June 11, 2021

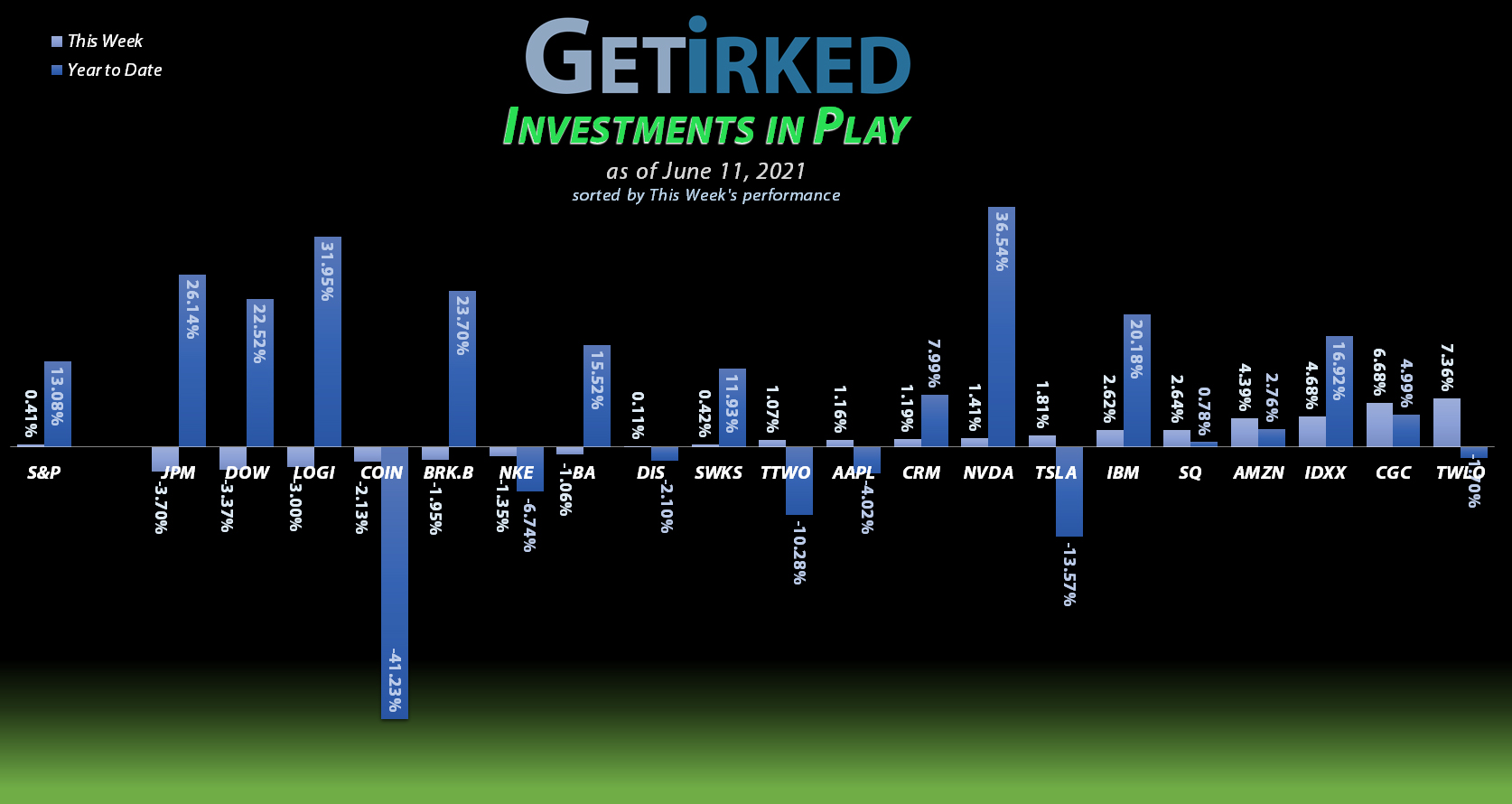

The Week’s Biggest Winner & Loser

Twilio (TWLO)

Growth stocks saw some love this week, and there are few growthier growth stocks than Twilio (TWLO). The cloud app-services play earned +7.36% this week, locking itself in as the Week’s Biggest Loser.

JP Morgan (JPM)

Big inflation numbers mean the Federal Reserve won’t be raising interest rates anytime soon, and without interest rates, the banks don’t fare as well.

Best-in-Breed JP Morgan (JPM) was not held exempt to the interest rate fears, dropping -3.70% and earning itself the spot of the Week’s Biggest Loser.

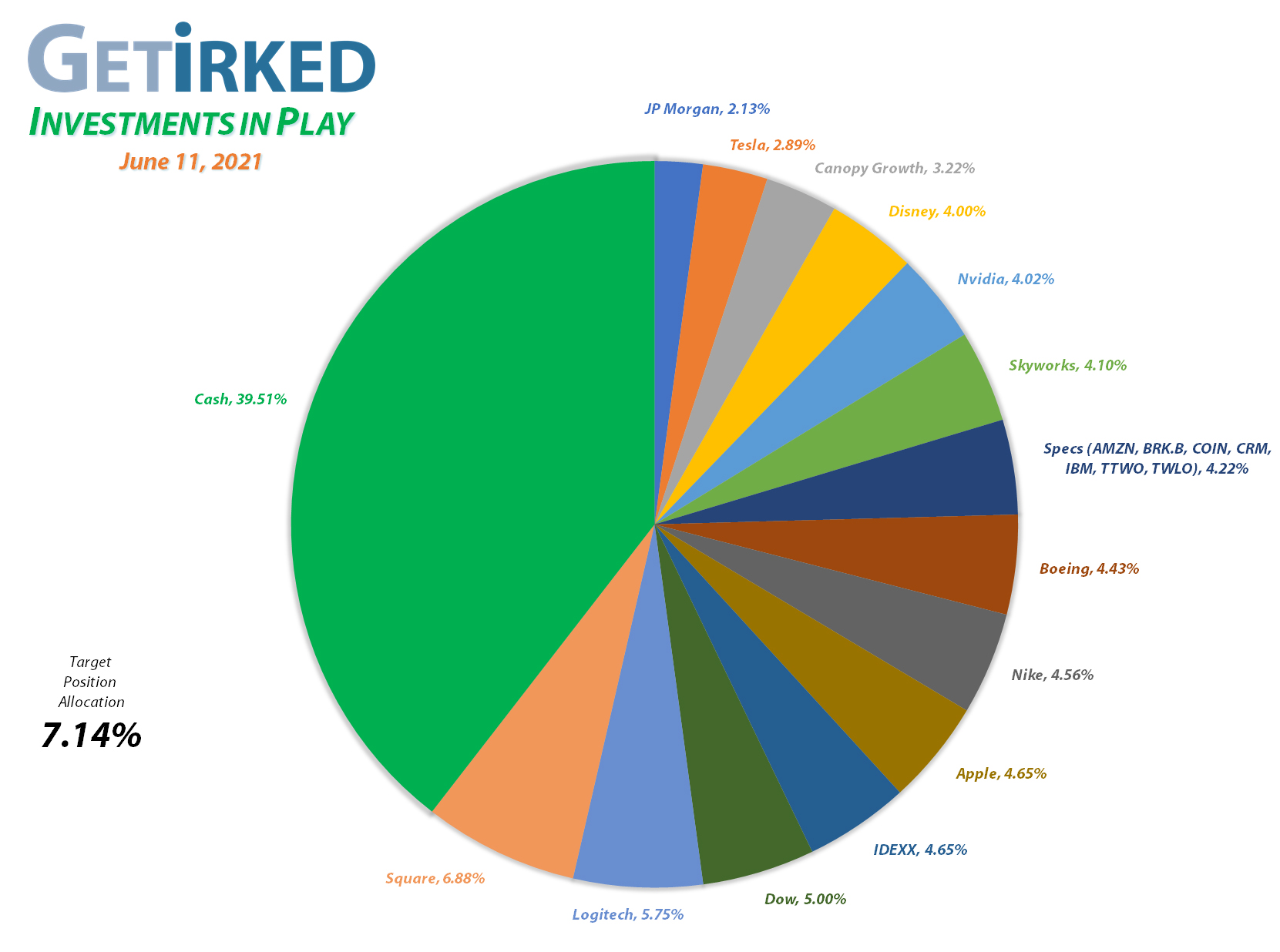

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Take Two (TTWO)

+2960.09%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $6.30

Canopy (CGC)

+1226.67%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $1.95

Logitech (LOGI)

+1070.03%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Square (SQ)

+986.06%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$133.90)*

Boeing (BA)

+720.66%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$292.05)*

Apple (AAPL)

+707.84%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.94)*

Nvidia (NVDA)

+650.17%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Tesla (TSLA)

+540.58%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+515.22%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Nike (NKE)

+500.37%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

Disney (DIS)

+370.87%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+277.81%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+185.07%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

JP Morgan (JPM)

+135.73%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $68.00

IBM (IBM)

+116.73%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Salesforce (CRM)

+108.60%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Skyworks (SWKS)

+107.05%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

Dow (DOW)

+91.77%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Berkshire (BRK.B)

+74.92%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-41.76%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

No Moves this Week!

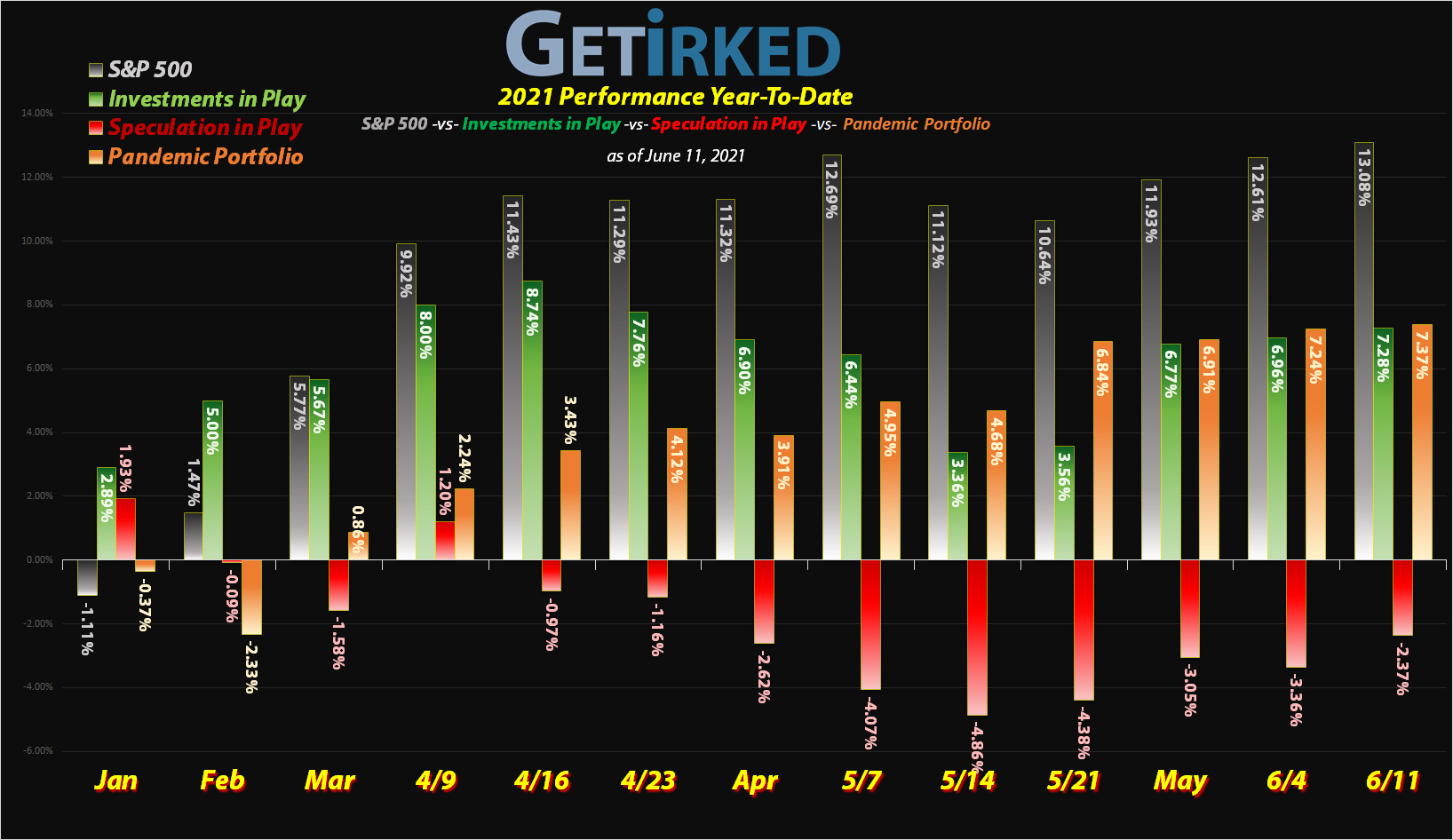

Once again, the market continues to shrug off all bad news and grind higher. Accordingly, I did raise the price targets for many of the positions in my Investments in Play portfolio in order to prepare for a potential correction sometime over the summer.

Despite a slew of pundits claiming we should expect to see extreme weakness due to all of the negative news, the market proves them all wrong. That being said, I continue to stay wary and remain unwilling to put a huge amount of money to work.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.