Where Are They Now? One Year Later…

One year ago on August 8, 2018, Get Irked was launched and I’ve been chronicling my portfolios’ moves in the markets at least once a week since that date.

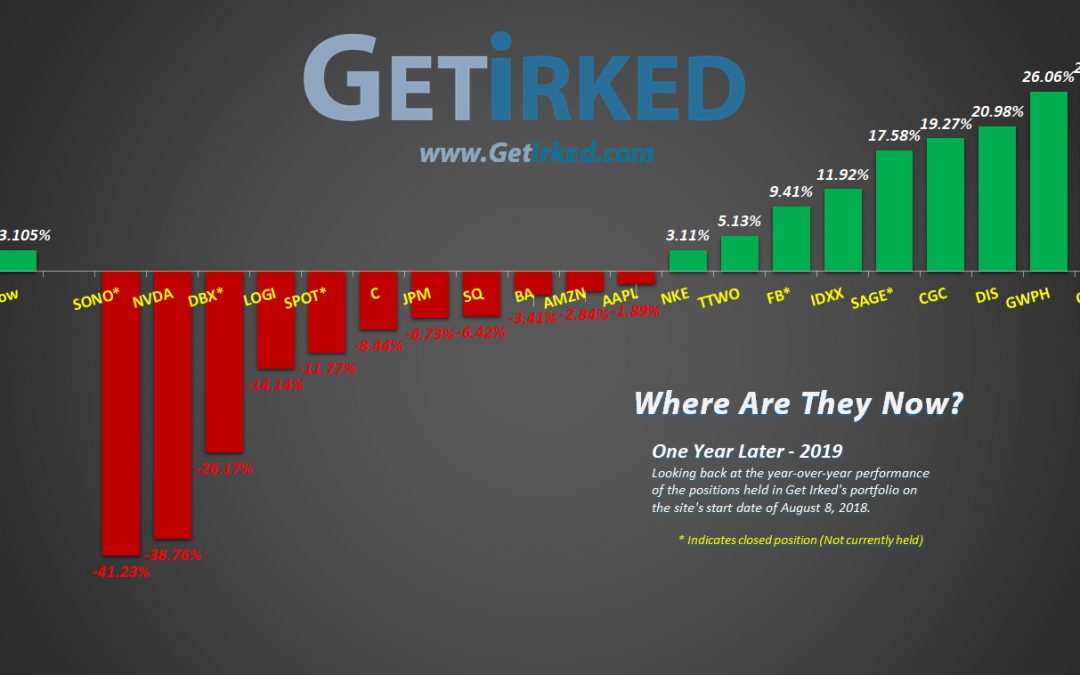

So, now that it’s been an entire year, I thought it might be interesting to take a look at the positions in my Investments in Play one year ago and see how they’ve performed compared to the S&P 500 and Dow Jones Indices.

Below are the positions that were in the portfolio exactly one year ago. If they are no longer in the portfolio, I’ve gone back through my trade journals to find exit prices and what change there’s been since exiting.

Lessons from Year One:

Use volatility to your advantage.

Buy in Stages and Sell in Stages because, sometimes, the market won’t move the average 7% in a year. Sometimes, as in 2018-2019, the market will move very little overall (just a little over 3% in this case), but move a lot throughout the course of the year. Take profits when you can and add to positions when you can.

Don’t be afraid to close a position and take the loss or gain.

I closed a lot of positions last year (as you’ll see below). Sometimes, I closed a position because my thesis fell through and it was time to get out. Sometimes, I closed a position because I had too large a gain to lose.

Sometimes, it can be easier to take a loss than it can be to take a gain. Selling a stock that seems to just be heading higher can be incredibly difficult. Remember: No one ever got hurt taking a profit.

The Results:

S&P 500 Index

(SPX)

Dow Jones Index

(DJI)

August 8, 2018

$2,850.10

August 8, 2019

$2,938.10

August 8, 2018

$25,583.80

August 8, 2019

$26,378.20

Annual Change

+3.088%

Annual Change

+3.105%

Amazon.com (AMZN)

August 8, 2018

$1,886.52

August 8, 2019

$1,832.89

Annual Change

-2.843%

Apple (AAPL)

August 8, 2018

$207.25

August 8, 2019

$203.34

Annual Change

-1.887%

Boeing (BA)

August 8, 2018

$347.78

August 8, 2019

$335.91

Annual Change

-3.413%

Canopy Growth Corp (CGC)

August 8, 2018

$27.55

August 8, 2019

$32.86

Annual Change

+19.274%

Citigroup (C)

August 8, 2018

$72.89

August 8, 2019

$66.74

Annual Change

-8.437%

Cypress Semiconductor (CY)

August 8, 2018

$17.94

August 8, 2019

$22.86

Annual Change

+27.425%

No Longer in Portfolio

I closed the position in Cypress Semiconductor on

June 3, 2019 at $22.37 following the company receiving a takeover offer – better to miss out on what little extra upside there may be to avoid a huge drop should the deal fall through.

The stock is up +2.19% since closing the position.

Disney (DIS)

August 8, 2018

$113.98

August 8, 2019

$137.89

Annual Change

+20.997%

Dropbox (DBX)

August 8, 2018

$31.55

August 8, 2019

$20.31

Annual Change

-26.172%

No Longer in Portfolio

I closed the position in Dropbox on September 24, 2018 at $25.92 when the stock showed weakness, capturing a small 1.48% gain.

The stock is down -21.64% since closing the position.

Facebook (FB)

August 8, 2018

$183.09

August 8, 2019

$190.16

Annual Change

+9.413%

No Longer in Portfolio

I closed the position in Facebook on August 27, 2018 at $176.86 after the stock bounced back from a sudden drop, capturing a gain of 41.98% from when I first opened the position on September 16, 2017.

The stock is up +7.52% since closing the position.

GW Pharma (GWPH)

August 8, 2018

$134.46

August 8, 2019

$169.50

Annual Change

+26.060%

IDEXX Labs (IDXX)

August 8, 2018

$246.22

August 8, 2019

$275.57

Annual Change

+11.920%

JP Morgan (JPM)

August 8, 2018

$117.79

August 8, 2019

$109.86

Annual Change

-6.732%

Logitech (LOGI)

August 8, 2018

$46.12

August 8, 2019

$39.60

Annual Change

-14.137%

Nike (NKE)

August 8, 2018

$80.50

August 8, 2019

$83.00

Annual Change

+3.106%

Nvidia (NVDA)

August 8, 2018

$258.42

August 8, 2019

$158.26

Annual Change

-38.759%

Sage Thera (SAGE)

August 8, 2018

$146.69

August 8, 2019

$172.48

Annual Change

+17.581%

No Longer in Portfolio

I closed the position in Sage Therapeutics on August 31, 2018 at $163.00 after deciding I didn’t like its volatility with a negligible gain of 0.72% from when I first opened the position on July 13, 2018.

The stock is up +5.816% since closing the position.

Sonos (SONO)

August 8, 2018

$18.14

August 8, 2019

$10.66

Annual Change

-41.235%

No Longer in Portfolio

I closed the position in Sonos on August 21, 2018 at $20.07 following incredibly poor performance in the stock, capturing a gain of 3.10%.

The stock is down -46.89% since closing the position.

Spotify (SPOT)

August 8, 2018

$178.70

August 8, 2019

$157.66

Annual Change

-11.774%

No Longer in Portfolio

I closed the position in Spotify on August 20, 2018 at $185.61 to earn 15.70% gains when it started to show weakness.

The stock is down -15.06% since closing the position.

Square (SQ)

August 8, 2018

$70.82

August 8, 2019

$66.27

Annual Change

-6.425%

Take Two (TTWO)

August 8, 2018

$124.95

August 8, 2019

$131.36

Annual Change

+5.130%

Want to Follow Along?

If you’d like to see my current positions and follow along for free, you can join the website to get access to my Investments in Play (those above) as well as check out my much smaller and far riskier Trades in Play portfolio.

Click here to learn how to join!

You must be logged in to post a comment.