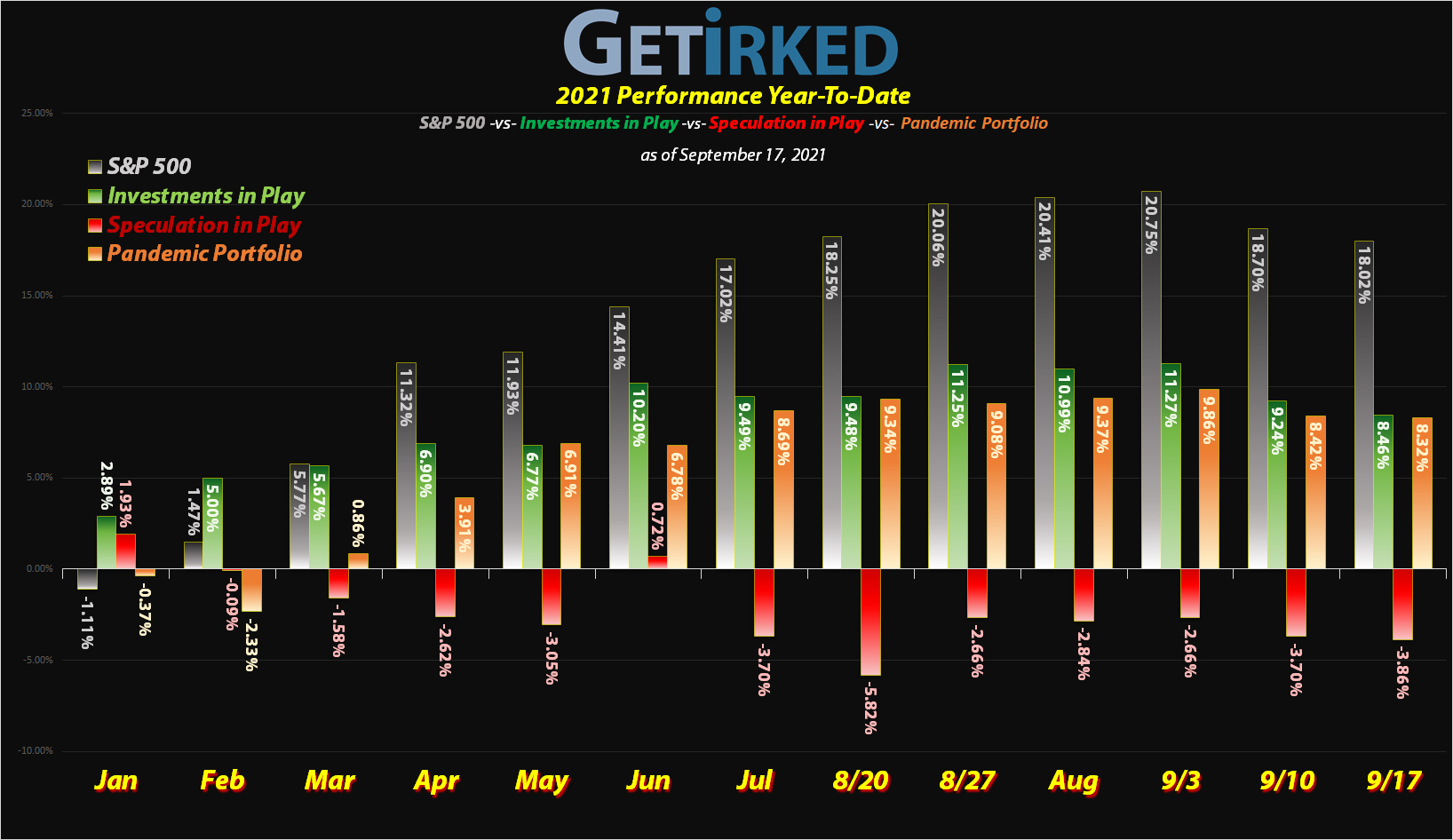

September 17, 2021

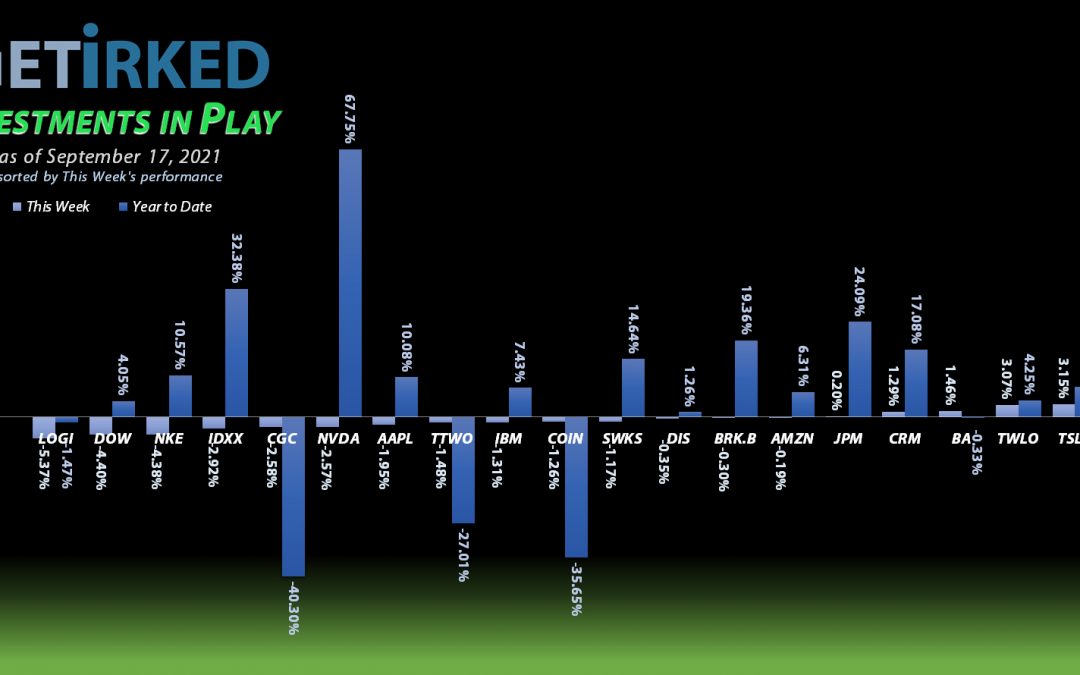

The Week’s Biggest Winner & Loser

Square (SQ)

During another round of selloffs, you might think that a high-flying growth play like Square (SQ) would get slammed, but you would be wrong.

Fintech favorite SQ closed the week +3.18% which, in this market, constitutes a win and earns it the Week’s Biggest Winner spot.

Logitech (LOGI)

The bears have been out for Logitech (LOGI) for months now and this week’s selloff didn’t see them let up one bit. LOGI got slammed -5.37% and landed the Week’s Biggest Loser spot.

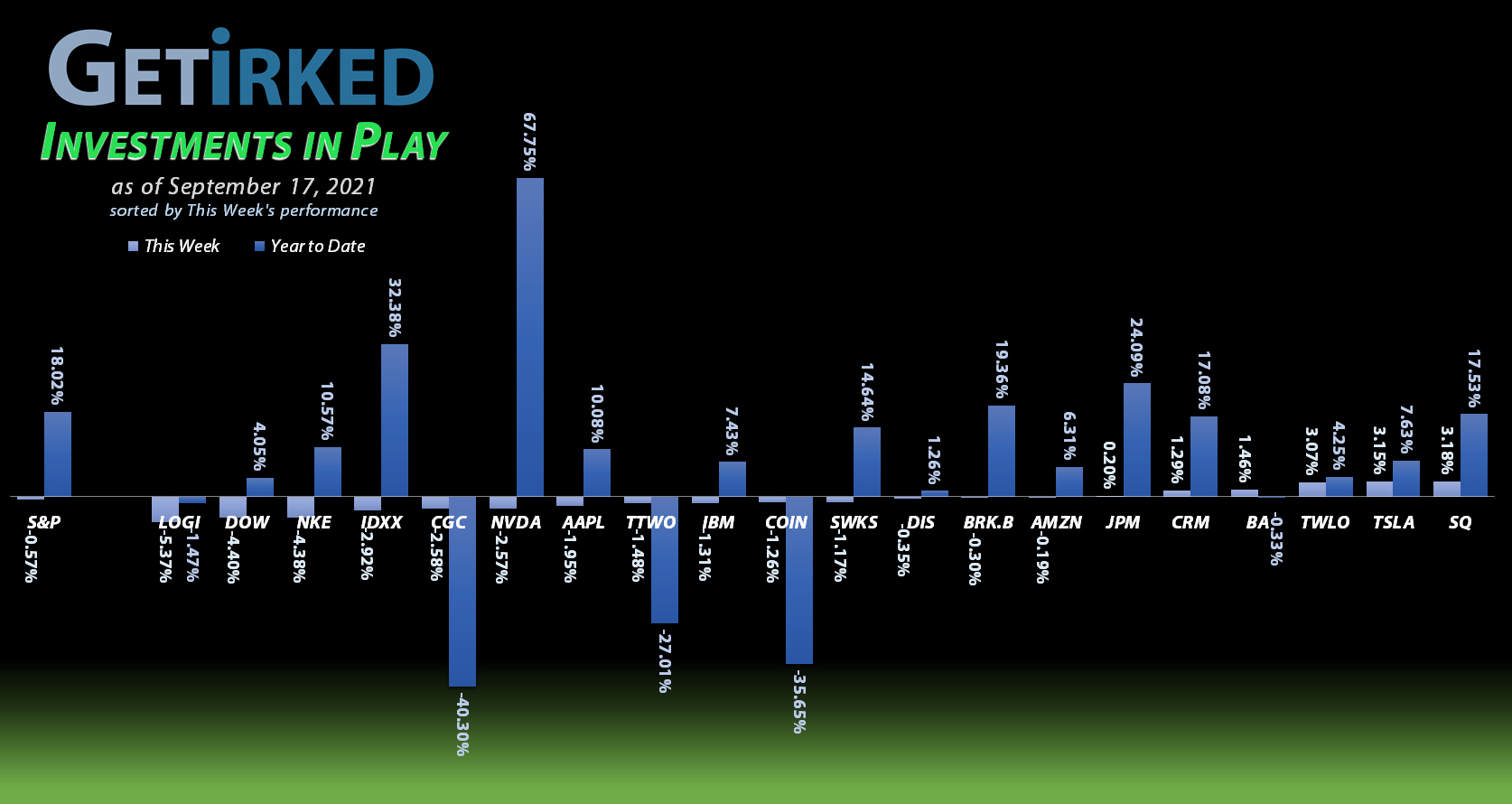

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

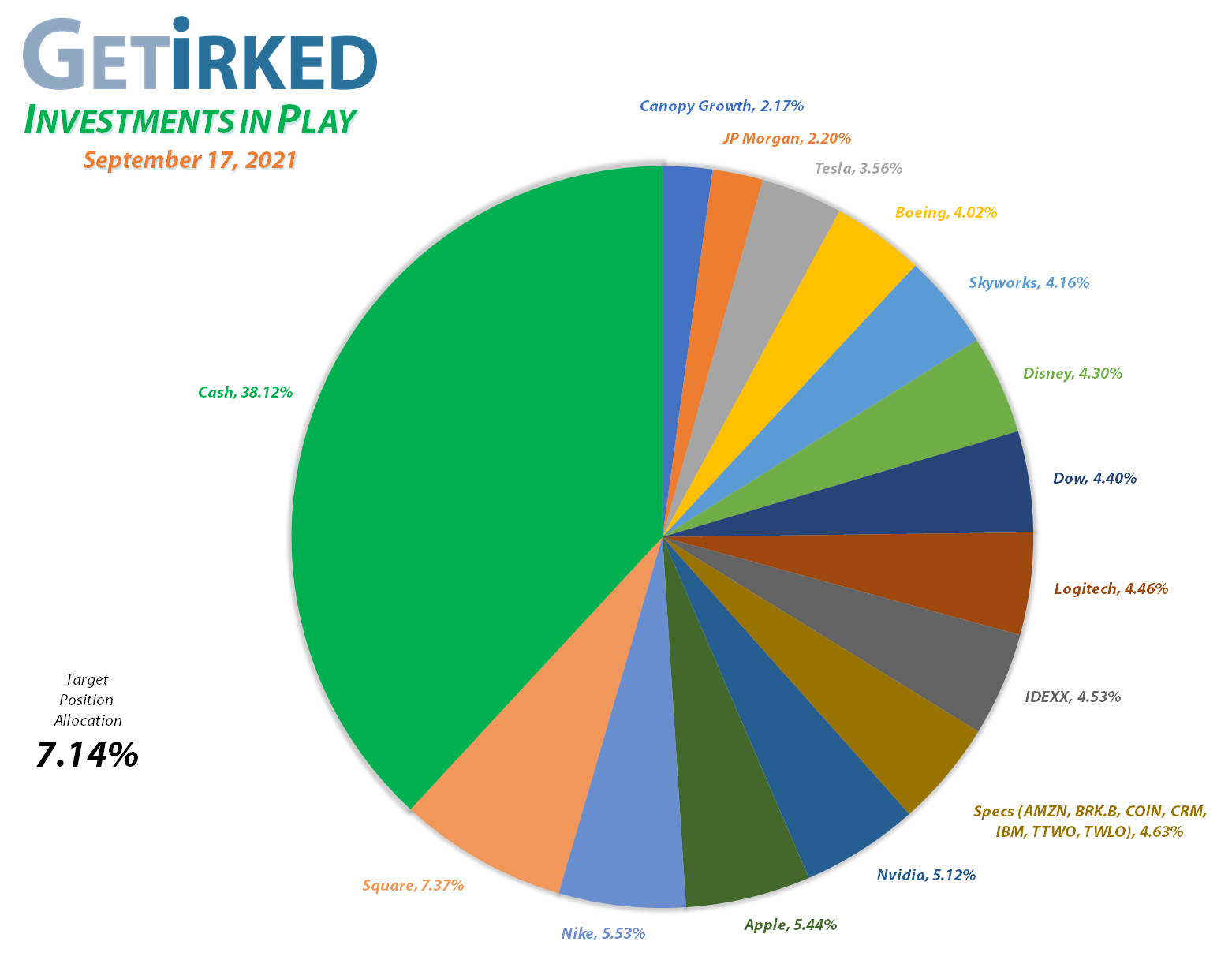

Square (SQ)

+1090.86%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Logitech (LOGI)

+801.44%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $2.65

Apple (AAPL)

+785.60%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$39.20)*

Nvidia (NVDA)

+784.94%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Boeing (BA)

+674.59%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Tesla (TSLA)

+654.18%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+583.94%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$132.83)*

Nike (NKE)

+579.31%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.95)*

Take Two (TTWO)

+564.80%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $26.85

Disney (DIS)

+384.68%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $8.15

Canopy (CGC)

+212.98%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.70

Twilio (TWLO)

+195.75%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Amazon (AMZN)

+142.46%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Salesforce (CRM)

+126.15%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+120.21%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $71.60

Skyworks (SWKS)

+112.72%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.39

IBM (IBM)

+65.96%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $81.49

Dow (DOW)

+63.20%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.39

Berkshire (BRK.B)

+51.34%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Coinbase (COIN)

-36.22%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Added to Position

Apple (AAPL) sold off with the rest of the market later in the week, triggering a buy order I had in place at $146.05 on Friday. The order raised my per-share “cost” +$5.68 from -$44.88 to -$39.20 (a negative price means each of my shares cost nothing and each adds $39.20 to my portfolio’s bottom line in addition to the shares’ current value).

From here, my next buy target is $132.30. My next sell target is around $205 when Apple will have exceeded the portfolio’s target allocation size.

AAPL closed the week at $146.06, up +$0.01 from where I added Friday.

Berkshire-Hathaway (BRK.B): Added to Position

Berkshire-Hathaway (BRK.B) is often referred to as an analog for the S&P 500 since the giant conglomerate has its fingers in pretty much every sector of the economy, however, I do like having a small amount of it in my portfolio just so I can say I own some Berkshire-Hathaway.

BRK.B sold off with the rest of the market this week, reaching a level that I thought was interesting so I added a small amount to my position on Friday with a buy order that filled at $276.27.

The order raised my per-share cost +11.53% from $163.97 to $182.87, however, that is still -9.45% less than my initial $201.96 buy on August 2, 2019. From here, my next buy target is $247.90, a past point of support, and I have no sell targets on the stock, for the moment.

BRK.B closed the week at $276.76, up +$0.49 from where I added Friday.

Dow Chemical (DOW): Added to Position & Dividends

Dow Chemical (DOW) came under pressure with the rest of the infrastructure plays this week, testing the $60.00 level which prompted me to put in a small buy on Monday which filled at $60.38.

The buy order did raise my per-share cost +0.68% from $35.55 to $35.79, but, with its dividend in excess of 4.6% at Monday’s levels, I felt adding a small bit to the position was reasonable.

Additionally, Dow paid out its quarterly dividend of $0.70/shr this week which reduced my per-share cost -1.12% from $35.79 to $35.39. My next buy price target for DOW is $57.30 and my next sell target is $71.75.

DOW closed the week at $57.75, down -4.36% from where I added Monday.

Logitech (LOGI): Added to Position

The selling pressure in Logitech (LOGI) has been relentless, and this week was no exception. When it dropped beneath $95, I decided to add some more capital into my position with a buy order that filled at $94.90, a -32.30% reduction from LOGI’s all-time high of $140.17 made earlier this year.

The buy did increase my per-share cost from $0.40 to $2.65, however, considering my first buy was at $24.40 on November 11, 2016, my current cost is a reduction of -89.14% from my initial buy. Plus, with LOGI’s ex-dividend date on 9/20, I made it in under the wire to get a bit more of its $0.96/shr dividend which is 1.01% annually at my buy price.

From here, my next buy target is $84.35 and my sell target is around $160 when Logitech will have exceeded the target allocation size for the portfolio.

LOGI closed the week at $95.76, up +0.91% from where I added Friday.

Nike (NKE): Added to Position

A combination of China fears and a Covid-19 outbreak at some of Nike’s (NKE) Vietnam factories caused the big swoosh to sell off this week, triggering a sell order I had in place which filled on Tuesday at $157.57. The buy raised my per-share “cost” by $5.71 from -$24.66 to -$18.95 (a negative figure means each share cost nothing and, instead, adds $18.95 to my portfolio’s bottom line in addition to the value of the shares).

From here, my next buy target is $132.40, above a past point of support, and my sell target will be after the position exceeds the allocation target for the portfolio, currently above $210/shr for Nike.

NKE closed the week at $156.42, down -0.73% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.