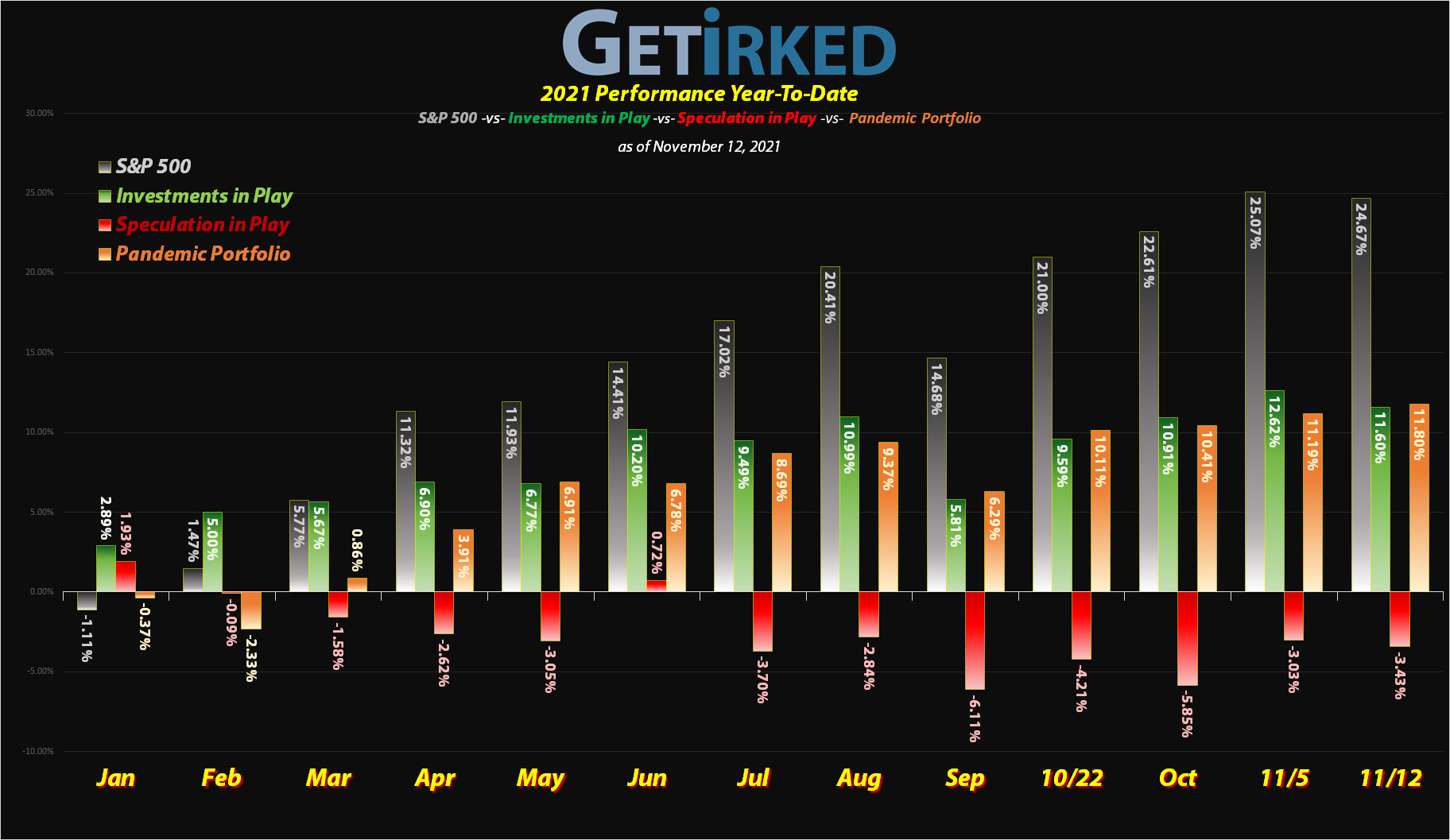

November 12, 2021

The Week’s Biggest Winner & Loser

Roblox (RBLX)

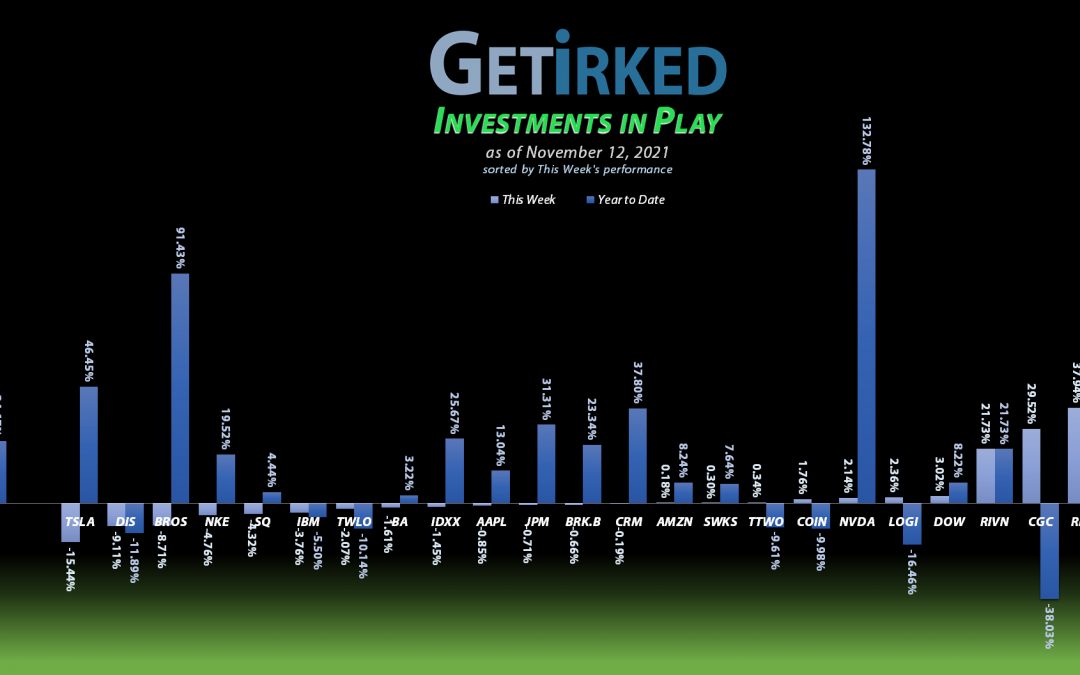

The Bearish analysts who believed Roblox (RBLX) was just a pandemic play were positively obliterated this week when RBLX reported an amazing quarterly earnings report, blowing out even the most bullish of expectations. RBLX rocketed into the stratosphere with a +37.94% gain on the week, easily landing itself the spot of the Week’s Biggest Winner.

Tesla (TSLA)

Between the IPO of Rivian (RIVN) and Elon Musk’s inability to keep his gigantic pie-hole shut for more than 30 seconds, Tesla (TSLA) positively dissolved this week. While it was down much further than where it closed the week, no longer the Belle of the Ball, Tesla stunk up the joint with a -15.44% loss, beating out Disney (DIS) by more than 6% and DIS delivered the stinkiest quarter in AGES! TSLA definitely earned itself the spot of the Week’s Biggest Loser. I’m sure I’m far from the first to say this, but, Elon, will you please shut the *$%& up?!!

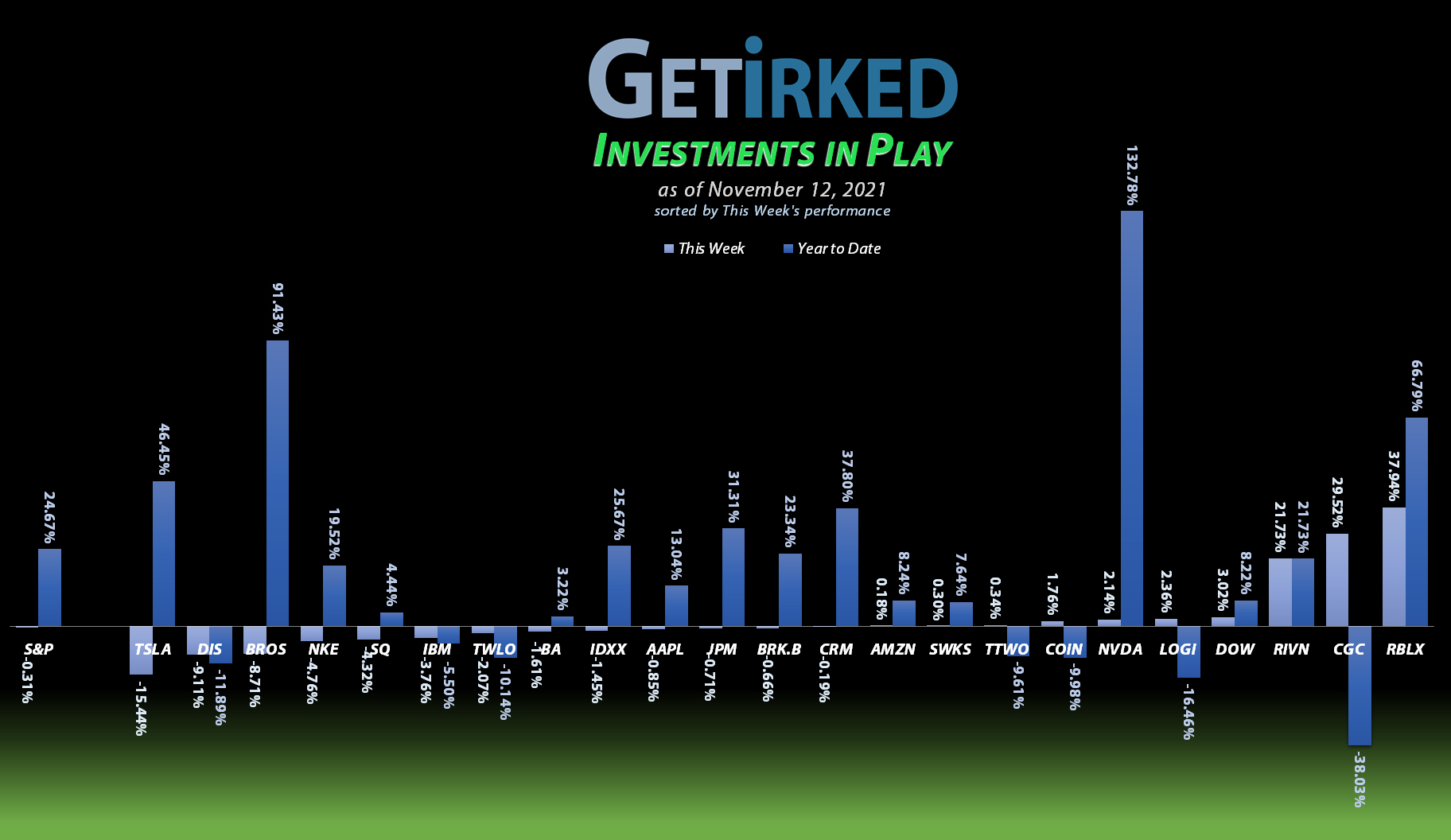

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

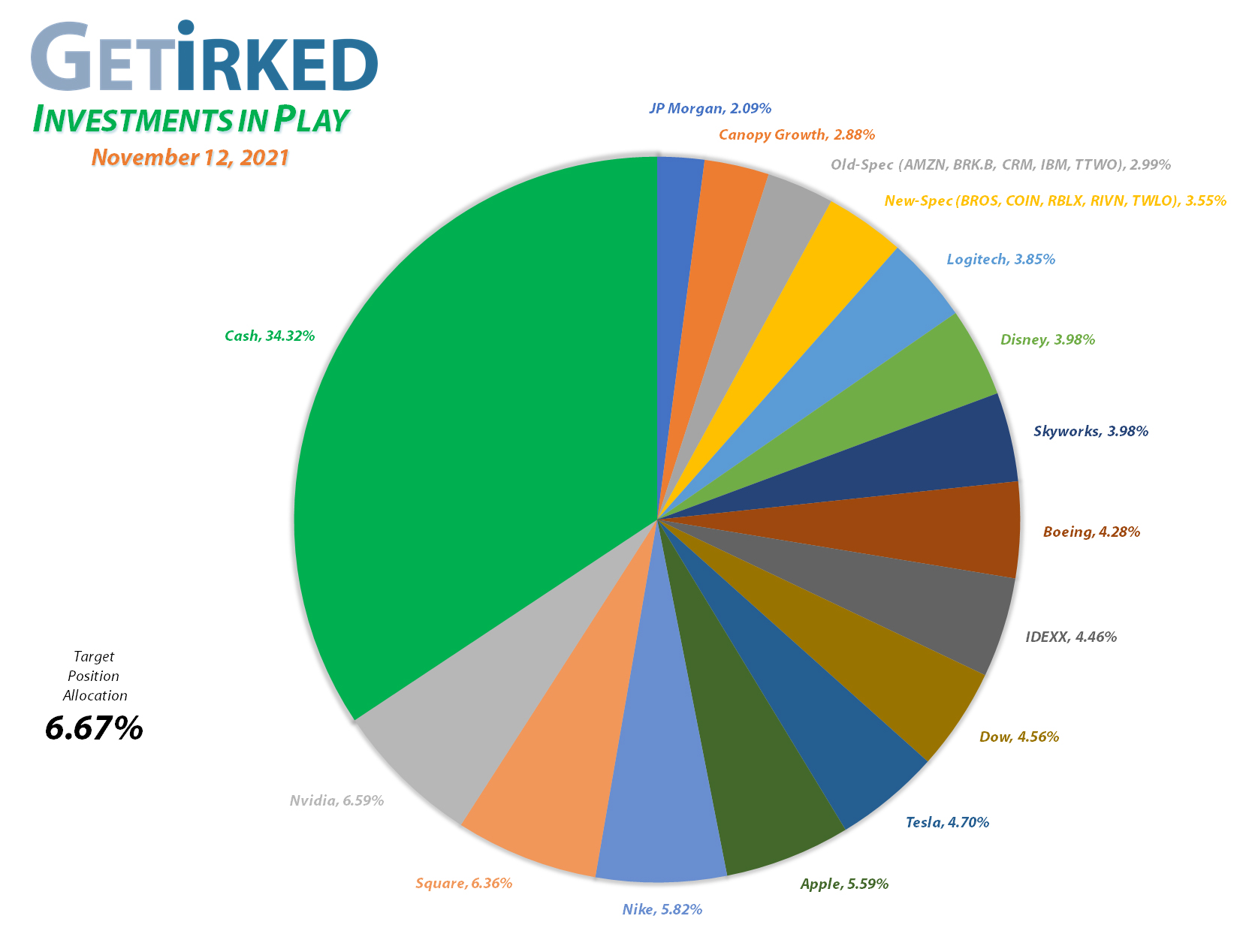

Current Position Performance

Nvidia (NVDA)

+1070.67%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$31.80)*

Square (SQ)

+1017.01%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Tesla (TSLA)

+862.18%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Apple (AAPL)

+803.63%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.05)*

Boeing (BA)

+686.45%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$235.70)*

Logitech (LOGI)

+679.49%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $5.84

Disney (DIS)

+632.25%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $21.80

Nike (NKE)

+622.08%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+559.23%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$85.40)*

Take Two (TTWO)

+474.83%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+411.08%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+259.24%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+164.73%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+144.47%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Canopy (CGC)

+131.78%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.59

Skyworks (SWKS)

+91.57%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $85.90

Dow (DOW)

+67.31%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.90

Berkshire (BRK.B)

+56.39%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dutch Bros (BROS)

+55.15%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.00

Roblox (RLBX)

+43.06%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $75.20

IBM (IBM)

+33.07%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $89.39

Rivian (RIVN)

+2.32%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $127.00

Coinbase (COIN)

-10.79%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Disney (DIS): Added to Position

Disney (DIS) sold off in a spectacular fashion on Thursday following a disastrous earnings report after the market closed Wednesday. Oddly, a pandemic isn’t good for theme parks, cruise lines, or movies, plus, the streaming service doesn’t seem to be growing since people have gone back to work and school.

A buy order I had in place filled Thursday morning at $161.45, raising my per-share cost +6.31 from $15.49 to $21.80, still a -47.93% reduction from my first buy back on February 14, 2012 at $41.87 (after commissions, of course).

From here, my next buy target is $147.30, slightly above a past point of support, and my next sell target is $199.95, slightly below DIS’s $203.02 all-time high.

DIS closed the week at $159.63, down -1.13% from where I added Thursday.

Rivian (RIVN): *New Position*

New market EV darling, Rivian (RIVN), came public via IPO this week and positively skyrocketed, leaving me to waffle between buying the stock up higher or waiting for it to retrace. I decided to split the difference, buying a very small quantity to open the position with a buy order that filled at $127.00 on Friday.

Since I already have a full allocation dedicated to the Best-in-Breed (at least currently) in the space, Tesla (TSLA), my position in Rivian will be part of the New-Spec Basket alongside colleagues Dutch Bros (BROS), Coinbase (COIN), Roblox (RBLX), and Twilio (TWLO).

From here, I have many small buys at different key levels with the next price target at $115.45, a very recent point of support. Naturally, I have no sell targets for what will likely become a long-term investment in this portfolio.

RIVN closed the week at $129.95, up +2.32% from where I opened Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.