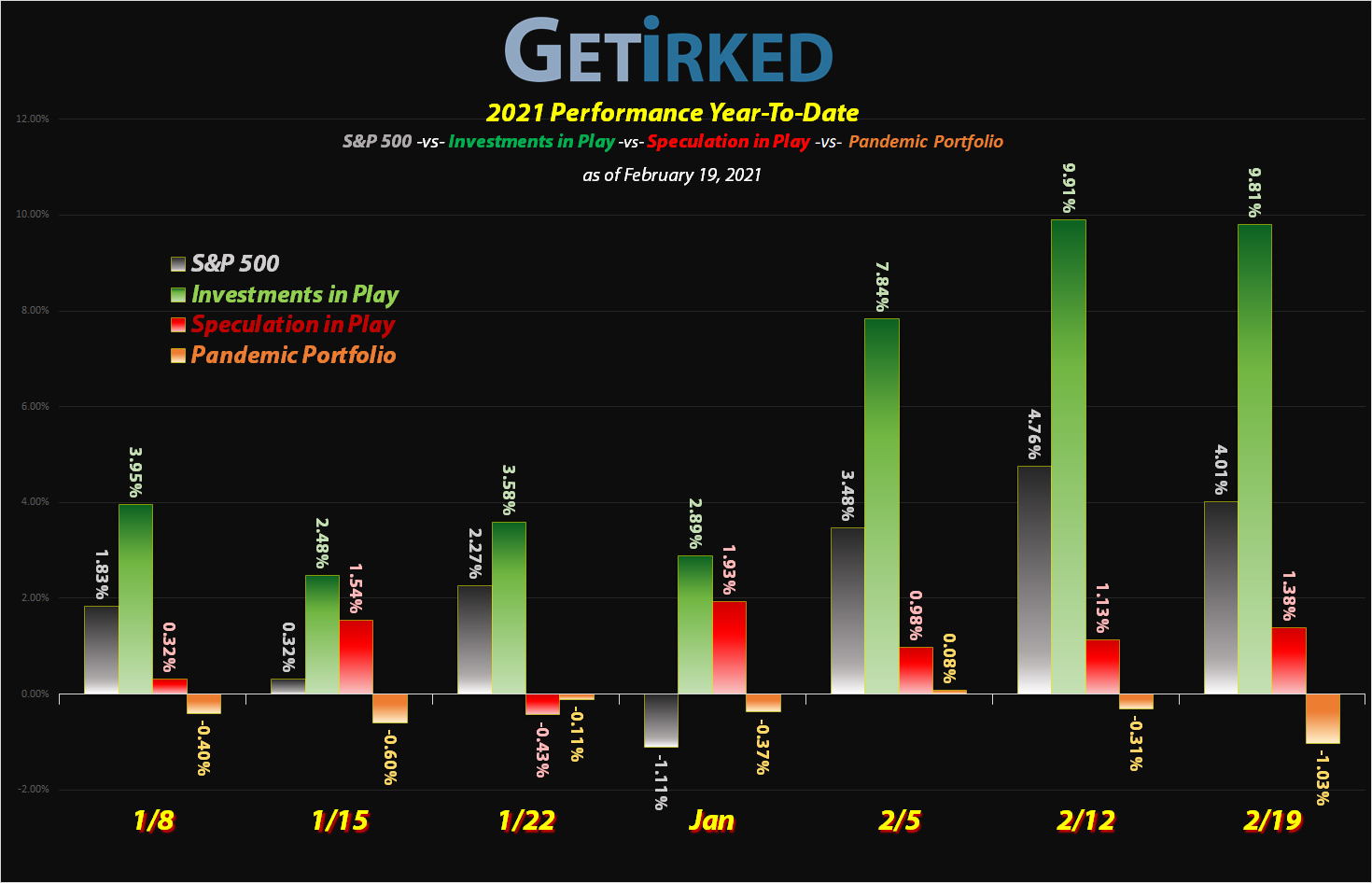

February 19, 2021

The Week’s Biggest Winner & Loser

JP Morgan (JPM)

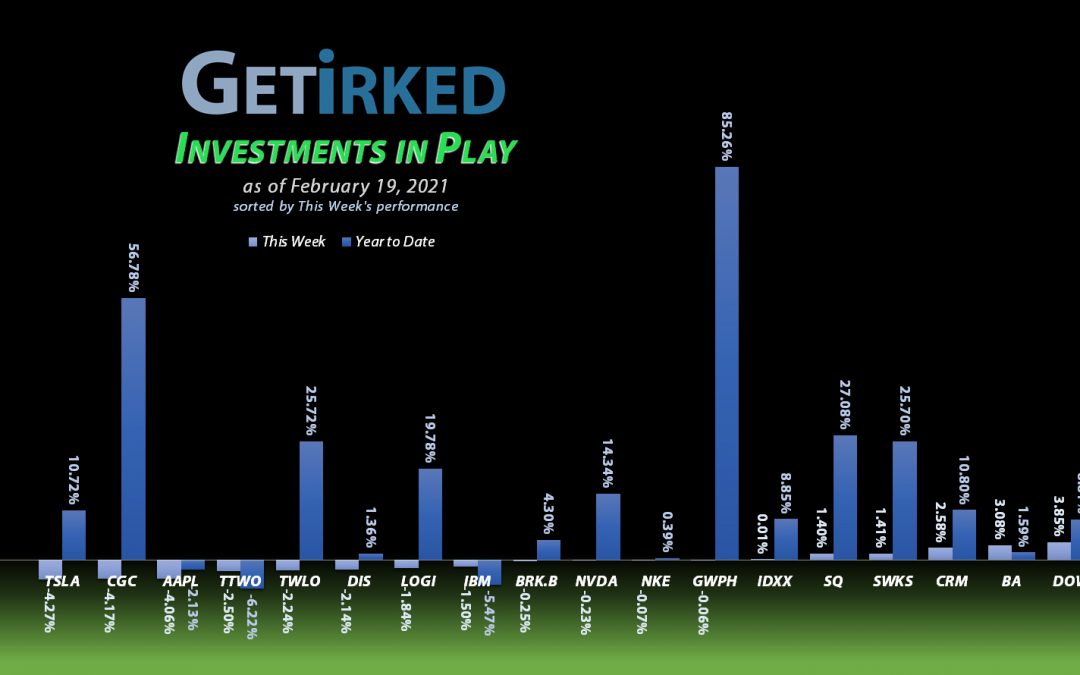

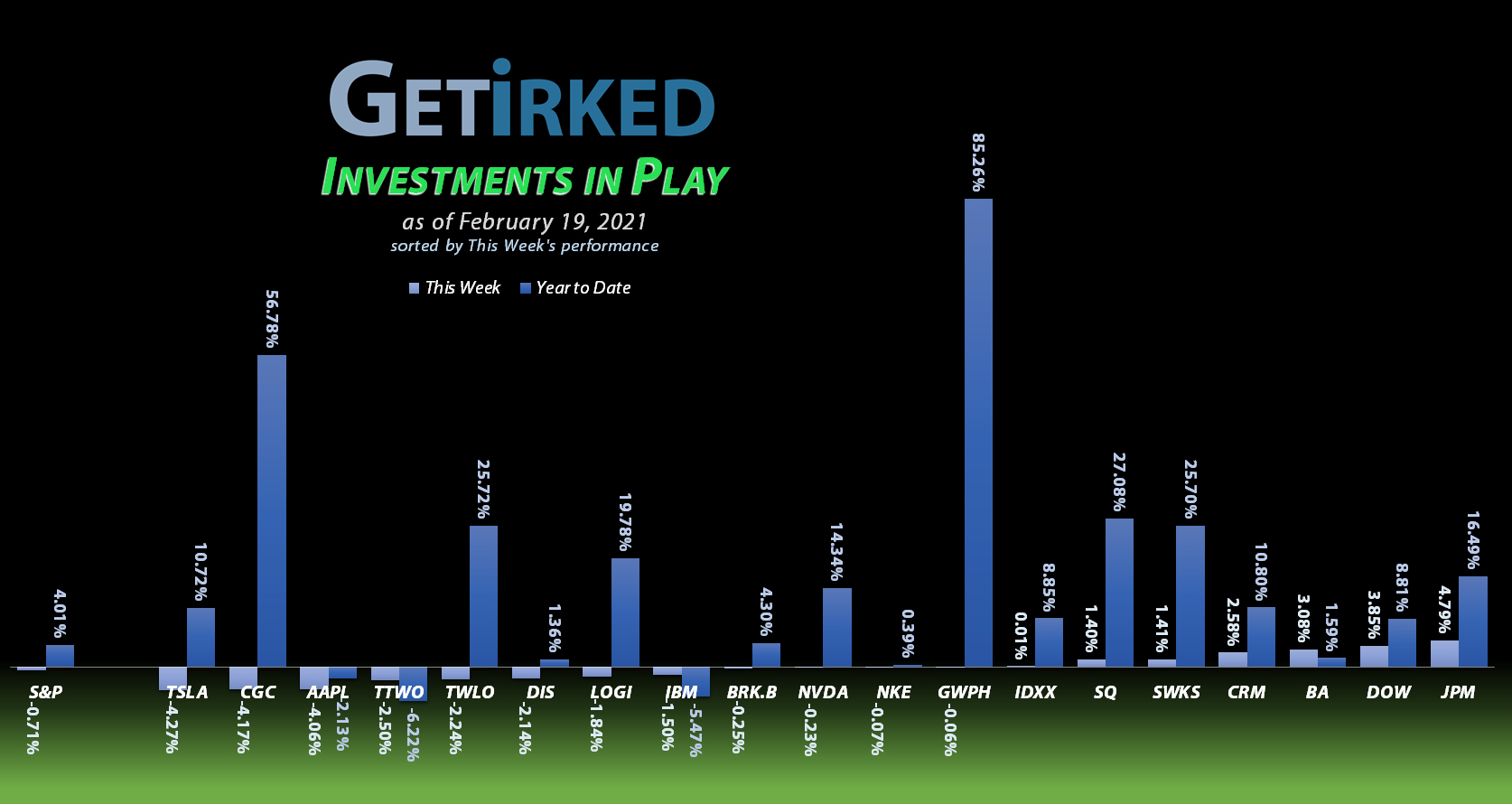

As goes the interest rates, so go the financials, and, this week, the interest rates were rising so the big banks like Best-in-Breed JP Morgan (JPM) rocketed higher with JPM making new all-time highs with a +4.79% gain on a flat-to-down week for the markets, earning itself the spot of the Week’s Biggest Winner.

Tesla (TSLA)

The Electric Vehicle (EV) sector seemed to lose its charge this week with every stock in the sector dropping. Tesla (TSLA) was no exception, losing -4.27% and earning itself the Week’s Biggest Loser spot.

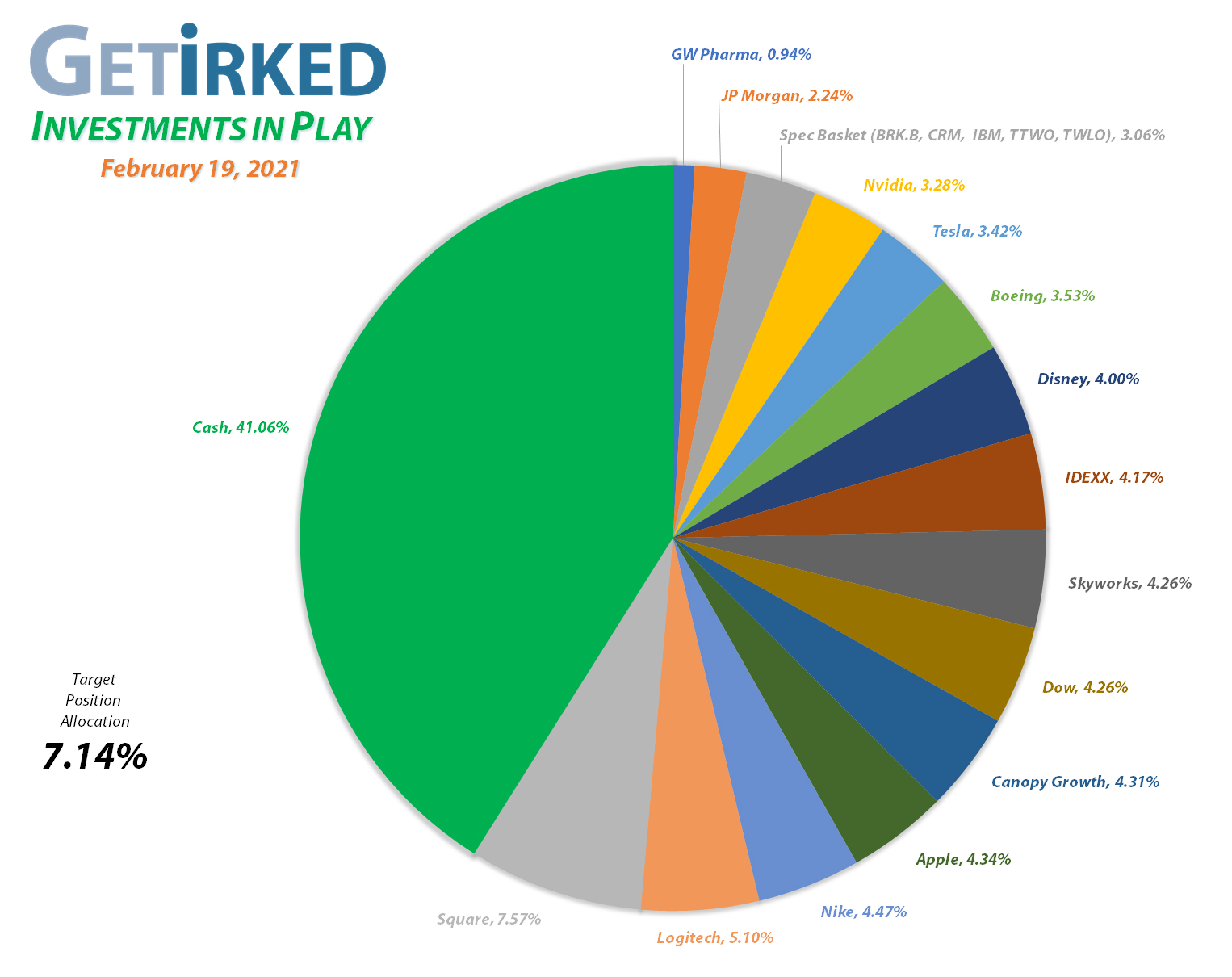

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1120.51%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$173.00)*

Logitech (LOGI)

+973.05%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+714.35%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$55.72)*

Boeing (BA)

+682.58%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$333.52)*

Tesla (TSLA)

+662.60%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nvidia (NVDA)

+557.62%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+529.09%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.48)*

IDEXX Labs (IDXX)

+480.48%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Canopy (CGC)

+456.03%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -($0.43)*

Disney (DIS)

+384.10%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.00)*

Twilio (TWLO)

+234.30%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+185.95%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+147.96%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Skyworks (SWKS)

+142.41%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.28

Salesforce (CRM)

+114.03%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+80.95%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $81.80

Berkshire (BRK.B)

+70.05%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+69.40%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.65

IBM (IBM)

+68.32%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) continued to experience selling pressure along with the rest of the market this week, pushing through my next buying target which filled on Thursday at $38.69, putting more of the capital to work which I raised by selling Covered Calls on my position.

Thursday’s purchase locks in a -13.23% price reduction between where I took my capital out on February 3 at $43.81 and the shares I added. From here, my next buying price target to put more of my Covered Call money to work is $33.90, a past point of support and slightly above the 50-Day Moving Average.

My sell target to start reducing my allocation is around $64-65, assuming that the Covered Calls I sold expire worthless on March 6.

CGC closed the week at $38.63, down -$0.06 from where I added Thursday.

Square (SQ): Profit-Taking

The party didn’t stop for Square (SQ) this week as the high-flying fintech flew even higher, triggering another sell order for me to take profits at $281.67 which filled on Monday.

The sale slightly reduces the allocation size of my position (which is still overweight as the biggest portfolio position, by far) and locks in +2,437.57% in profits on some of the original shares I bought for $11.10 on August 5, 2016. From here, my next sell target is $313.00. My next buy target is $222.60.

SQ closed the week at $276.57, down -1.81% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.