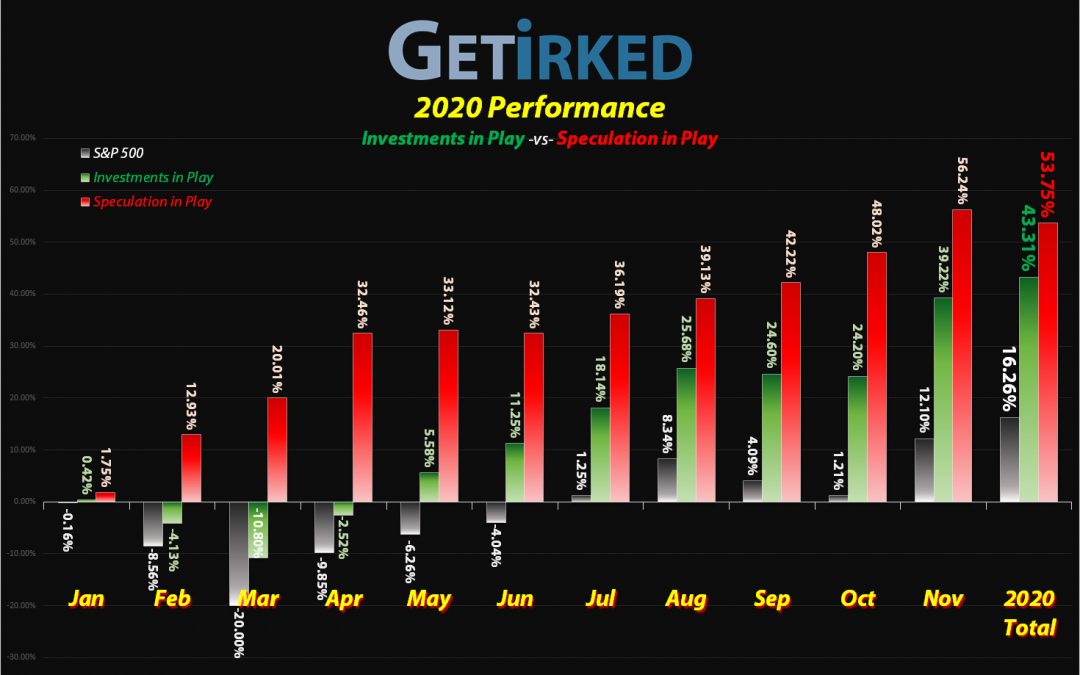

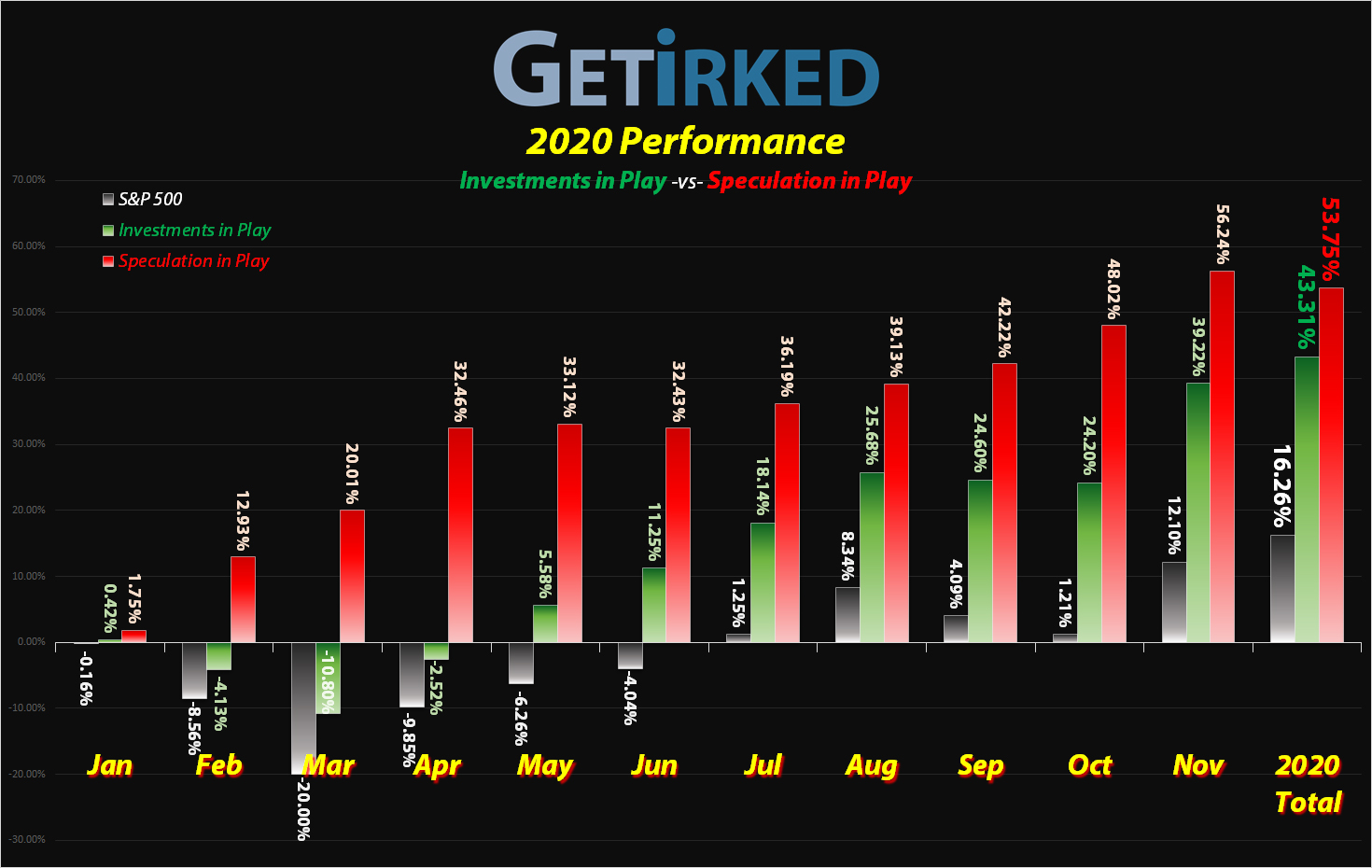

Get Irked Destroyed the S&P 500 in 2020

Speculation in Play: +53.75%

Investments in Play: +43.31%

S&P 500: +16.26%

Click on the chart to enlarge it for a bigger view

The most overused word to describe the events of 2020 was definitely “unprecedented,” but there’s no question that the once-in-a-century pandemic caused (and continues to cause) extreme volatility and unprecedented effects in the stock market as well as the rest of the world.

The above chart shows the month-by-month for the S&P 500 as well as my two portfolios Investments in Play and Speculation in Play.

The Pandemic Portfolio doesn’t make an appearance this year because it was first started halfway through the year in mid-May.

From a nearly -40% selloff in the S&P 500 to finishing the year at 16.26%, the S&P 500 index fund gave a remarkable turnaround for those who held it.

However, Get Irked’s portfolios destroyed the index’s performance, with the more conservative Investments in Play bringing in a year-end gain of +43.31% (nearly triple the S&P 500’s performance) and the highly speculative Speculation in Play portfolio adding more than 10% on top for a +53.75% annual gain.

Outperform on the Upside and Downside

As important as it is for my portfolios to outperform the index on the upside, it’s just as important for them to outperform on the downside, too.

What is “outperforming on the downside?”

When the S&P 500 increases in value, outperforming means getting an even higher return in your portfolio than the S&P 500. However, when the S&P 500 decreases in value, outperforming means seeing less of a loss than the index. Newer investors might think taking any loss is underperforming, however, long-term investors know that losses happen; limiting those losses is one of the keys to long-term investing.

This year, the S&P 500 sold off more than -35% at its lows in March. The index finished the month bouncing to a -20% loss. The Investments in Play portfolio was down -10.80% at the end of the March, nearly cutting the S&P 500’s loss by half. While still down, a -11% loss is much easier to stomach than a -20% loss.

In the meantime, thanks to the extremely risky nature of the Speculation in Play portfolio, its performance for March was more than a +20% gain thanks to the use of option put spreads which increase in value in opposition to the underlying asset (in this case, when the S&P sold off, the put spreads’ value skyrocketed).

Can individual investors really beat the markets? Oh, yes. Yes, we can.

Stay Tuned for more Year-in-Review Feature Stories!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.