Click chart for enlarged version

Happy 2nd Birthday, GetIrked!

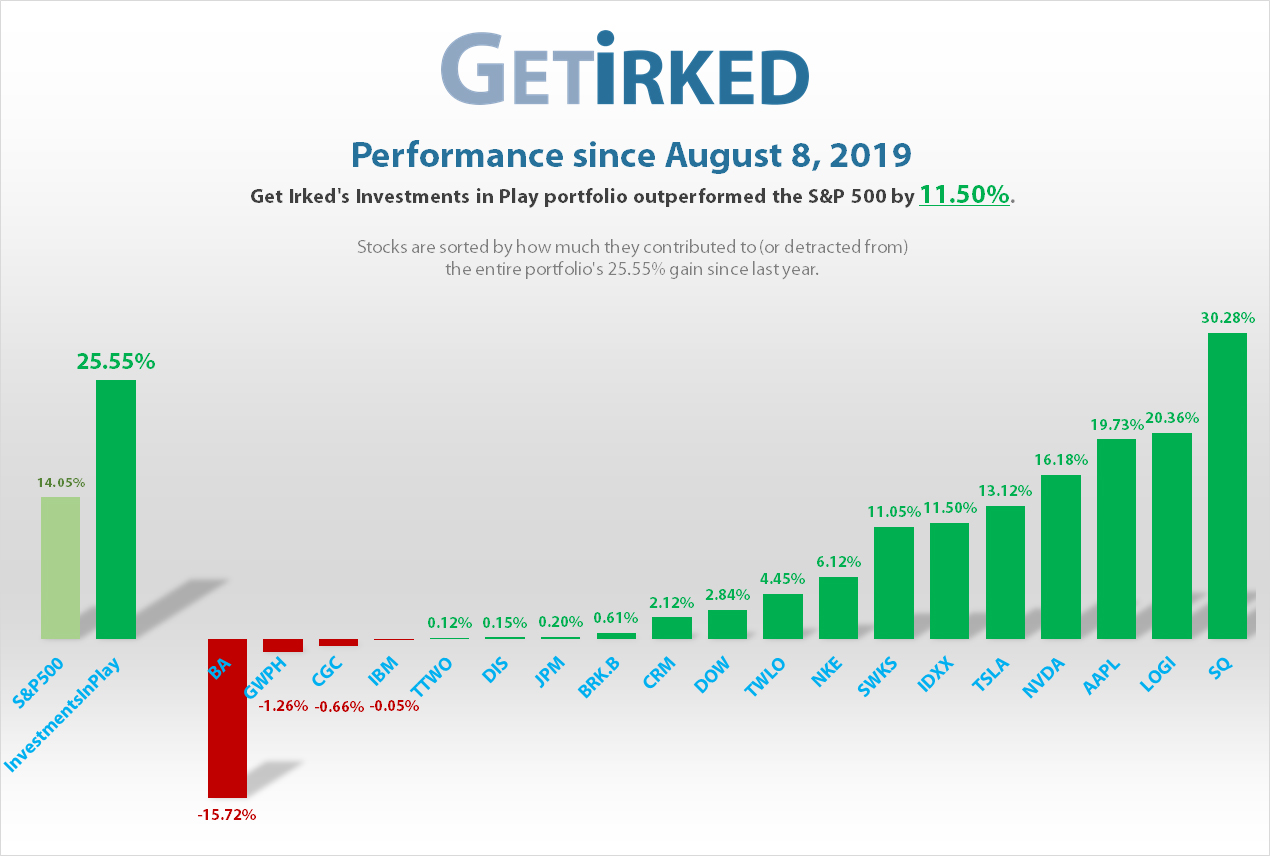

Last year, I started the practice of reviewing Get Irked’s performance on the anniversary of when I first started the website – August 8, 2018. This year, I wanted to do the same, the accompanying chart shows the Investments in Play portfolio earned +25.55% in gains since August 8, 2019 where the S&P 500 earned only +14.05%, a difference of +11.50%.

I don’t intend this annual post as a way for me to brag about my performance, rather as a form of encouragement to all retail investors – if I can do it, YOU can do it.

Retail Investors CAN Beat The Market

Professional investment advisers often give the same advice: “Retail investors cannot beat the markets by investing in individual stocks. The best long-term approach is to invest in a reliable, low-cost index fund that tracks the S&P 500.”

While this may be true for the uninitiated individual who simply wants to “set it and forget it” when it comes to investing for retirement, my portfolio’s performance over the past decade has beaten the S&P 500 every single year since 2011.

If an individual takes the time to seriously research each company in their portfolio and selects the stocks of high-quality companies, I truly believe anyone can beat the market. All it takes is a little time and dedication.

Last year, I reviewed some lessons that I found important to my own investing over the previous year. Given the historic events that have taken place in 2020 thanks to the global COVID-19 pandemic, I feel this is an important practice to repeat.

Lesson 1: Stay Diversified

As you can see from the chart above, despite the overall portfolio’s performance, not all of my investments have performed well over the past year.

In fact, Boeing (BA) alone was responsible for subtracting -15.72% from my annual gains, no small amount. However, when you consider that Boeing’s stock is down -49.45% since last year (its closing price on Friday, August 7, 2020 was $170.02 versus $346.40 on August 8, 2019), it shows the vital importance of maintaining a diversified portfolio.

Diversification is the practice of ensuring that a portfolio is made up of a variety of companies from different sectors and industries in the market with no one position overexposing the portfolio to too much risk.

While it may feel to some that diversification limits a portfolio’s gains, the benefits of limiting risk far exceed any potential missed profits. Imagine if my entire portfolio had been made up of Boeing’s stock! Instead of gains, my portfolio would be worth half what it was a year ago. You can read more about diversifying a portfolio by clicking here.

Lesson 2: Keep Some Cash on the Sidelines

While it may be difficult to watch the market increase in value knowing your portfolio isn’t fully invested, keeping some of your portfolio in cash is a vital part of successful active investing.

How can you take advantage of a selloff like the one that happened following the coronavirus COVID-19 outbreak in Q1-2020 without having funds to put to work?

Determining how much cash to keep on the sidelines is a decision each investor must make for themselves. How much risk are you comfortable taking? Is the market currently overbought or oversold? Do you have positions where you should take some profits? These are all questions an investor should ask themselves often throughout each year.

Professional advisers and investors like Jim Cramer of CNBC Mad Money fame recommend keeping at least 10% of a portfolio in cash. For me, the amount I keep in cash varies, but I typically keep substantially more than advisers recommend.

For example, on February 1, 2020, my portfolio was nearly 60% in cash, an incredibly beneficial situation to be in heading into the pandemic selloff which started later that month. How did I know to have that much in cash? I didn’t. My substantial cash position was the result of a reallocation I was making in certain holdings that resulted in incredibly lucky timing.

As the old investing adage goes, “Better to be lucky than good.”

As I write this update, about 40% of my Investments in Play portfolio is in cash as I feel the markets are becoming increasingly overbought in light of the potential negative catalysts looming on the horizon.

Lesson 3: Buy in Stages

During the epic systemic selloff in March, many professional hedge fund managers and famous investors were interviewed on CNBC with most, if not all, warning investors not to put money to work. From the start of the year to the S&P 500’s bottom on March 23, 2020, the markets sold off more than -35%!

However, even as the market reached its lows, economists and advisers continued to tell investors not to buy. In just five trading days after March 23, the market rallied an incredible 20% and is currently near its all-time highs, up more than +50% from its March lows as of Friday, August 8.

What’s the lesson?

No investor can time the markets, and even the professionals didn’t know what the market was going to do. Had you listened to the “professionals,” you would have missed out on a generational bottom buying opportunity. On the flip side, if you’d gone all-in at the beginning of the selloff, you would have been disappointed that you missed out on substantially better deals.

What’s the solution?

In order to practice investing discipline, it’s vital to have a plan in place to Buy in Stages. Particularly during a systemic selloff when every stock in the market is dropping like a rock, it’s important to add to positions (not all at once!) as they sell off.

There are different ways of making a buying plan. Some investors will add to positions at certain selloff percentage amounts such as when a position is down 5%, then down 7.5%, followed by down 10%, and so on. For me, I review the price history of my positions using charts and Technical Analysis (TA) to find points of past price consolidation to estimate where a position might drop to and I can add to it.

You can review your positions’ charts for free using a service like Yahoo Finance and Google Finance, or you can go even more in-depth with a charting service like TradingView, an online charting service that offers a free option. Referral Disclaimer: If you use my link and decide to sign up for a paid account, we both receive a $30 referral bonus.

Lesson 4: Selling in Stages

Just as important as Buying in Stages is Selling in Stages. As my positions gain profits, I make sure to sell some of the position (called “taking profits”) at certain stages as the stock price increases higher and higher.

Selling in Stages can be a difficult concept for some investors to grasp: Why wouldn’t you want to keep making money if a stock is going up? In fact, for some investors, taking gains can be more difficult than taking losses. However, just as no investor can time the markets on the way down, no investor can time when the market has reached a top prior to a selloff, either.

By taking profits, an investor locks in gains on some of a position and also lowers the per-share cost of a position (you can calculate your per-share cost by dividing the entire amount of capital you have in a position by the number of shares).

Selling in Stages frees up capital to re-invest in the position during the next selloff. If the stock never sells off (a “high-quality problem” as Jim Cramer would say), the investor now has that capital to invest in a new or different position.

Individual Stock Performance

Below are a list of the positions currently held in the Investments in Play portfolio.

Outperforming on the Upside by Taking Profits

You’ll notice examples where not trying to capitalize on volatility by Buying and Selling in Stages would have outperformed my methods as the stock’s price performance outperformed how it did in my portfolio, however, on the whole, Buying and Selling in Stages outperforms in the long run. In fact, in some circumstances, such as JP Morgan (JPM), a stock can be down year-over-year but my position may have actually increased thanks to my capitalizing on volatility.

Outperforming on the Downside with Limited Risk

Buying or Selling can also limit downside risk as seen in Boeing (BA) and Canopy Growth Corp. (CGC), two stocks down nearly 50% in the past year with my positions having lost significantly less than half that over the same time period thanks to taking advantage of the year’s extreme volatility. GW Pharmaceuticals (GWPH) is another key example – the stock is down -35.48% but my position is only down -2.07%.

How to Read the Results

- The first number indicates the stock’s price performance from August 8, 2019 to August 7, 2020.

- The bolded second number indicates the performance of the position in my portfolio following Buying and Selling in Stages as described above.

- The italicized bolded third number after the equal sign indicates my position’s relative performance to the stock. For example, Apple (AAPL) gained +118.48% since last year as a stock, but my position didn’t perform as well, gaining +80.45% for a comparative relative performance of -38.03%.

For a stock like Boeing which is both down as a stock and as my position, a +30% relative performance means my method avoided a downside loss of -30%.

- Apple (AAPL): +118.48% | +80.45% = -38.03%

- Berkshire-Hathaway (BRK.B): +4.47% | +0.83% = -3.64%

- Boeing (BA): -49.45% | -19.45% = +30.00%

- Canopy Growth Corp. (CGC): -49.22% | -20.02% = +29.20%

- Disney (DIS): -5.77% | +0.66% = +6.43%

- Dow Chemical (DOW): -8.89% | +10.80% = +19.69%

- GW Pharmaceuticals: -35.49% | -2.07% = +33.41%

- IBM (IBM): -10.81% | -2.47% = +8.34%

- IDEXX Laboratories (IDXX): +38.54% | +94.09% = +55.56%

- JP Morgan (JPM): -9.54% | +17.07% = +26.61%

- Logitech (LOGI): +84.42% | +154.09% = +69.67%

- Nike (NKE): +22.72% | +22.12% = -0.61%

- Nvidia (NVDA): +183.07% | +206.60% = +23.53%

- Salesforce.com (CRM): +39.79% | +131.84% = +92.05%

- Square (SQ): +122.15% | +86.75% = -35.41%

- Skyworks Solutions (SWKS)*: +51.300% | +71.87% = N/A*

- Tesla (TSLA)*: +292.26% | +163.02% = N/A*

- Take Two Interactive (TTWO): +33.16% | +5.16% = -28.00%

- Twilio (TWLO): +89.10% | +239.27% = +150.17%

* Stocks marked with an asterisk indicate a position that was newly-opened in 2020 and therefore has no accurate year-over-year comparison. The listed figure simply indicates the position’s current profit or loss since inception.

Follow Along for Free

Want to see what happens next? I release weekly updates on my Investments in Play portfolio available to members.

Membership is free and is only required so readers fully understand and accept certain disclaimers including the following:

- I am not a professional investment adviser.

- All investments carry significant risks and could lose all value.

- The information provided on this website is not a recommendation to buy or sell an investment and is provided for educational and entertainment purposes only.

- Every investor should consult a financial adviser to determine if an investing idea or strategy is right for them.

- Every investor invests at their own risk.

Ready to follow along for the next year? Click here to join and Get Irked today.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.

You must be logged in to post a comment.