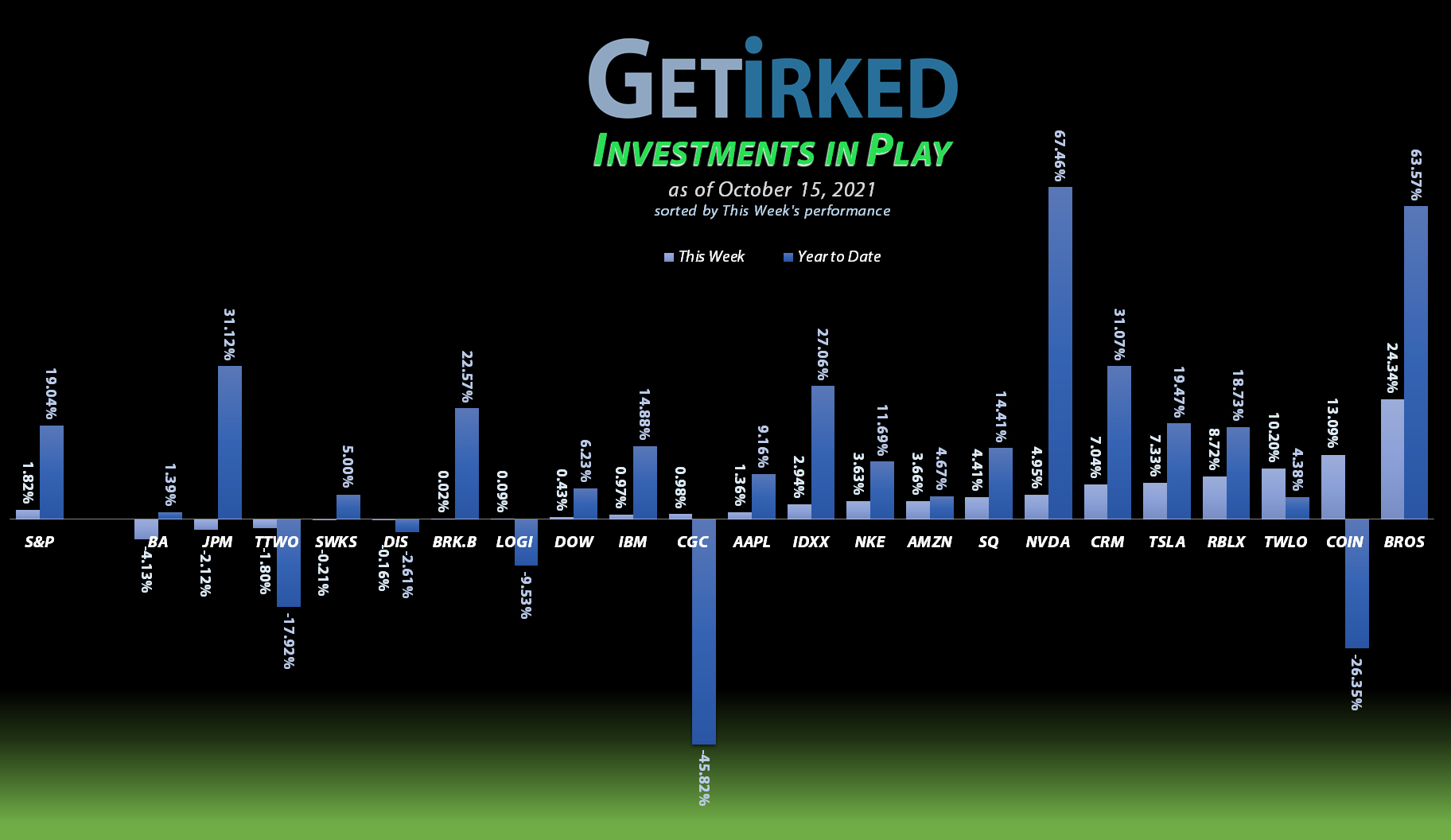

October 15, 2021

The Week’s Biggest Winner & Loser

Dutch Bros (BROS)

The quiet period on analyst coverage following Dutch Bros (BROS) initial public offering ended this and the results are in – analysts absolutely *LOVE* Dutch Bros and its potential growth prospects. The reviews were so stellar that BROS brewed up a +24.34% gain, earning the spot of the Week’s Biggest Winner.

Boeing (BA)

Good god, Boeing (BA)! Can you not get out of your own way for at least a few days?! Boeing (BA) came out with more bad news this week – apparently, some of the parts on their three-year-old 787 Dreamliner (not the 737 Max) had been improperly manufactured. In a week where almost everything saw gains, BA dropped -4.13% to become the Week’s Biggest Loser.

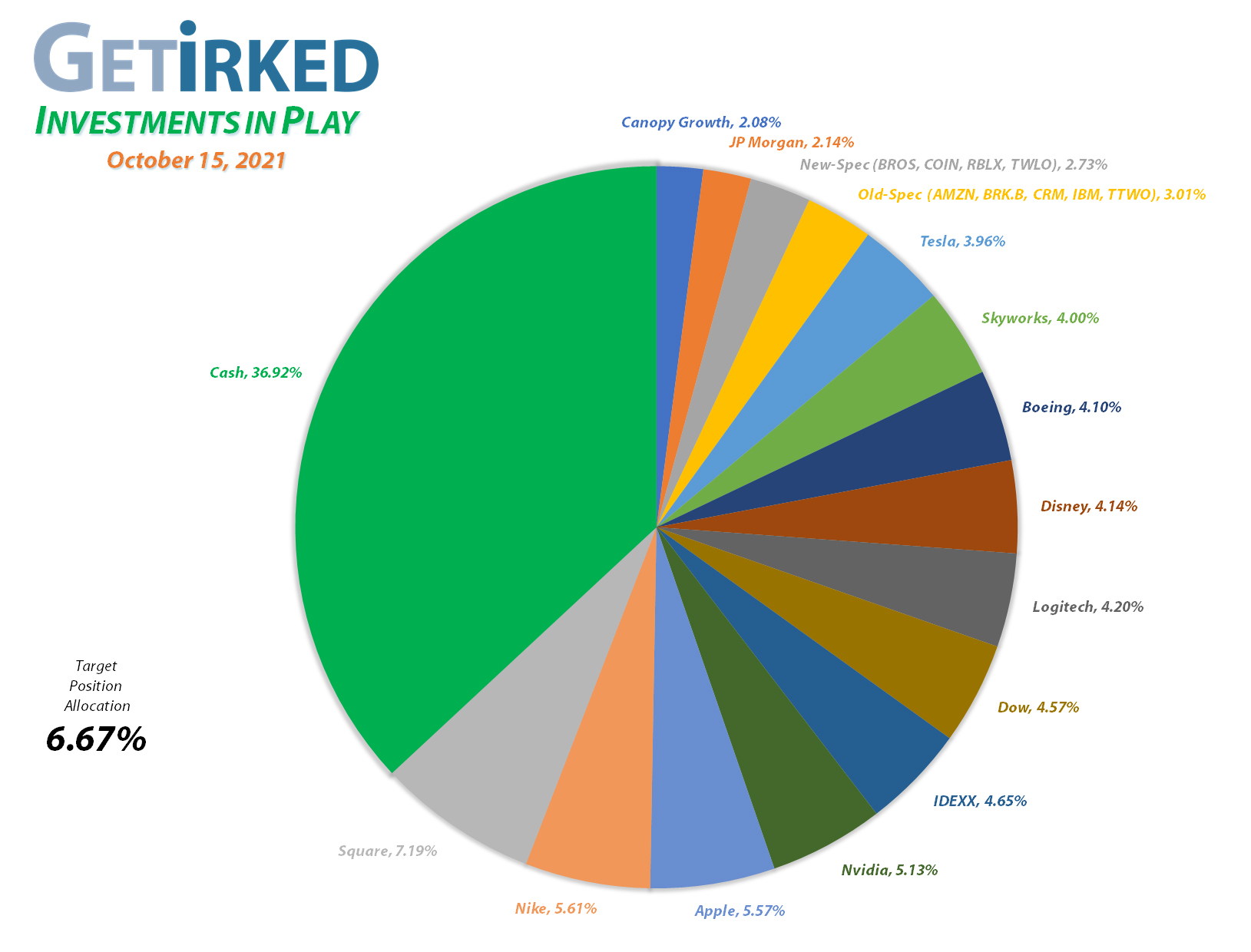

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), IBM (IBM), Roblox (RBLX), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Square (SQ)

+1073.26%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Nvidia (NVDA)

+783.80%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Apple (AAPL)

+781.14%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.05)*

Logitech (LOGI)

+739.16%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $4.05

Tesla (TSLA)

+717.62%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Boeing (BA)

+679.82%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Nike (NKE)

+585.51%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.92)*

IDEXX Labs (IDXX)

+564.70%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$85.40)*

Take Two (TTWO)

+431.17%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+386.10%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Disney (DIS)

+369.30%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $8.15

Twilio (TWLO)

+195.99%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

JP Morgan (JPM)

+162.79%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.40

Canopy (CGC)

+159.22%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.15

Amazon (AMZN)

+140.76%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Skyworks (SWKS)

+86.88%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $85.90

IBM (IBM)

+77.47%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $81.49

Dow (DOW)

+65.22%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.69

Berkshire (BRK.B)

+55.41%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dutch Bros (BROS)

+25.51%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $42.25

Roblox (RLBX)

+1.84%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $75.20

Coinbase (COIN)

-27.01%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

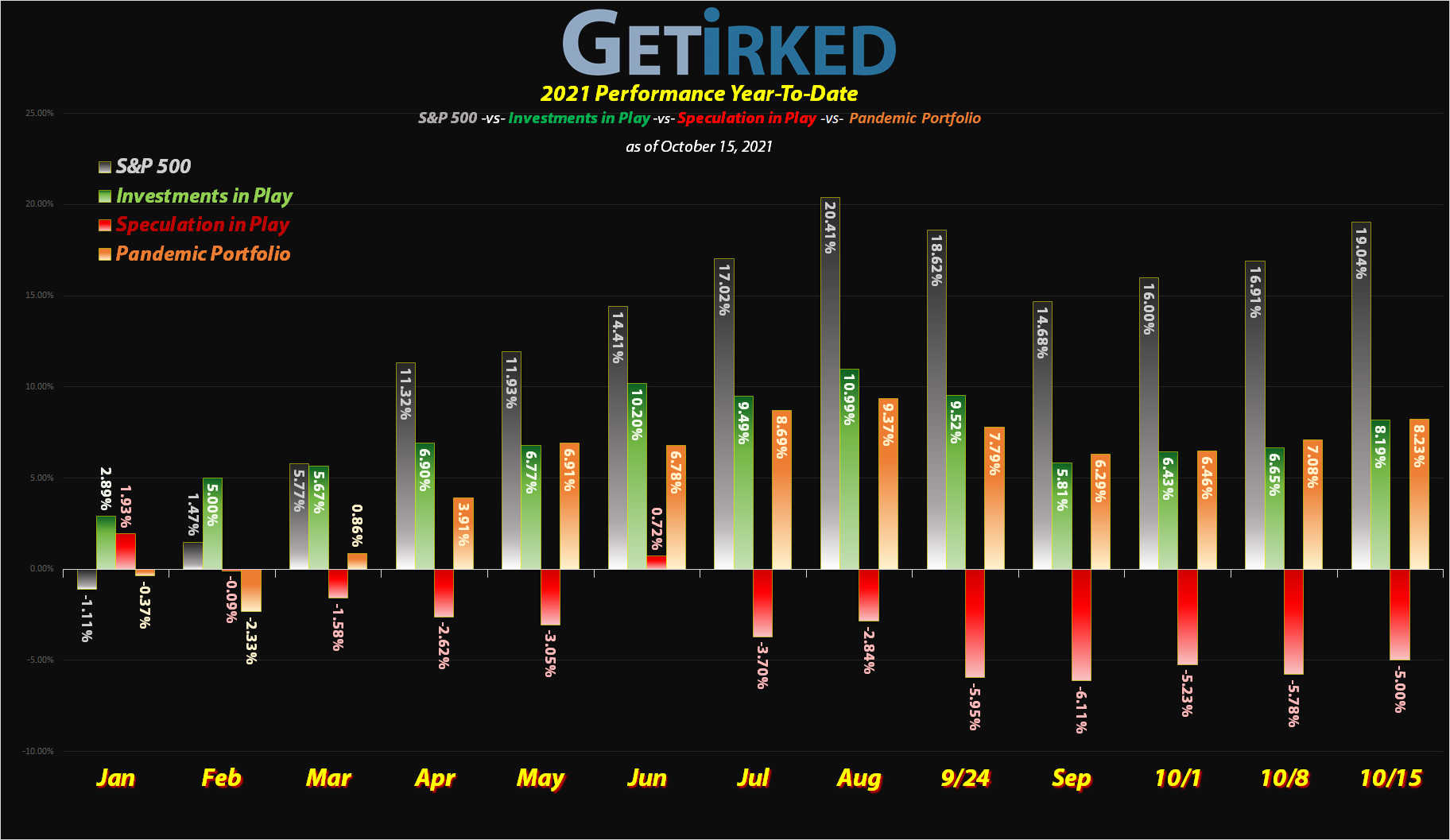

Calm before the storm?

After a few weeks of insane volatility, this week was quiet. Almost… too quiet? In all seriousness, we’re still not out of the historical period for volatility for the markets. Typically, the volatility dies off in the 3rd or 4th week of October before the market rallies into the end of the year.

Of course, nothing is ever “typical.” Back in 2018, the markets collapsed all the way through November and into the end of the year. In fact, if you recall, Christmas Eve 2018 was the worst Christmas Eve since the Great Depression. This is all my long way of saying is that the best plan is to have a plan for both outcomes – what will you do if the market heads higher? What will you do if the market heads lower?

Personally, I’m hoping for a bigger downside move so I can add to all of my positions, however, judging from this week’s rally it’s hard to know whether we can expect even a little selloff from here.

Have a great weekend, everyone! I’ll see you next week!

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.