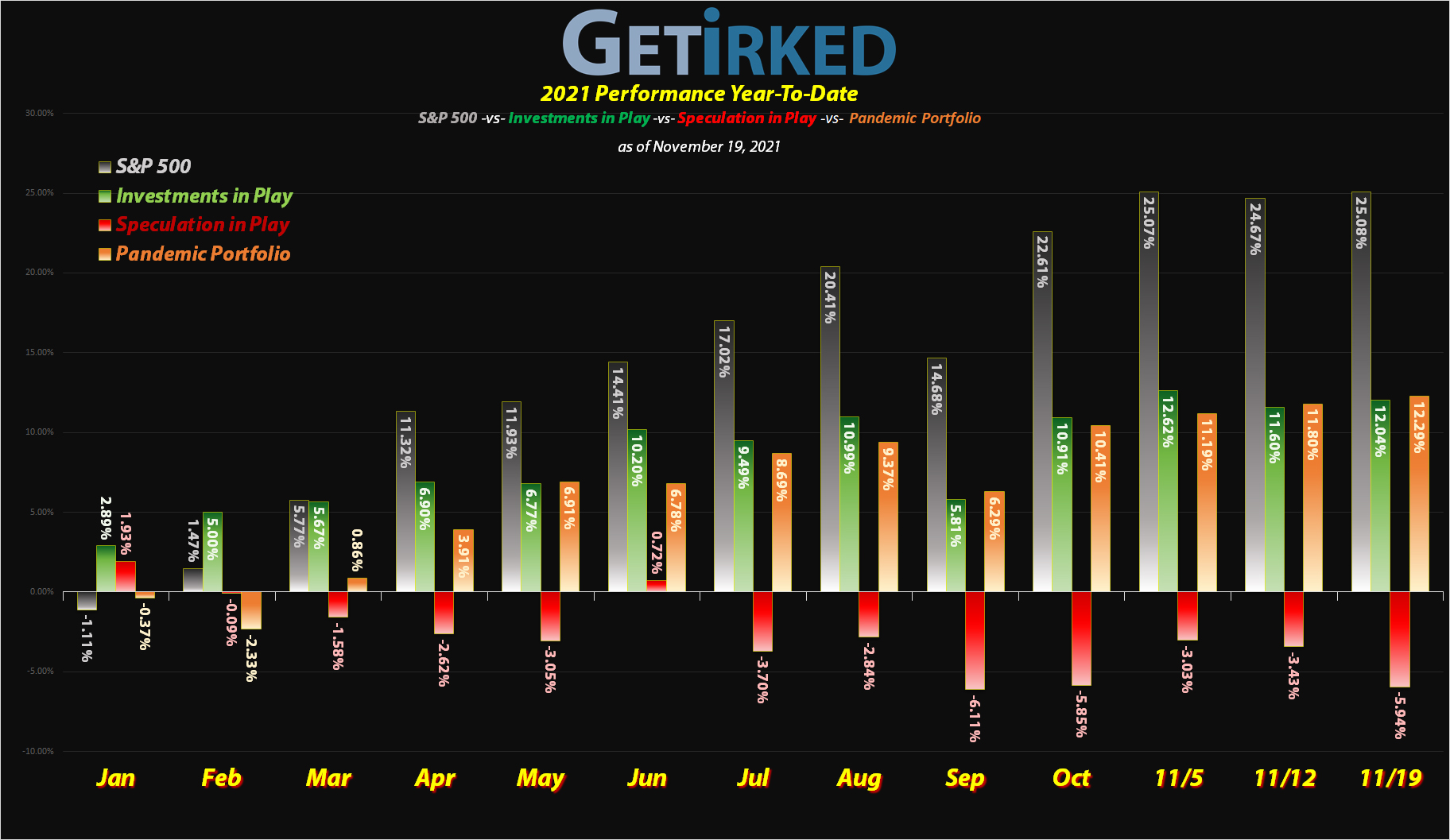

November 19, 2021

The Week’s Biggest Winner & Loser

Roblox (RBLX)

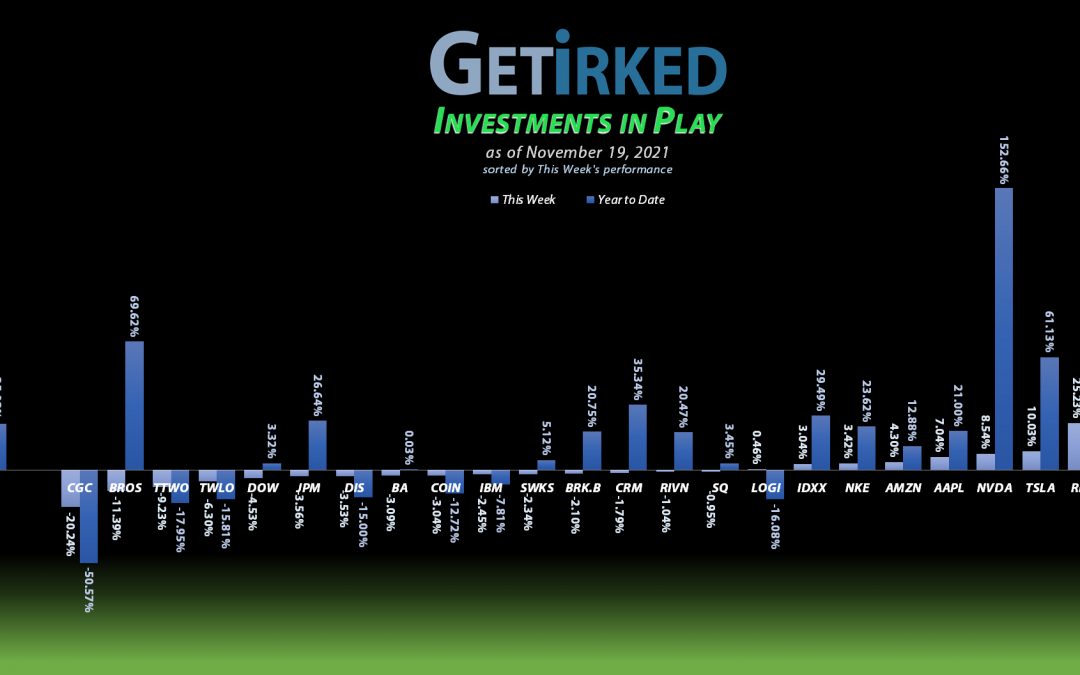

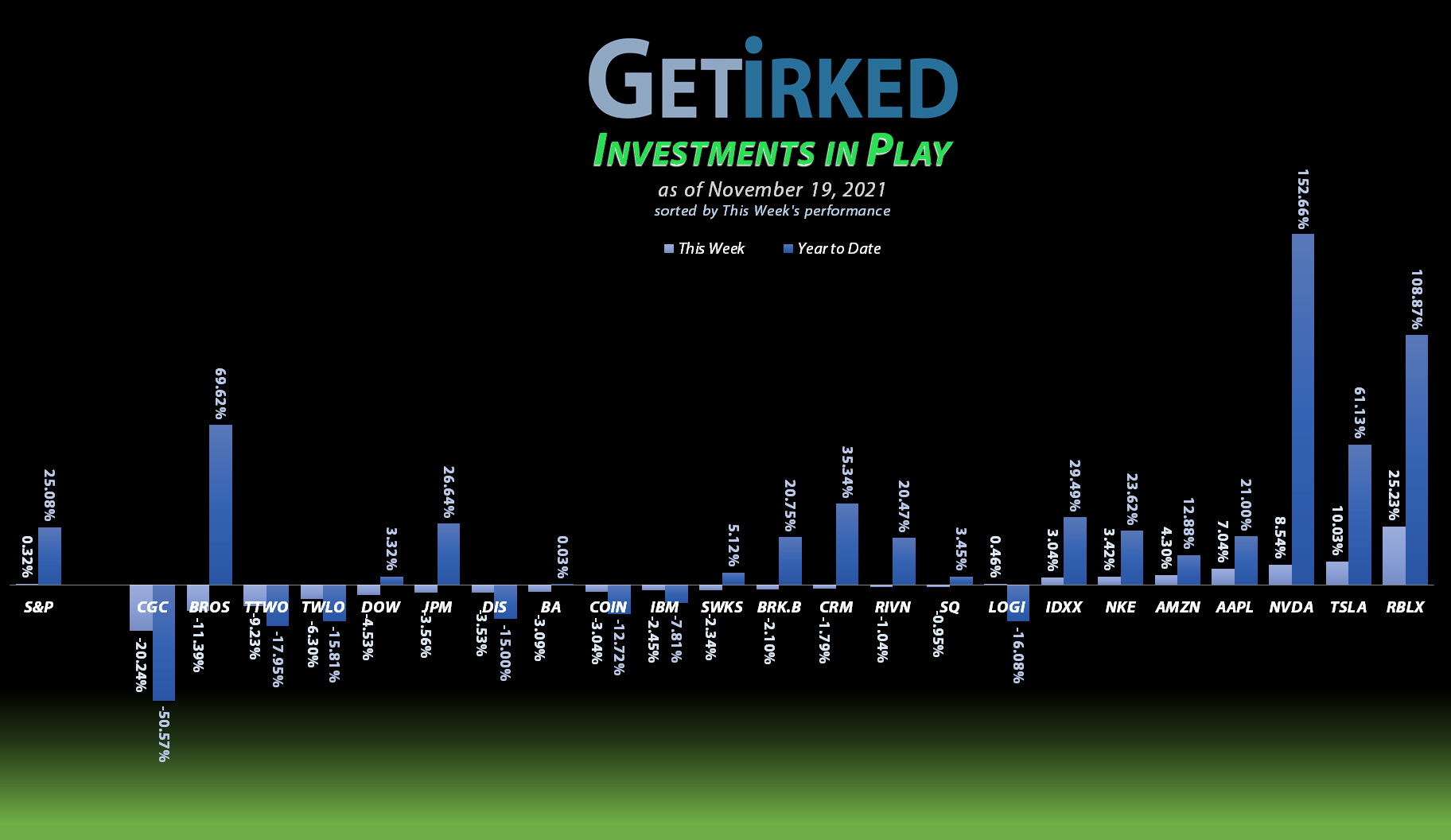

With everyone and their grandparents talking about the metaverse, who thought a little kids’ video game development platform would rule the roost? Well, Roblox (RBLX) certainly did, and rule the roost it is – locking in an epic +25.23% gain this week, easily slamming into the spot of the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

While it looked like the recreational cannabis sector may be catching a break last week, that completely fell apart this week with the entire sector coming down hard. Canopy Growth Corporation (CGC) gave up whatever ground it had taken last week, dropping a painful -20.24% and skidding to a halt as the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Nvidia (NVDA)

+1153.44%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$31.80)*

Square (SQ)

+1011.28%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$150.55)*

Tesla (TSLA)

+940.88%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Apple (AAPL)

+850.78%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.00)*

Logitech (LOGI)

+682.82%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $5.84

Boeing (BA)

+676.18%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$235.70)*

Nike (NKE)

+641.34%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

Disney (DIS)

+606.43%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $21.80

IDEXX Labs (IDXX)

+574.19%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$85.40)*

Take Two (TTWO)

+431.02%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+401.95%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+236.61%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+155.30%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+149.31%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Skyworks (SWKS)

+87.09%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $85.90

Canopy (CGC)

+84.88%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.59

Roblox (RLBX)

+79.15%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $75.20

Dow (DOW)

+59.74%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.90

Berkshire (BRK.B)

+53.10%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dutch Bros (BROS)

+37.48%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.00

IBM (IBM)

+24.45%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $93.25

Rivian (RIVN)

+1.26%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $127.00

Coinbase (COIN)

-13.50%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

IBM (IBM): Added to Position

IBM (IBM) continued to come under selling pressure this week, triggering a buy order on Tuesday which filled at $118.47. The order raised my per-share cost +$3.86 from $89.39 to $93.25, a reduction of -23.36% from my initial $121.67 purchase price back on November 6, 2018.

From here, my next buy price target is $110.75 and my next sell target is around $145, just below a recent point of resistance.

IBM closed the week at $116.05, down -2.04% from where I bought Tuesday.

Square (SQ): Added to Position

Square (SQ) and the rest of the payment-processing fintech space came under selling pressure this week following news that Amazon would stop accepting VISA credit cards in Europe due to exorbitant fees. On Friday, Square dipped below my next buy target at $226.45.

The buy order replaced shares I sold for $280.25 on August 2 and locked in a -19.20% discount. The order also increased my per-share cost +$14.50 from -$165.05 to -$150.55.

From here, my next buy target is $212.05 and my next sell target is $269.35, near a recent point of resistance.

SQ closed the week at $225.14, down -0.58% from where I added Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.