December 18, 2020

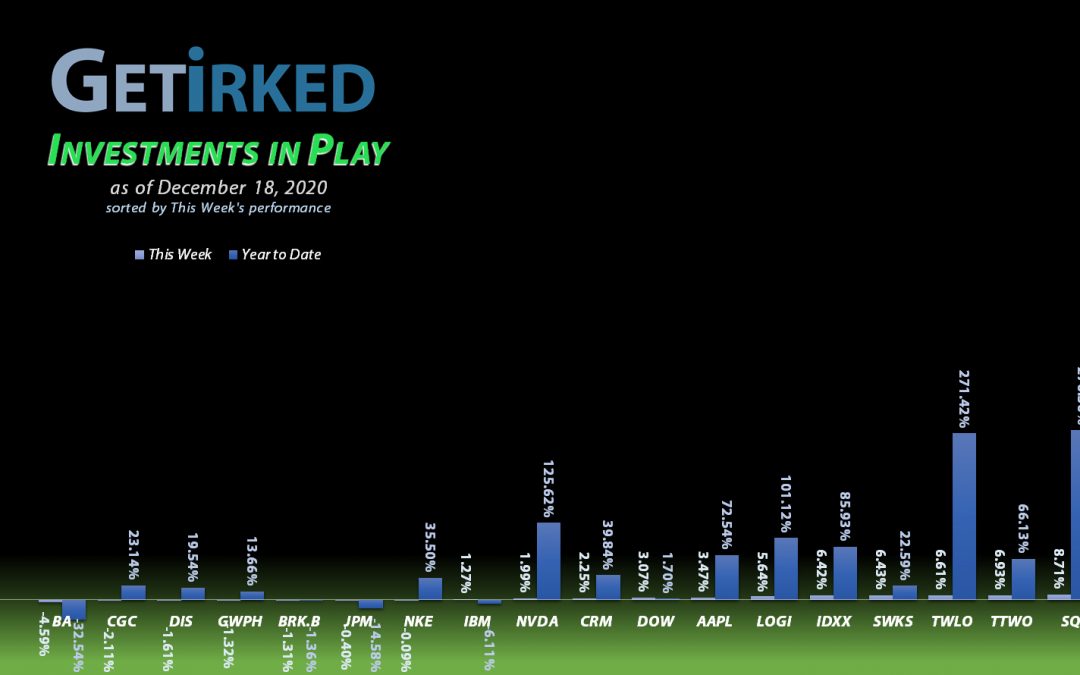

The Week’s Biggest Winner & Loser

Tesla (TSLA)

Tesla (TSLA) has been one of the biggest winners in the entire market this year, with one positive news catalyst after another. On Monday, Tesla gets ushered into the S&P 500, however, all the institutions had to start buying up shares for their index Exchange Traded Funds (ETFs) today, resulting in a +13.94% pop which won TSLA the spot of the Week’s Biggest Winner.

Boeing (BA)

Boeing’s (BA) wings got singed a bit as it flew too close to the sun after such a huge run. Time to lower the altitude to price-consolidate with a weekly loss of -4.59%, earning BA the spot of the Week’s Biggest Loser.

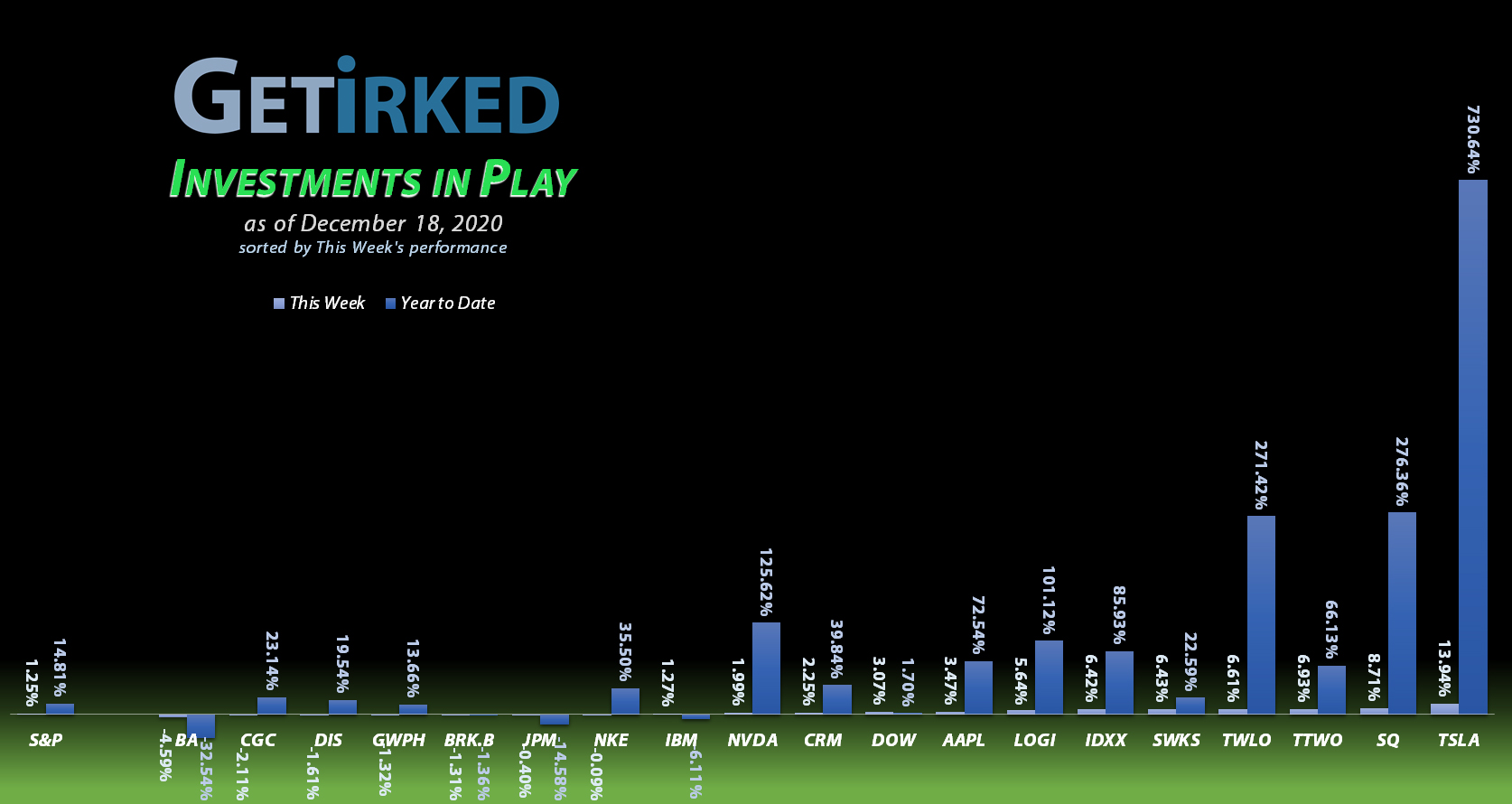

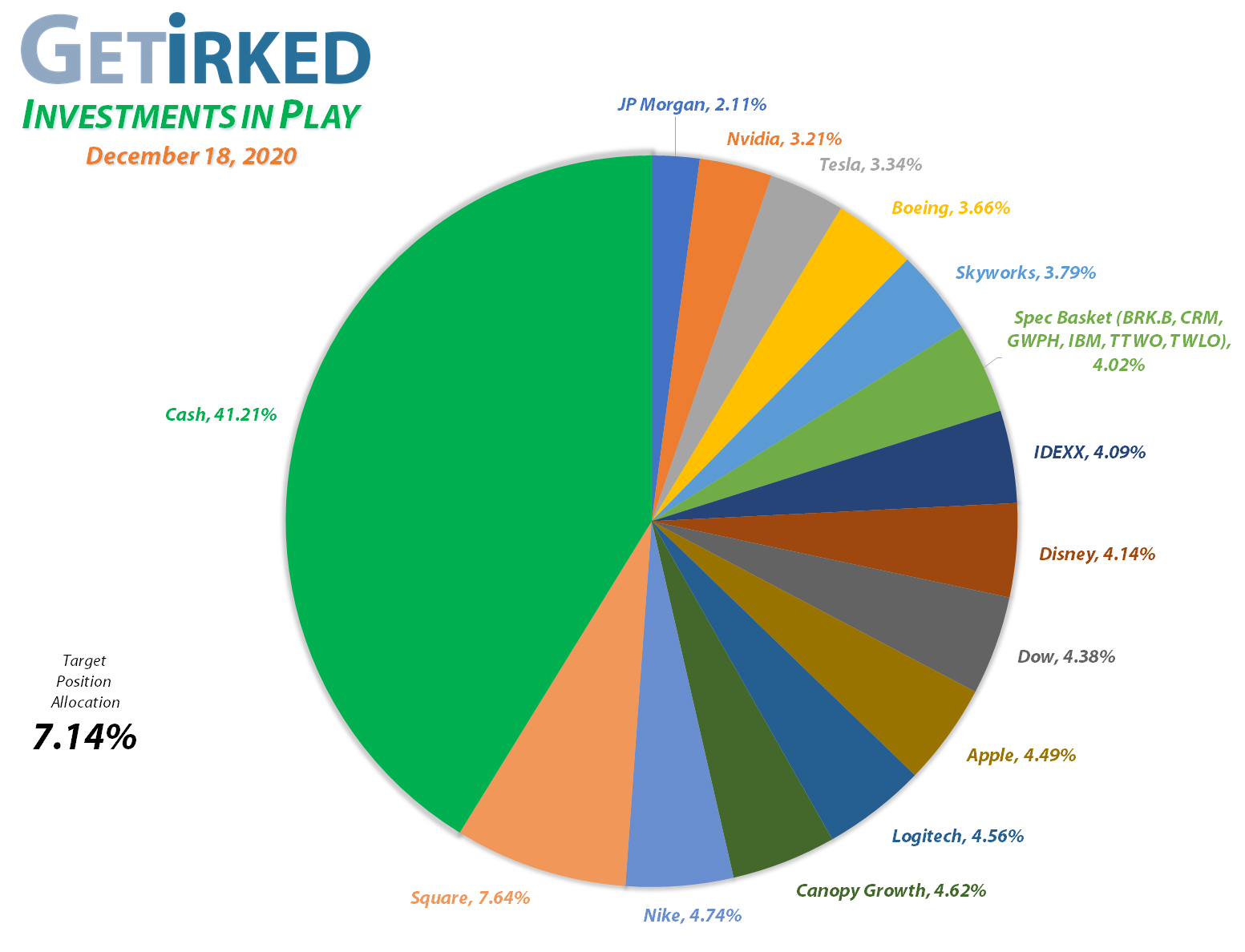

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1,008.35%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$139.15)*

Logitech (LOGI)

+754.83%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+702.40%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Boeing (BA)

+684.04%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Tesla (TSLA)

+600.57%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+514.16%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.55)*

Nvidia (NVDA)

+504.76%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

IDEXX Labs (IDXX)

+431.67%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+361.83%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-2.00)*

Twilio (TWLO)

+202.20%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Salesforce (CRM)

+184.60%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Take Two (TTWO)

+149.28%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Canopy (CGC)

+82.83%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.20

IBM (IBM)

+78.03%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

Skyworks (SWKS)

+77.64%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $83.42

Berkshire (BRK.B)

+57.10%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+54.47%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $36.03

JP Morgan (JPM)

+37.80%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.42

GW Pharm (GWPH)

+30.45%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $91.10

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow Chemical (DOW): Dividend Reinvestment

Dow Chemical (DOW) paid out its quarterly dividend on Friday, December 11. DOW pays out $2.80 annually for each share an investor holds, a nice yield of 5.19% at its $53.94 closing price Friday.

The dividend lowered my per-share cost -1.288% from $36.50 to $36.03. From here, my next buy target is $31.20, at a point of resistance from its selloff throughout the March panic.

IBM (IBM): Dividend Reinvestment

IBM (IBM) paid out its quarterly dividend on Thursday, December 10. IBM pays out $6.52 annually for each share an investor holds, a decent yield of 5.25% at its $124.27 closing price Thursday.

The dividend lowered my per-share cost -1.299% from $71.62 to $70.69. From here, my next buy target is $106.70, slightly above the last selloff’s low.

Skyworks Solutions (SWKS): Dividend Reinvestment

Skyworks Solutions (SWKS) also paid out its quarterly dividend on Thursday, December 10. SWKS pays out $2.00 annually for each share an investor holds, a yield of 1.41% as of its $142.01 closing price.

The dividend lowered my per-share cost -0.69% from $84.00 to $83.42. From here, my next buy target is $103.90.

Square (SQ): Profit-Taking

Even though analysts have given Square (SQ) a price target of $300, I can’t help feeling surprised every time it makes all-new highs knowing full well that the majority of its customers – small businesses – may go bankrupt in the coming months.

On Wednesday, Square crossed over the $220 mark and made a new all-time high at $225.00 where I took profits at $224.91, locking in +1,926.22% in gains on a few of the original position shares I bought at $11.10 on August 5, 2016 once again.

Wednesday’s sale still left my SQ position over its 7.14% portfolio allocation target, but I’m letting it grow since it’s been the heavy-lifter of the entire Investments in Play this year. My next sell target is $250 and my next buy target is $155.90.

SQ closed the week at $235.45, up +4.69% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.