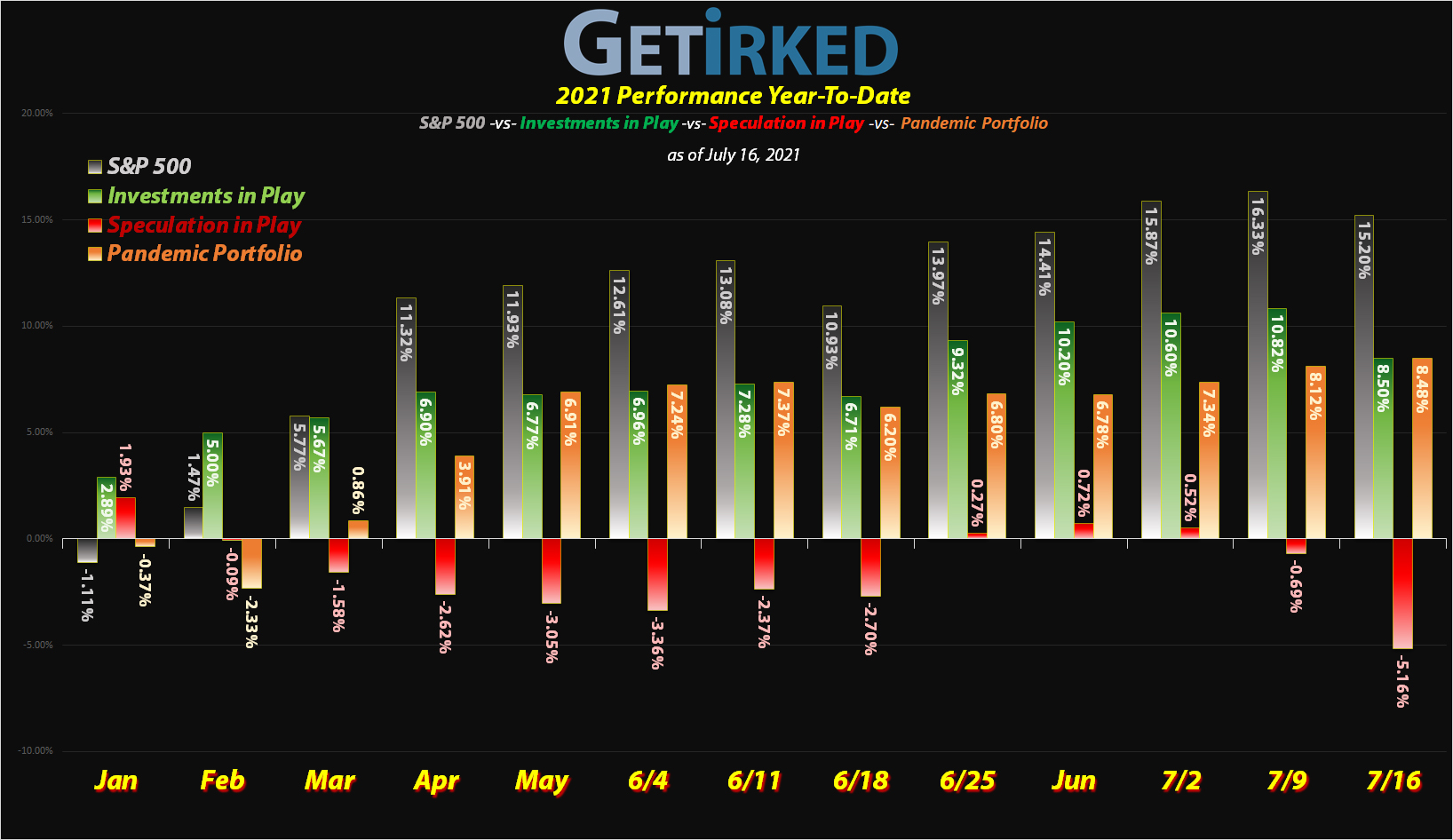

July 16, 2021

The Week’s Biggest Winner & Loser

Disney (DIS)

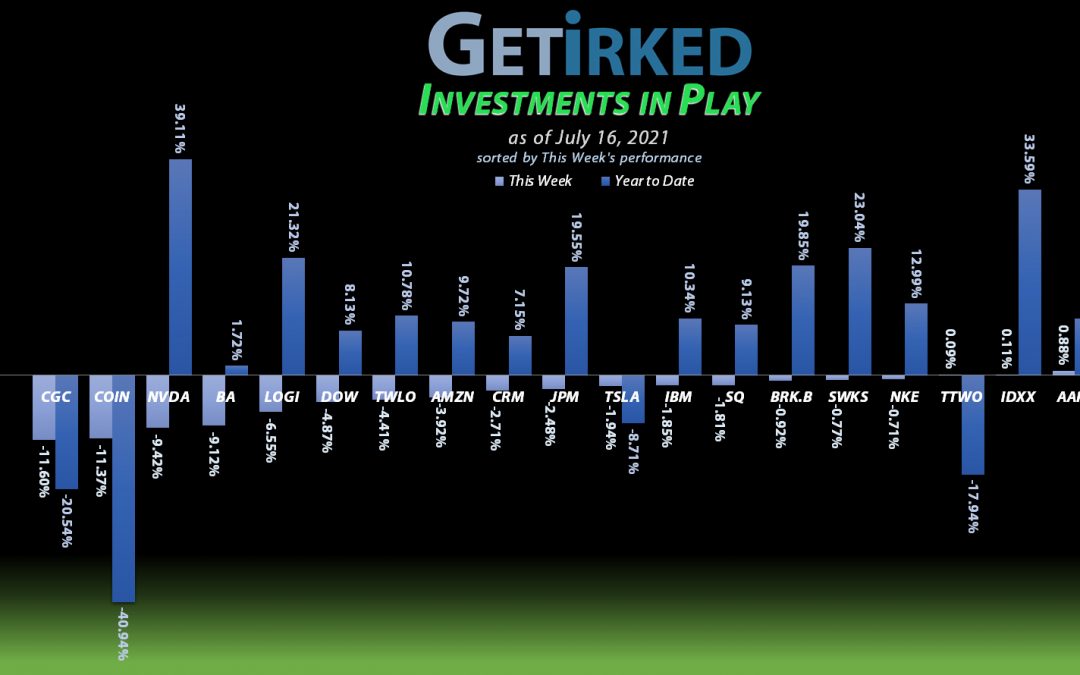

Oof… it’s definitely a rough week when the biggest winner, Disney (DIS), the House of Mouse, squeaked out a win for the entire week with just +1.28% in gains. Yes, that pun was intended because we definitely need humor for a week like this.

Canopy Growth (CGC)

Canopy Growth Corporation (CGC), the recreational cannabis play, scores a hat trick – three weeks-in-a-row where CGC is the Week’s Biggest Winner. This week, CGC dropped -11.60% when Chuck Schumer’s comprehensive bill on legalizing cannabis on a national level came in so over-laden with stuff that it’s virtually guaranteed never to pass both houses of Congress.

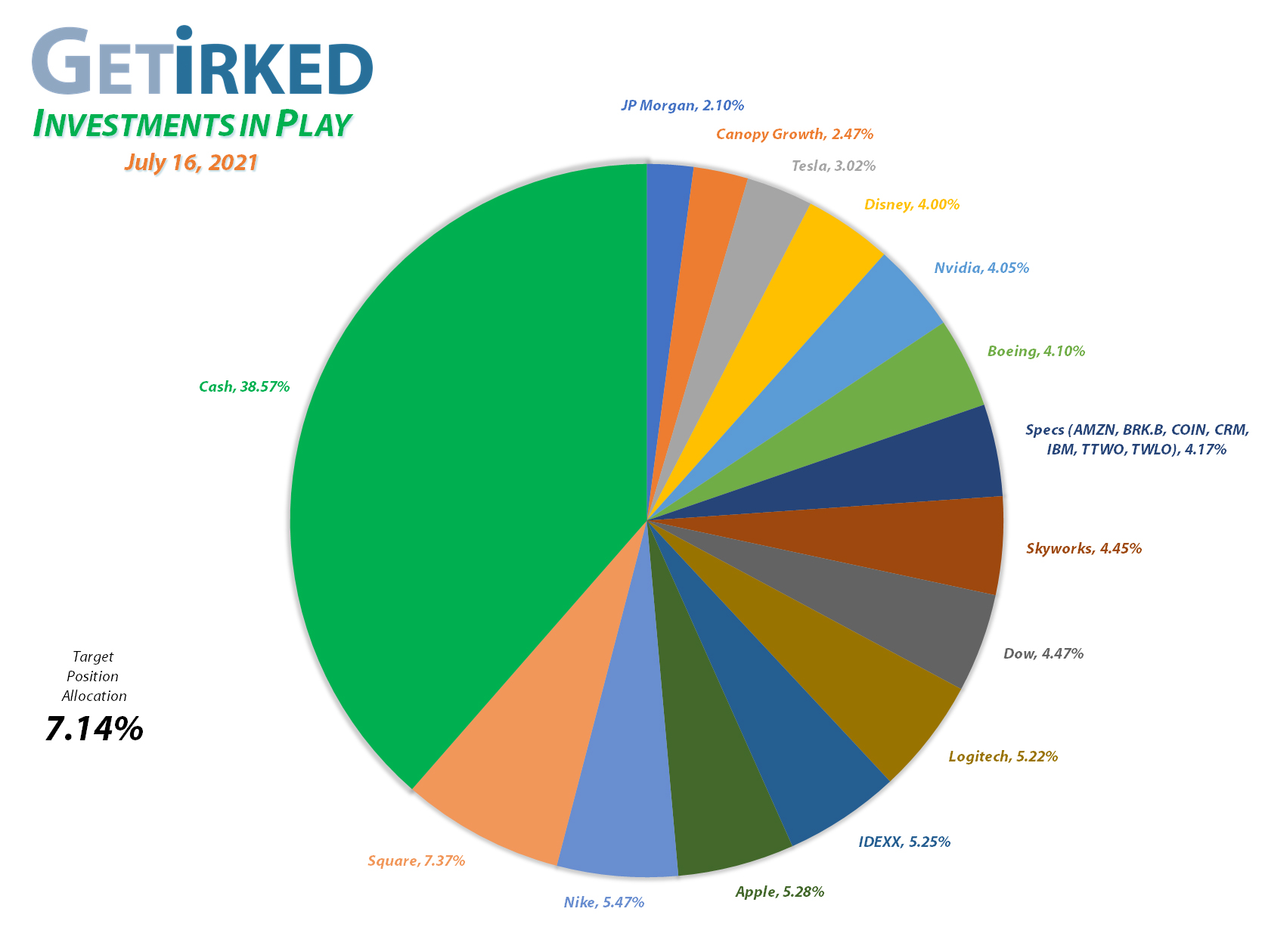

Portfolio Allocation

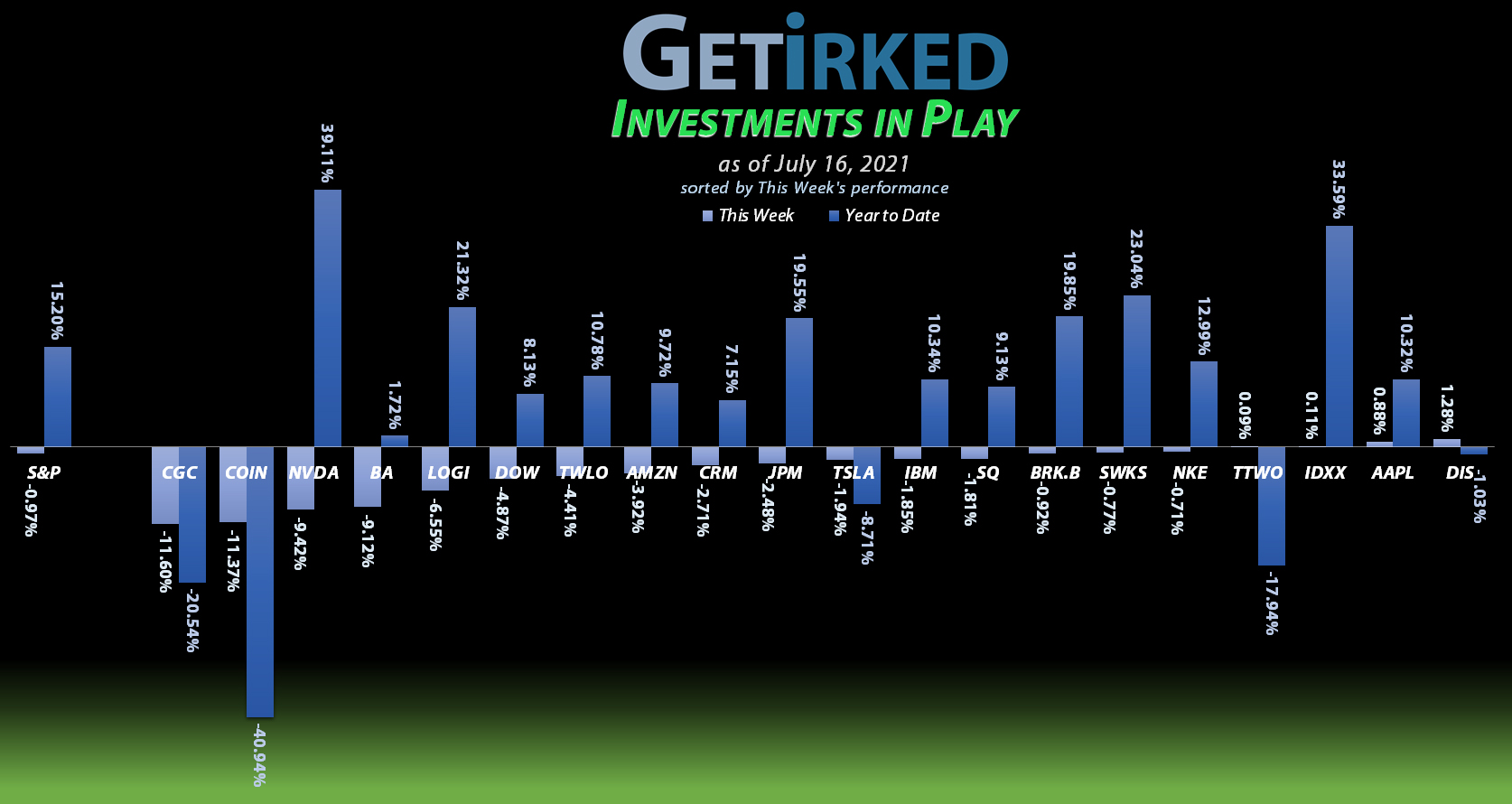

Positions

%

Target Position Size

Current Position Performance

Take Two (TTWO)

+2707.62%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $6.30

Square (SQ)

+1036.81%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$133.90)*

Logitech (LOGI)

+985.35%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+786.07%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.94)*

Canopy (CGC)

+683.20%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $2.50

Boeing (BA)

+680.81%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Nvidia (NVDA)

+660.99%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.71)*

Nike (NKE)

+590.40%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.66)*

IDEXX Labs (IDXX)

+585.60%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Tesla (TSLA)

+566.65%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Disney (DIS)

+374.90%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+285.36%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+207.48%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Skyworks (SWKS)

+127.61%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

JP Morgan (JPM)

+110.90%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $72.03

Salesforce (CRM)

+106.97%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+101.14%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.06

Berkshire (BRK.B)

+69.48%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Dow (DOW)

+68.80%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Coinbase (COIN)

-41.47%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Boeing (BA): Added to Position

Following news that Boeing (BA) would have to halt production on its 787 Dreamliner due to structural design concerns, big ol’ Boeing sold off bad this week, tripping a buy order I had in place which filled on Thursday at $222.21.

The buy replaces some shares that I sold throughout 2019 at an average price of $369.67, locking in a -39.89% discount. The order also “raises” my per-share cost +10.35% from -$292.05 to -$261.81 (negative per-share prices means that there is no capital in the position, and, in fact, each share owned adds $261.81 to the portfolio’s bottom line).

From here, my next buy target is $192.90 and my sell target is around $410.

BA closed the week at $217.59, down -2.08% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.