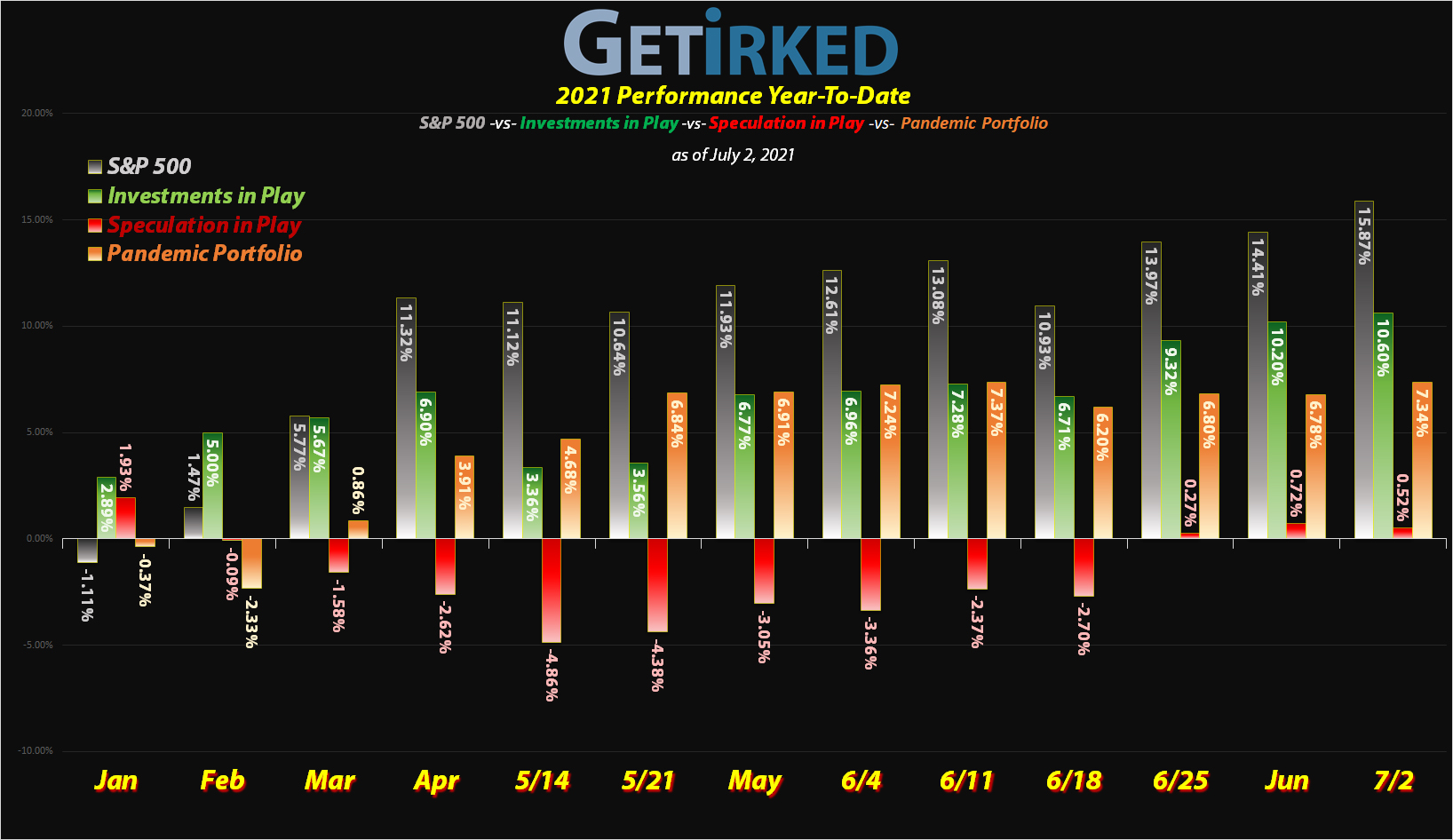

July 2, 2021

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

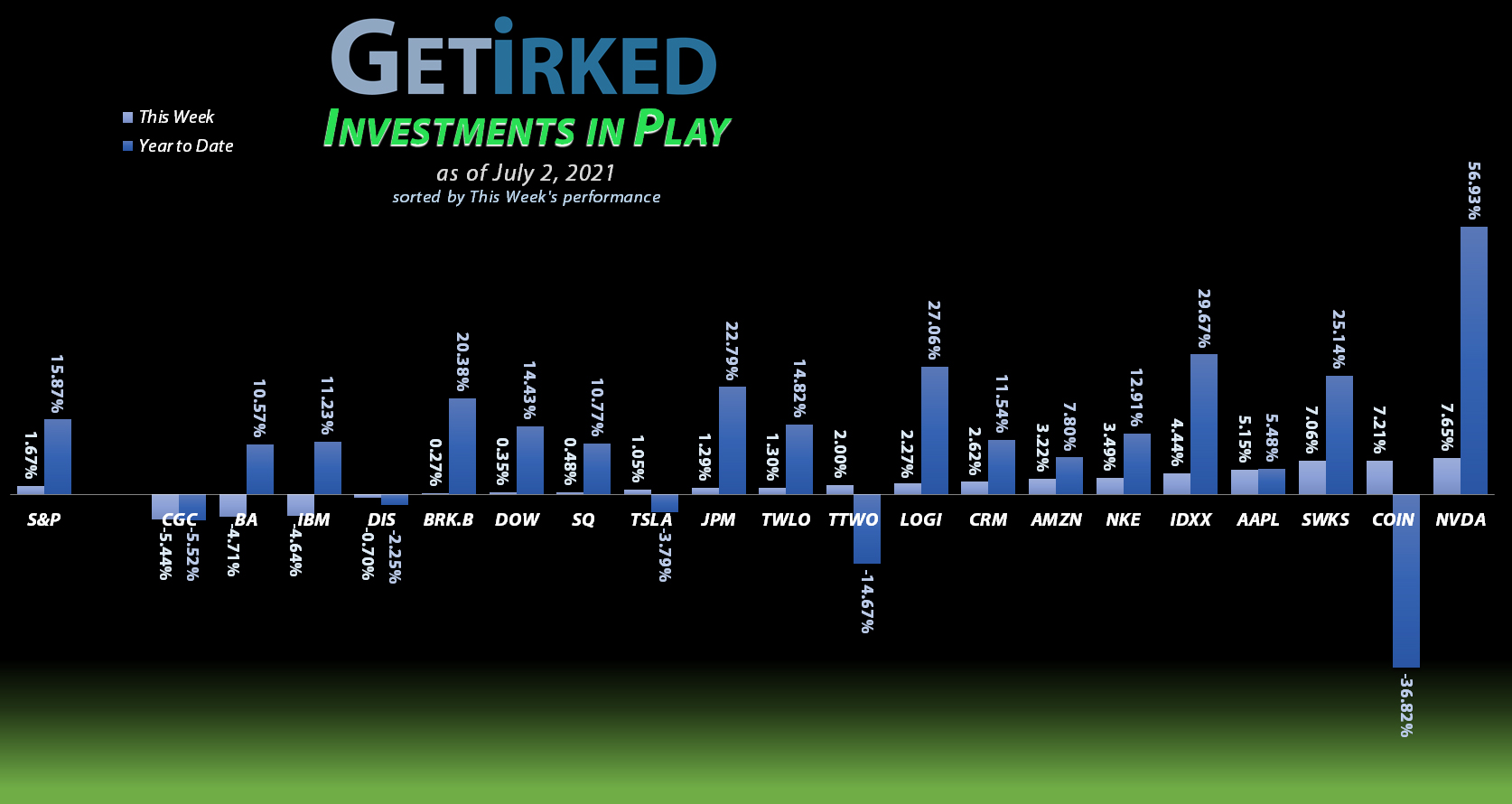

The rotation back into tech and semiconductors is happening a BIG way and there is no single company more focused in both high-growth super-tech and the semi sector than unbelievable leader, Best-in-Breed in the space, Nvidia (NVDA). Already on a huge run this year, NVDA tacked on another +7.65% gain this week to earn itself the spot of the week’s Biggest Winner.

Canopy Growth Corp (CGC)

As long as legalized cannabis struggles at the Federal level in the U.S., it doesn’t matter how many individual states approves measures – Canopy Growth (CGC) will continue to struggle. This week saw, Canopy dip -5.44%, enough to earn it the spot of the Week’s Biggest Loser.

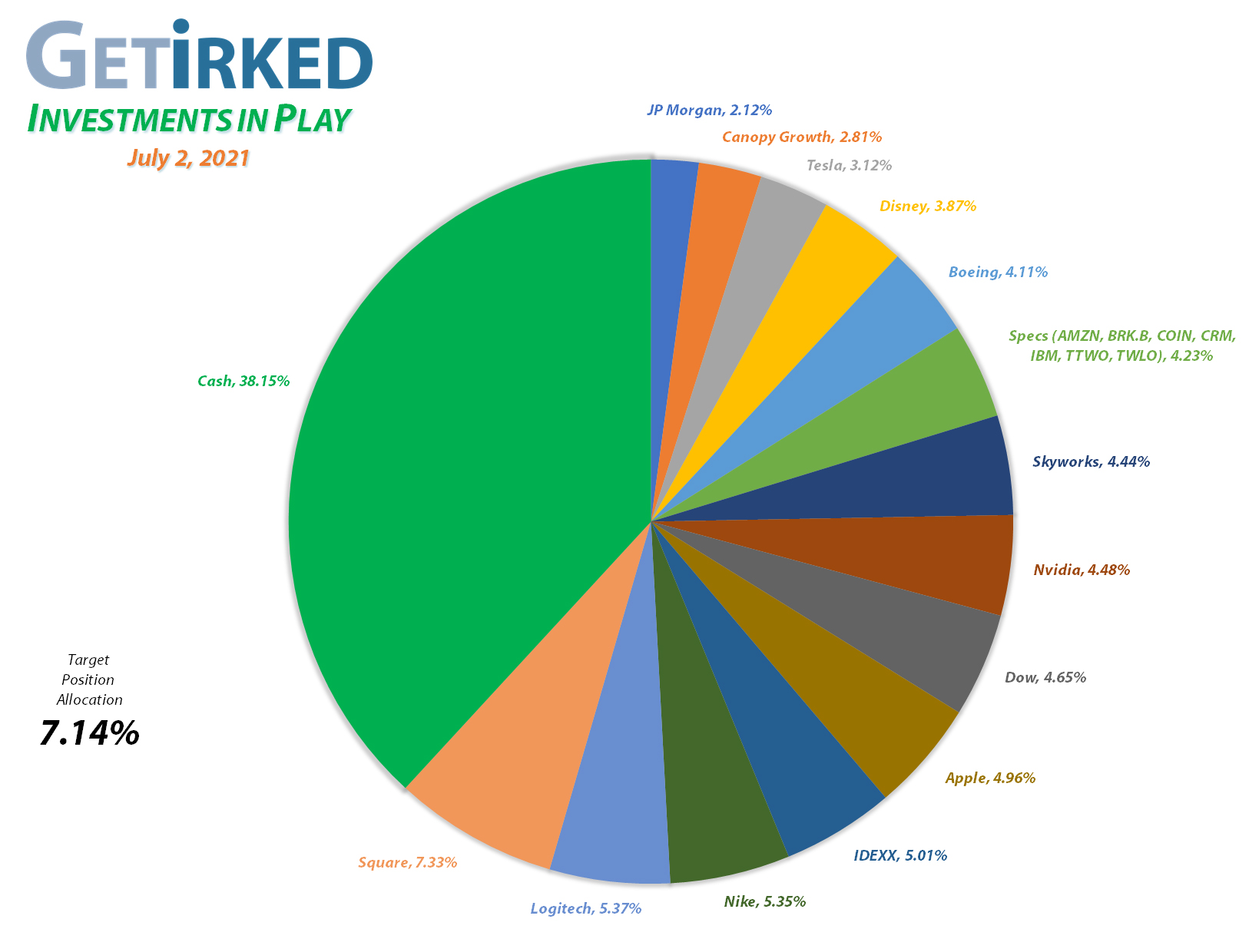

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Take Two (TTWO)

+2814.49%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $6.30

Canopy (CGC)

+1093.33%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $1.95

Square (SQ)

+1046.72%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$133.90)*

Logitech (LOGI)

+1031.25%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+759.65%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.94)*

Nvidia (NVDA)

+735.04%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Boeing (BA)

+706.44%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$292.05)*

Tesla (TSLA)

+592.99%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Nike (NKE)

+589.14%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

IDEXX Labs (IDXX)

+569.61%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+370.24%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+283.28%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+214.92%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Skyworks (SWKS)

+131.54%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

JP Morgan (JPM)

+116.62%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $72.03

Salesforce (CRM)

+115.40%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+102.75%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.06

Dow (DOW)

+78.65%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Berkshire (BRK.B)

+70.20%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-37.41%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

No Moves This Week!

Once again, the summer doldrums saw not enough movement in any of my positions to put them within buying ranges or selling range, so it was time to just sit on my hands and re-evaluate my Trading Plans for each one.

There are a few positions nearing buying targets, however:

- Canopy Growth Corp (CGC) is just 1.805% from its target,

- IBM (IBM) is slightly over 5% away,

- and Boeing (BA) only needs to drop 6.5% to hit my buy order.

I guess we’ll just have to wait and see what next week brings, eh?

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.