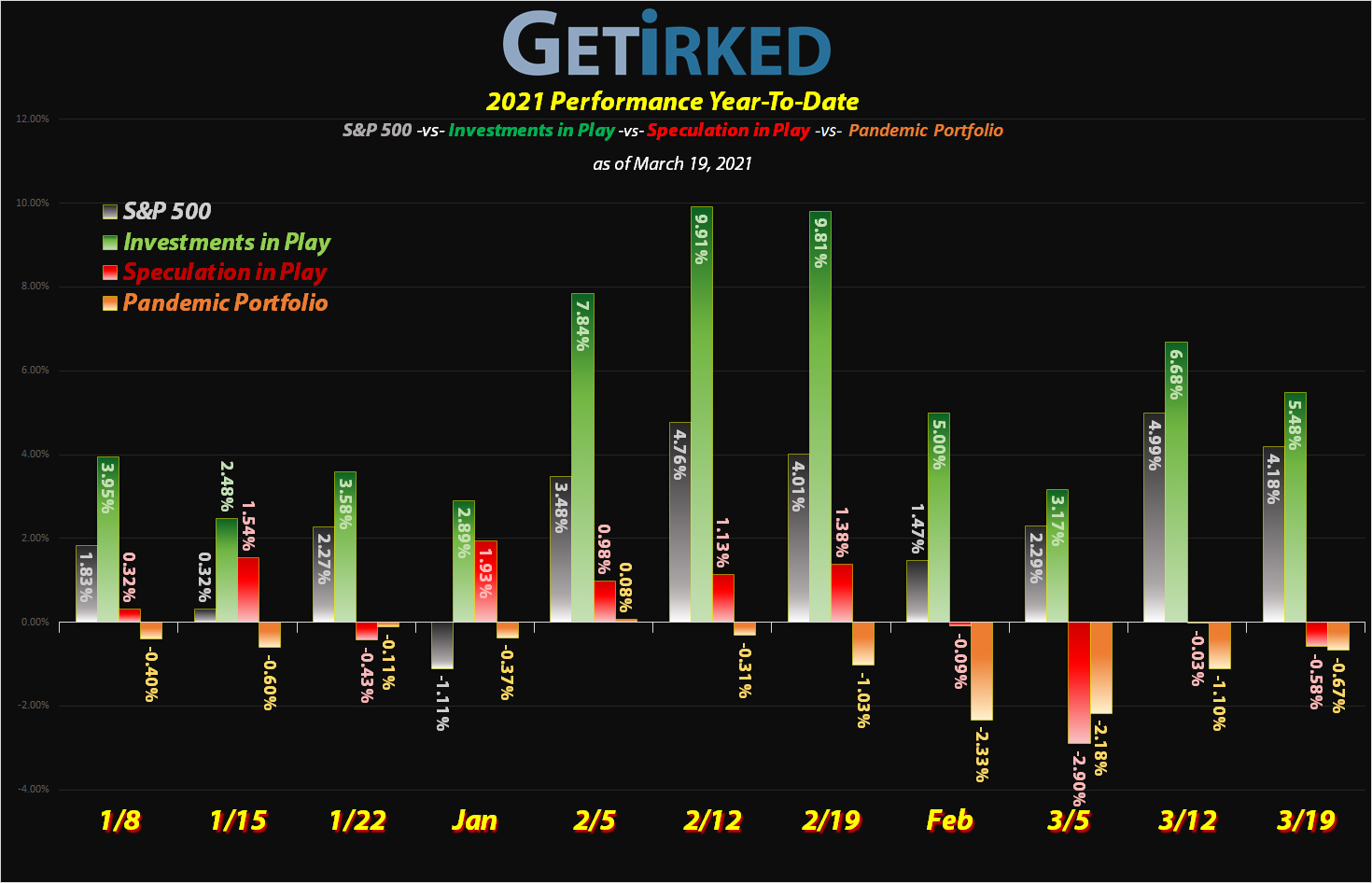

March 19, 2021

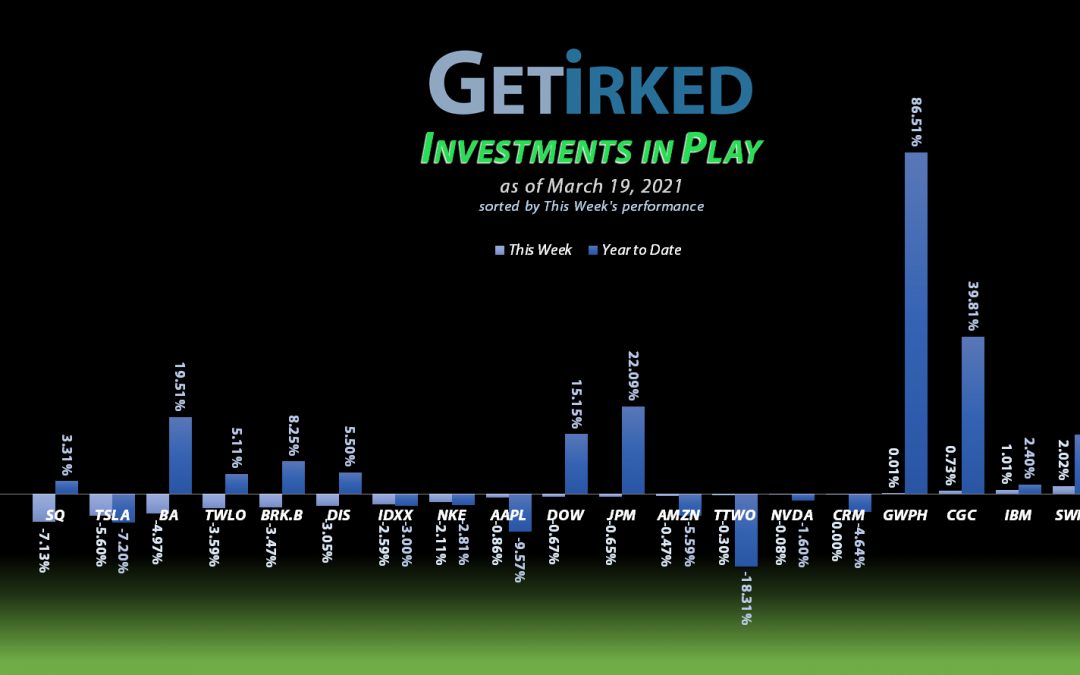

The Week’s Biggest Winner & Loser

Logitech (LOGI)

In a rough week for stocks, Logitech was able to finish in the green and squeak out a +2.61% gain, earning itself the Week’s Biggest Winner.

Square (SQ)

Always the most volatile asset in the group, Square (SQ) got slammed this week, dropping -7.13% and earning itself the spot of the Week’s Biggest Loser.

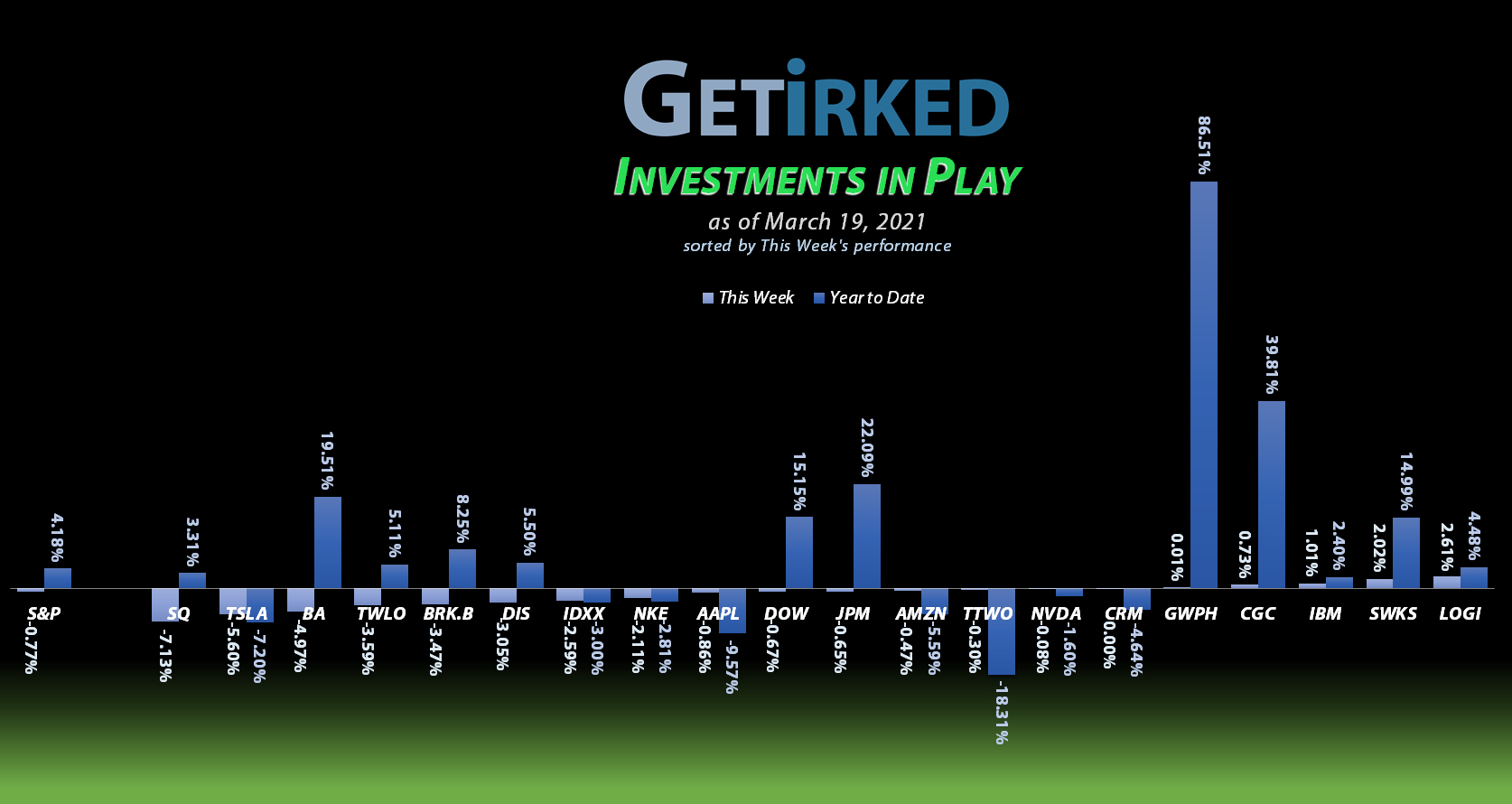

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+995.00%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$131.60)*

Logitech (LOGI)

+851.15%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Boeing (BA)

+730.09%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$333.52)*

Apple (AAPL)

+676.75%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Tesla (TSLA)

+571.73%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+516.14%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$29.85)*

Nvidia (NVDA)

+491.30%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

IDEXX Labs (IDXX)

+431.07%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Canopy (CGC)

+406.79%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.38)*

Disney (DIS)

+399.59%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.00)*

Amazon (AMZN)

+268.76%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+197.31%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+186.52%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+144.09%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

Skyworks (SWKS)

+122.39%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

JP Morgan (JPM)

+105.21%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $75.60

IBM (IBM)

+84.66%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Salesforce (CRM)

+84.20%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Dow (DOW)

+81.25%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.26

Berkshire (BRK.B)

+76.48%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

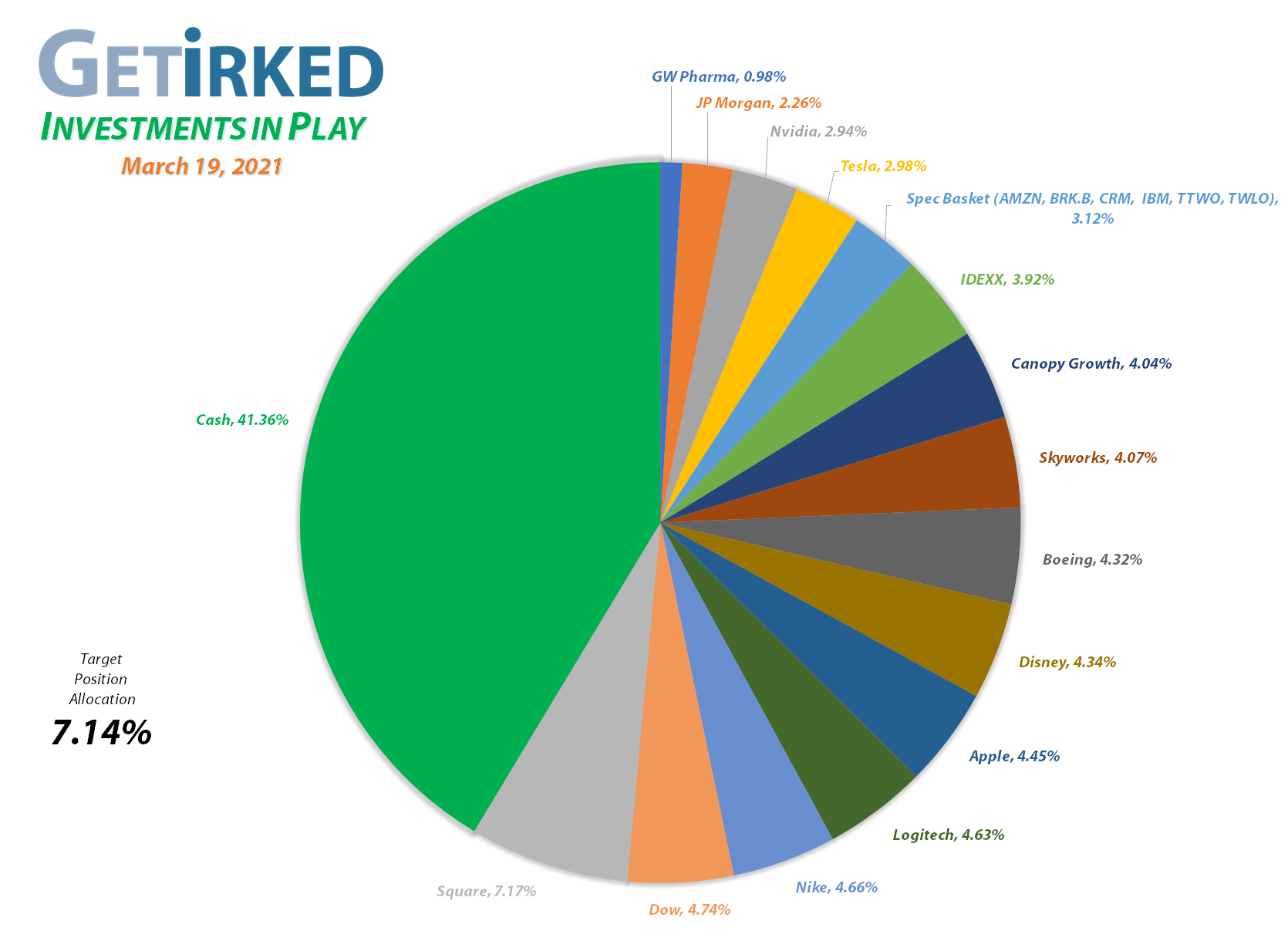

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Added to Position

Apple (AAPL) once again took it on the chin this week, leading me to add even more to my position when it dipped below $120 briefly on Friday, adding shares at $119.89.

From here, my next buy target is $104.90, slightly above the next point of support based on previous selloffs. As for a sell target, I’m holding Apple until it exceeds the 7.14% allocation for the portfolio, making my next sell price around $200-$205 per share.

AAPL closed the week at $119.99, up +$0.10 from where I added Friday.

Dow Chemical (DOW): Dividend Reinvestment

Dow Chemical (DOW) paid out its ample quarterly dividend of $0.70 a share on March 15, an annual yield of 4.42% at its $63.37 closing price.

I use my broker’s Dividend Reinvestment Program (DRiP) to receive fractional shares instead of cash, both lowering my per-share cost -1.09% from $35.65 to $35.26 and also increasing my allocation, allowing for compounding interest over time.

DOW is in the sweet spot of the reopening right now as an expected infrastructure bill would definitely increase business for the company, however, in the meantime, its dividend is definitely worth keeping it in the portfolio.

From here my next buy target is $59.50 and I have no plans to reduce the position until it exceeds the 7.14% target allocation for the portfolio.

IDEXX Laboratories (IDXX): Added to Position

On Thursday, IDEXX Laboratories (IDXX) sold off with the rest of the tech, nearing its low from the last tech wreck. Given that IDEXX Labs is more of a play on the humanization of pets than it is a play on technology, I decided to add some to my position with an order that filled at $490.48, -14.55% off IDXX’s all-time high of $573.99.

The order raised my per-share “cost” from -$32.76 to -$25.25 meaning each share in the position costs nothing and, in fact, adds $25.25 to the overall portfolio’s value.

From here, my next buy target is $426.00 and I currently don’t have a sell target for this position until it exceeds the allocation size for the portfolio.

IDXX closed the week at $484.88, down -1.14% from where I added Thursday.

JP Morgan Chase (JPM): Profit-Taking

While banks perform exceptionally well in a rising interest rate environment like we have here, when JP Morgan (JPM) broke through to new all-time highs on Thursday, I decided to take some profits with an order that filled at $161.17.

The order locks in +67.36% in profits on shares I bought during the pandemic crash for $96.30 on March 11. The sale also lowered my per-share cost -7.58% from $81.80 to $75.60. From here, my next buy target is $119.70 and my next sell target is around $180.

JPM closed the week at $155.14, down -3.74% from where I sold Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.