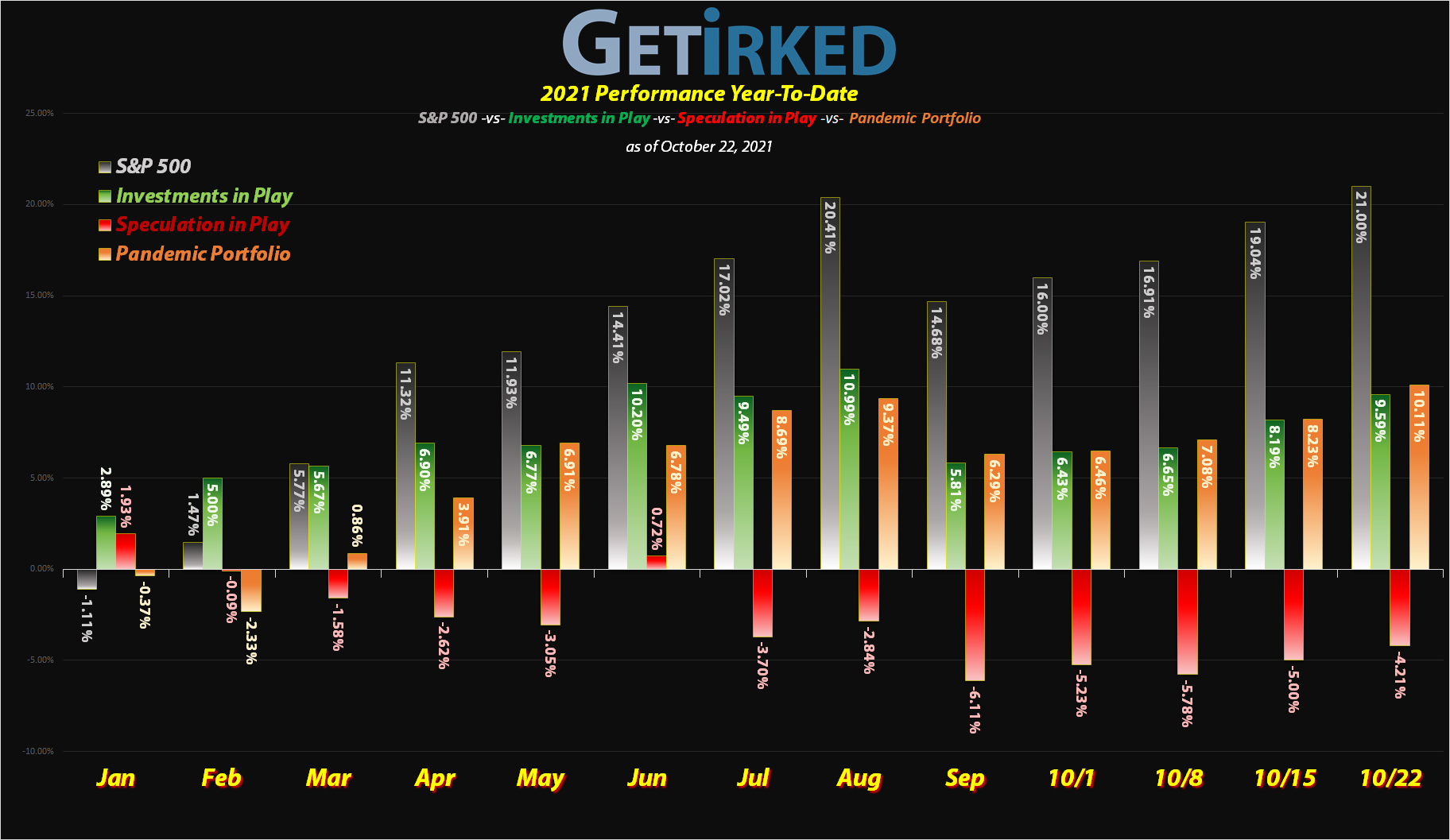

October 22, 2021

The Week’s Biggest Winner & Loser

Dutch Bros (BROS)

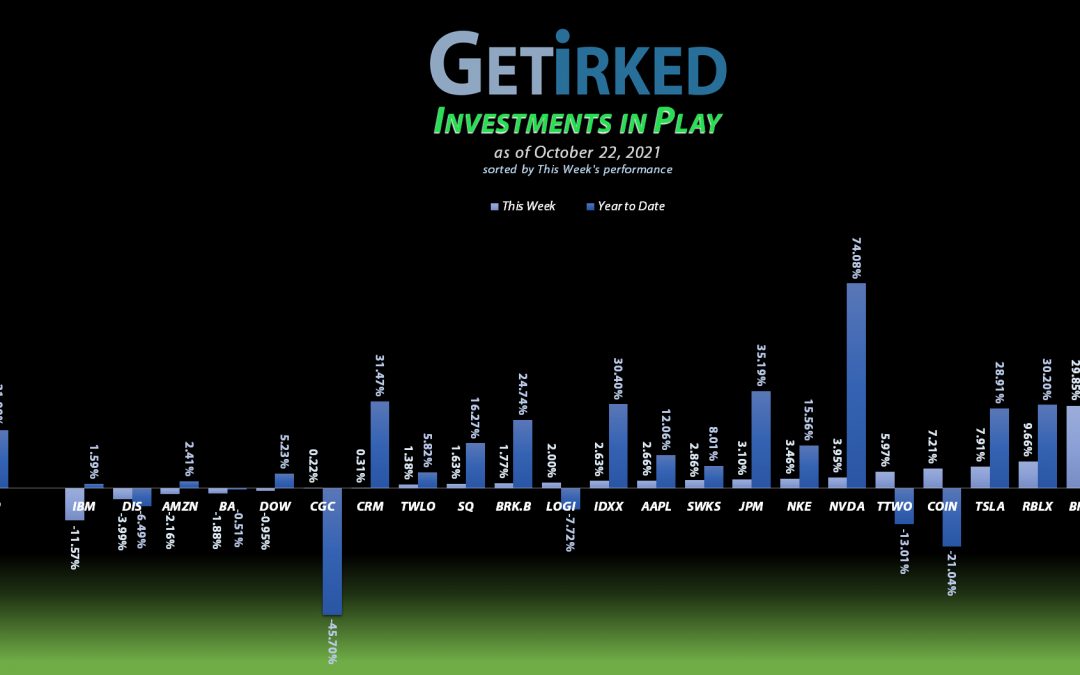

Man, when the markets love a new IPO, they *love* a new IPO. Coffee-maker Dutch Bros (BROS) has been riding a buzz ever since analysts came out with nothing about adoration for the company’s prospects.

The stock rocketed +29.85% this week a gain of +112.40% from where it opened in the markets just a few weeks ago.

There’s no question that BROS easily earned the spot of the Week’s Biggest Winner for the second week in a row.

IBM (IBM)

IBM (IBM), you have one job to do – turn yourself around and make some profits. But, noooooo, every time you have the ball in your hands, you cough it up and trip over your own two feet.

IBM reported abysmal earnings this week, disappointing investors and then offering even poorer guidance for future prospects.

IBM bailed -11.57% in a week and once again earned itself the spot of the Week’s Biggest Loser… the stinker.

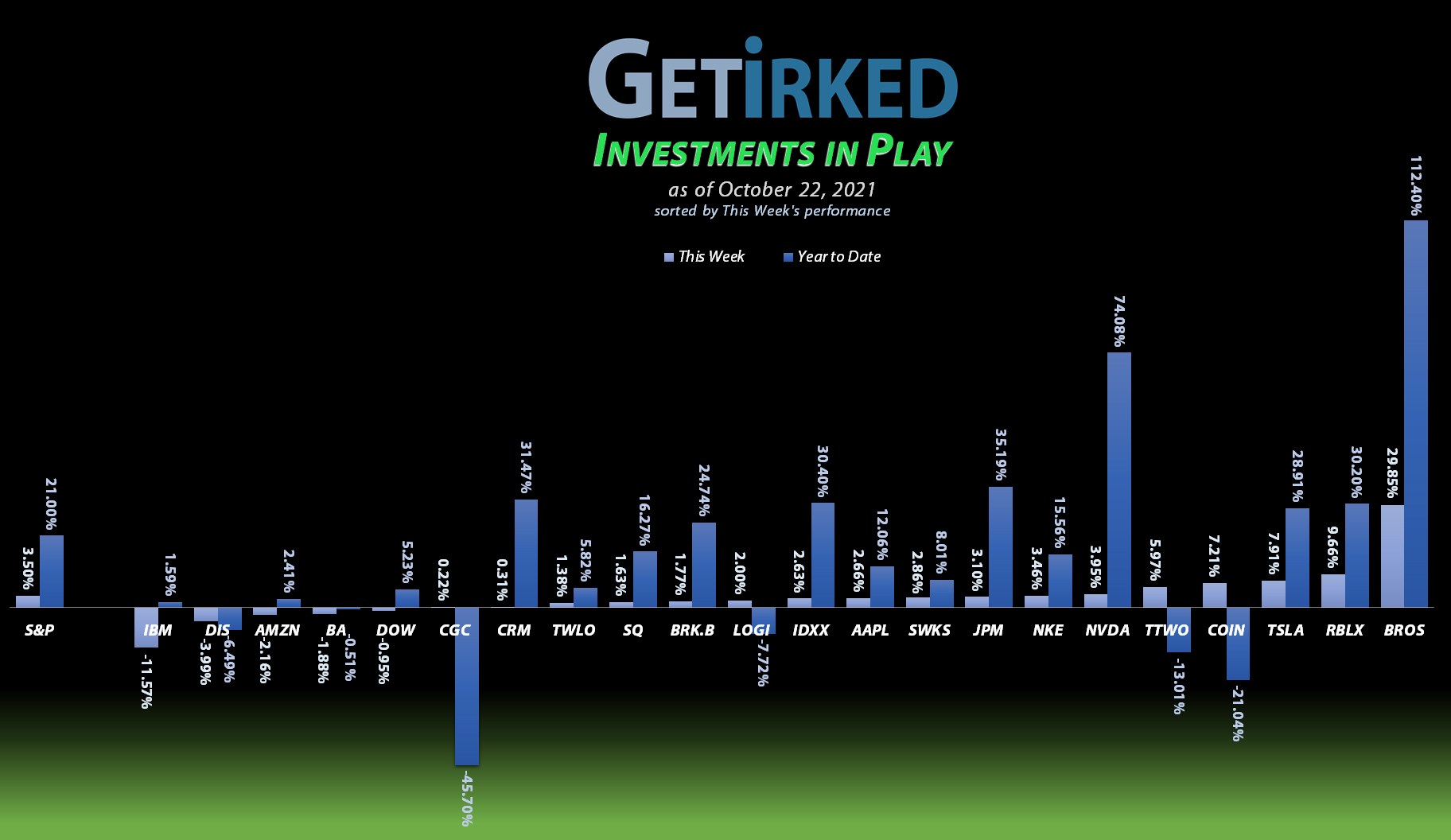

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Roblox (RBLX), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

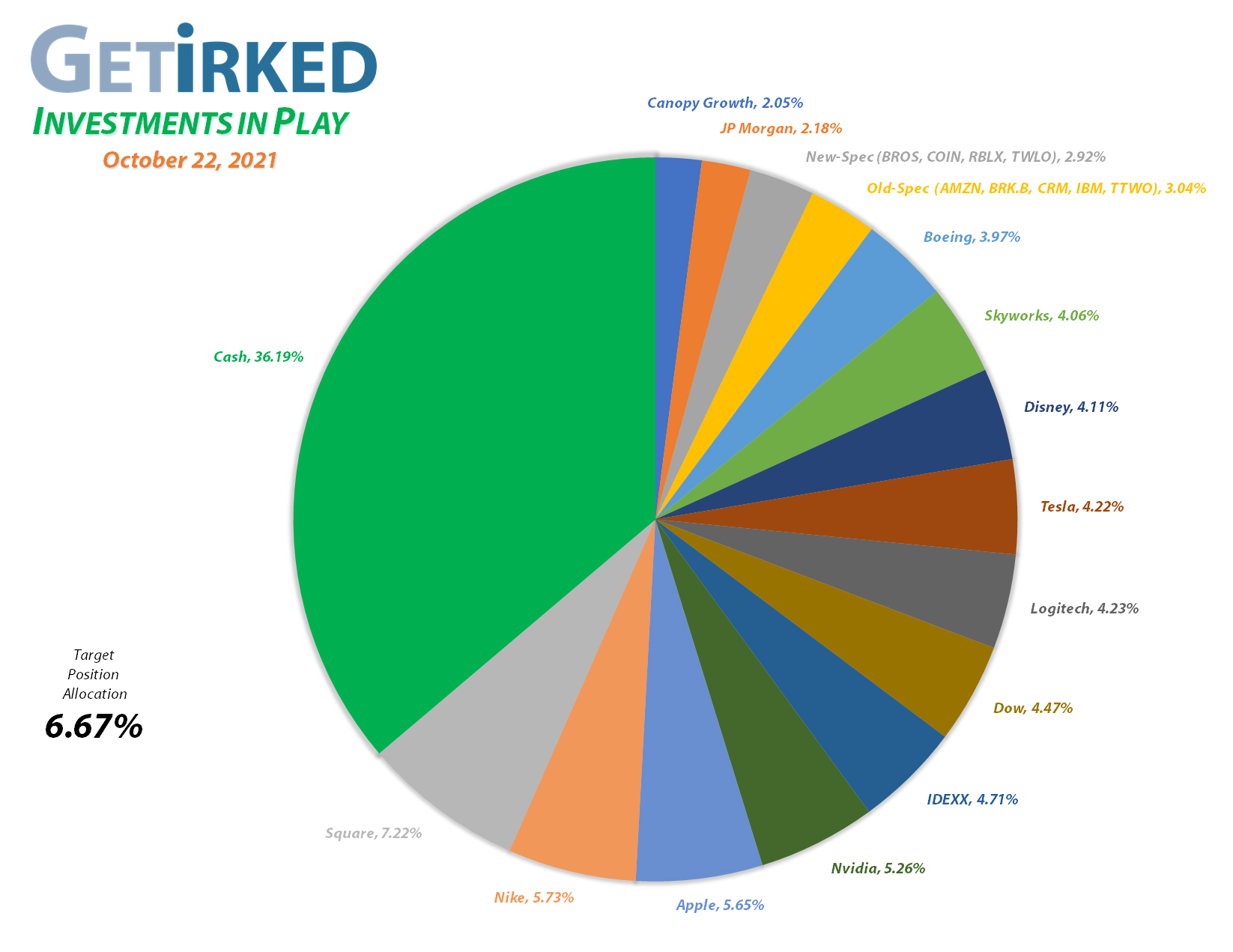

Current Position Performance

Square (SQ)

+1083.78%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Nvidia (NVDA)

+812.72%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Apple (AAPL)

+797.95%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.05)*

Tesla (TSLA)

+768.22%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Logitech (LOGI)

+754.67%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $4.05

Boeing (BA)

+674.04%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Nike (NKE)

+603.61%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+577.78%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$85.40)*

Take Two (TTWO)

+456.93%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+387.60%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Disney (DIS)

+353.73%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $15.49

Twilio (TWLO)

+198.57%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

JP Morgan (JPM)

+170.95%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.40

Canopy (CGC)

+159.81%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.15

Amazon (AMZN)

+138.41%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Skyworks (SWKS)

+92.22%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $85.90

Dutch Bros (BROS)

+72.15%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.00

Dow (DOW)

+63.65%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.69

Berkshire (BRK.B)

+58.16%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

IBM (IBM)

+43.05%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $89.39

Roblox (RLBX)

+11.68%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $75.20

Coinbase (COIN)

-21.75%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Disney (DIS): Added to Position

Disney (DIS) sold off hard this week after a Barclays analyst released a report claiming DIS isn’t developing enough content for streaming to compete with the likes of Netflix (NFLX). On Tuesday, I added to my position with a buy order that filled at $170.57, raising my per-share cost +$7.34 from $8.15 to $15.49.

My new per-share cost still represents a -63.01% reduction from my first purchase of Disney on February 14, 2012 for $41.87 (after commissions). From here, my next buy target is $153.35 and my next sell target is around $300 where DIS will have exceeded the target allocation for the portfolio.

DIS closed the week at $169.42, down -0.67% from where I added Tuesday.

Dutch Bros (BROS): Profit-Taking

Following last week’s outstanding analyst coverage, Dutch Bros (BROS) rocketed higher this week, breaking its previous $61.97 all-time high to set a new high at $63.35 before pulling back. On its way up, it triggered a sell order I had in place which filled at $62.50 on Tuesday.

Given this brand-new stock’s insane volatility, I couldn’t pass up the opportunity to lock in +47.93% in gains in less than a month, selling 10% of my position and lowering my per-share cost -5.33% from $42.25 to $40.00. From here, my next buy target is $43.60, slightly above BROS’ last selloff, and I have no sell targets at this point.

BROS closed the week at $68.86, up +10.18% from where I sold Tuesday.

IBM (IBM): Added to Position

IBM (IBM) sold off in substantial fashion after reporting disappointing quarterly earnings Wednesday evening, triggering a buy order which filled at $133.21 during Thursday trading.

The order raised my per-share cost +$7.90 from $81.49 to $89.39, still representing a -26.53% reduction from where I initially opened the position at $121.67 on November 6, 2018. From here, my next buy target is $119.25 and I have no sell targets at this time.

IBM closed the week at $127.88, down -4.00% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.