April 23, 2021

The Week’s Biggest Winner & Loser

IBM (IBM)

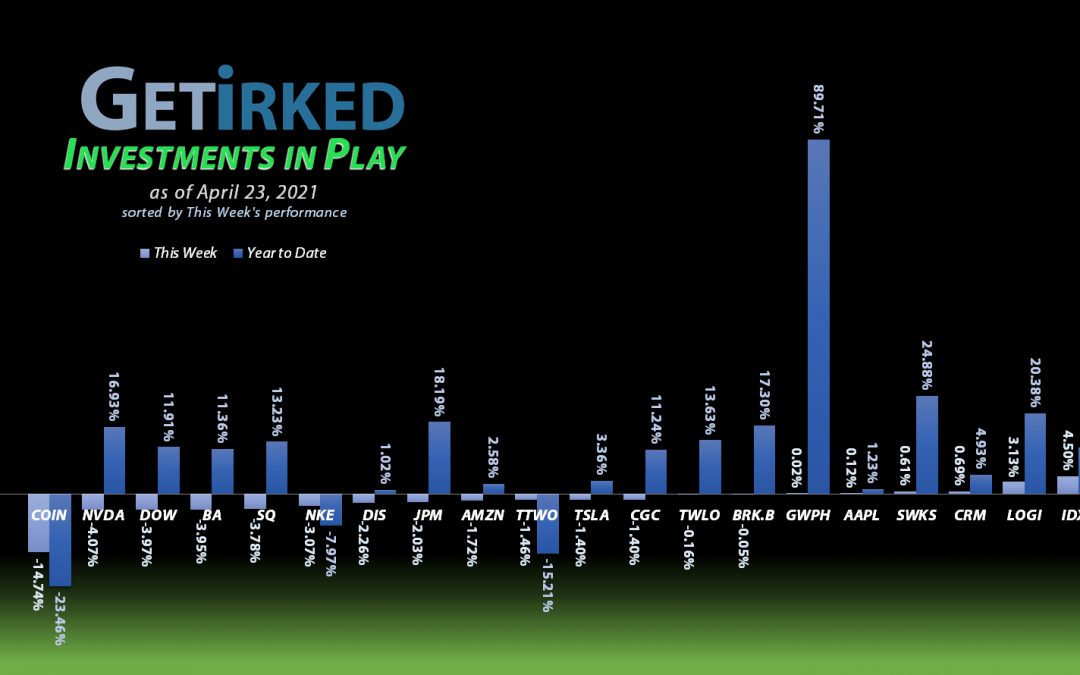

Well, well, well… IBM (IBM) finally did it – they reported a halfway decent quarter. Still stuck in a seemingly-endless downward trend, IBM did get to pop +6.62% and earn itself the spot of the Week’s Biggest Winner with some analysts going so far as to say, I kid you not, “this time is different…”

Coinbase (COIN)

Coinbase (COIN) continues to be the poster child for ringing the bell at the top of the Bitcoin bull run, down another -14.74% to earn itself the Week’s Biggest Loser spot two weeks in a row… and the company has only been public for less than two weeks!

As Bitcoin continues to sell off, it’s hard to know how much of a stinker COIN will turn out to be as lower crypto prices equates to less profits for this digital dumpster fire.

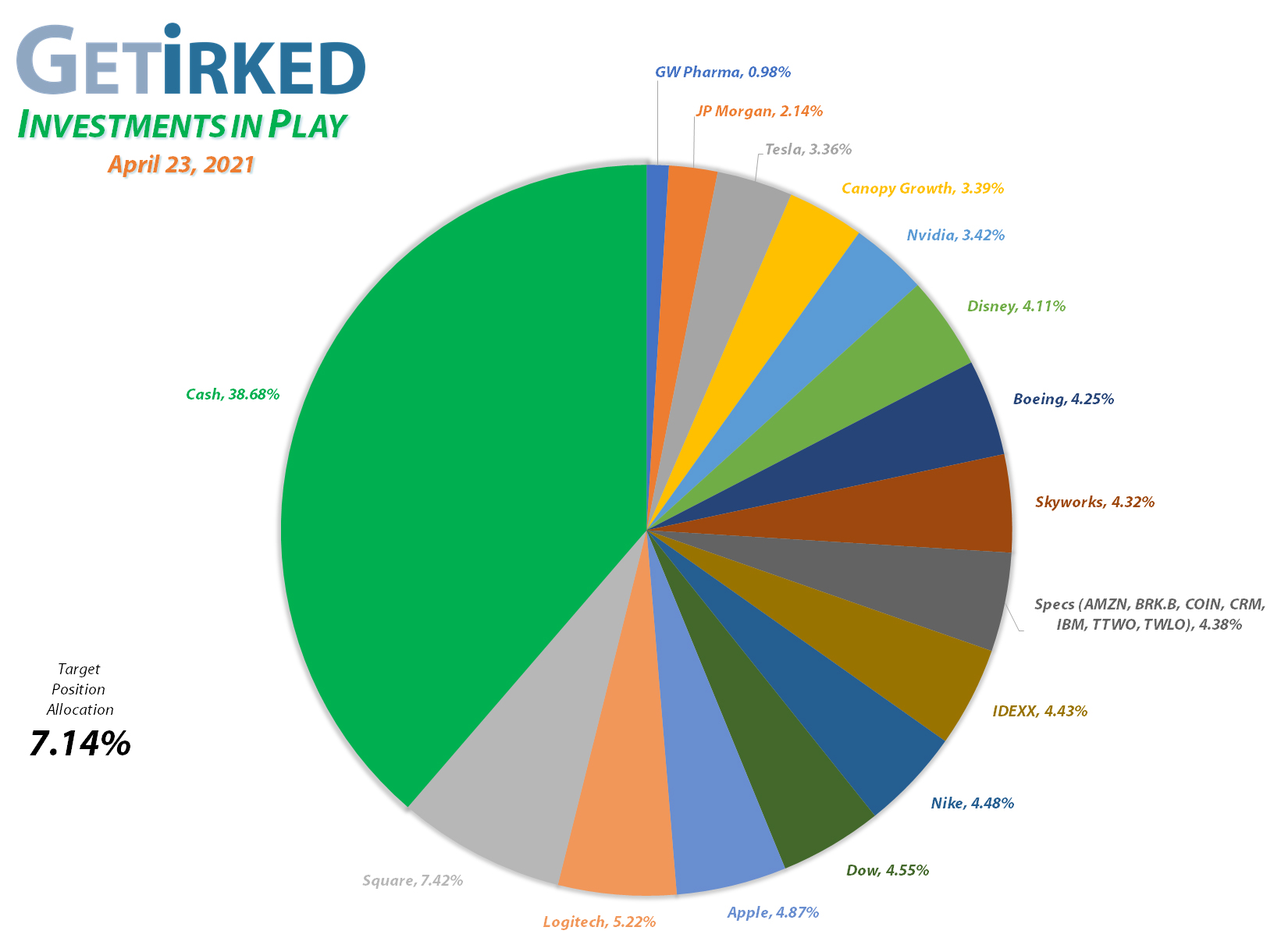

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Canopy (CGC)

+1305.64%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $1.95

Square (SQ)

+1056.88%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$146.20)*

Logitech (LOGI)

+977.89%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+735.52%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Boeing (BA)

+708.77%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$292.05)*

Tesla (TSLA)

+628.07%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$117.85)*

Nvidia (NVDA)

+568.56%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+494.78%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

IDEXX Labs (IDXX)

+493.78%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+382.66%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+277.61%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+212.60%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+188.00%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+145.59%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

Skyworks (SWKS)

+141.54%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

IBM (IBM)

+104.05%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Salesforce (CRM)

+102.70%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+98.66%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $75.60

Dow (DOW)

+75.16%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Berkshire (BRK.B)

+65.87%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-24.15%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Boeing (BA): Added to Position

I added to Boeing (BA) when the entire market came under selling pressure on Tuesday, picking up additional shares at $234.66 and locking in a -36.52% discount on shares I sold throughout 2018-2019 at an average price of $369.67.

The buy order raises my per-share “cost” to -$292.05 (meaning each share I hold in my position has all investment capital removed plus $292.05 in profit added to the portfolio’s bottom line).

From here, my next buy target is $202.75, and my next sell target will be when Boeing outgrows the 7.14% target allocation for the portfolio, currently around the stock’s all-time high at $453.65.

BA closed the week at $238.38, up +1.59% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.