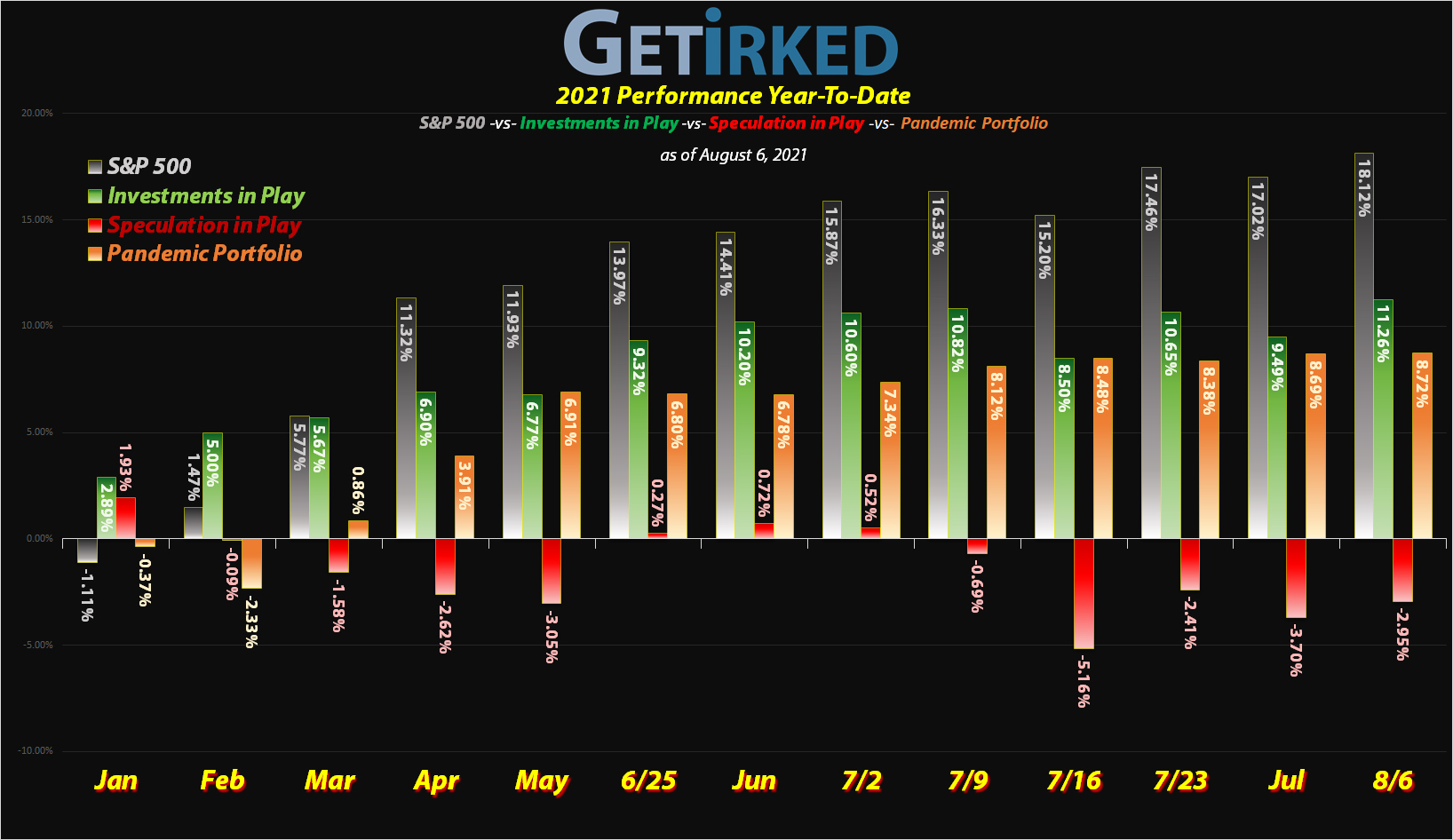

August 6, 2021

The Week’s Biggest Winner & Loser

Square (SQ)

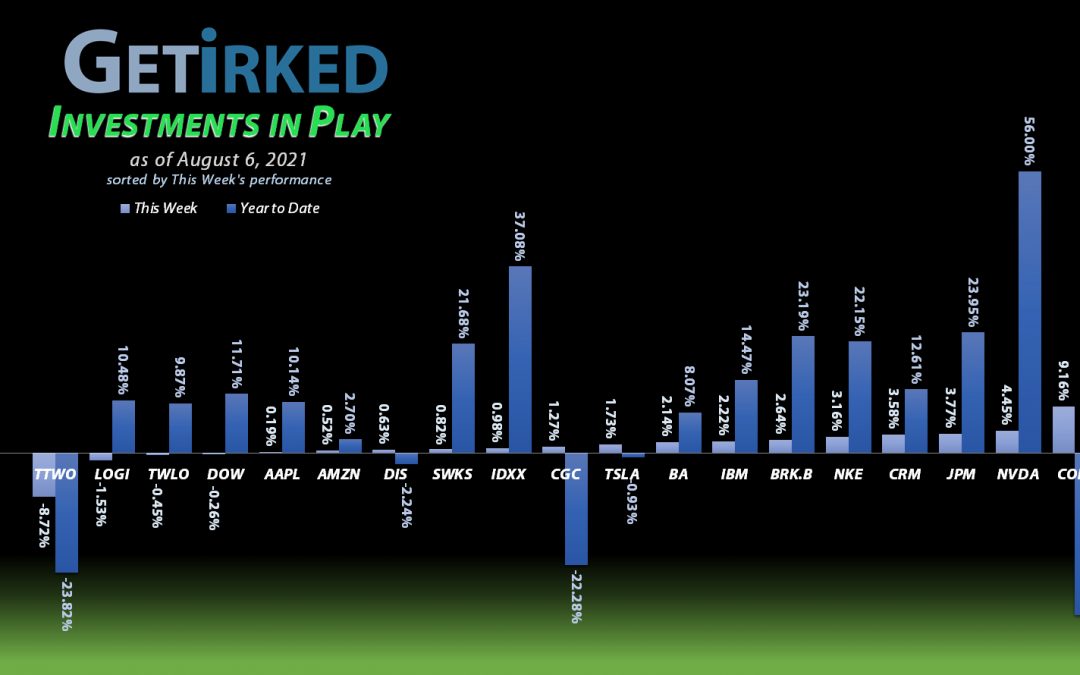

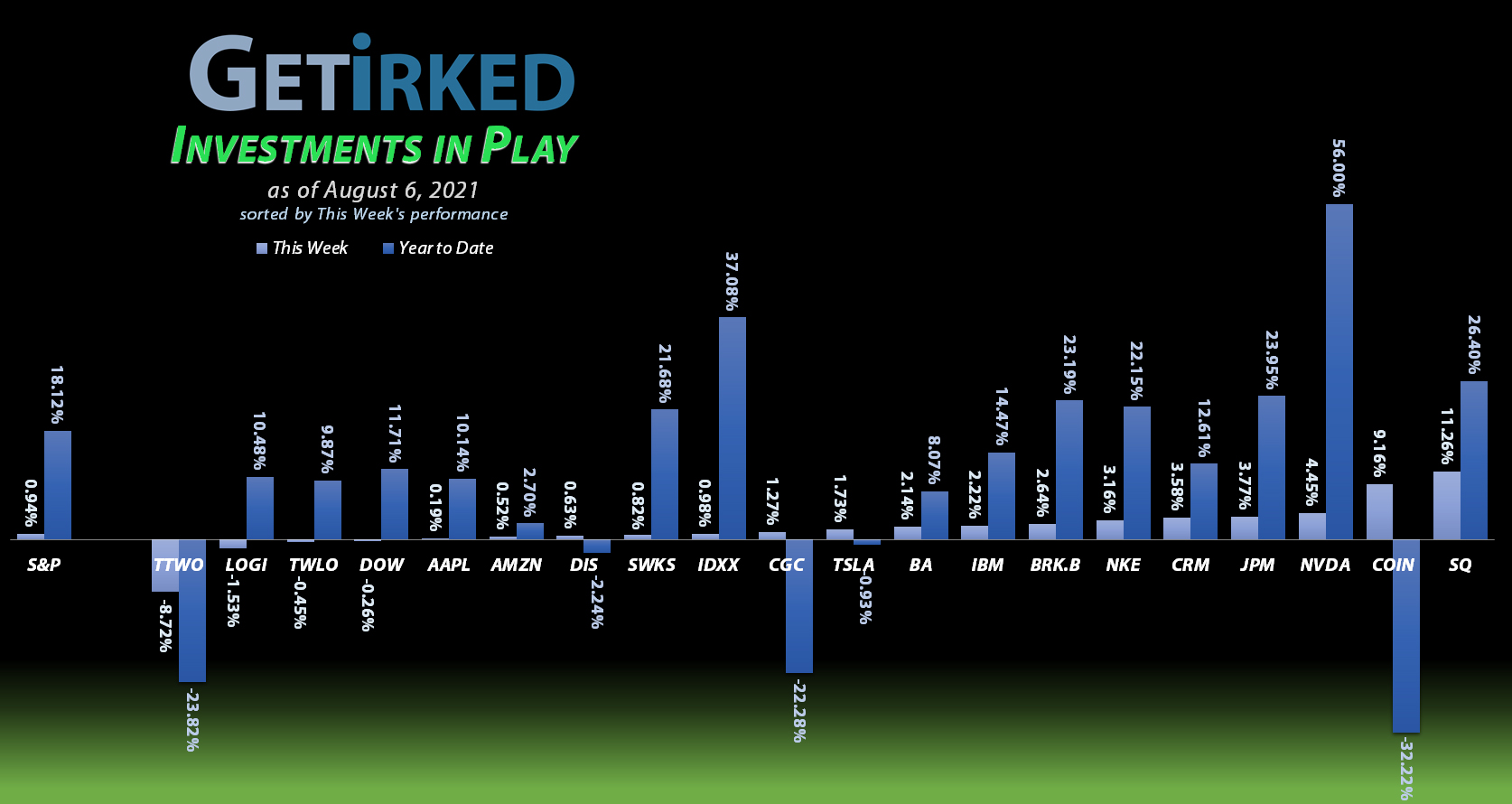

Square (SQ) announced it would be spending nearly $30 billion to buy Australian’s Buy-Now-Pay-Later (BNPL) company, Afterpay, and, for some reason, Square’s price went up!

Typically, when a company announces it intends to acquire another company, the acquirer’s stock goes down and the acquired company’s stock goes up.

Square is so loved that BOTH companies’ stocks went up – SQ’s to the tune of +11.26% which landed it the spot of this Week’s Biggest Winner.

Take Two Interactive (TTWO)

Take Two Interactive (TTWO) reported a blowout earnings quarter, but when management got a little shy and forward guidance for the remainder of 2021, investors were not pleased.

As a result, Take Two lost a life and -8.72%, earning itself the spot of the Week’s Biggest Loser.

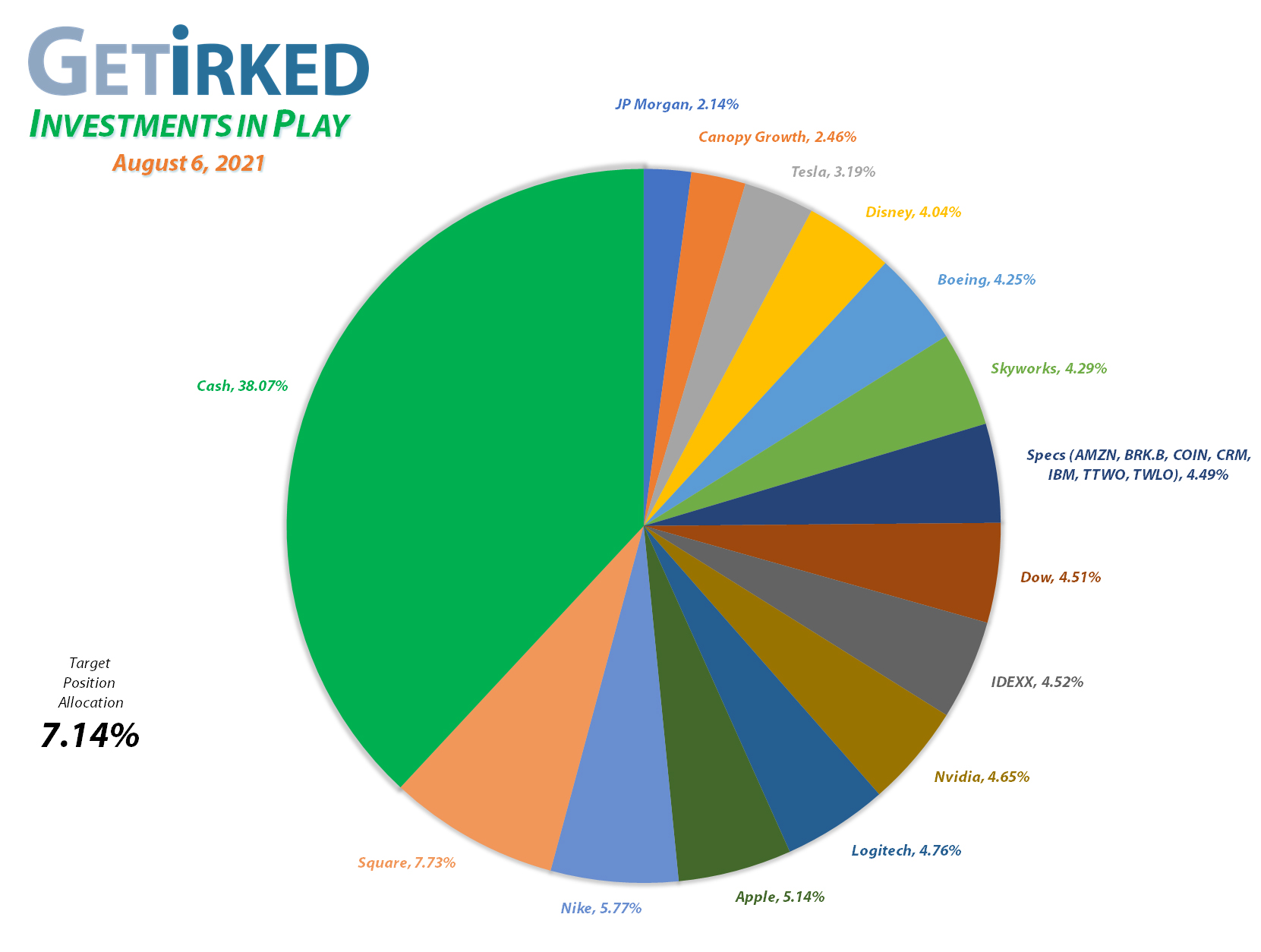

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1140.91%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Logitech (LOGI)

+898.90%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $0.40

Apple (AAPL)

+785.04%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.94)*

Nvidia (NVDA)

+733.59%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Boeing (BA)

+700.11%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Nike (NKE)

+631.84%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.66)*

Tesla (TSLA)

+608.32%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+601.04%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$142.65)*

Take Two (TTWO)

+589.52%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $26.85

Canopy (CGC)

+498.44%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.20

Disney (DIS)

+370.77%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $8.15

Twilio (TWLO)

+205.84%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Amazon (AMZN)

+179.72%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($2249.40)*

Skyworks (SWKS)

+125.09%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

JP Morgan (JPM)

+119.96%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $71.60

Salesforce (CRM)

+117.53%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+74.76%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $82.45

Dow (DOW)

+74.40%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Berkshire (BRK.B)

+74.20%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-32.82%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Disney (DIS): Added to Position

I decided it was time to put some capital back into Disney when it pulled back to the low $170s on Tuesday with a purchase that filled at $173.06, a -14.76% discount from its all-time high of $203.02. The purchase gives my position a per-share cost of $8.15, a reduction of -80.54% from where I first bought it at $41.87 on February 14, 2012.

From here, I have no sell targets until much higher as I would prefer to wait for Disney to outgrow its allocation target before taking profits. My next buy target is $153.10.

DIS closed the week at $177.13, up +2.35% from where I added Tuesday.

IBM (IBM): Added to Position

IBM (IBM) reported an excellent quarter and was able to bounce from the high $130s back to the mid-$140s. I had been waiting for a more substantial pullback, but after consolidating for the past few weeks, I believe IBM may be headed higher, so I went ahead and pulled the trigger on Tuesday, adding some more to my position at $142.40.

The buy raises my per-share cost to $82.45, however, the overall position per-share cost is still -32.23% les than my first buy at $121.67 on November 6, 2018. Plus, with a dividend in excess of 4.5% and the upcoming spinoffs later this year, I feel IBM may have some true long-term potential.

All that being said, IBM still shares an allocation with its speculative brethren: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Salesforce (CRM), and Twilio (TWLO). From here, I have no current sell targets and my next buy target is $118.40.

IBM closed the week at $144.09, up +1.87% from where I added Tuesday.

Logitech (LOGI): Added to Position

After reporting a blowout earnings report and still crashing afterward, I decided it was time to add some capital back into Logitech (LOGI) when it retested the sub-$110 level on Monday with a buy order that filled at $108.00.

The buy reinstated my capital position with an incredibly tiny $0.40 per-share cost and locked in a -22.95% discount from Logitech’s all-time high of $140.17. From here, my next buy target is $92.80 and my next sell target is around $170 where Logitech will exceed the target allocation for the portfolio.

LOGI closed the week at $107.38, down -0.57% from where I added Monday.

Square (SQ): Profit-Taking

After Square (SQ) announced Monday that it would be buying Australian buy-now-pay-later firm Afterpay for nearly $30 billion in stock, Square POPPED an astounding 13%+ in a single day!

Square was already far in excess of the allocation target for my Investments in Play portfolio, so I took profits on Monday with an order that filled at $280.25. The sale locked in +24.67% in gains on shares I bought on February 25 for $224.80 and lowered my per-share “cost” to -$165.05 (meaning each remaining share in the portfolio cost nothing and instead adds $165.05 to the portfolio’s bottom line along with the value of the share).

I’ve now raised my buying target to $206.20 and despite Square remaining very solidly over the allocation target (it was 7.881% after the sale on Monday against the target allocation of 7.14%), I am waiting to sell more until around $310.

SQ closed the week at $275.10, down -1.84% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.