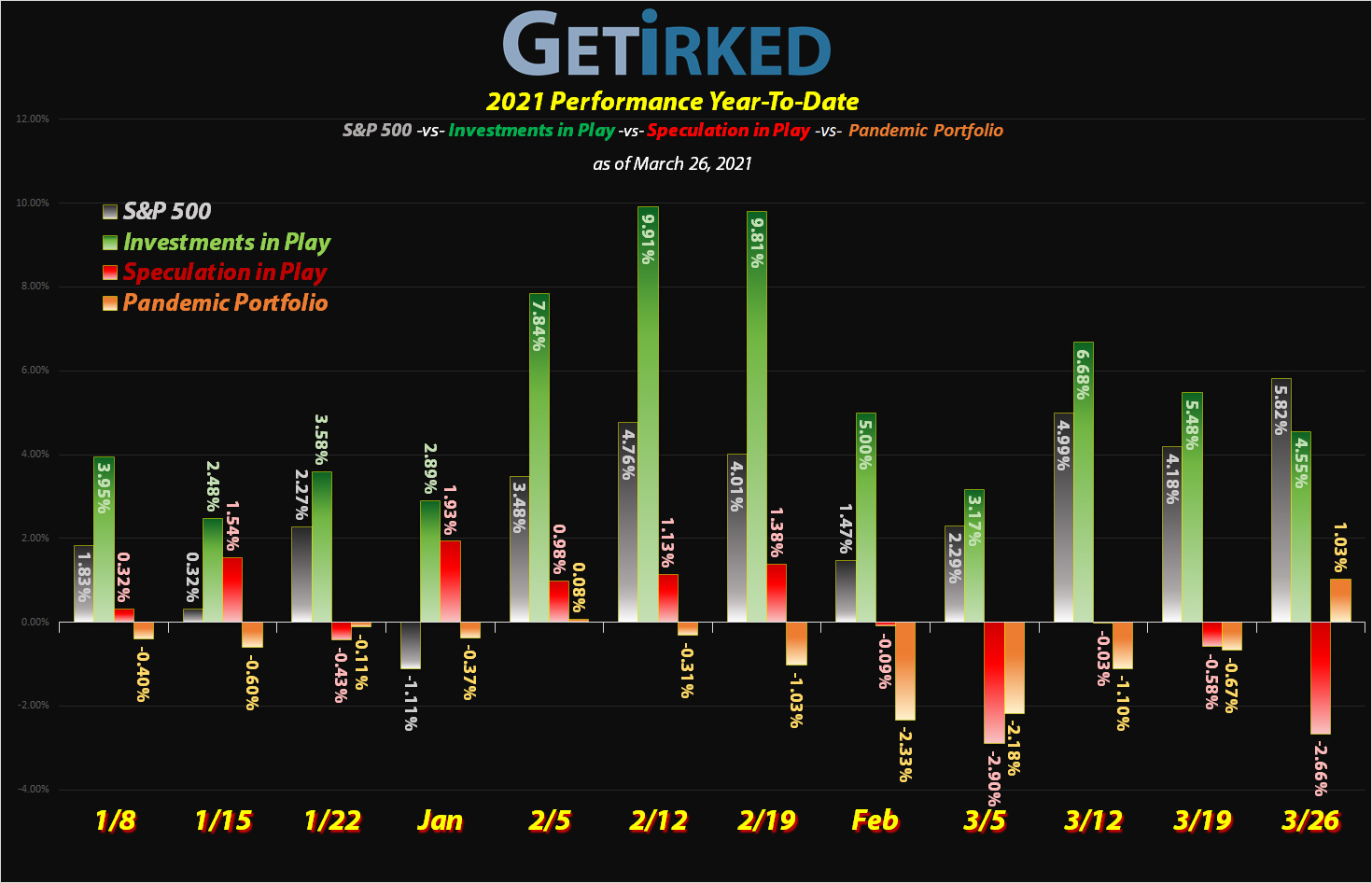

March 26, 2021

The Week’s Biggest Winner & Loser

IBM (IBM)

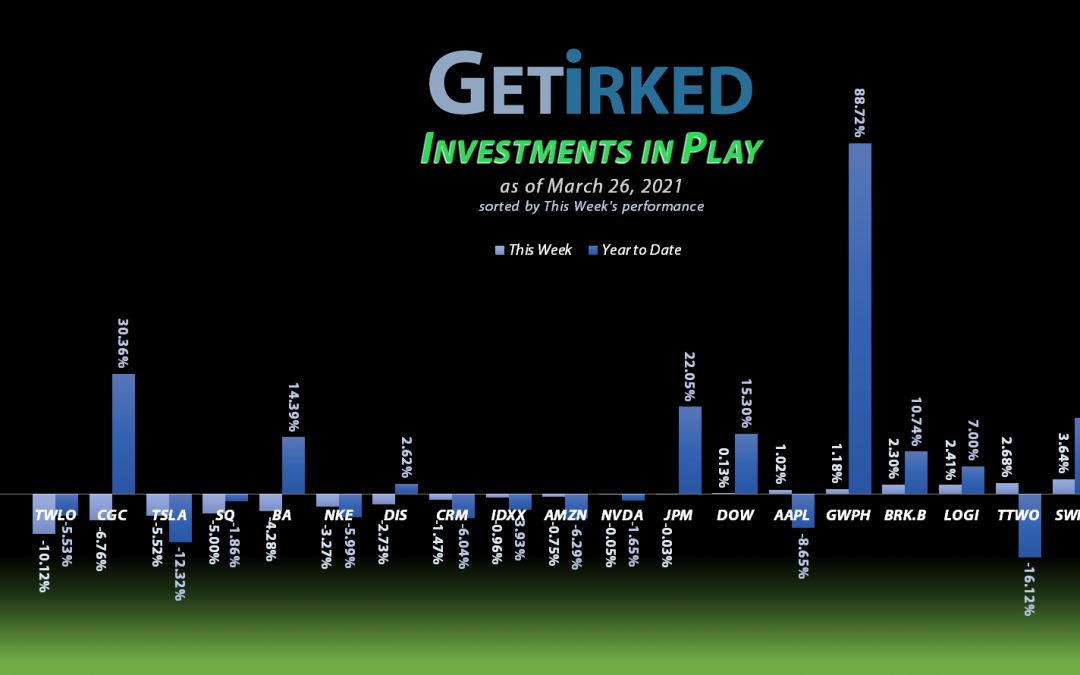

And the Week’s Biggest Winner is… IBM (IBM)?! How is this possible? Isn’t IBM technology and aren’t we rotating out of tech???

As near as I can tell, IBM (always an ugly duckling in the tech space), is being viewed as the best blend between technology and value because it sports a nearly 5% dividend.

Plus, IBM may be the first “blue chip stock,” meaning a stock you can build your portfolio around.

Now, IBM has definitely struggled in recent years and is by no means a high-flyer like other growth stocks so who knows how long this trend will go, but, for this week, IBM earned itself +5.80% and came away a winner.

Twilio (TWLO)

Growth tech stocks have fallen out of fashion as investors rotate into cyclicals and value plays. When it comes to high-flying growth tech, it doesn’t come growthier than Twilio (TWLO), the cloud-based service provider with apps and companies.

TWLO got slammed -10.12% this week and earned itself the Week’s Biggest Loser spot, accordingly.

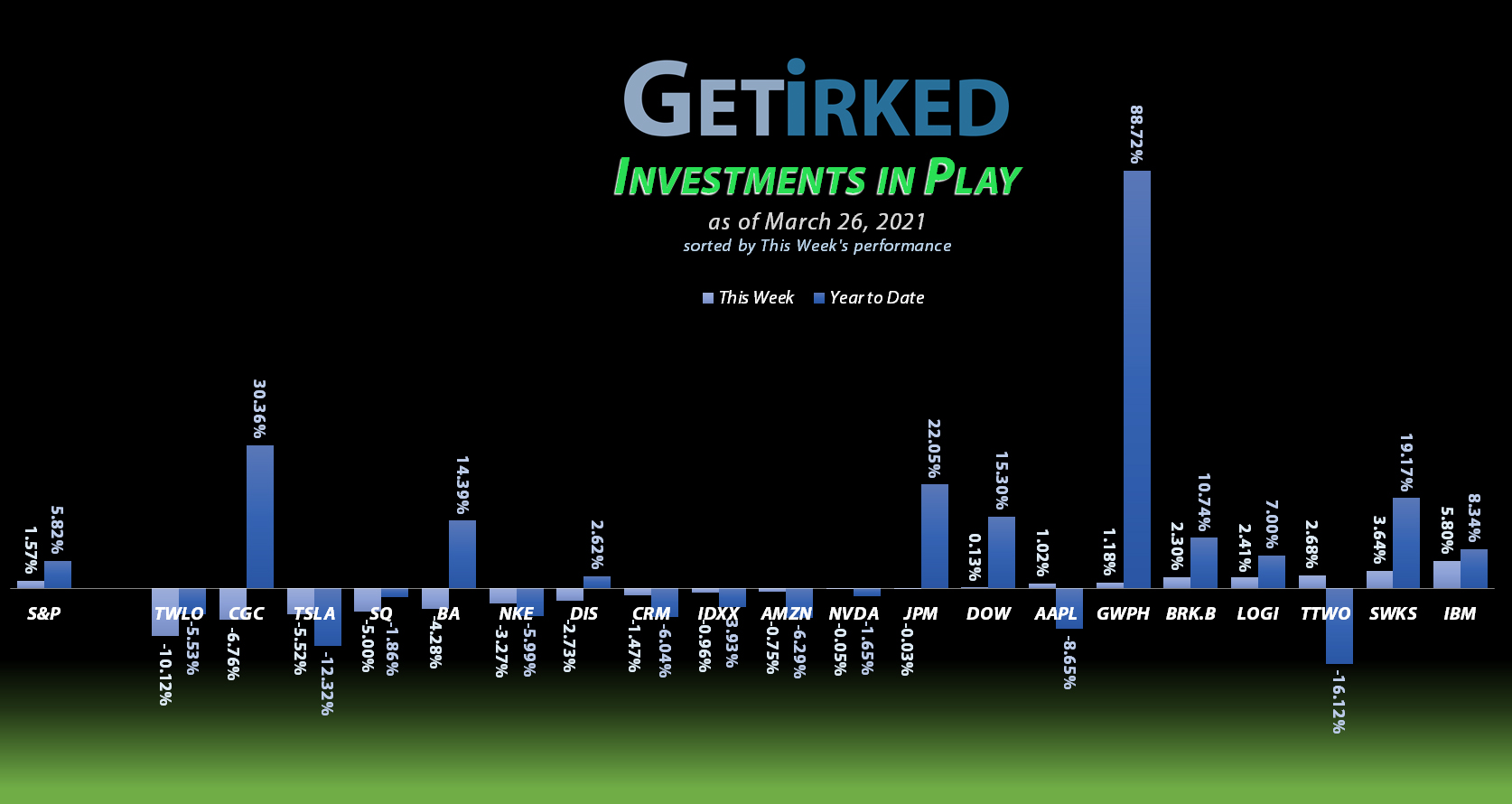

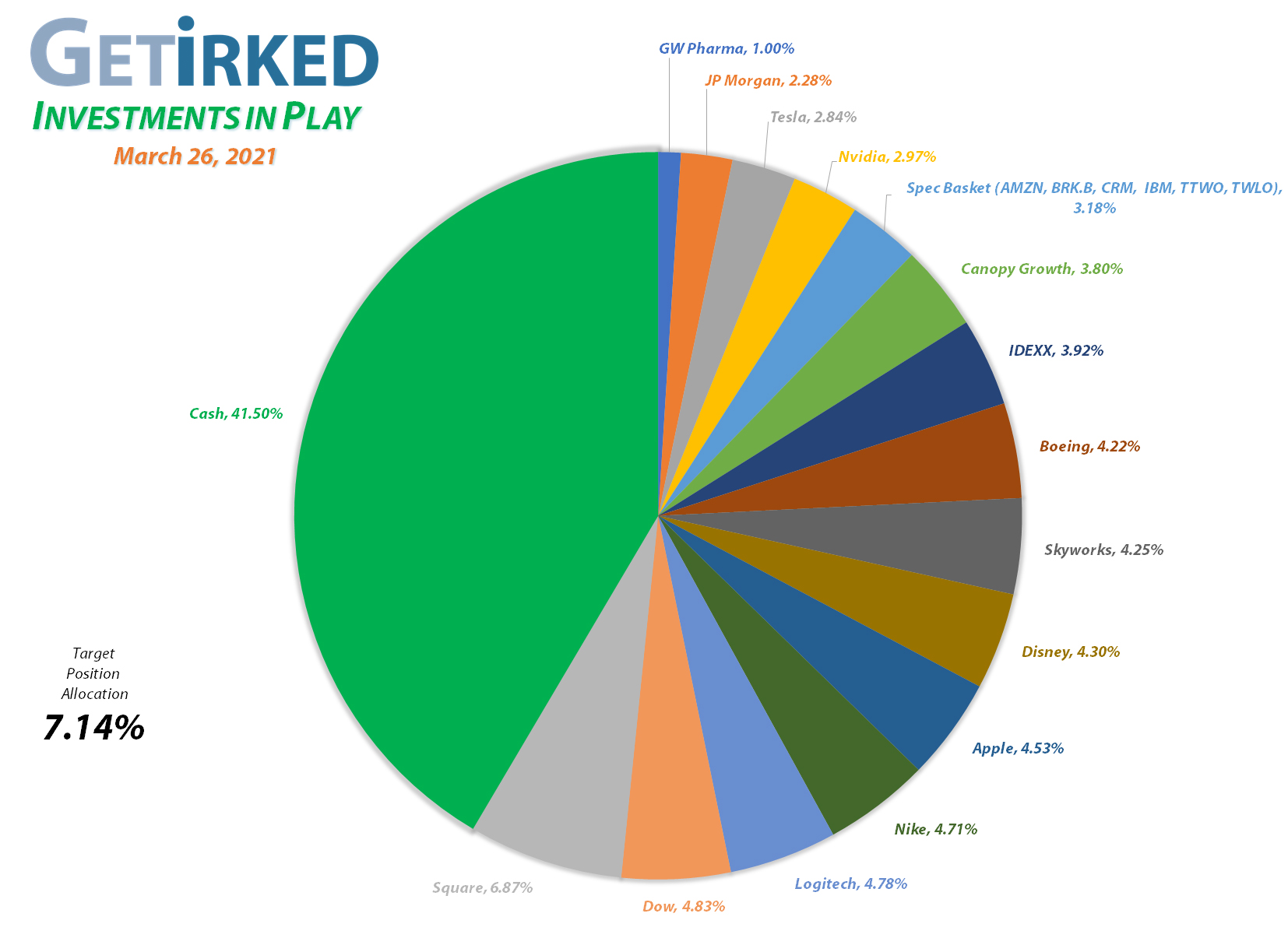

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+963.63%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$131.60)*

Logitech (LOGI)

+871.24%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Boeing (BA)

+716.59%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$327.16)*

Apple (AAPL)

+681.75%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Tesla (TSLA)

+545.73%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+502.88%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.76)*

Nvidia (NVDA)

+491.09%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

IDEXX Labs (IDXX)

+427.13%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+388.72%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Canopy (CGC)

+379.32%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.38)*

Amazon (AMZN)

+268.00%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

GW Pharm (GWPH)

+187.54%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Twilio (TWLO)

+178.21%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Take Two (TTWO)

+145.15%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

Skyworks (SWKS)

+130.48%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

JP Morgan (JPM)

+105.15%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $75.60

IBM (IBM)

+95.38%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Salesforce (CRM)

+81.50%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Dow (DOW)

+80.47%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Berkshire (BRK.B)

+56.59%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Berkshire-Hathaway (BRK.B): Added to Position

When Berkshire-Hathaway (BRK.B) came under pressure this week with many of the industrial and cyclical plays, I decided to add a little to this “speculative” position with an order which filled Tuesday at $250.46

The buy raised my per-share cost a fairly substantial +15.29% from $142.22 to $163.97, however, given that my new per-share cost is still near BRK.B’s low of $159.50 in March 2020, I’m comfortable with that to get some more exposure to this company that’s shocked everyone by making a new all-time high this year.

My next price target to add more is $222.00 and I currently have no intention of taking profits as we wait to see where this one can go.

BRK.B closed the week at $256.77, up +2.52% from where I added Tuesday.

Boeing (BA): Added to Position

Just like Berkshire-Hathaway (BRK.B) above, Boeing (BA) also came under selling pressure on Tuesday, so I decided to add a little at $240.55, replacing only a small portion of shares I sold between 2018-2019 for an average price of $369.67, locking in a -34.928% discount.

The buy raised the per-share “cost” on my position by +1.907% from -$333.52 to -$327.16 (Boeing remains in the top 2 biggest lifetime earners in the portfolio with each share costing no capital and instead adding $327.16 to the bottom line). From here, my next buy price target is $215.50 and my next sell target is near BA’s all-time high around $450.00.

BA closed the week at $244.87, up +1.80% from where I added Tuesday.

Disney (DIS): Added to Position

With DisneyLand opening later this month, a renewed focus on its Disney+ streaming services, and its line of movie studios, cruise lines, hotels, and theme parks making it the ultimate economic reopening play, I decided to add the profits I took out of Disney (DIS) back in when it came under weakness on Tuesday.

I placed an order which filled at $189.36, throwing only my profit back into the position and leaving me with a per-share “cost” of -$0.04 (meaning each share in the position cost the portfolio nothing and instead adds $0.04 to the bottom line).

From here, my next price target to add to Disney is $162.30, slightly above the low of its last big selloff.

DIS closed the week at $185.92, down -1.82% from where I added Tuesday.

Dow Chemical (DOW): Added to Position

Dow Chemical (DOW) sold off with the rest of reopening plays on Tuesday, prompting me to half of the shares I sold back on January 12 for $60.66 at the same price with an order that filled Tuesday afternoon at $60.66. The order raised my per-share cost +0.567% from $35.26 to $35.46, but given the rock-solid +4.616% yield even at these levels, the deal was too hard to pass up.

My next buy price target is $54.90 and my sell target is around $100, at which point DOW will be outgrowing the target 7.14% allocation size for each position in the portfolio.

DOW closed the week at $63.99, up +5.50% from where I added Tuesday.

Nike (NKE): Added to Position

When threats of a boycott from China broadened on Thursday, many stocks got slammed, including Nike (NKE) which dropped nearly -4% from already depressed prices despite an earnings report which was overall positive.

Many analysts felt like since Nike missed its numbers that the company isn’t popular, but it turns out demand is huge and the only reason NKE missed was due to supply chain constraints and known congestion at ports.

Accordingly, it was time for me to swoosh (get it?) in with a buy order which filled at $127.05 Thursday morning. The order raised my per-share “cost” +17.05% from -$29.85 to -$24.76 (each share in the portfolio cost no capital and instead adds $24.76 to the bottom line). At my fill price, Nike’s 0.866% dividend is nothing to get too excited about, although any dividend is nice in a rising rate environment.

From here, my next buy target is $112.10, and my next sell target is near $210 where Nike will have exceeded the 7.14% allocation target for the portfolio.

NKE closed the week at $132.99, up +4.70% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.