Summing Up The Week

The market shrugged off bad news for much of the week with stocks heading higher and both the S&P 500 and Nasdaq making new all-time highs. However, that all changed on Friday when a much weaker than expected payroll report sent a shock through the system.

Let's take a deeper dive into the news that moved the markets this week...

Market News

Trump's tariffs ruled illegal, Treasury yields spike

When a Federal appeals court ruled President Donald Trump's tariffs illegal Friday night after the market closed, investors expected a wild day when the markets reopened on Tuesday and they weren't disappointed. With no income from the tariffs, Treasury yields rose on Tuesday (the 30-year topped 4.97%) to reflect the greater debt build due to U.S. spending, reported CNBC.

When bond yields rise, the equity markets get jittery. Combine that with the fact that September is seasonally the most volatile month of the year, and the month kicked off in the red with both the S&P 500 and Nasdaq selling off as investors tried to lock in profits ahead of additional fiscal uncertainty.

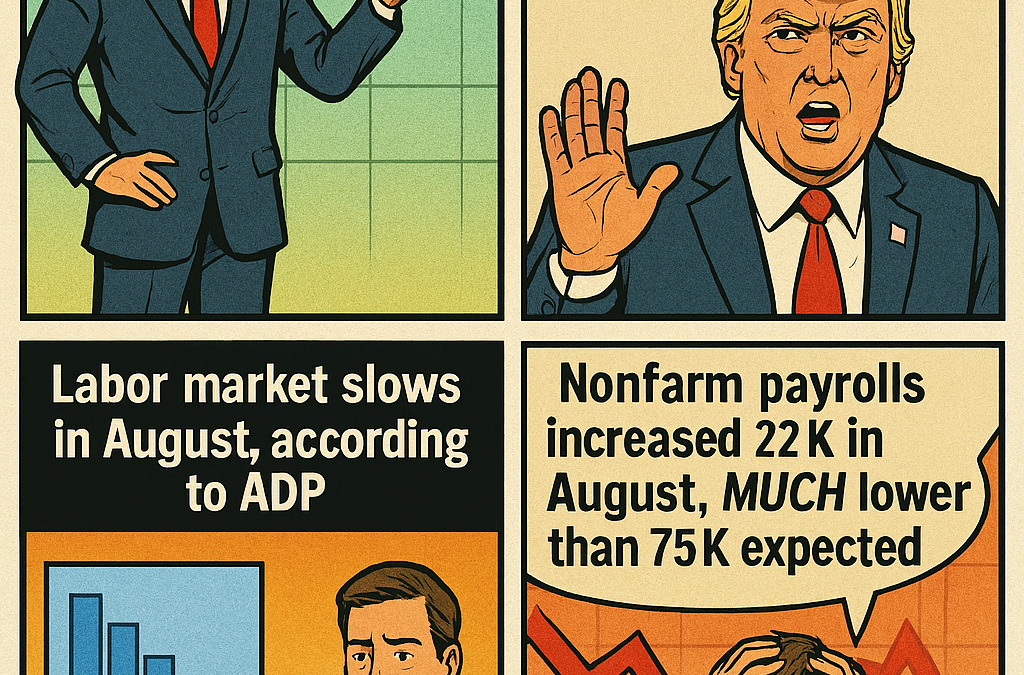

Labor market slows in August, according to ADP

Following Trump's termination of the head of the Bureau of Labor Statistics after last month's payroll report, a lot of experts believe payroll processor ADP may be the preferred gauge of the job market. Well, on Thursday, ADP reported that the U.S. job market only added 54,000 jobs in August compared to the consensus forecast of 75,000, reported CNBC.

Despite ADP's bearish report, stocks rallied on Thursday after the market opened. This was likely due to the fact that a weak job market would help guarantee the Federal Reserve cutting rates when they meet later this month. We're once again in that strange situation where bad news is good news.

Nonfarm payrolls increased 22K in August, MUCH lower than 75K expected

On Friday, the nonfarm payrolls report for August showed the U.S. economy added 22,000 jobs in August which was much lower than the 75,000 jobs that Dow Jones economists expected, reported CNBC. Initially, the stock market popped on the news, presumably because such a weak number would virtually guarantee a rate cut by the Fed later in September before rolling over once investors processed exactly how bad the jobs report really was.

"The job market is stalling short of the runway," said Daniel Zhao, Chief Economist at jobs site Glassdoor. "The labor market is losing lift, and August’s report, along with downward revisions, suggests we’re heading into turbulence without the soft landing achieved."

While most economists agreed that the Fed needs to cut rates, what was previously being thought of as "cutting rates with a good reason to do so" has now changed to "cutting rates with a bad reason to do so."

"The warning bell that rang in the labor market a month ago just got louder. A weaker-than-expected jobs report all but seals a 25-basis-point rate cut later this month," said Olu Sonola, Head of U.S. Economic Research at Fitch Ratings. "Four straight months of manufacturing job losses stand out. It’s hard to argue that tariff uncertainty isn’t a key driver of this weakness."

Next Week's Gameplan

Next week brings us a lot of economic data that may or may not affect what the Federal Reserve chooses to do when they meet mid-month. On Monday, we get the consumer credit report which will provide insight into how the U.S. consumer is spending their money.

On Wednesday, we get the Producer Price Index (PPI) followed by the Consumer Price Index (CPI) on Thursday. Last month, PPI showed inflation was coming in hot for businesses and sent the markets lower, if only briefly. On the flip side, CPI showed no real inflation for the end consumer. Some experts are predicting we'll see CPI come in hot as a result of the higher costs for businesses, so next week's inflation numbers could be exciting for markets.

I'll meet you all back next Friday here to go over the price action, friends!

Check out Get Irked Premium on Substack!

After providing FREE content since 2018, the time constraints of producing Investments in Play, Speculation in Play, the Pandemic Portfolio, and Stock Shopping List have become too much to continue doing for free.

On Substack, you can subscribe for FREE to have the Week in Review and Crypto Corner, now separate newsletters, sent to your email inbox at no cost. The portfolio updates and Stock Shopping List are now part of a premium subscription plan.

I hope you will join me on Substack as I continue on this exciting journey!

THANK YOU FOR YOUR ONGOING SUPPORT!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Bitcoin’s Bounce: Bullish Hope or Bear Trap?

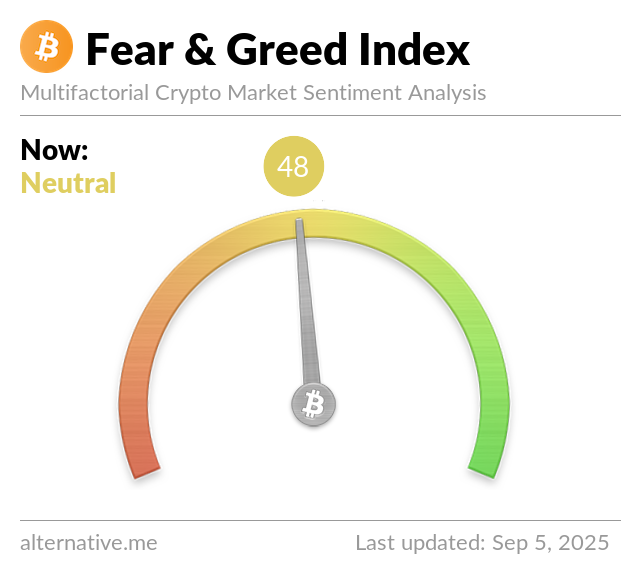

The week didn’t start off great with Bitcoin making a new lower weekly-low at $107,250.00 on Monday. Bitcoin’s price action remained in a bearish downtrend over the past week until Friday when the big orange crypto finally broke out through last week’s high of $112,600.00, stopping just short of the next point of resistance at $113,390.00.

The Bullish Case

Bulls continue to remain incredibly bullish, arguing that the $107K region remains a strong support level. While the bounce Bitcoin saw on Friday gave some hope to a turnaround, the overall narrative does continue to support the Bears currently.

The Bearish Case

The Bears continue to dominate Bitcoin’s narrative as the longer timelines still show the world’s largest crypto remaining in a downtrend. While I do agree that we may see further downside for Bitcoin throughout September, I look at this selling pressure as a buying opportunity and continue to add to my trade as Bitcoin tests past points of support (and breaks through them to even more discounted prices).

Bitcoin Trade Update

Premium subscribers to Get Irked get access to all the moves I've made in my Bitcoin trade over the past week as well as my next thirty (30) ... yes, 30 ... buys in Bitcoin including price levels, quantities, and a full layout of my ongoing long-term trade in the world's biggest crypto.

Not Your Keys, Not Your Crypto...

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges - Gemini and Coinbase - in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use my Gemini referral link to open an account.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin's price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

- In January 2024, Bitcoin rallied +97% to a high of $49,102.29.

- Later in January, Bitcoin dropped -22% to a low of $38,501.00.

- In March, Bitcoin rallied +92% to a new all-time high of $73,835.57.

- In August, Bitcoin dropped -33% to a low of $49,050.01.

- In January 2025, Bitcoin rallied +150% to a new all-time high of $109,358.01.

- In April, Bitcoin dropped -32% to a low of $74,420.69.

- In May, Bitcoin rallied +51% to a new all-time high of $112,000.00.

- In June, Bitcoin dropped -12% to a low of $98,247.01.

- In July, Bitcoin rallied +25% to a new all-time high of $123,231.07.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.