December 4, 2020

The Week’s Biggest Winner & Loser

Skyworks Solutions (SWKS)

It seemed as though the market finally woke up and realized that Skyworks Solutions (SWKS) is destined to be a huge winner from this whole transition-to-5G thing. SWKS popped +10.29% on no real news to lock in the spot as this Week’s Biggest Winner.

Salesforce (CRM)

Remember how investors were disappointed and sold off Salesforce (CRM) last week when it was rumored the company would buy Slack (WORK)?

Turns out the investors are still disappointed, selling off the once-cloud-darling Salesforce an additional -8.79% during an up-week for the market, truly earning it the spot of the Week’s Biggest Loser twice-in-a-row. Ouch!

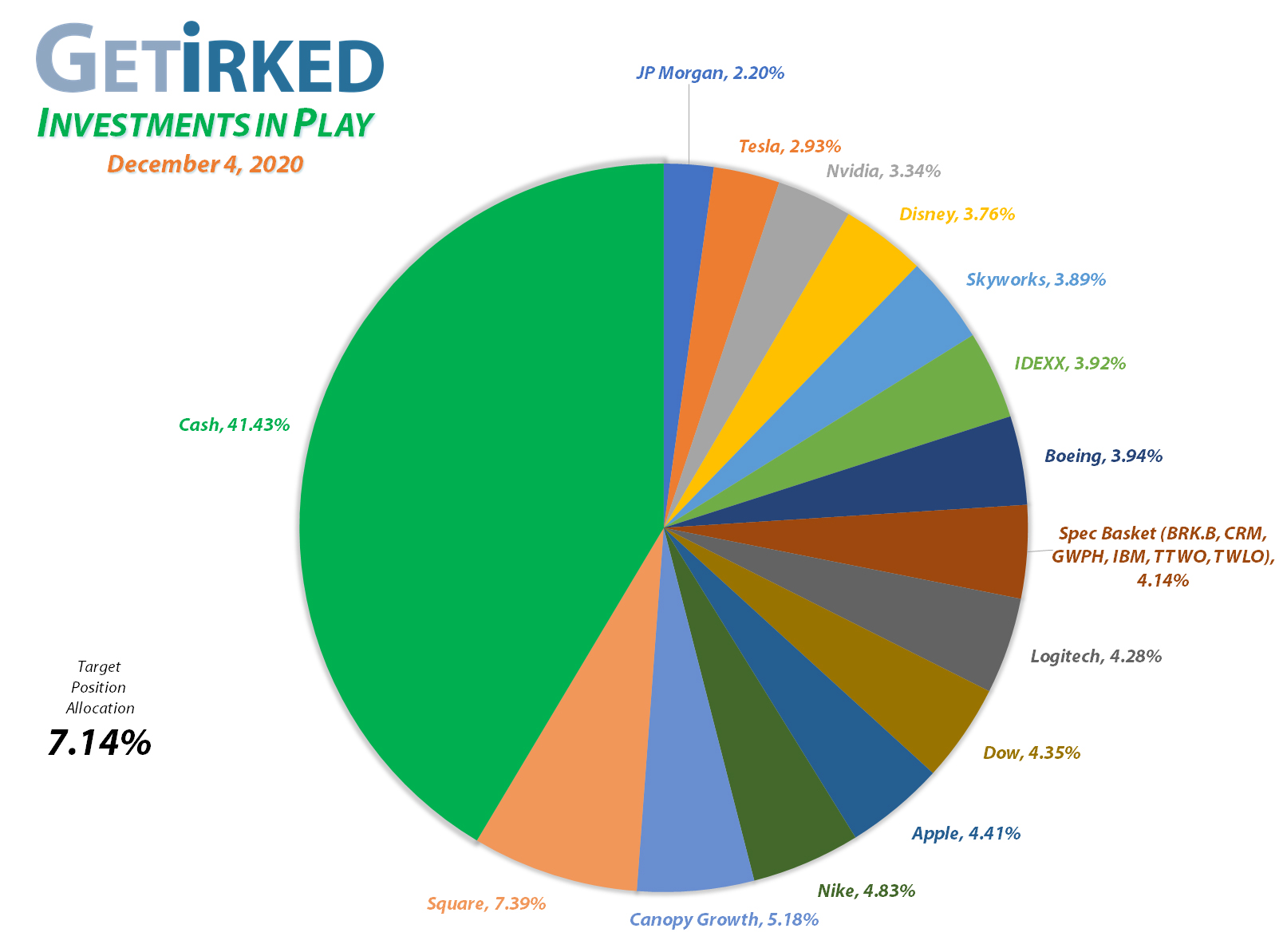

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+932.56%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$114.40)*

Logitech (LOGI)

+734.58%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Boeing (BA)

+699.01%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Apple (AAPL)

+686.03%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Tesla (TSLA)

+531.60%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+513.89%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.55)*

Nvidia (NVDA)

+513.88%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

IDEXX Labs (IDXX)

+408.04%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+323.04%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-2.00)*

Salesforce (CRM)

+182.63%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Twilio (TWLO)

+178.05%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Take Two (TTWO)

+145.77%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Canopy (CGC)

+101.27%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.20

Skyworks (SWKS)

+79.38%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

IBM (IBM)

+77.62%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+62.67%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

GW Pharm (GWPH)

+50.92%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $91.10

Dow (DOW)

+50.82%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $36.50

JP Morgan (JPM)

+41.57%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.42

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corporation (CGC): Profit-Taking

When Canopy Growth Corporation (CGC) once again experienced significant resistance at the $28-30 mark, I used trailing-stop orders Thursday to take some more profits with an order filling at $28.84.

The order locked in +208.88% in gains on a few of the shares I bought back on March 18 for $9.34. It also lowered my per-share cost a slight -1.39% from $14.40 to $14.20.

My next sell target is around $34 and my buy target is right around my per-share cost at $14.00

CGC closed the week at $28.59, down -0.87% from where I sold Thursday.

Disney (DIS): Capital Investment Removed

As Disney (DIS) kept playing around with the idea of making a new all-time high this week (which it ended up doing), I decided not to be greedy and pulled the remaining capital I had in the position out at $150.44 on Tuesday.

While I still very much believe in Disney’s long-term growth potential, the amount of gains I’ve made in the stock over the years (my first buy was on February 14, 2012 at $41.70) combined with a suspended dividend gave me pause – I’m less comfortable holding a position this in-the-money with capital invested without the safety of a cushy dividend.

Tuesday’s sale locked in +41.32% in gains on shares I bought from February 28 to March 12 during the coronavirus selloff at an average price of $106.45. The sale eliminated my per-share cost, making it -$2.00 which means for each share in my portfolio, its value is the current share price plus the $2.00 in profit I’ve already pulled.

From here, I’m holding the shares I have until they grow in value to exceed the portfolio allocation target of 7.14% with no sell targets. I will add to the position if DIS pulls back to around $120 near its 200-Day Simple Moving Average (SMA).

DIS closed the week at $154.14, up +2.46% from where I sold Tuesday.

GW Pharmaceuticals (GWPH): Profit-Taking

GW Pharmaceuticals (GWPH) continued to rally this week with the rest of the cannabis sector, triggering a sell order on Tuesday that filled at $141.95.

The order locked in +46.72% in gains from my then-per-share cost of $96.75. It also lowered my per-share cost -5.84% from $96.75 to $91.10. From here, my next sell target is near $170 and my next buy target remains $87.90, near GWPH’s last selloff low.

GWPH closed the week at $137.49, down -3.14% from where I sold Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.