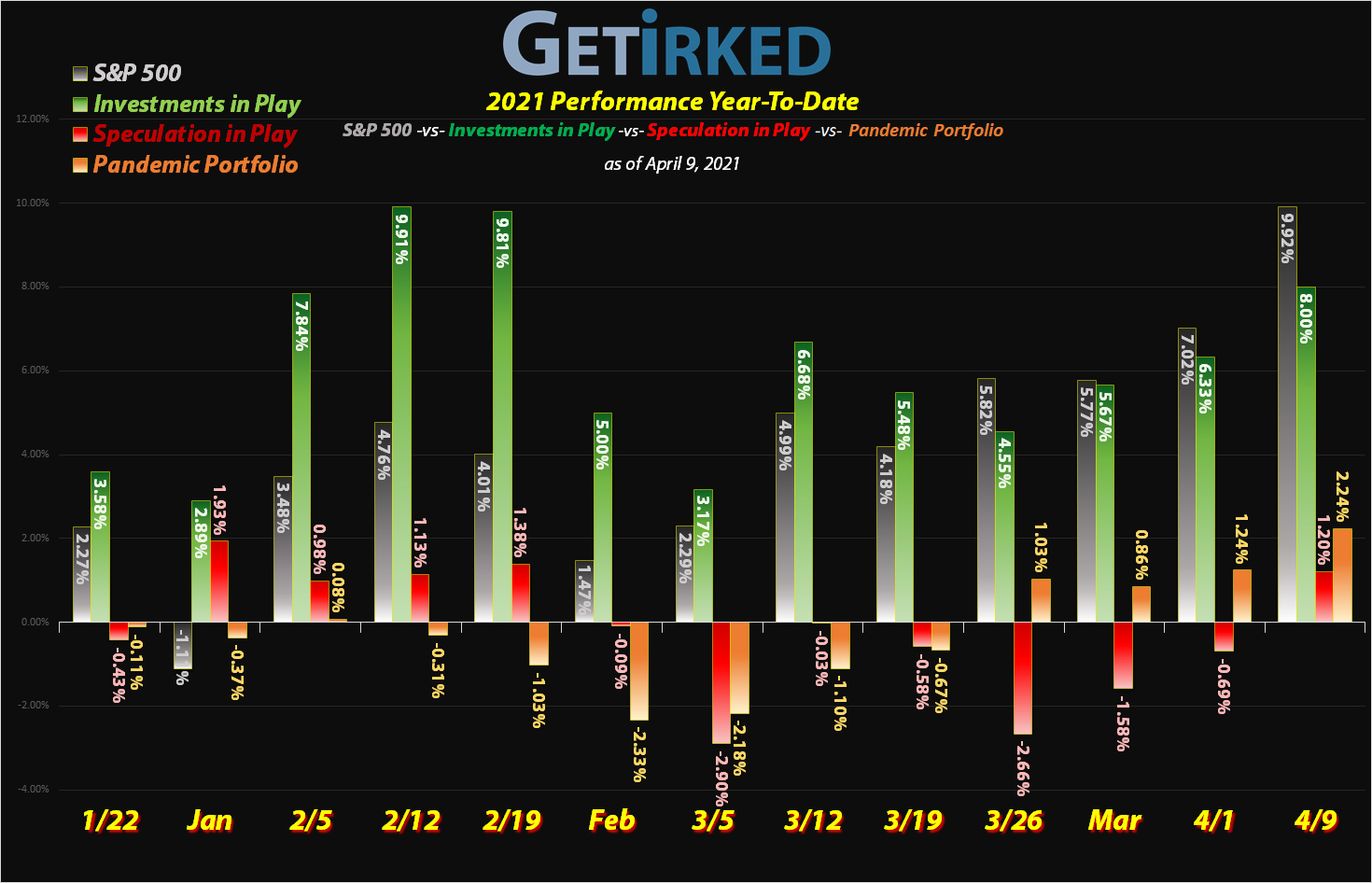

April 9, 2021

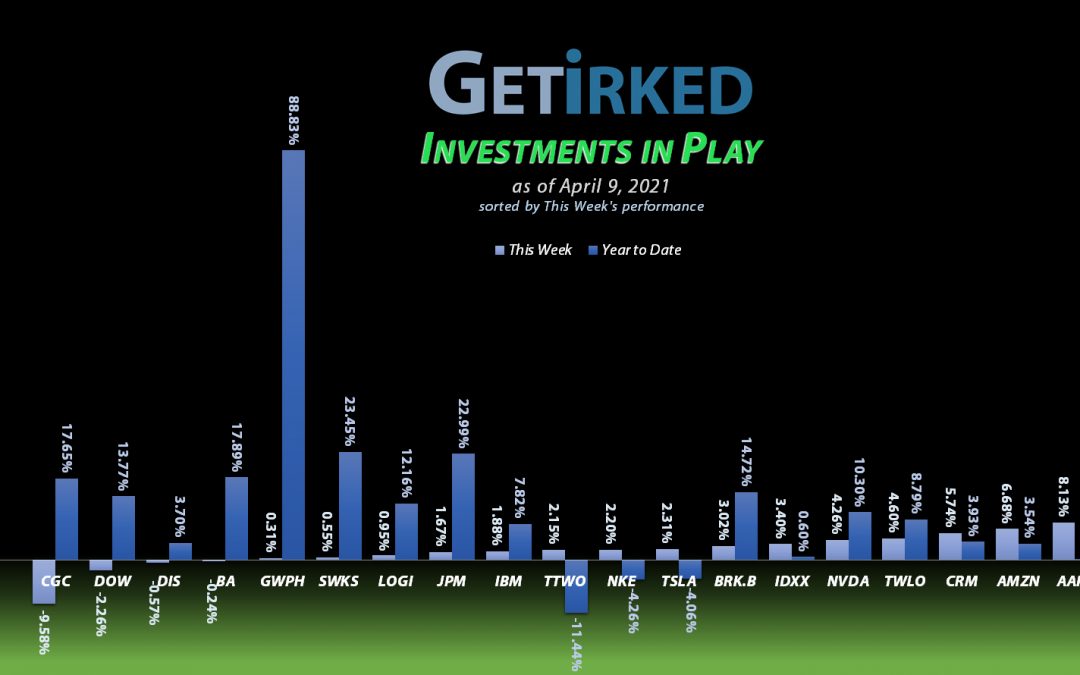

The Week’s Biggest Winner & Loser

Square (SQ)

Square (SQ) got name-checked as a potential competitive threat in Jamie Dimon’s letter to JP Morgan (JPM) shareholders this week.

The result?

Everyone piled back into the fintech company that’s making JPM nervous causing SQ to finish the week up +14.00% as the Week’s Biggest Winner!

Canopy Growth Corp (CGC)

Cannabis Best-of-Breed player, Canopy Growth Corporation (CGC), picked up Supreme Cannabis company for a steamy $435 million and the markets didn’t like it one bit.

Despite the acquisition likely adding to long-term potential for CGC, the stock sold off to the tune of -9.58%, earning the company the spot of the Week’s Biggest Loser.

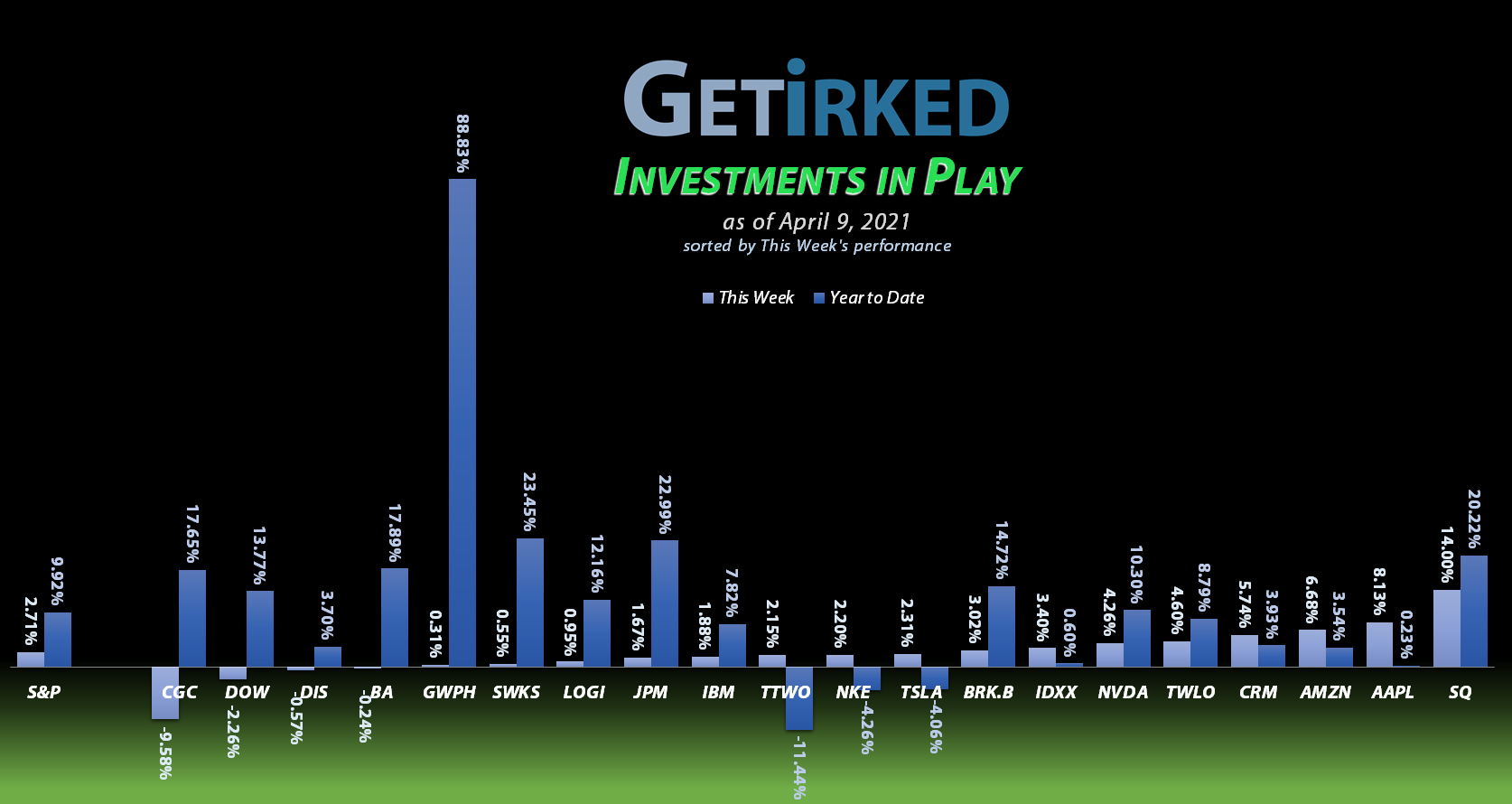

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

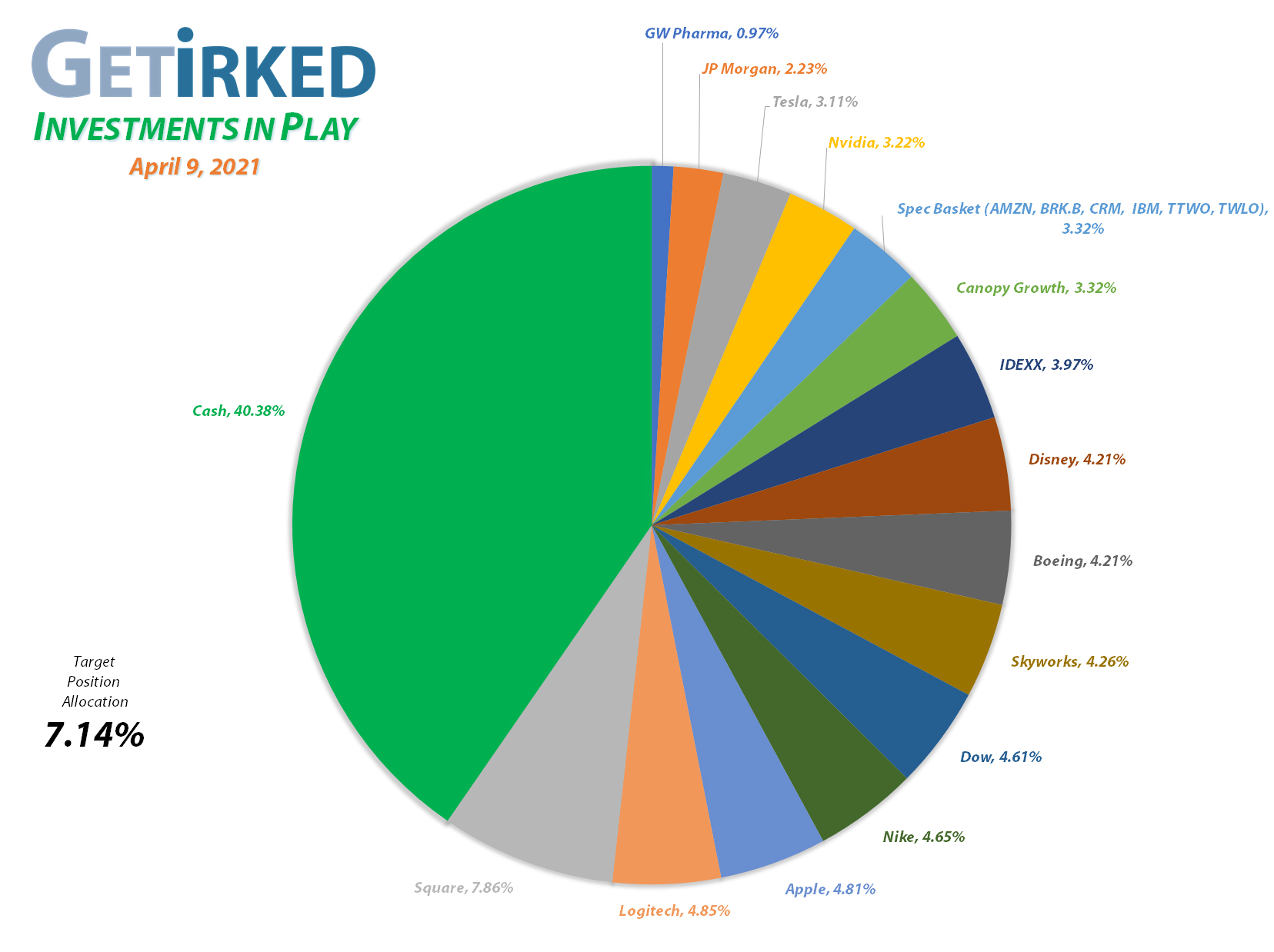

Square (SQ)

+1097.85%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$146.20)*

Logitech (LOGI)

+912.39%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+730.09%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Boeing (BA)

+725.97%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$327.16)*

Tesla (TSLA)

+589.24%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$117.85)*

Nvidia (NVDA)

+540.97%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+511.58%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

IDEXX Labs (IDXX)

+446.28%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+392.84%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Canopy (CGC)

+342.41%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.38)*

Amazon (AMZN)

+278.66%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+203.90%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+187.60%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+147.41%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

Skyworks (SWKS)

+138.76%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

JP Morgan (JPM)

+106.72%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $75.60

Salesforce (CRM)

+100.76%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+94.45%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Dow (DOW)

+78.07%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Berkshire (BRK.B)

+62.23%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Square (SQ): Profit-Taking

With a market this frothy, it was time to take profits in my swollen position in Square (SQ) when it hit $262.53 on Friday. The sale locked in +32.70% in gains on shares I bought literally just a month ago on March 9 for $197.83. The profits reduced my per-share “cost” -11.09% from -$131.60 to -$146.20. Square is now the biggest lifetime profit-earner in the entire portfolio with Boeing (BA) coming in second place more than -25% behind!

Even after the sale, Square still exceeds the 7.14% allocation target for this portfolio, ringing in at 7.873%. However, I continue to stay overweight in Square for two reasons: (1) this company is the definition of super-volatile high-growth and I believe it can go much higher than here, and (2) with a cash stockpile of more than 40%, I’d like to maintain more exposure to the markets.

From here, my next sell target is under its $300 price target, and my next buy target is $202.40, near the bottom of its most recent selloff.

SQ closed the week at $261.65, down -0.34% from where I sold.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.