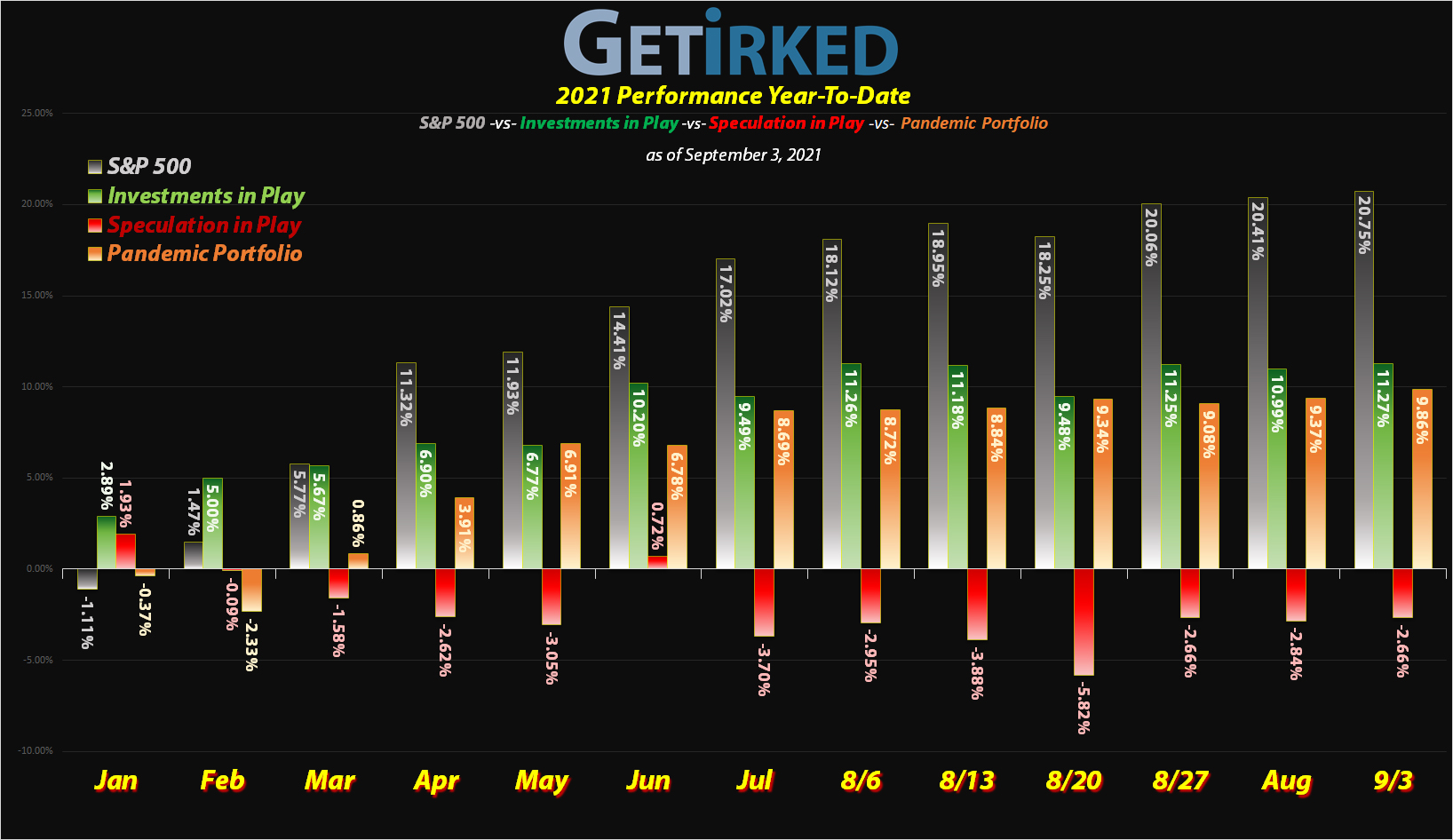

September 3, 2021

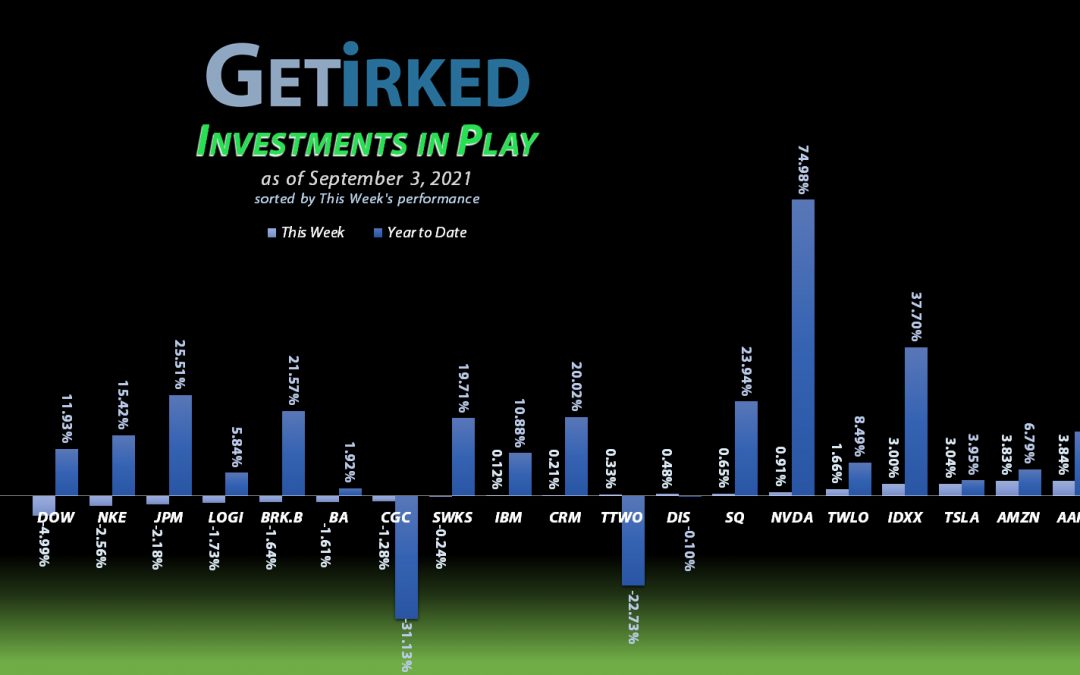

The Week’s Biggest Winner & Loser

Coinbase (COIN)

With Bitcoin (BTC) breaking through $50,000 again and Ether (ETH) making a run at its all-time high, crypto exchange Coinbase (COIN) saw a reasonable +7.46% pop this week which was enough to earn it the spot of the Week’s Biggest Winner.

Dow Chemical (DOW)

The Delta variant of Covid-19 continues to smack the economy around. Combine the virus with an infrastructure bill whose future is still relatively uncertain, and you’ve got mediocre news for any construction play, Dow Chemical (DOW) included. DOW dropped -4.99% this week which was enough to land it as the Week’s Biggest Loser.

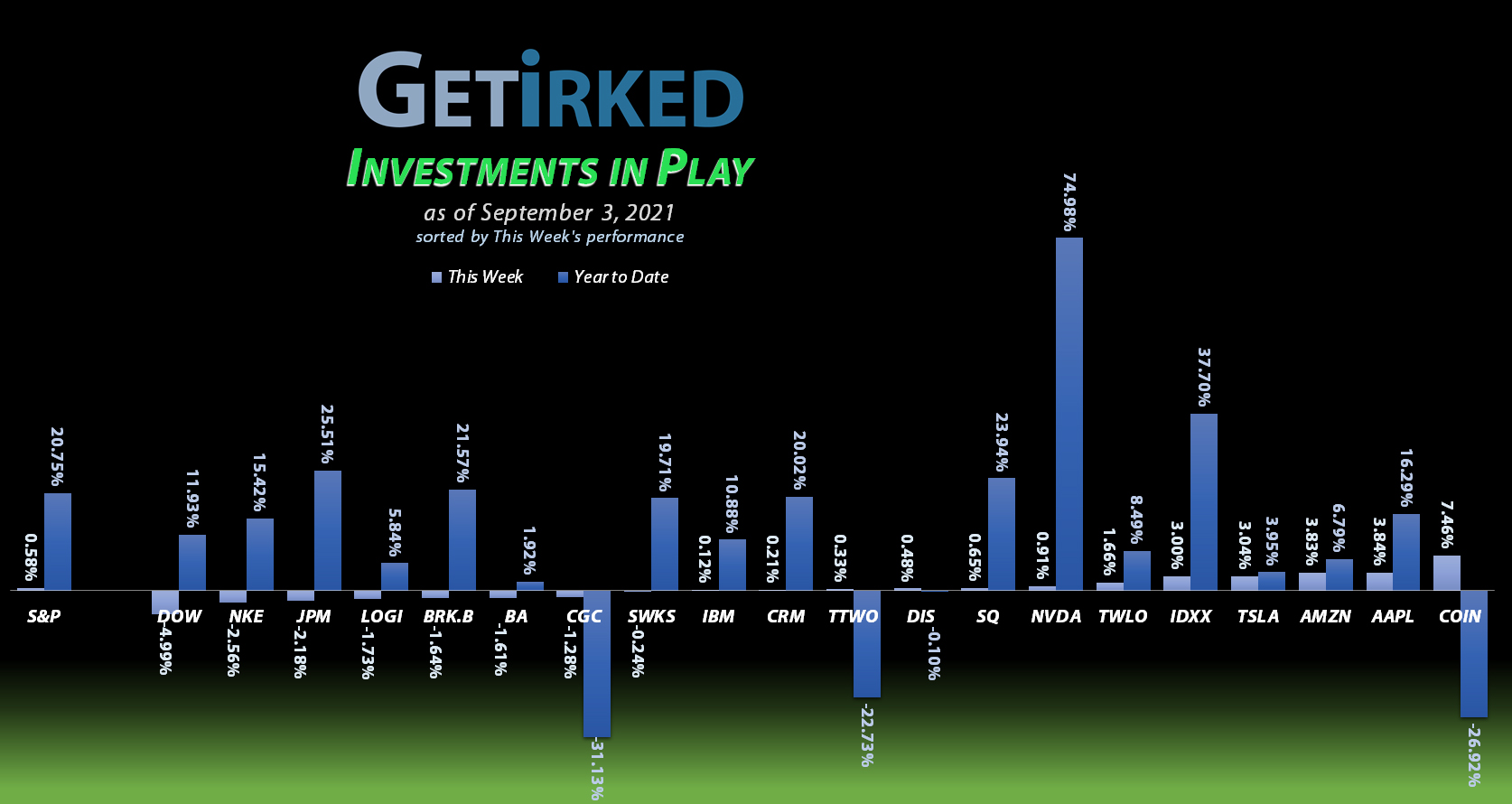

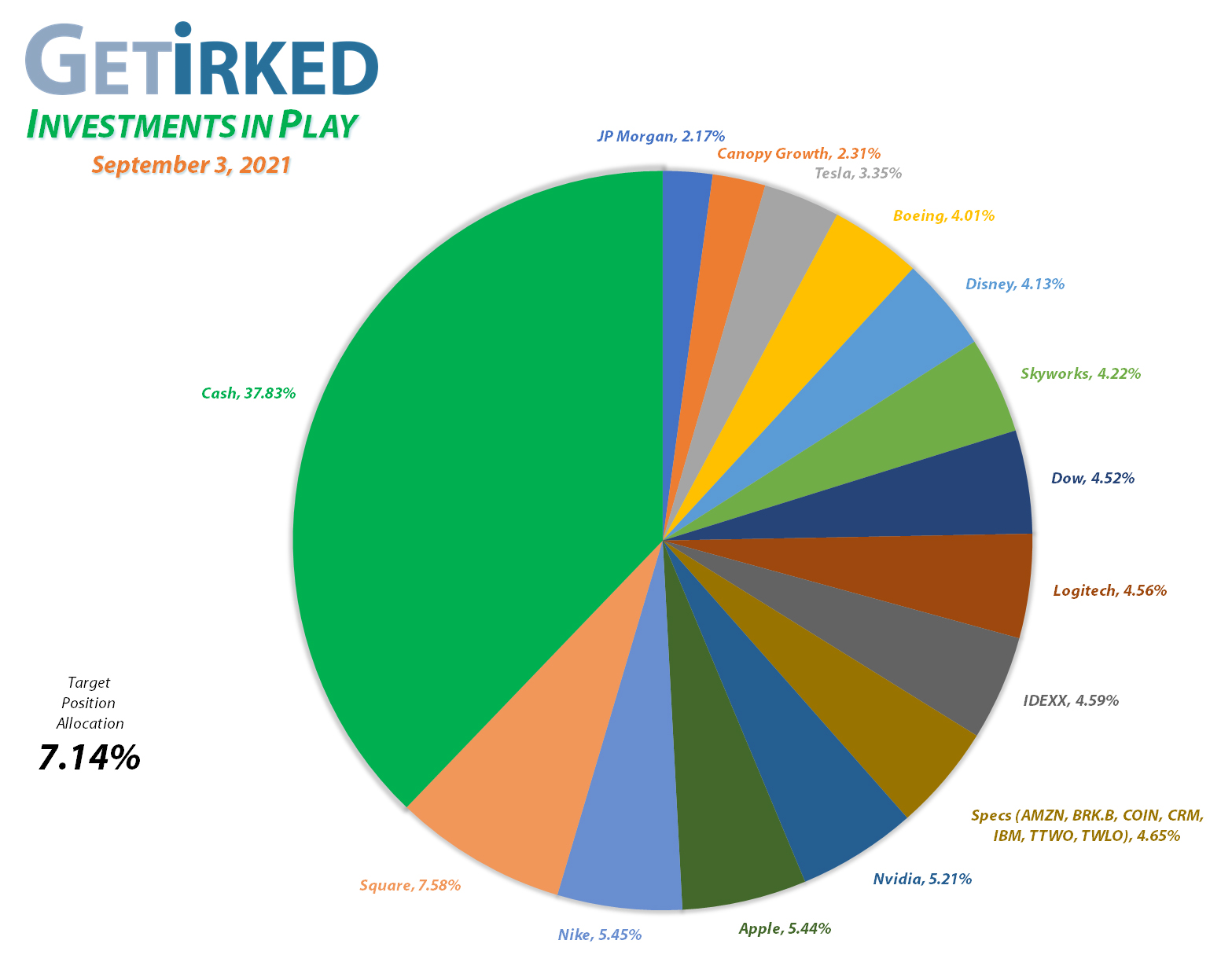

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1127.12%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Logitech (LOGI)

+861.00%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $0.40

Apple (AAPL)

+819.79%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.88)*

Nvidia (NVDA)

+816.60%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Boeing (BA)

+681.40%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Tesla (TSLA)

+634.64%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+603.30%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$132.83)*

Nike (NKE)

+601.38%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.66)*

Take Two (TTWO)

+597.75%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $26.85

Disney (DIS)

+379.19%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $8.15

Canopy (CGC)

+319.01%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.05

Twilio (TWLO)

+203.32%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Amazon (AMZN)

+143.00%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Salesforce (CRM)

+131.81%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+122.78%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $71.60

Skyworks (SWKS)

+121.44%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

Dow (DOW)

+74.74%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Berkshire (BRK.B)

+71.94%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

IBM (IBM)

+69.28%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $82.45

Coinbase (COIN)

-27.55%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

IDEXX Laboratories (IDXX): Added to Position

I added a small amount back into my IDEXX Laboratories (IDXX) position when it pulled back on Wednesday this week with a buy order filling at $667.42. Since that only represents a discount of -3.423% off the sale that went through on

July 28 at $691.11, I only replaced about 7.23% of the shares I sold.

The buy still keeps the position very much playing with the house’s money with a per-share “cost” of -$132.83 (each share in the position adds $132.83 to the portfolio’s bottom line in addition to the current value of the share). From here, my next buy target is slightly lower around $631.90 and I have no current sell targets at this time.

IDXX closed the week at $688.06, up +3.09% from where I added Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.