Summing Up The Week

Inflation delaying the next Federal Reserve interest rate cut was the drumbeat of the news this week with both the Consumer Price Index (CPI) and Producer Price Index (PPI) inflation gauges coming in hotter than expected. Federal Reserve Chairman Jerome Powell foreshadowed this likelihood when he told Congress that the Fed is in no hurry to lower interest rates.

As a result, the extra news added to the market volatility, once again proving that the Bull Market has shifted to a "stock picker's market" where choosing the right stocks to outperform will be critical headed forward.

Let's look at the news that moved markets this week...

Market News

The Fed is in no hurry to lower interest rates further

During Federal Reserve Chairman Jerome Powell's testimony to Congress on Tuesday, the Fed Chair reiterated that the central bank does "not need to be in a hurry to adjust [its] policy stance," pointing to a strong economy and "solid" labor market as reasons to hold fast, reported CNBC.

Additionally, with inflation still above the Fed's 2% goal, Powell iterated the need to be patient. “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” Powell said. “We know that reducing policy restraint too fast or too much could hinder progress on inflation. At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment.”

Powell also went on to talk about the fact mortgage rates have remained high even thought the Fed cut several times, saying those rates could change as we head foward. “It’s true that mortgage rates have gone or remained high, but that’s not so directly related to the Fed’s rate,” Powell said. “It’s really related more to long-term bond rates, particularly the Treasury, the 10-year Treasury, 30-year Treasury, for example. And those are high for reasons not particularly closely related to Fed policy.”

CPI rose more than expected in January

On Wednesday, the Consumer Price Index (CPI) showed an increase in prices of 0.5% in January, higher than the estimates for 0.3% by Dow Jones economists and provided even more incentive for the Federal Reserve to keep interest rates steady, reported CNBC.

The CPI, a broad measure of costs in goods and services across the U.S. economy, accelerated a seasonally adjusted 0.5% for the month, putting the annual inflation rate at 3%, the Bureau of Labor Statistics reported Wednesday. They were higher than the respective Dow Jones estimates for 0.3% and 2.9%. The annual rate was 0.1 percentage point higher than December.

Naturally, stocks pulled back in pre-market trading as a return of rising inflation is not positive for companies, individuals, or the country.

PPI rose more than expected in January

After Wednesday's hotter-than-expected CPI report, it came as no surprise when Thursday's Producer Price Index (PPI) showed a 0.4% increase in inflation in January over the 0.3% expected by Dow Jones economists, reported CNBC.

As a result of both reports, the market's expectations for the Fed's rate cut were pushed back into the second half of the year. That being said, inflation data can be volatile (obviously) so the timing of the next rate cut will almost certainly change as we continue through 2025.

Trump announces plan for "reciprocal tariffs"

On Thursday, President Donald Trump announced his plan to deal with foreign nations who impose "reciprocal tariffs" on the United States by saying, "They charge us a tax or tariff and we charge them," during a press conference, reported CNBC.

Trump said that foreign countries will not be allowed to send merchandise or other items to the U.S. through another country, “We want a level playing field." He went on to suggest that Congress should pass a "Trump Reciprocal Trade Act" which would give the President the power to impose tariffs on any country with higher tariffs on U.S.-made goods.

While not outright bullish or bearish in nature, the stock market did rally quite a bit on Thursday following Trump's press conference. Maybe stocks like tariffs after all?

Retail sales down much more than expected in January

On Friday, the Commerce Department's retail sales report showed sales dropped 0.9% in January, far worse than the Dow Jone estimate of 0.2%, reported CNBC. A weak retail sales report indicates American consumers pulling back on spending, and, with the United States primarily being a goods-and-services-based economy, is not a good sign for the health of companies, either.

Some pundits tried to maintain upbeat outlooks, claiming the drop was due to bad weather preventing shoppers from buying goods. “The drop was dramatic, but several mitigating factors show there’s no cause for alarm. Some of it can be chalked up to bad weather, and some to auto sales tanking in January after an unusual surge in December due to fat dealer incentives,” said Robert Frick, corporate economist with Navy Federal Credit Union. “Especially considering December was revised up strongly, the rolling average of consumer spending remains solid,” Frick added.

Next Week's Gameplan

We head into another shortened trading week with markets closed on Monday for the President's Day holiday. On Tuesday, we get the Empire State manufacturing survey and the home builder confidence index followed by minutes of the Fed's January meeting on Wednesday. On Thursday, we see the Philadelphia Fed manufacturing survey with S&P flash U.S. services and manufacturing PMI and consumer sentiment on Friday.

So, just from an economic datapoint standpoint, next week stands to be pretty busy. While earnings season is starting to come down from its high, there are still plenty of reports from my own portfolios next week:

- Equinox (EQX) and Nutrien (NTR) both report after the bell on Wednesday;

- and, on Thursday, Cameco (CCJ), Newmont Mining (NEM), Rivian (RIVN), and Block (XYZ) all report after the close.

Plus we still have no idea what crazy ideas President Trump will throw at the markets next, so there should be plenty to talk about when you join me back here on Friday, friends!

Check out Get Irked Premium on Substack!

After providing FREE content since 2018, the time constraints of producing Investments in Play, Speculation in Play, the Pandemic Portfolio, and Stock Shopping List have become too much to continue doing for free.

On Substack, you can subscribe for FREE to have the Week in Review and Crypto Corner, now separate newsletters, sent to your email inbox at no cost. The portfolio updates and Stock Shopping List are now part of a premium subscription plan.

I hope you will join me on Substack as I continue on this exciting journey!

THANK YOU FOR YOUR ONGOING SUPPORT!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

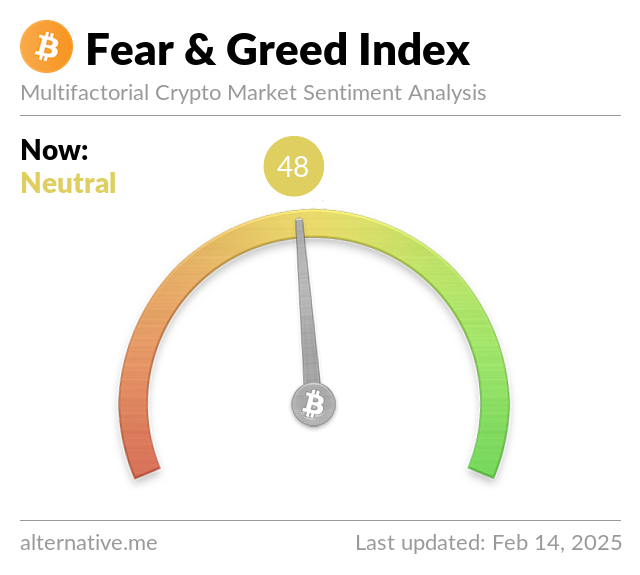

Bitcoin is Enjoying Itself Going Absolutely NOWHERE...

For some reason, I’m able to be incredibly patient when it comes to stocks, gold, or any asset beside Bitcoin. Whether it takes days, months, or even years for an investment of mine to finally pay off in a big way, I have no problem waiting.

… except when it comes to BITCOIN!

Maybe starting in investing in Bitcoin and other cryptocurrencies right at their peak in December 2017 was what did this to me, but I just can’t stand it when Bitcoin goes nowhere. It’s not even that I want Bitcoin to just go up, either! In fact, I think the lizard brain in my head prefers it when Bitcoin goes DOWN because I get to buy more at lower prices!

Regardless, this past week was one of those boring weeks: Bitcoin set a much lower weekly high at $98,500.00 on Tuesday only to roll over and set a much higher weekly low at $94,066.92 on Wednesday.

In other words… we’ve got NOTHING. Neither the bulls nor the bears have any real price action to go on as long as Bitcoin stays in a range between $91,178.01 - the low from two weeks ago - and $102,599.85 - the high from two weeks ago.

Big. Fat. YAWN.

The Bullish Case

The Bulls are excited. Over the past week, Tesla (TSLA) announced it would be buying more Bitcoin. Microstrategy (MSTR)… errm… Strategy (?)… announced it was going to buy more Bitcoin. Heck, even rumors started swirling that meme-king GameStop (GME) was going to start buying Bitcoin!

… except none of that actually moved Bitcoin.

The Bearish Case

After last week’s whipsaw action, all of the Bears were claiming Bitcoin would finally crash below $89,000 this past week on the back of tariff fears and reports of higher inflation. The Bears still argue that Bitcoin isn’t a hedge against inflation and scream how it’s correlation to tech stocks and other risk-off assets means Bitcoin’s doomed for lower lows.

… except none of that actually moved Bitcoin.

Bitcoin Trade Update

Premium subscribers to Get Irked get access to all the moves I've made in my Bitcoin trade over the past week as well as my next thirty (30) ... yes, 30 ... buys in Bitcoin including price levels, quantities, and a full layout of my ongoing long-term trade in the world's biggest crypto.

Not Your Keys, Not Your Crypto...

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges - Gemini and Coinbase - in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use my Gemini referral link to open an account.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin's price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

- In January 2024, Bitcoin rallied +97% to a high of $49,102.29.

- Later in January, Bitcoin dropped -22% to a low of $38,501.00.

- In March, Bitcoin rallied +92% to a new all-time high of $73,835.57.

- In August, Bitcoin dropped -33% to a low of $49,050.01.

- In January 2025, Bitcoin rallied +150% to a new all-time high of $109,321.90.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.