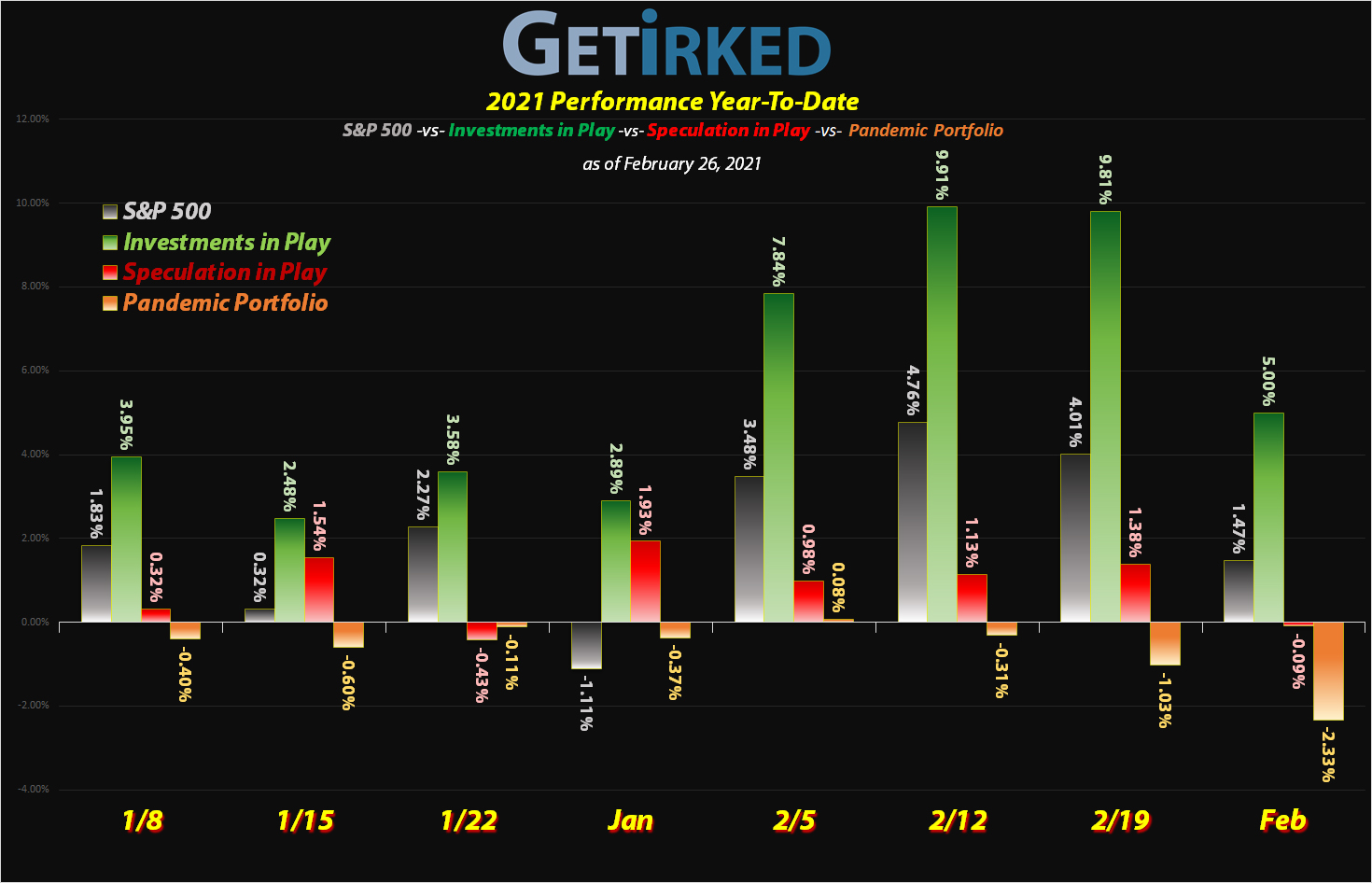

February 26, 2021

The Week’s Biggest Winner & Loser

Disney (DIS)

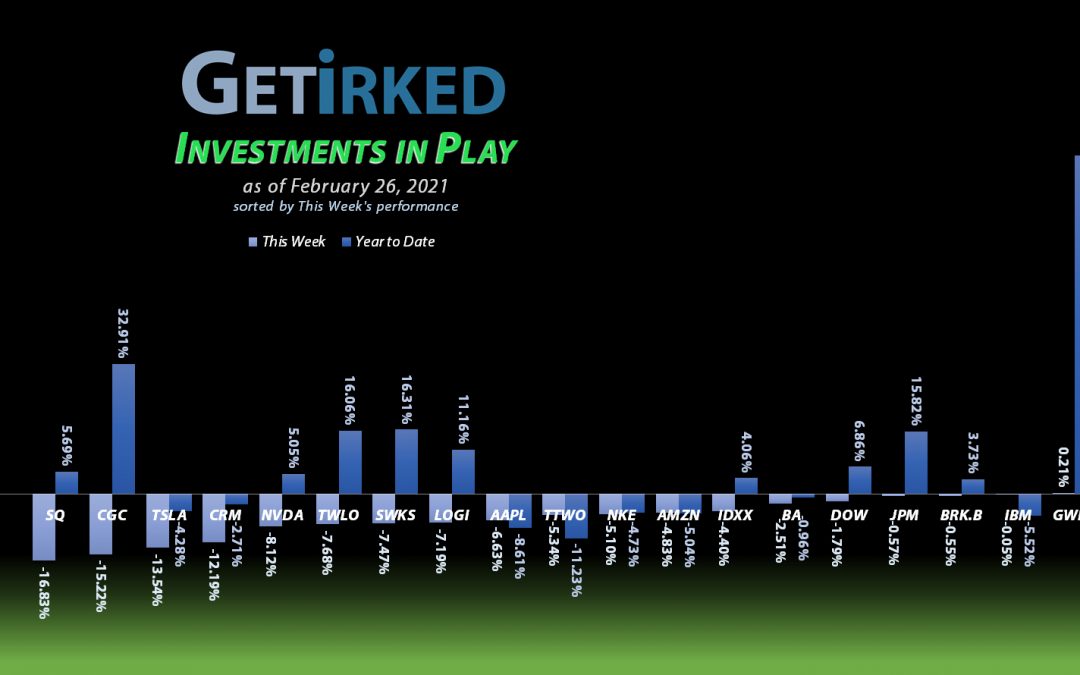

It was a very rough week for stocks in general, and the Investments in Play portfolio, in particular. In fact, if it weren’t for GW Pharma’s (GWPH) buyout deal keeping the stock afloat, Disney (DIS) would have been the only position to see any green at all, popping +2.93% to earn itself the Week’s Biggest Winner spot.

Square (SQ)

Tie your fortunes to Bitcoin (BTCUSD) and your stock price will follow. When Bitcoin sold off this week, Square (SQ) was close behind, dropping -16.83% and earning itself a spot as the Week’s Biggest Loser.

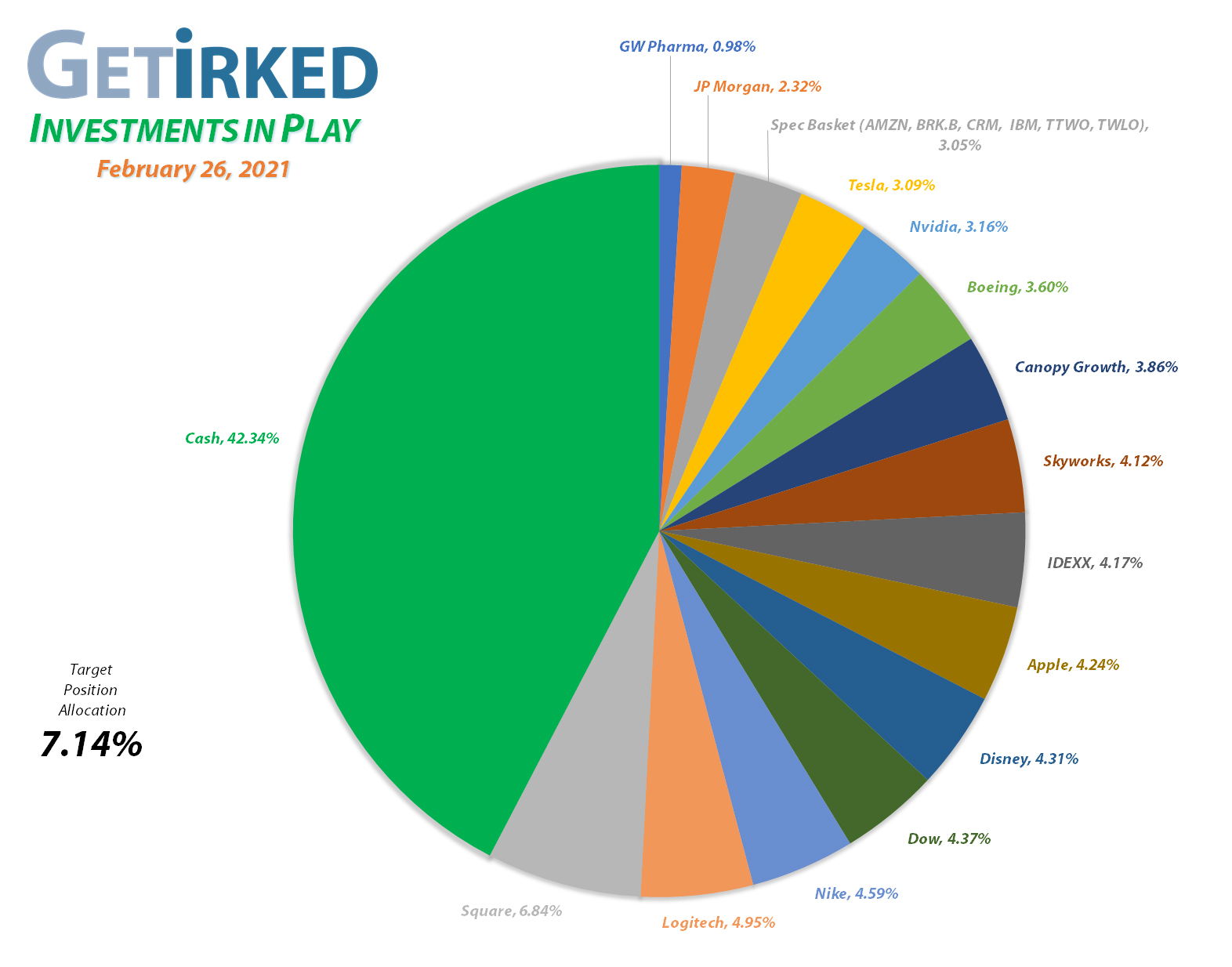

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1005.03%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$157.70)*

Logitech (LOGI)

+904.04%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+681.21%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$55.72)*

Boeing (BA)

+675.82%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$333.52)*

Tesla (TSLA)

+586.56%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nvidia (NVDA)

+518.99%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+507.78%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$29.85)*

IDEXX Labs (IDXX)

+460.53%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Amazon (AMZN)

+396.64%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($9,022.52)*

Disney (DIS)

+395.25%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.00)*

Canopy (CGC)

+386.75%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.38)*

Twilio (TWLO)

+216.97%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+186.12%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+146.35%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Skyworks (SWKS)

+124.31%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.28

Salesforce (CRM)

+87.93%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+79.92%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $81.80

Berkshire (BRK.B)

+69.11%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

IBM (IBM)

+68.24%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

Dow (DOW)

+66.37%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.65

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): *Reopened Position*

With Amazon (AMZN) down nearly -15% from its all-time high during this week’s Tech Wreck selloff, I couldn’t help but try to rectify one of the biggest mistakes in this portfolio’s history – taking profits on my entire Amazon position on January 2020 at $1,883.96 and missing out on a double in the stock.

That being said, I’m not ready to make Amazon a full allocation in the portfolio, yet, so I’m rolling it into the Speculative Basket, replacing GW Pharmaceuticals (GWPH) thanks to its buyout offer, and joining the remaining crew: Berkshire-Hathaway (BRK.B), IBM (IBM), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO), all sharing a single allocation.

Plus, I’m re-entering AMZN with only some of the profits I pulled from it initially, with my first buy filling on Friday at $3,054.50. For my next order I’m eyeing the $2,900 mark, and, of course, no sell targets anywhere on the horizon for this long-termer.

AMZN closed the week at $3,092.93, up +1.26% from where I reopened it.

Canopy Growth (CGC): Covering Covered Calls

On Monday, the value of the Mar 5 60 Covered Calls I sold on my Canopy Growth Corporation (CGC) position dropped under $0.05. I wasted no time covering my covered calls i.e. I bought back the calls I sold on my position for $0.465 per call. This decision resulted in locking in $1.207 per call ($120.07 per contract) in gains after fees or 96.29% of the maximum profit for the calls.

Why not let the Covered Calls expire worthless?

Had I just let the calls stay out there until March 5, I would have captured the full 100% of the profit. While Canopy Growth reaching $60 in about two weeks means a move of more than +57%, the amount of profit is simply too small to make it worth the risk.

I already feel like I dodged a bullet after the Reddit Rebellion targeted the cannabis space and caused CGC to pop to $56.20, dangerously close to calling me out, before the bears came in and pushed down the stock. So, I felt like leaving a little profit on the table and getting out while the getting’s good was the most advisable course of action.

All in all, I made an extra 3.1% on my entire CGC position doing nothing more than risking having to sell the position at $60 (and buying it back later, if I wanted). Oh, and I used the funds I drew in to buy even more shares in Canopy when it dropped below $40, more than -10% less than where I took my original capital out just a few weeks ago.

Covered Calls are definitely a strategy that I will practice again in the future.

Canopy Growth (CGC): Added to Position

The cannabis sector sold off along with the rest of the market on Tuesday, with Canopy Growth (CGC) dropping to my next buy target of $33.58 where I used more of the capital I raised selling Covered Calls on the position to add a few more shares.

The purchase raised my per-share “cost” to -$0.05 per share (each share I hold has no capital investment and actually adds $0.05 to the portfolio).

Given CGC’s historically notorious volatility, my next price target to add to the position is a lot lower than here at $24.30, where, believe it or not, I will actually start adding capital back into the position. My sell target is around $64-65 at which point CGC will start exceeding the portfolio’s allocation target.

CGC closed the week at $32.75, down -2.47% from where I added Tuesday.

Nike (NKE): Added to Position

Nike (NKE) experienced selling pressure with the rest of the market early in the week, with the continued downward action taking NKE through my buy order which filled at $132.11, bringing my per-share “cost” up to -$29.85 (each share I hold has no capital investment and actually adds $29.85 to the portfolio).

The buy replaces shares I sold lower in October 2020 at $131.18. I decided to buy them back after Nike revealed incredible upward momentum, rocketing to nearly $150.00. Combined with its dividend, Nike is a long-held position that I want to continue to add to as it drops.

My next buy price target is $120.35, slightly above Nike’s 200-Day Moving Average (MA) and a past point of support. I have no intentions to sell Nike until it outgrows its allocation size for the portfolio.

NKE closed the week at $134.78, up +2.02% from where I added Tuesday.

Square (SQ): Added to Position

Square (SQ) has been positively slammed since its disappointing earnings report, and Thursday’s massive selloff pushed SQ through a buy order I had in place which filled at $224.80.

The order locks in +20.19% in gains on shares I sold less than two weeks ago back on February 16 for $281.67. From here, my next buy price target is $198.70, slightly above a past point of support, and my sell target is $299.80, slightly under analysts’ price target for the stock.

SQ closed the week at $230.03, up +2.33% from where I bought Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.