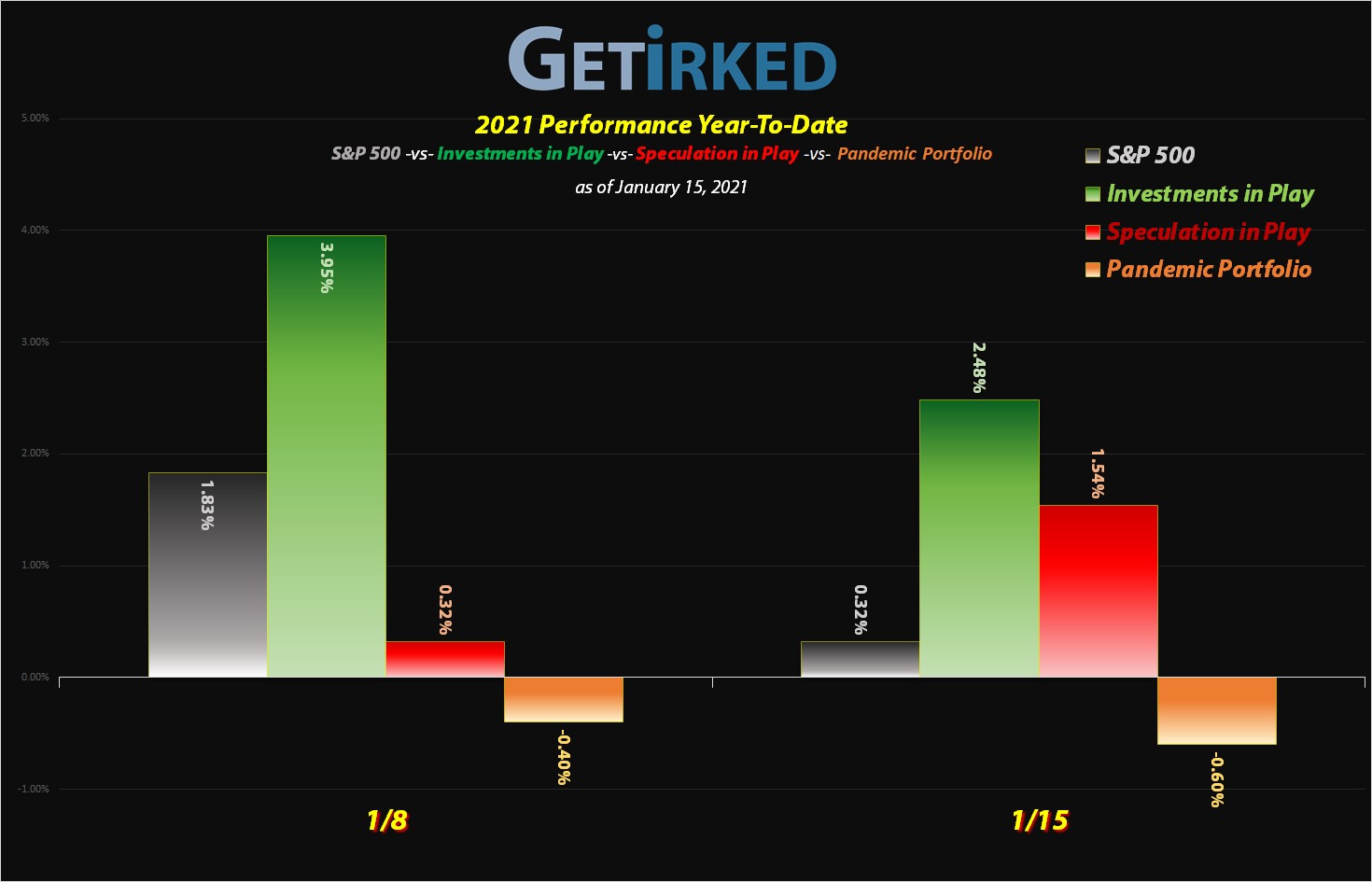

January 15, 2021

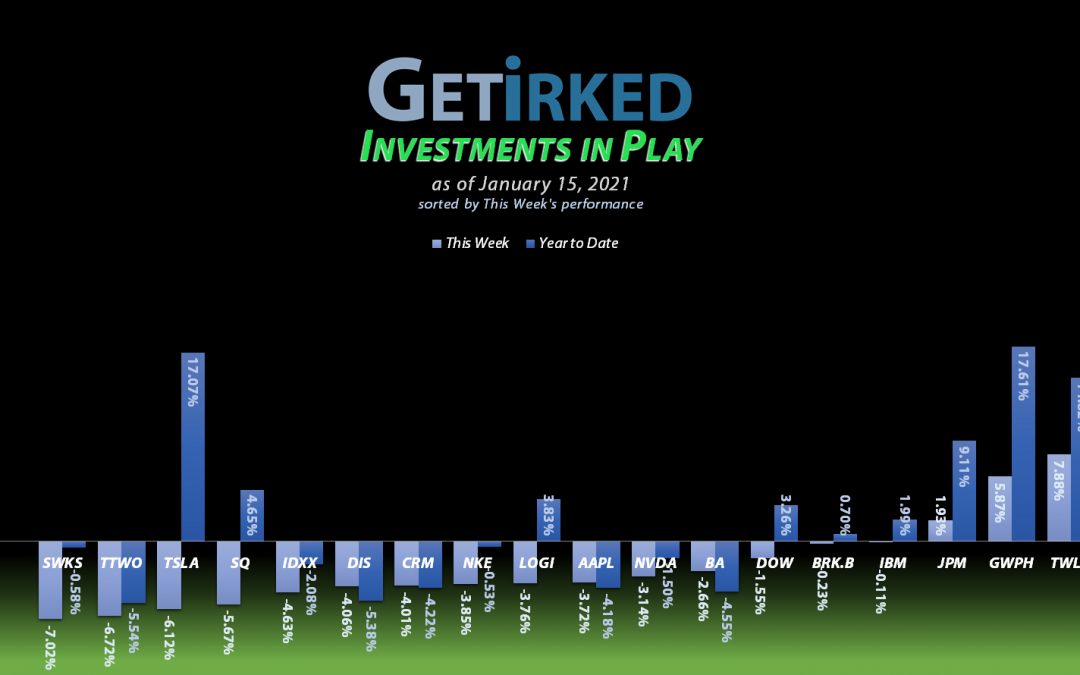

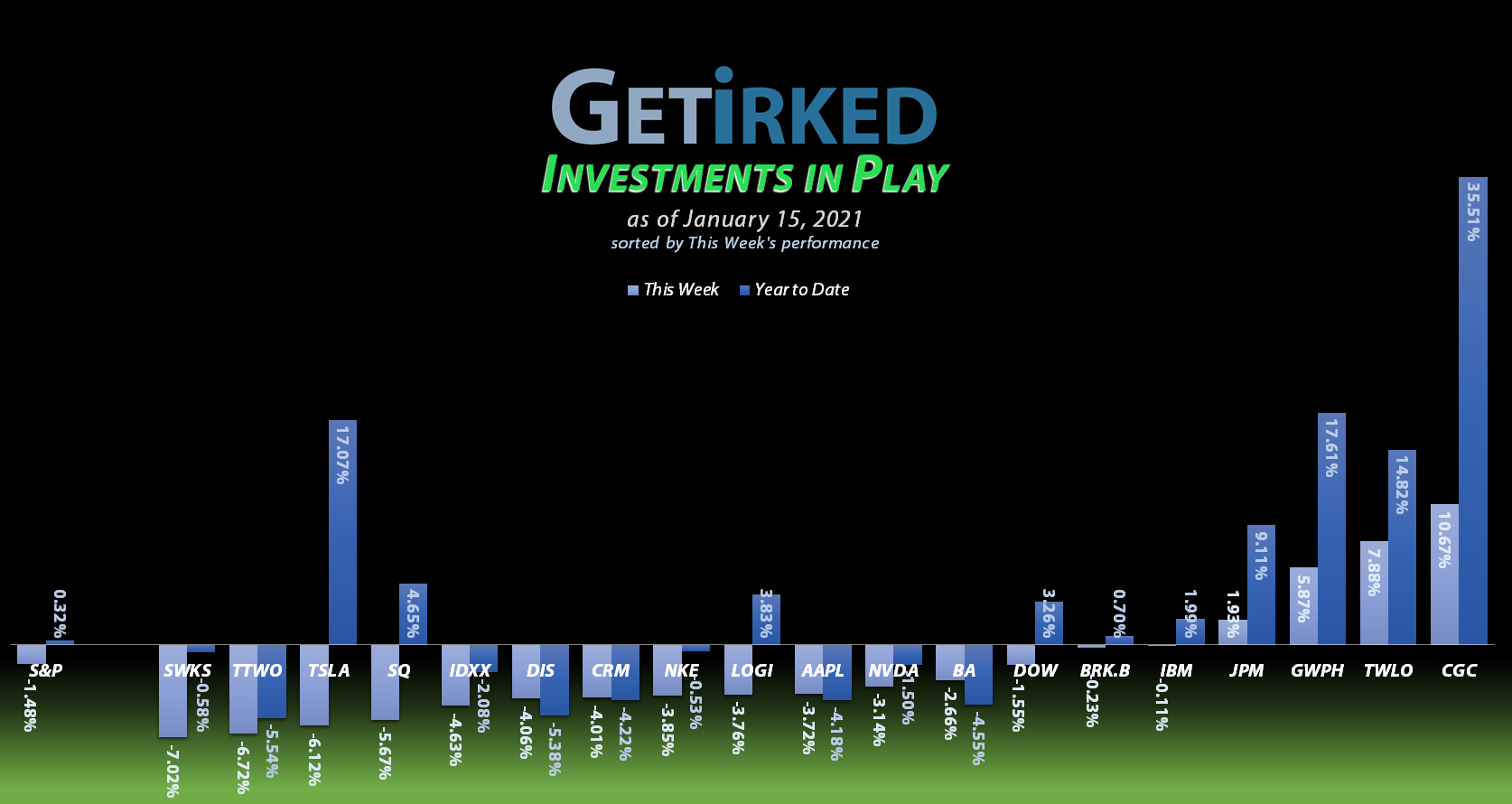

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

The consumer cannabis sector couldn’t be more excited at having so many Democrats in Federal office – legalized marijuana for the entire country seems like a virtually certainty (right??).

Regardless, Canopy Growth Corp (CGC) and its cohort reaped the rewards, gaining +10.67% in an otherwise weak week to earn itself the spot of the week’s Biggest Winner.

Skyworks Solutions (SWKS)

Institutional money appears to be rotating out of the growth technology names and into value or undervalued names leaving Skyworks Solutions (SWKS) and the rest of the semiconductor sector holding the bag.

SWKS lost -7.02% this week to earn itself the spot of the week’s Biggest Loser.

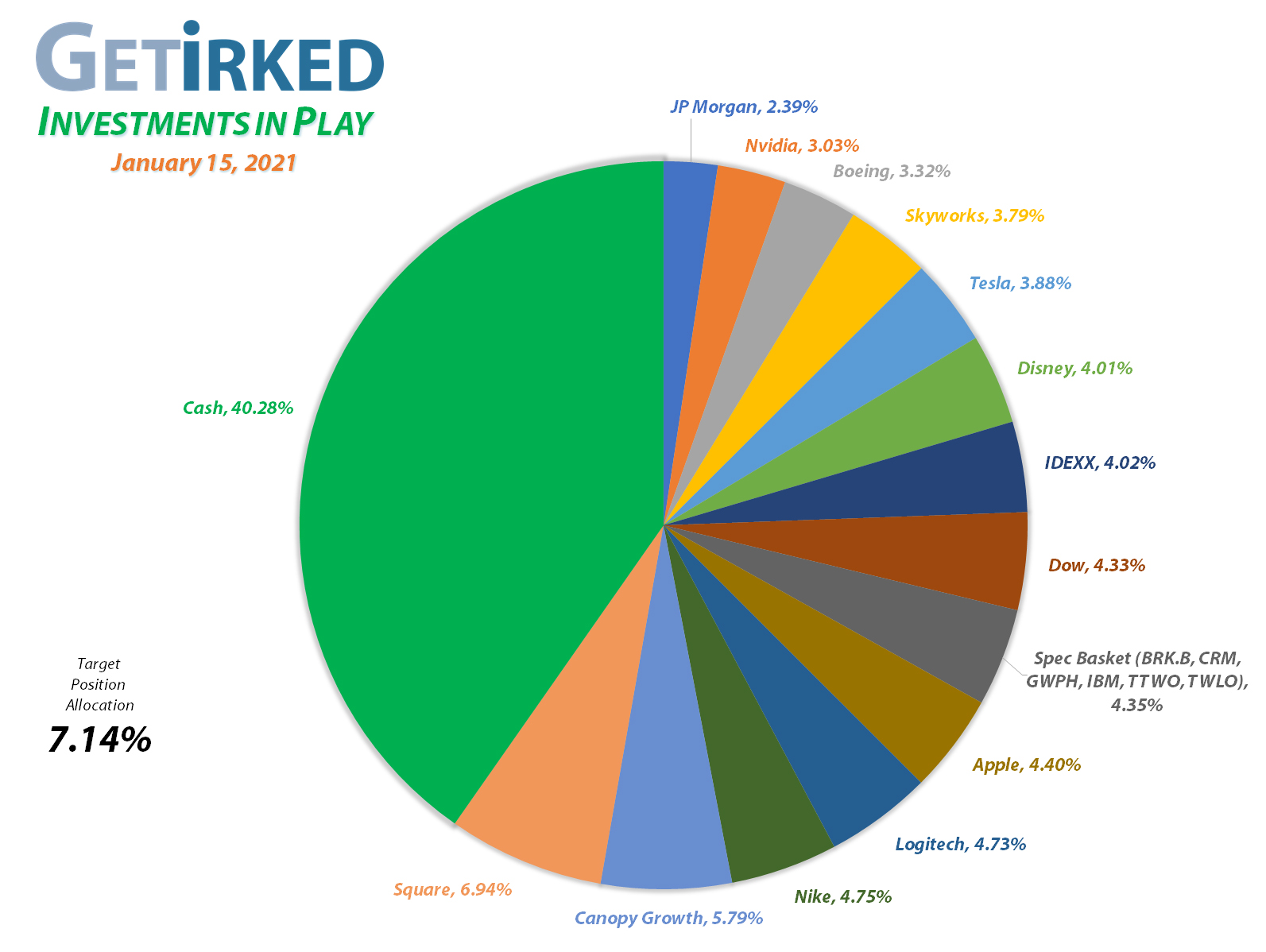

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+989.01%

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$153.80)*

Logitech (LOGI)

+845.99%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+704.21%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Tesla (TSLA)

+694.85%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Boeing (BA)

+666.18%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Nike (NKE)

+525.18%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.48)*

Nvidia (NVDA)

+491.74%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

IDEXX Labs (IDXX)

+439.95%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+358.73%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-2.00)*

Twilio (TWLO)

+214.70%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Take Two (TTWO)

+148.18%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Canopy (CGC)

+135.06%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.20

Salesforce (CRM)

+85.17%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Skyworks (SWKS)

+82.21%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $83.42

IBM (IBM)

+81.69%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

Berkshire (BRK.B)

+64.35%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+60.76%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.65

JP Morgan (JPM)

+60.70%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.42

GW Pharm (GWPH)

+48.99%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $91.10

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow Chemical (DOW): Profit-Taking

Dow Chemical (DOW) has been surging ever since the vaccine news broke in November with analysts expecting an infrastructure bill potentially requiring a lot of DOW’s products. On Tuesday, DOW broke through its all-time high, triggering a sell order I had in place which filled at $60.66.

The order locked in +74.96% in gains on a few of the shares I bought back on March 9, 2020 during the selloff at $34.67. The sale also lowered my per-share cost by -1.05% from $36.03 to $35.65.

From here, my next buy target is $32.20 and I’m holding pat to see how the stock performs before making another sale.

DOW closed the week at $57.31, down -5.52% from where I sold Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.