March 5, 2021

The Week’s Biggest Winner & Loser

Dow Chemical (DOW)

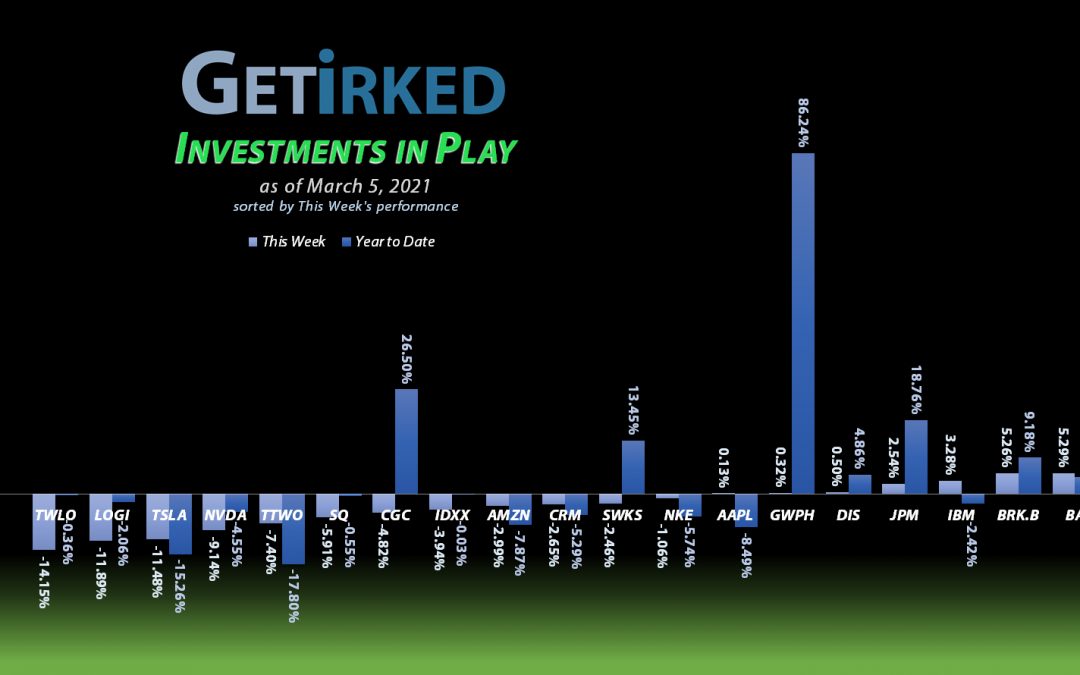

Ever wonder what “market rotation” looks like? It looks like this week with Dow Chemical (DOW) earning the Week’s Biggest Winner spot with a +6.07% gain, Boeing (BA) second-in-line at +5.29% and Berkshire-Hathaway (BRK.B) taking up third at +5.26%. Investors are running from high-growth tech and streaming into the industrials and value plays.

Twilio (TWLO)

High-growth tech took it hard this week, and there are few higher-growers out there than Twilio (TWLO) which lands the Week’s Biggest Loser spot with a -14.15% loss.

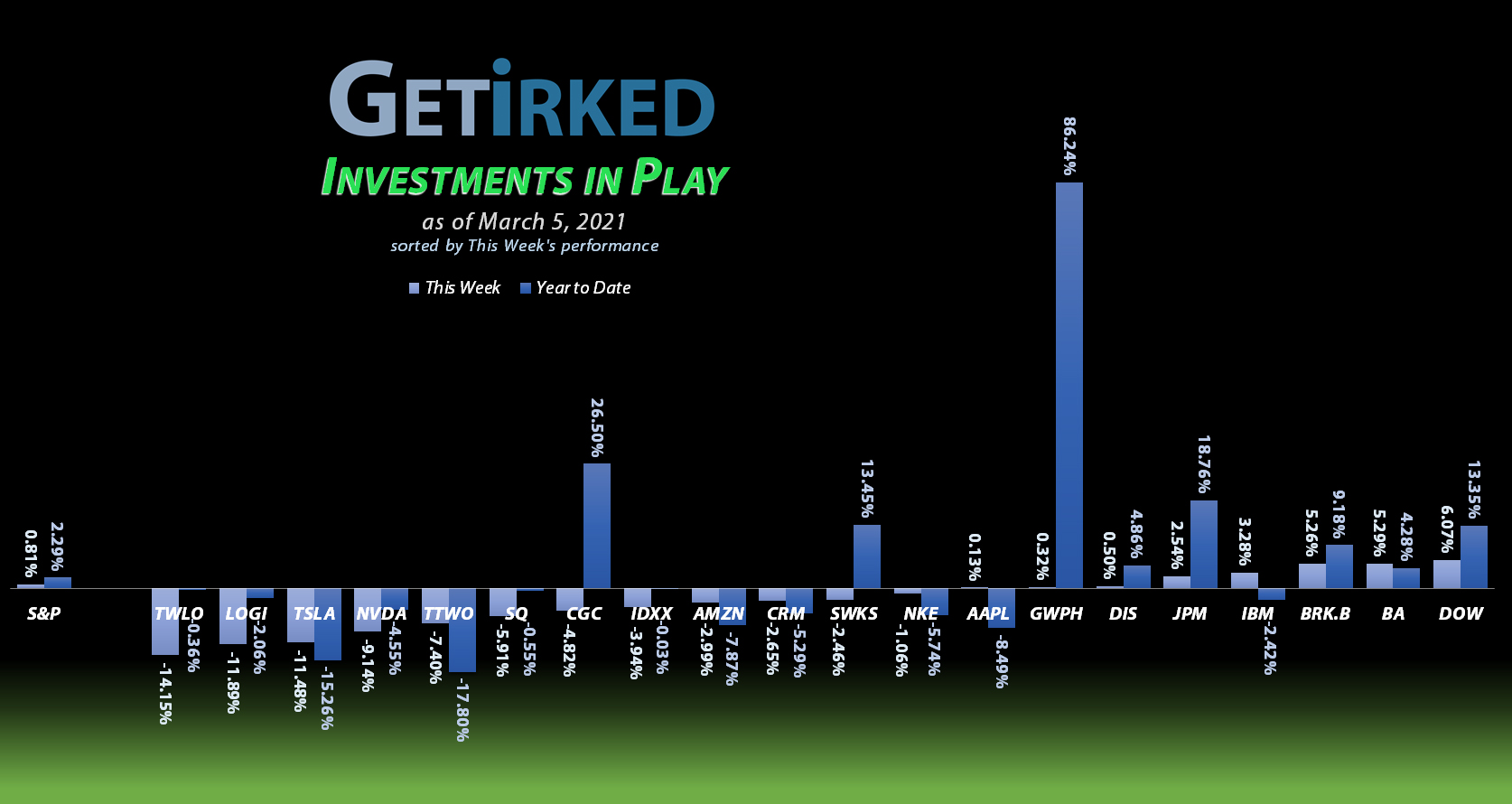

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

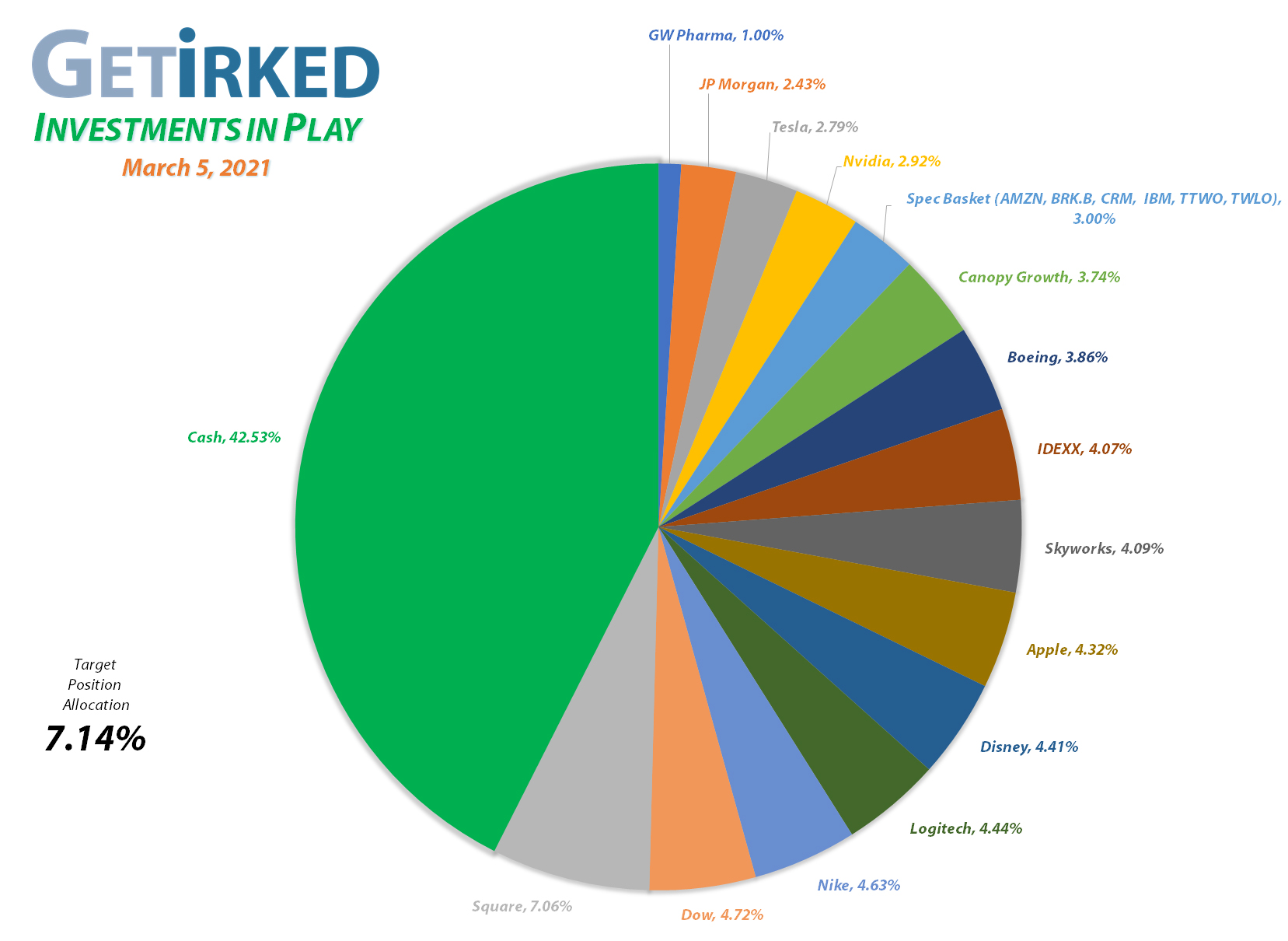

Square (SQ)

+971.56%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$131.60)*

Logitech (LOGI)

+799.10%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Boeing (BA)

+689.70%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$333.52)*

Apple (AAPL)

+681.83%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$55.72)*

Tesla (TSLA)

+530.81%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+503.37%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$29.85)*

Nvidia (NVDA)

+479.05%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

IDEXX Labs (IDXX)

+443.48%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+397.21%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.00)*

Canopy (CGC)

+368.12%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.38)*

Amazon (AMZN)

+266.28%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+187.48%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+186.40%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+144.24%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Skyworks (SWKS)

+118.78%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.28

JP Morgan (JPM)

+84.49%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $81.80

Salesforce (CRM)

+82.95%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Berkshire (BRK.B)

+78.00%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+76.47%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.65

IBM (IBM)

+73.76%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Added to Position

Technology stocks were slammed all week with Amazon (AMZN) getting hit so hard that it dropped under $2900, about -4.88% from where I reopened my position last week.

Accordingly, it was time to put a bit more of previous profits taken when I closed the position back into the stock with a small order which filled at $2,905.31 on Friday. From here, my next price target to add more to the position is much lower at $2,637.

AMZN closed the week at $3,000.46, up +3.28% from where I added Friday.

Square (SQ): Added to Position

Despite reporting excellent news of expanding into residential and corporate banking, Square (SQ) sold off with the rest of the market.

When Square moves, it moves big in both directions, and this week, Square fell through two different buy targets. On Thursday, an order filled for $217.50 to lock in +16.5% in profits on shares I sold on February 8 for $260.45. On Friday, an order filled at $197.83, locking in +18.1% in profits on shares I sold on December 22 for $241.69.

The two orders gave me an average buying price of $207.67. From here, my next buying target is $174.45 and my sell target is $298.95, slightly under analysts’ price target of $300.

SQ closed the week at $216.44, up +4.22% from my average buying price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.