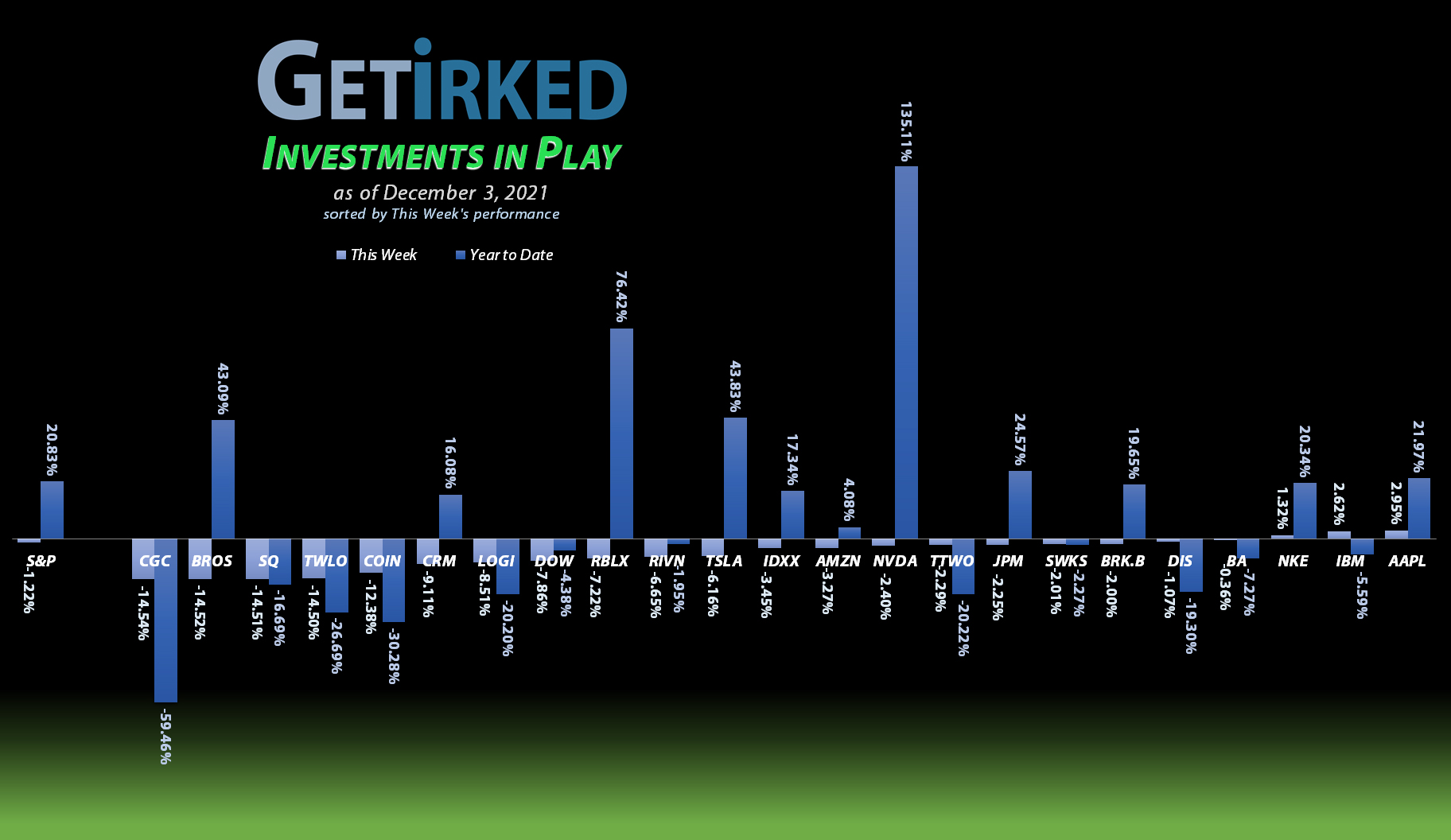

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

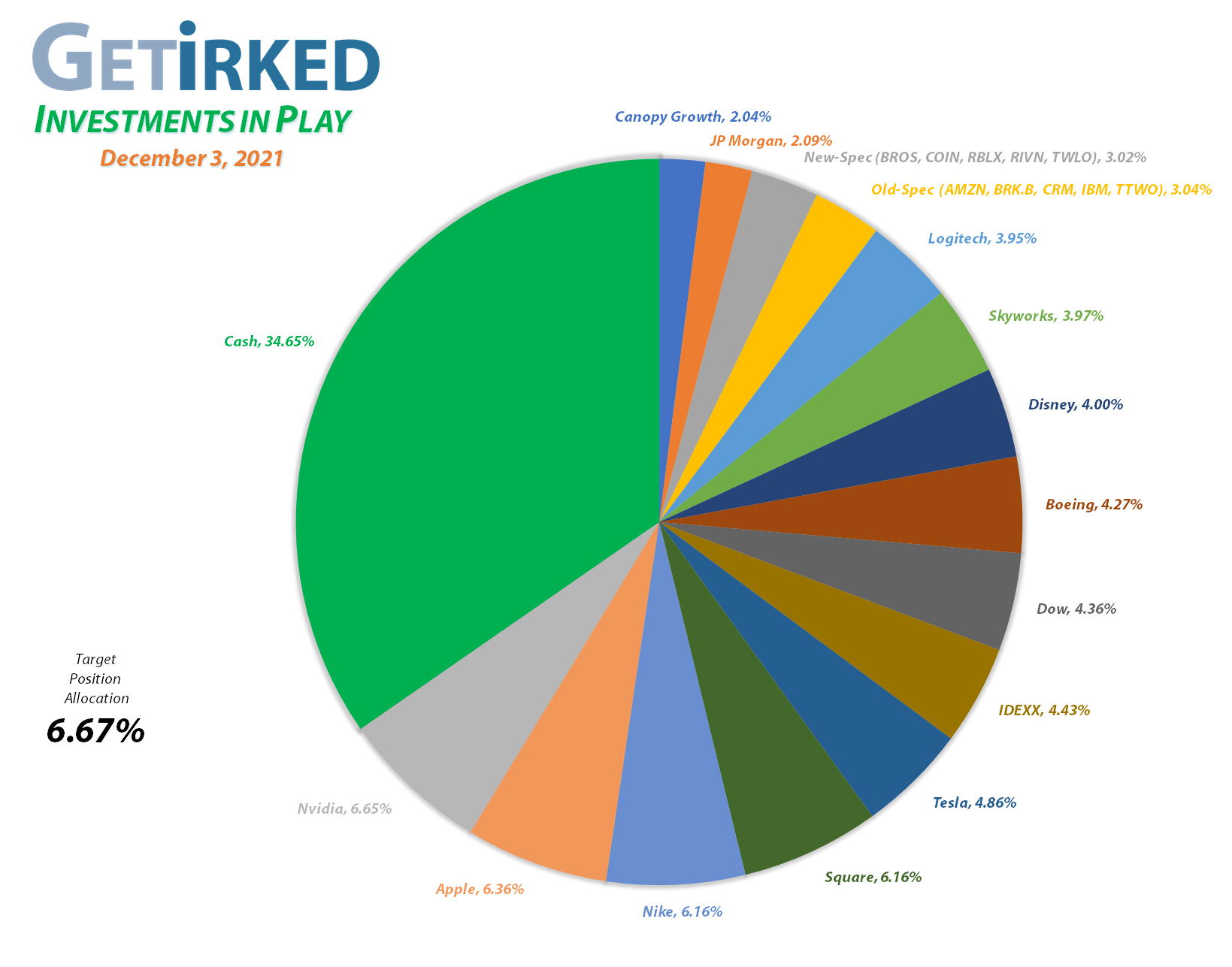

Current Position Performance

Nvidia (NVDA)

+1086.06%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$51.40)*

Square (SQ)

+889.67%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$116.15)*

Apple (AAPL)

+856.42%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.00)*

Tesla (TSLA)

+848.17%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Boeing (BA)

+652.73%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$212.89)*

Logitech (LOGI)

+646.57%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Nike (NKE)

+625.98%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+526.50%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$76.83)*

Disney (DIS)

+442.57%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $26.95

Take Two (TTWO)

+419.09%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+330.53%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+193.11%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+151.13%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+140.14%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Roblox (RLBX)

+89.65%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.00

Skyworks (SWKS)

+68.07%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.90

Berkshire (BRK.B)

+51.70%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Canopy (CGC)

+49.11%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.70

Dow (DOW)

+45.60%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $36.45

IBM (IBM)

+27.44%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $93.25

Dutch Bros (BROS)

+14.54%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Rivian (RIVN)

-17.58%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $127.00

Coinbase (COIN)

-30.90%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

If the recreational cannabis sector can’t get love during an up-market, imagine how it acts during a down-market! Canopy Growth Corp (CGC) continued selling off with the rest of the market this week, triggering a small buy order I had which filled on Tuesday, November 30 at $10.61.

The order raised my per-share cost +1.67% from $6.59 to $6.70. From here, my next buy target is $9.20, slightly above CGC’s pandemic low of $9.00 where it has previously found support, and my next sell target is around $44.70, a past point of resistance where I will pull all of the remaining capital out of the position.

CGC closed the week at $9.99, down -5.84% from where I added Tuesday.

Disney (DIS): Added to Position

Despite the market bounce on Monday following last week’s COVID Omicron Scare, Disney (DIS) continued to experience selling pressure and triggered a buy order I had in place which filled at $146.06.

The buy raised my per-share cost +$5.15 from $21.80 to $26.95, still a -35.63% from where I first opened the position at $41.87 on February 14, 2012. From here, my next buy target is $135.05, above a past point of support, and my next sell target is $197.80 where I will pull the remaining capital back out of the position once again.

DIS closed the week at $146.22, up +-0.11% from where I added Monday.

Dow Chemical (DOW): Added to Position

Despite the rest of the market bouncing on Wednesday, Dow Chemical (DOW) continued to sell off, triggering a buy order that filled at $54.35. The buy raised my per-share cost +0.69% from $36.20 to $36.45, still a -31.45% reduction from my initial $53.18 buy back on May 3, 2019.

At these prices, DOW’s dividend yields in excess of 5.15% annually, a frankly insane return on an investment given that the infrastructure bill will pass and provide huge upside to DOW over time. From here, my next buy target is $51.15, a past point of support, and my sell target is $72.25, slightly above DOW’s current all-time high.

DOW closed the week at $53.07, down -2.36% from where I added Wednesday.

Dutch Bros (BROS): Added to Position

Dutch Bros (BROS) and the rest of the high-flying Class of 2021 IPOs got hit particularly hard during the market selloff, with BROS crashing through my buy order on Friday, filling it at $45.00.

This buy represents a -28.00% discount on shares I sold for $62.50 not too long ago on October 19, and a whopping -44.72% drop from BROS’ $81.40 all-time set barely more than a month ago on November 1. The order raised my per-share cost +1.25% from $40.00 to $40.50.

From here, my next buy target is $41.60, slightly above BROS’ low from its last selloff and my next sell target is $81.00, just under its all-time high.

BROS closed the week at $46.39, up +3.09% from where I added Friday.

IDEXX Laboratories (IDXX): Added to Position

I added to IDEXX Laboratories (IDXX) when it continued to selloff on Thursday following Wednesday’s massive market rout with a buy order that filled at $596.54, locking in a -13.68% discount on some of the shares I sold back earlier this year on July 28 for $691.11.

The buy “raised” my per-share cost +8.57 from -$85.40 to -$76.83 (a negative per-share cost indicates all capital has been removed from the position and each share instead adds $76.83 to the portfolio in addition to the share’s current value).

From here, my next buy order is $541.90, near a past point of support, and I have no intention to sell any more until it exceeds the target allocation size for the portfolio, currently a price target around $1,050/shr.

IDXX closed the week at $586.54, down -1.68% from where I added Thursday.

Logitech (LOGI): Added to Position

Despite the rest of the market bouncing initially on Thursday, Logitech (LOGI) sold off with the rest of the stay-at-home plays, triggering a buy order which filled at $78.44.

The buy locked in a -16.32% discount on some of the shares I sold at $93.74 last year on November 5, 2020 and raised my per-share cost +$1.61 from $5.84 to $7.45, still a -69.46% reduction from my initial buy at $24.40 on

November 11, 2016 (yes, I’ve held Logitech for more than five years now).

From here, my next buy target is $69.55, above a past point of support, and my next sell target is $126.25, at a key point of resistance from Logitech’s last bull rally attempt to get to its $140.17 all-time high.

LOGI closed the week at $77.56, down -1.12% from where I added Thursday.

Roblox (RBLX): Profit-Taking

On Tuesday, Roblox (RBLX) took off once more, this time triggering a sell order I had put in place near its all-time high that filled at $136.00. The sale locked in +90.48% in gains on shares I bought less than two months ago at $71.40 on October 8 and lowered my per-share cost -20.21% from $75.20 to $60.00.

From here, my next buy target is $74.00, above a past point of key support, and my next sell target is $240.00 where I will pull all remaining capital out of the position.

RBLX closed the week at $113.79, down -16.33% from where I sold Tuesday.

Square (SQ): Added to Position

Square (SQ) dropped quite a bit below $200 on Wednesday when the market sold off following the announcement of the first case of COVID Omicron in the U.S., triggering a buy order I had in place at $194.40. On Friday, Square was positively slammed again, dropping down to trigger a second buy order that filled at $175.30, giving me an average buy of $184.85.

Wednesday’s buy locked in a -9.37% discount on shares I sold for $214.49 almost a year ago exactly on December 9, 2020. Friday’s buy locked in a smaller -3.95% discount on shares I sold for $182.50 on October 7, 2020. Combined the two buys raised my per-share cost $8.30 to -$116.15 from -$124.45 (a negative per-share price indicates the shares cost nothing and instead each share adds $116.15 to the portfolio’s bottom line in addition to its current value).

From here, my next buy target is $152.00, above a past point of support, and my next sell target is $265.20, just below SQ’s high from its last bull rally.

SQ closed the week at $181.31, down -1.92% from my average buy price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.