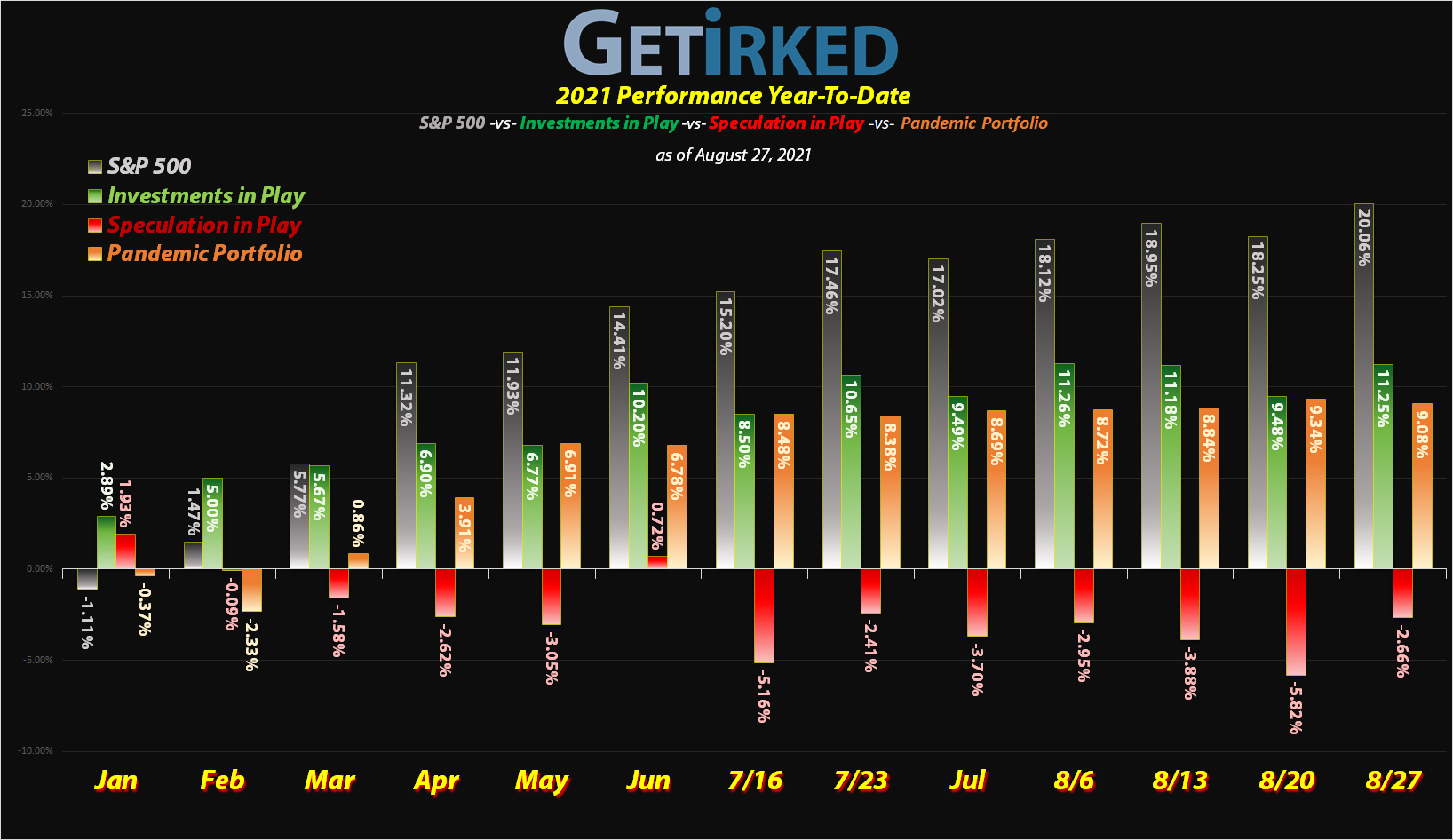

August 27, 2021

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

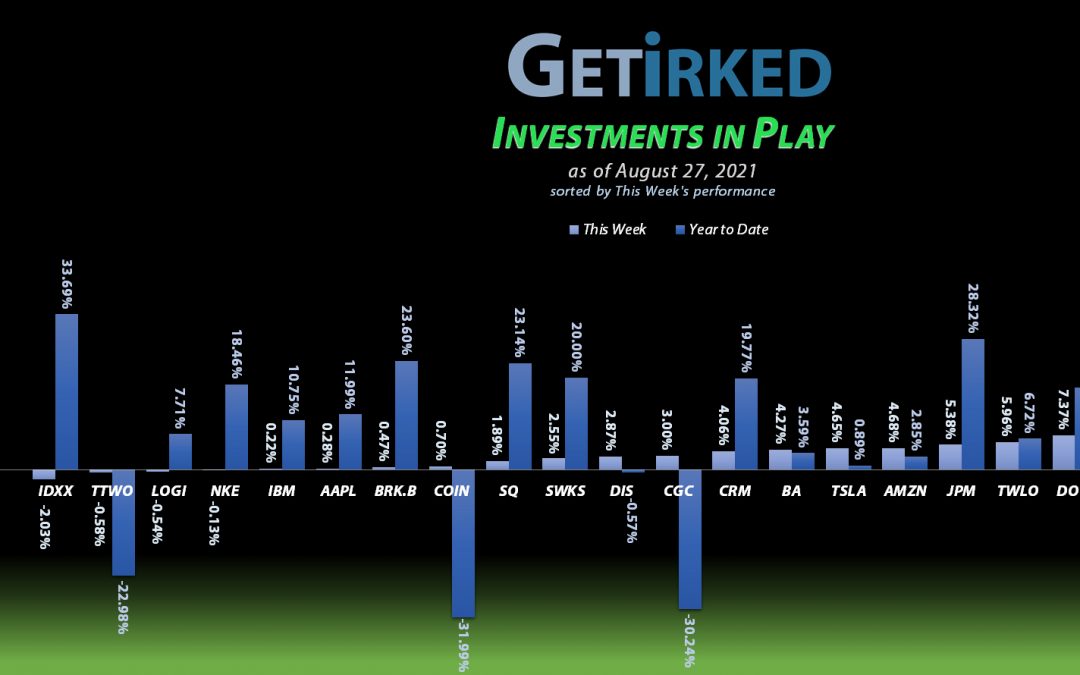

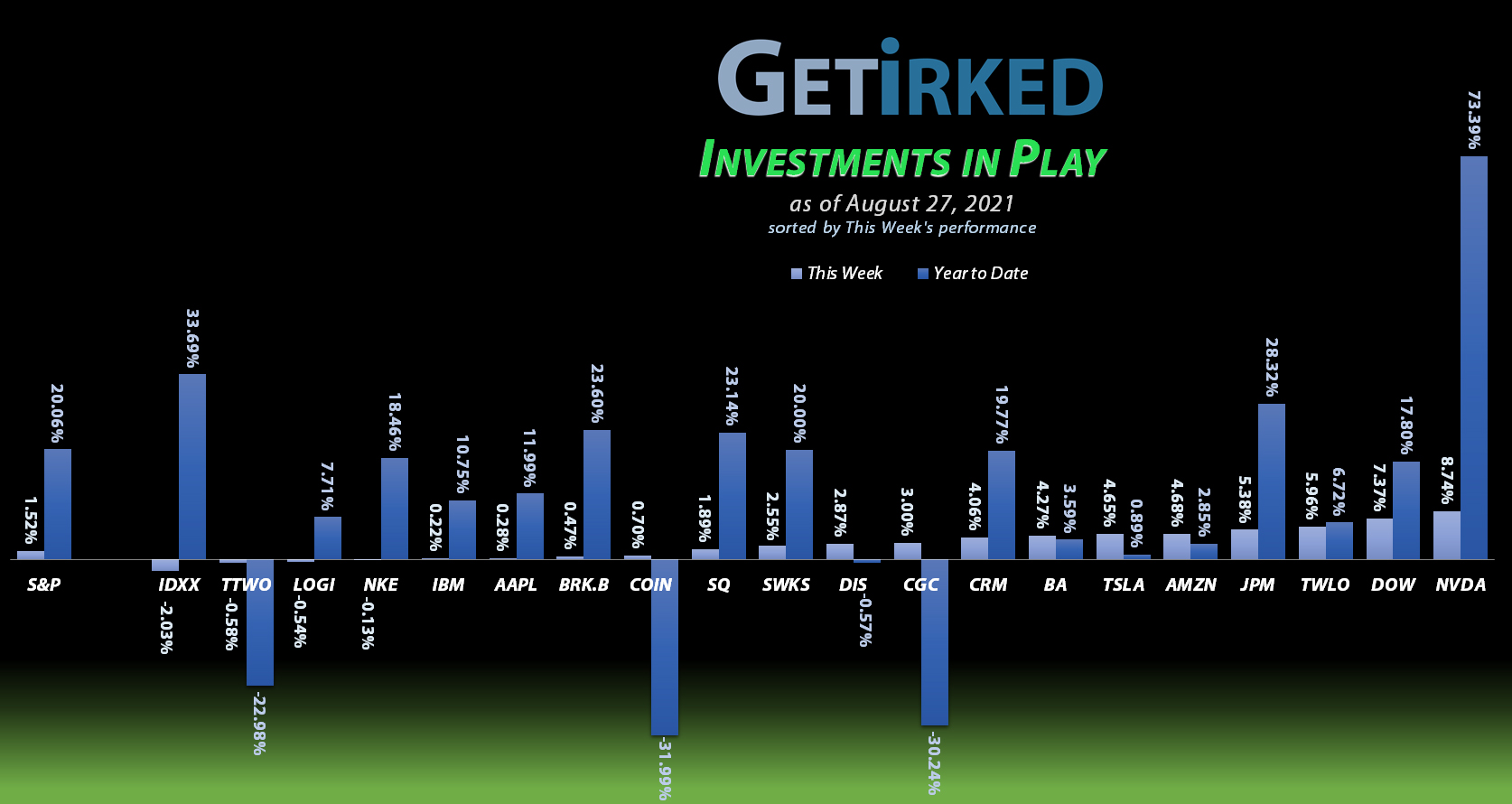

Following last week’s epic earnings report, Nvidia (NVDA) crashed through its all-time high this week, gaining +8.74% on the week and earning itself its second-in-a-row Week’s Biggest Winner title.

IDEXX Labs (IDXX)

After making a new all-time high, it was time for IDEXX Laboratories (IDXX) to pull back a bit this week, dropping a relatively minor -2.03%, but, in this up week, that was enough to land it as the Week’s Biggest Loser.

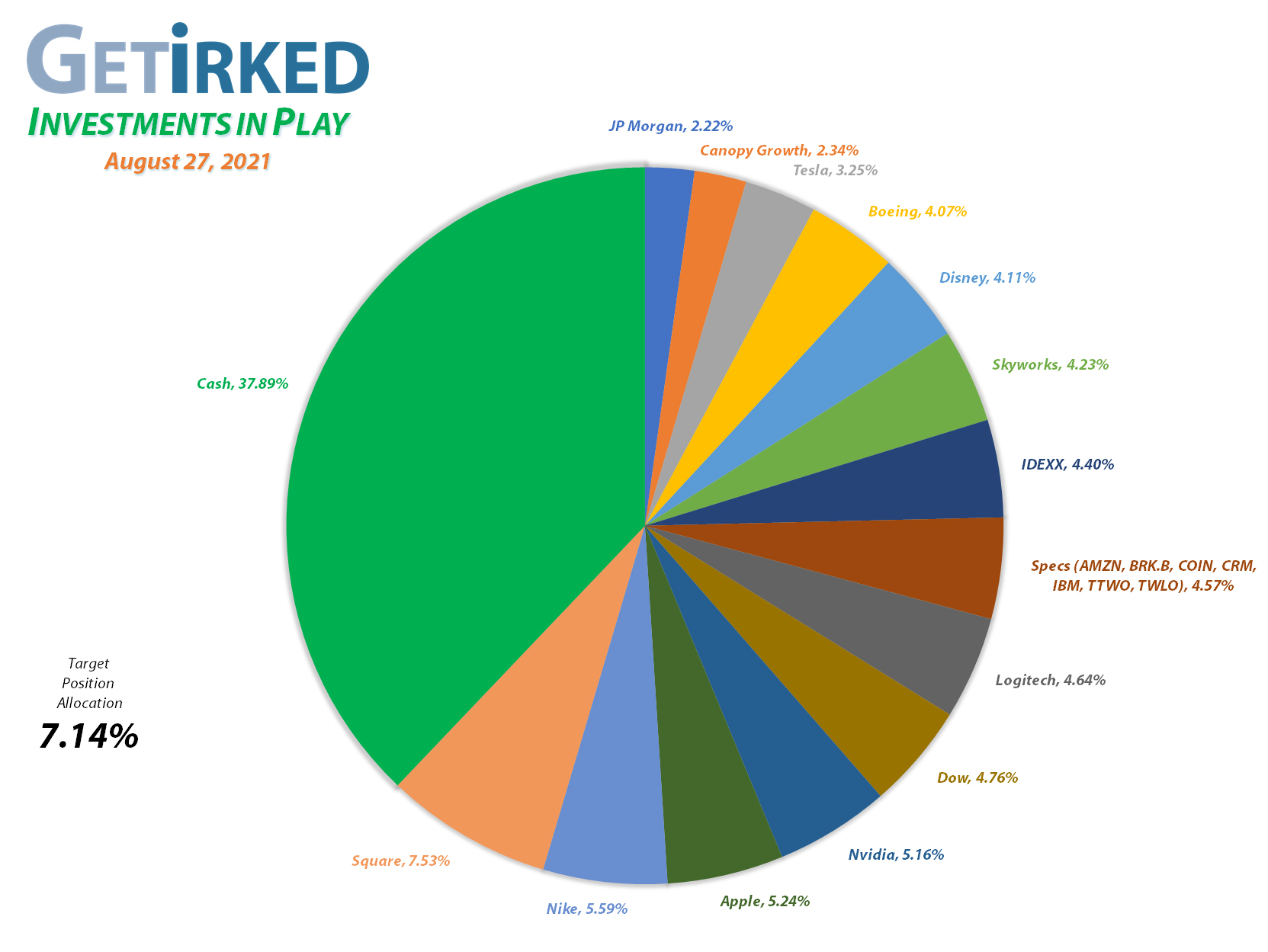

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1122.53%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Logitech (LOGI)

+876.21%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $0.40

Nvidia (NVDA)

+809.57%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Apple (AAPL)

+796.05%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.88)*

Boeing (BA)

+686.51%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Tesla (TSLA)

+618.06%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Nike (NKE)

+615.14%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.66)*

Take Two (TTWO)

+595.97%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $26.85

IDEXX Labs (IDXX)

+588.75%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$142.65)*

Disney (DIS)

+377.37%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $8.15

Canopy (CGC)

+324.44%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.05

Twilio (TWLO)

+200.20%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Amazon (AMZN)

+138.86%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Salesforce (CRM)

+131.36%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+127.71%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $71.60

Skyworks (SWKS)

+121.97%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

Dow (DOW)

+83.91%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Berkshire (BRK.B)

+74.79%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

IBM (IBM)

+69.08%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $82.45

Coinbase (COIN)

-32.60%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Eyeing a new contender…

There may have been no moves this week for the Investments in Play portfolio, however, that doesn’t mean I wasn’t busy. I’ve been eyeing a new addition for the speculative basket – Roblox (RBLX).

If you have kids older than 8, you’re probably familiar with Roblox, but for those of you who aren’t – Roblox is the ultimate video gaming platform. In addition to hundreds (if not thousands) of different games made on the platform itself, users can make and sell their own games, too.

Additionally, Roblox has its own currency – a “cryptocurrency” of sorts – that gamers use to buy in-game items. The company IPO’ed earlier this year and I’ve been watching and waiting to see it develop some price action before jumping in.

Well, that time is coming, so now I have to do that which I hate – wait for a good buying level. Given how September often brings with it a great deal of volatility, I’m betting my opportunity may be right around the corner…

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.