April 1, 2021

The Week’s Biggest Winner & Loser

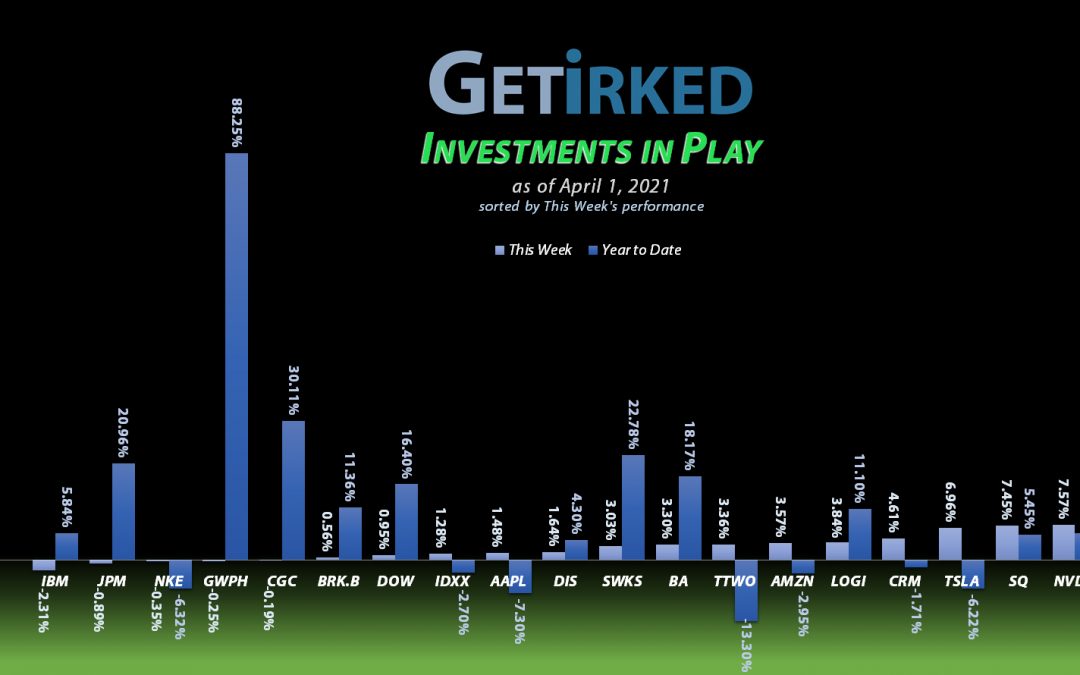

Twilio (TWLO)

This week, the fickle investing community flopped back out of the reopening cyclical plays and back into high-growth tech with Twilio (TWLO), the highest and growthiest of them all, receiving the biggest action, up +10.08% and earning the spot of the Week’s Biggest Winner.

IBM (IBM)

As I started noticing a few weeks ago, IBM (IBM) has swapped its high-growth tech roots for cyclical value plays which means a rotation out of tech slams the stock. IBM is the Week’s Biggest Loser, down -2.31%.

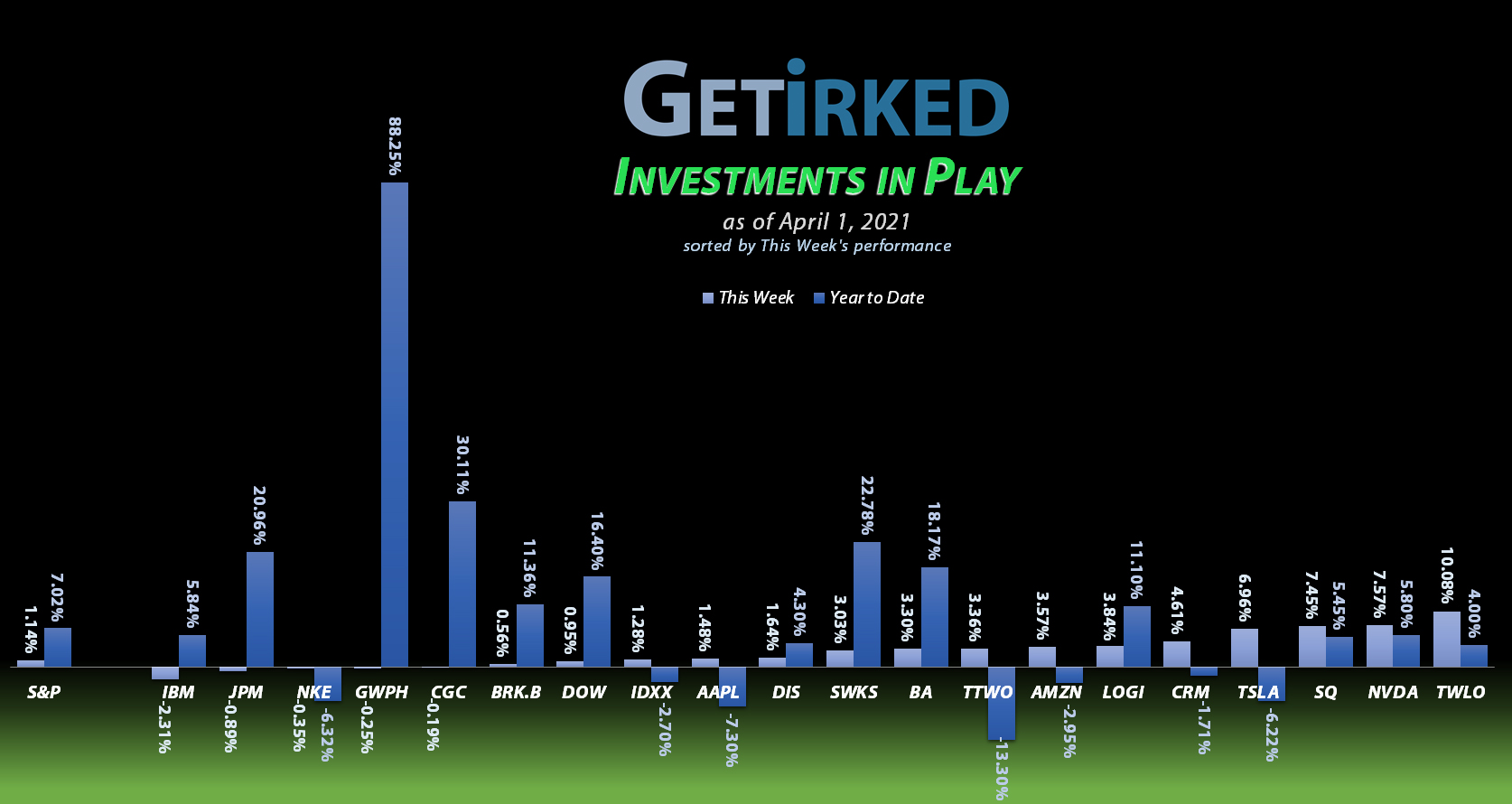

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1008.04%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$131.60)*

Logitech (LOGI)

+903.95%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Boeing (BA)

+726.72%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$327.16)*

Apple (AAPL)

+689.09%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Tesla (TSLA)

+577.92%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$117.85)*

Nvidia (NVDA)

+522.09%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+501.41%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.76)*

IDEXX Labs (IDXX)

+432.32%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+395.09%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Canopy (CGC)

+378.61%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.38)*

Amazon (AMZN)

+271.63%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+195.31%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+187.33%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+146.51%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

Skyworks (SWKS)

+137.46%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

JP Morgan (JPM)

+103.32%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $75.60

IBM (IBM)

+90.87%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Salesforce (CRM)

+89.87%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Dow (DOW)

+82.19%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Berkshire (BRK.B)

+57.47%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Tesla (TSLA): Added to Position

I have been waffling of adding some of the profits I’d taken out of Tesla (TSLA) back into the position for some time now, and I finally bit the bullet on Monday when TSLA came under pressure, with a small order that filled at $606.30.

Despite Tesla being truly overvalued on a fundamental analysis basis, my Monday order represented a discount of -32.66% off of Tesla’s all-time high of $900.40 so I just couldn’t resist the sale.

The order takes my per-share “cost” up +16.14% from -$140.53 to -$117.85 (the negative price indicates the position cost no capital and, instead, each share adds $117.85 to the portfolio’s bottom line). From here, my next buy price target is $501.00.

TSLA closed the week at $661.75, up +9.15% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.