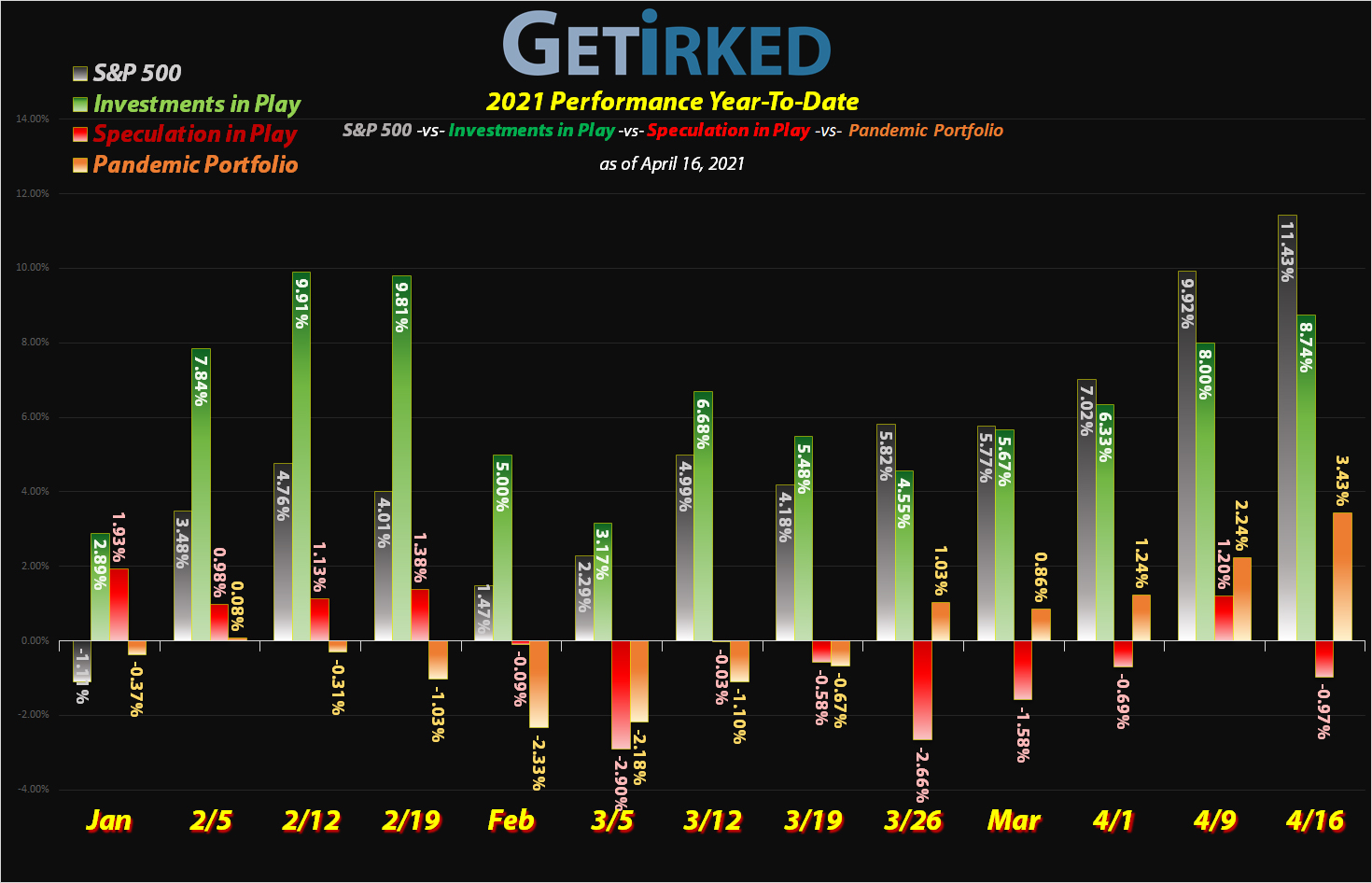

April 16, 2021

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

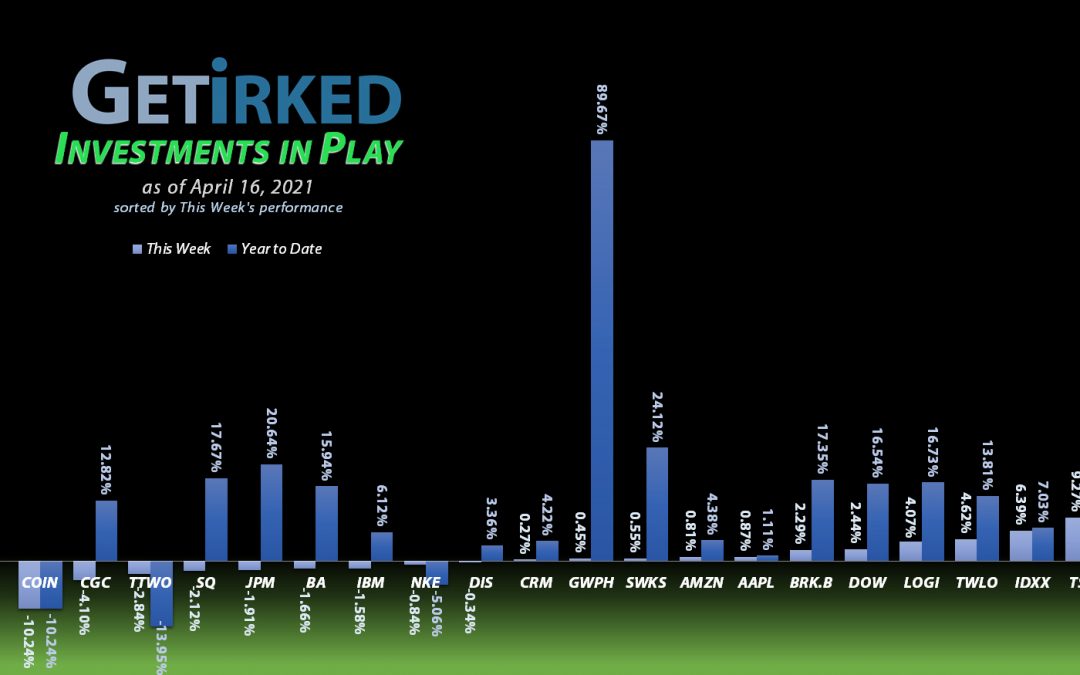

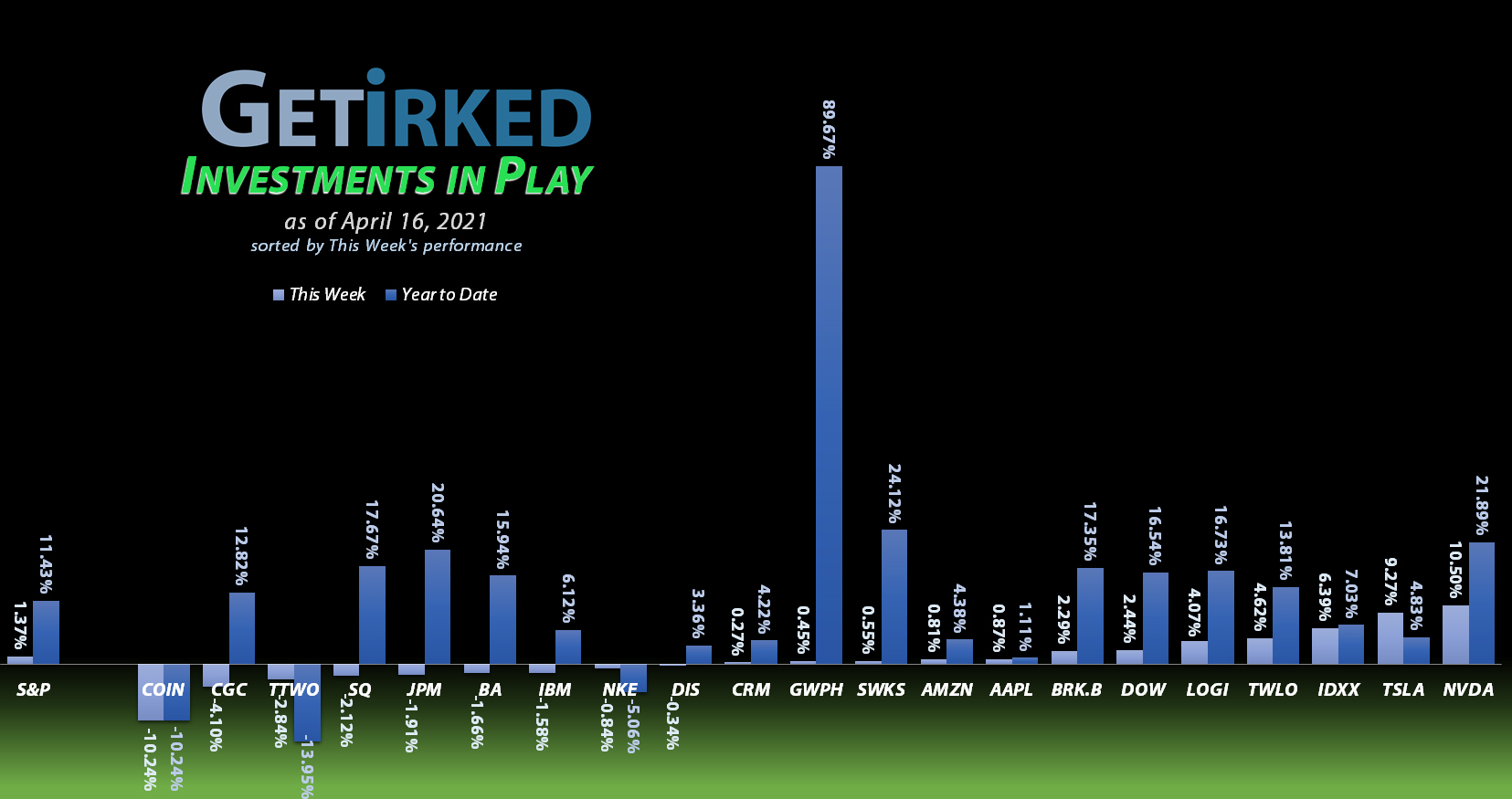

Funny thing happens when you have a shareholders meeting and announce you’ve got new GPUs in the works, and, oh yeah, you’re going to start making CPUs that will positively destroy Intel (INTC) and AMD (AMD).

Naturally, Nvidia (NVDA) accelerated +10.50% this week to earn the spot of the Week’s Biggest Winner.

Coinbase (COIN)

A bungled direct listing all the reporters consider a success, Coinbase (COIN), the cryptocurrency exchange platform, came onto the public markets this week like a turd in the wind.

Opening at $381, popping to $430, and then crashing to $310 before finally finding support does not a good first trading day make.

COIN finished the week down -10.24% and for a first week out, that definitely earns it the spot of the week’s Biggest Loser.

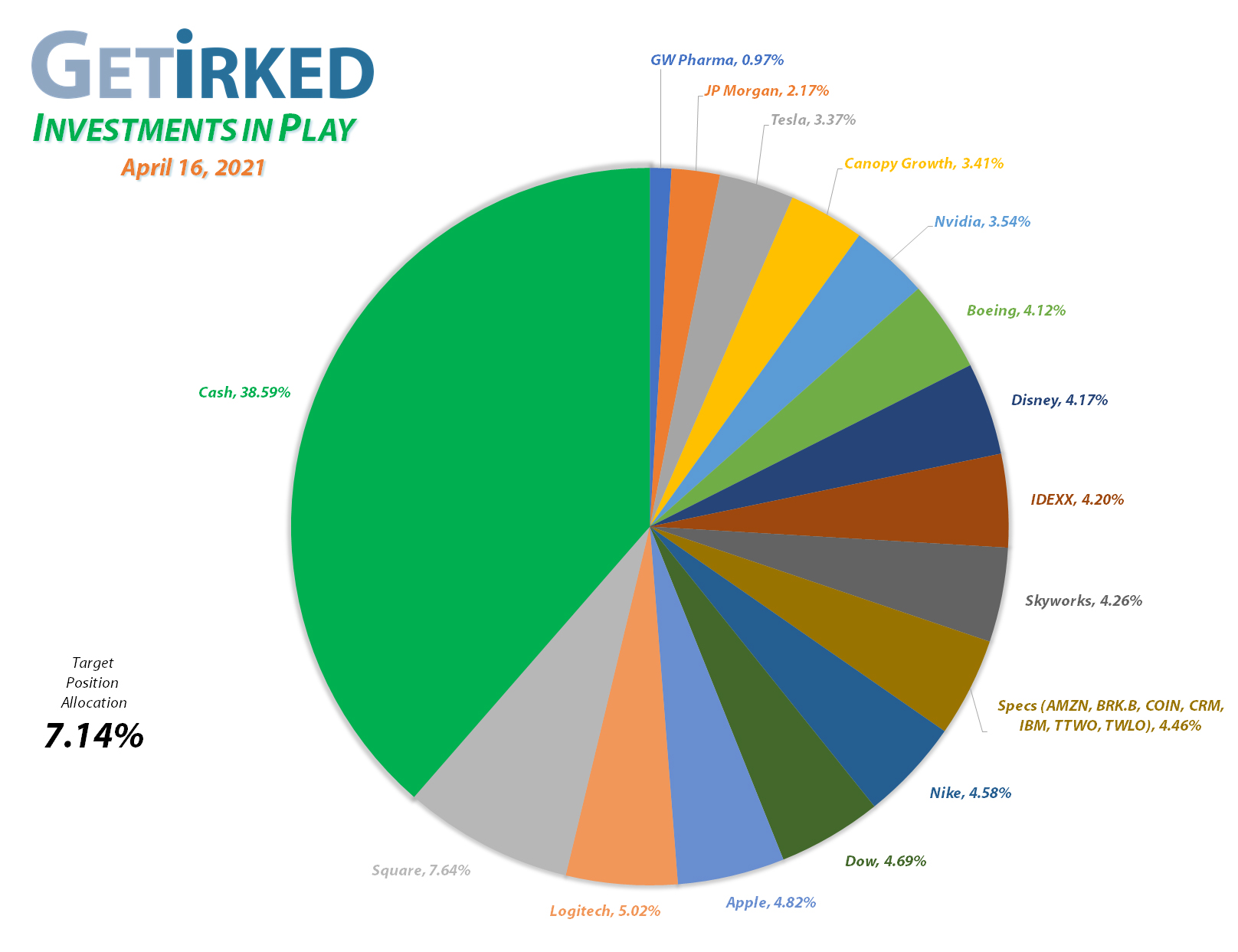

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Canopy (CGC)

+1325.64%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $1.95

Square (SQ)

+1082.91%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$146.20)*

Logitech (LOGI)

+948.79%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+734.86%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Boeing (BA)

+720.73%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$327.16)*

Tesla (TSLA)

+635.76%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$117.85)*

Nvidia (NVDA)

+589.19%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+507.94%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

IDEXX Labs (IDXX)

+473.42%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+391.52%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+279.56%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+212.92%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+187.98%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+146.19%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

Skyworks (SWKS)

+140.07%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

JP Morgan (JPM)

+102.78%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $75.60

Salesforce (CRM)

+101.31%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+91.38%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Dow (DOW)

+82.41%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Berkshire (BRK.B)

+65.95%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-11.04%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

The Stock Market Fashion Show has definitely moved on from the cannabis stocks as Canopy Growth Corporation (CGC) continued to sell off even after getting hit hard last week. On Wednesday, I decided to put some capital back into the position with a buy order which filled at $27.70.

Unlike 2018-2020 where I added to CGC on the way down, eventually raising my per-share cost above CGC’s value as it dropped to $9.00 a share at its bottom in March, I’m being much more conservative this time around.

Wednesday’s buy replaced only 1/8 of the shares I sold for $43.81 on Feb 11 of this year, locking in a 36.77% discount and giving me a cost of $1.95 per share.

From here, my next buy target is much lower at $19.40. If Canopy finds significant support before dropping to that level, I’ll raise my target, but, as I said, I’ve been to this rodeo before and won’t make the same mistakes I made last time. (I’ll make all new ones!)

My sell target to once again remove all of my capital from this position is around $54-$54.25, slightly less than the $56.48 high that the Reddit crowd hit earlier this year.

CGC closed the week at $27.80, up +0.36% from where I added Wednesday.

Coinbase (COIN): *New Position*

Coinbase (COIN), the cryptocurrency exchange which allows users to trade Bitcoin, Ether, and a variety of other altcoins, came public through a direct listing on Wednesday. Although I hold Bitcoin, I like the idea of playing the entire crypto space without having to worry about potential wallet hacks, so I decided to add COIN to my Speculative Basket.

The Speculative Basket now holds seven companies: Amazon (AMZN), Berkshire-Hathaway (BRK.B), IBM (IBM), Salesforce (CRM), Take Two (TTWO), Twilio (TWLO), and, of course, now Coinbase (COIN).

Usually, I don’t buy a position the day it comes public on the markets as most issues see extreme volatility on their first day of trading, and Coinbase was certainly no different. While its “reference price” (the price it’s “supposedly” starting at) was $250.00, COIN came public at $381.

What’s the difference between an IPO and a Direct Listing?

Whereas in an Initial Public Offering (IPO), a handful of lucky investors and firms do have the opportunity to buy the stock at the IPO or “offering price,” in a Direct Listing, there is no pre-buying so the company offers a “reference price.” The reference price is a rough estimate of what a stock might be valued at, but since no shares trade hands at the reference price, the true starting price for a Direct Listing is its opening price.

During an IPO, the newly-public company is raising money by selling shares at the price determined by thorough financial analysis. Companies coming public during Direct Listings typically do not need to raise money, so their Reference Price should be close to fairly-valued for the company. This was not the case for COIN, whose reference price was dramatically different than its starting price of $381.00.

For all future calculations, I will use $381.00 as COIN’s starting price, not the ridiculous Reference Price which, consequently, was significantly lower than what the private shares were trading before the Direct Listing.

As always with any new position, especially a speculative one, I started with a small order which cost-averaged at $412.47 on Wednesday. Then, I waited. COIN had an incredibly rough first day – after popping to nearly $430, it then COLLAPSED… dropping to a low of $310.00 before finding any support.

Using the previous day’s price action as a guide, I added to the position on Thursday at $328.42, lowering my per-share cost -6.79% to $384.45. From here, I’m using Fibonacci Retracement to predict lower levels based on the low of the first day of trading to the high of the second day giving me a price target of $282.65 followed by $238.50, below the stock’s $250.00 reference price.

COIN closed the week at $342.00, down -11.04% from my per-share price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.