Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #20

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Holding up just fine, thank you.

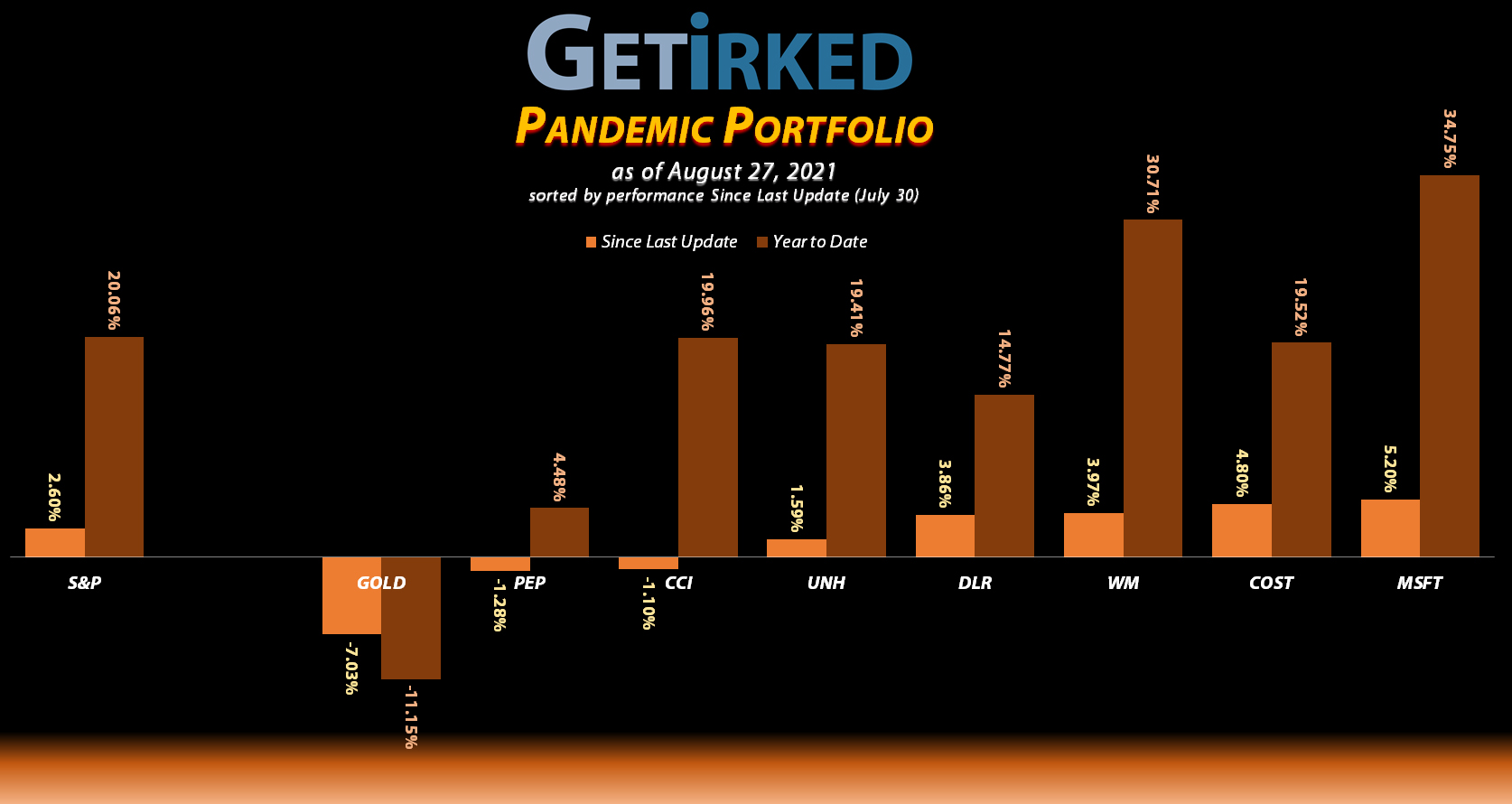

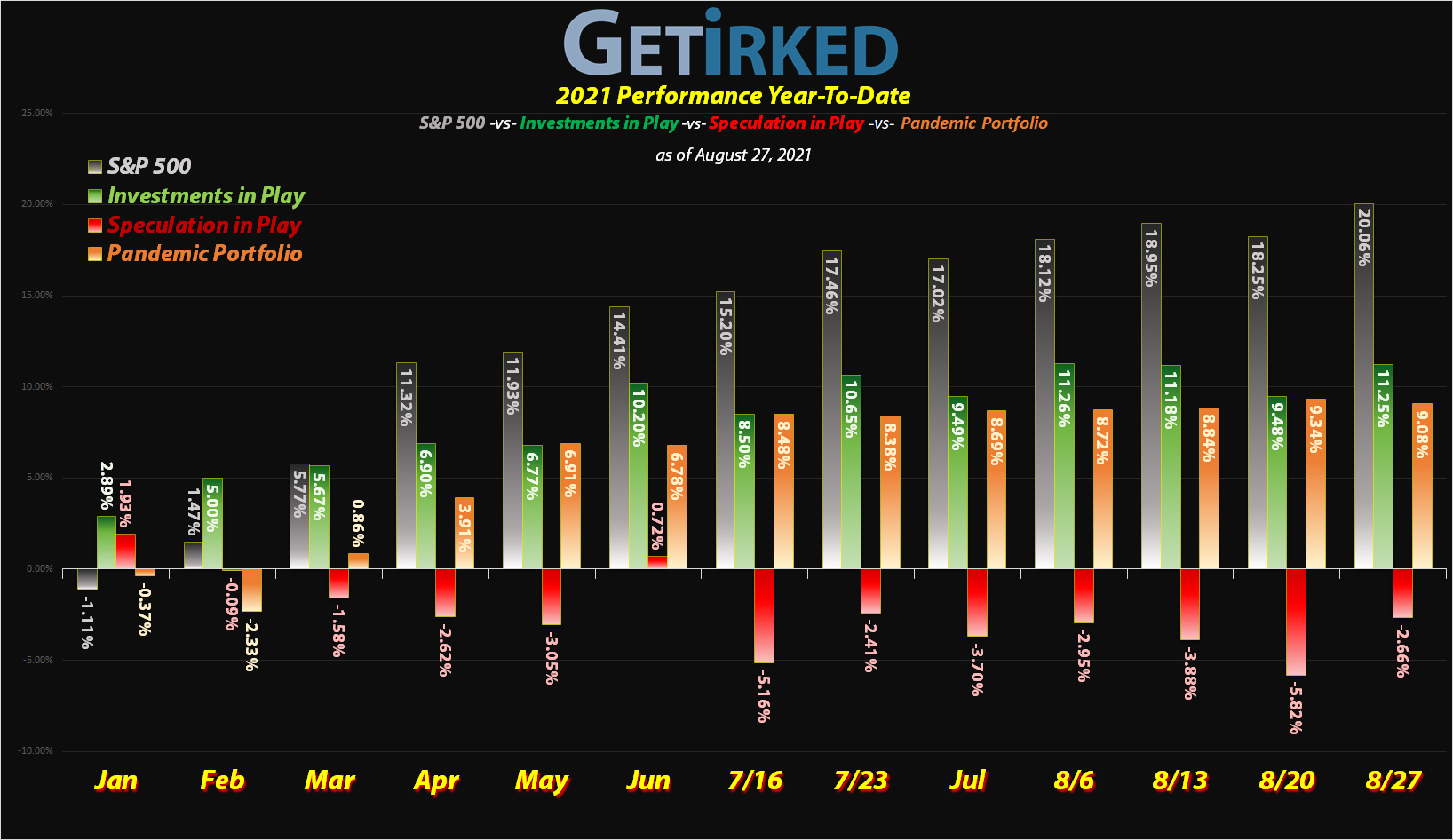

Despite being a relatively dull portfolio in terms of growth stocks, the Pandemic Portfolio performed exceptionally well throughout the past month. Even a few surprise selloffs did nothing to slow the majority of the positions

However, that certainly can’t be said of Barrick Gold (GOLD) which got hit hard with the rest of the precious metals commodities space when the yellow metal sold off hard earlier in the past month.

This month saw me add to GOLD, take profits in Costco (COST) and Digital Realty Trust (DLR), and reinvest the dividends I received from COST.

Let’s take a look at where the positions stand and what I see as next steps…

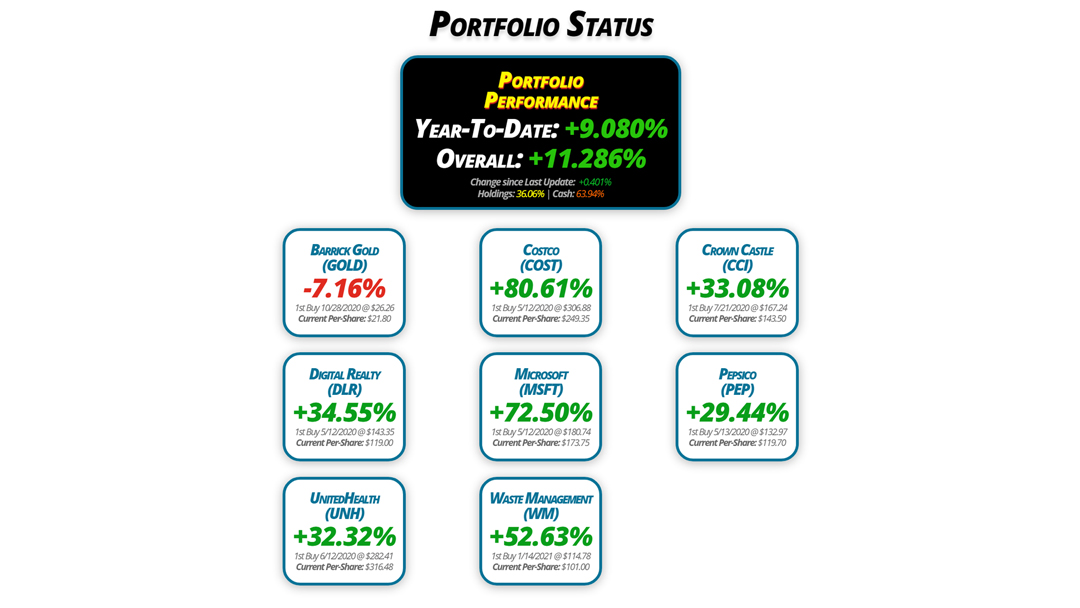

Portfolio Status

Portfolio

Performance

Year-To-Date: +9.080%

Overall: +11.286%

Change since Last Update: +0.401%

Holdings: 36.06% | Cash: 63.94%

Barrick Gold

(GOLD)

-7.16%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $21.80

Digital Realty

(DLR)

+34.55%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $119.00

UnitedHealth

(UNH)

+32.32%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $316.48

Costco

(COST)

+80.61%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $249.35

Microsoft

(MSFT)

+72.50%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $173.75

Waste Management

(WM)

+52.63%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $101.00

Crown Castle

(CCI)

+33.08%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $143.50

Pepsico

(PEP)

+29.44%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $119.70

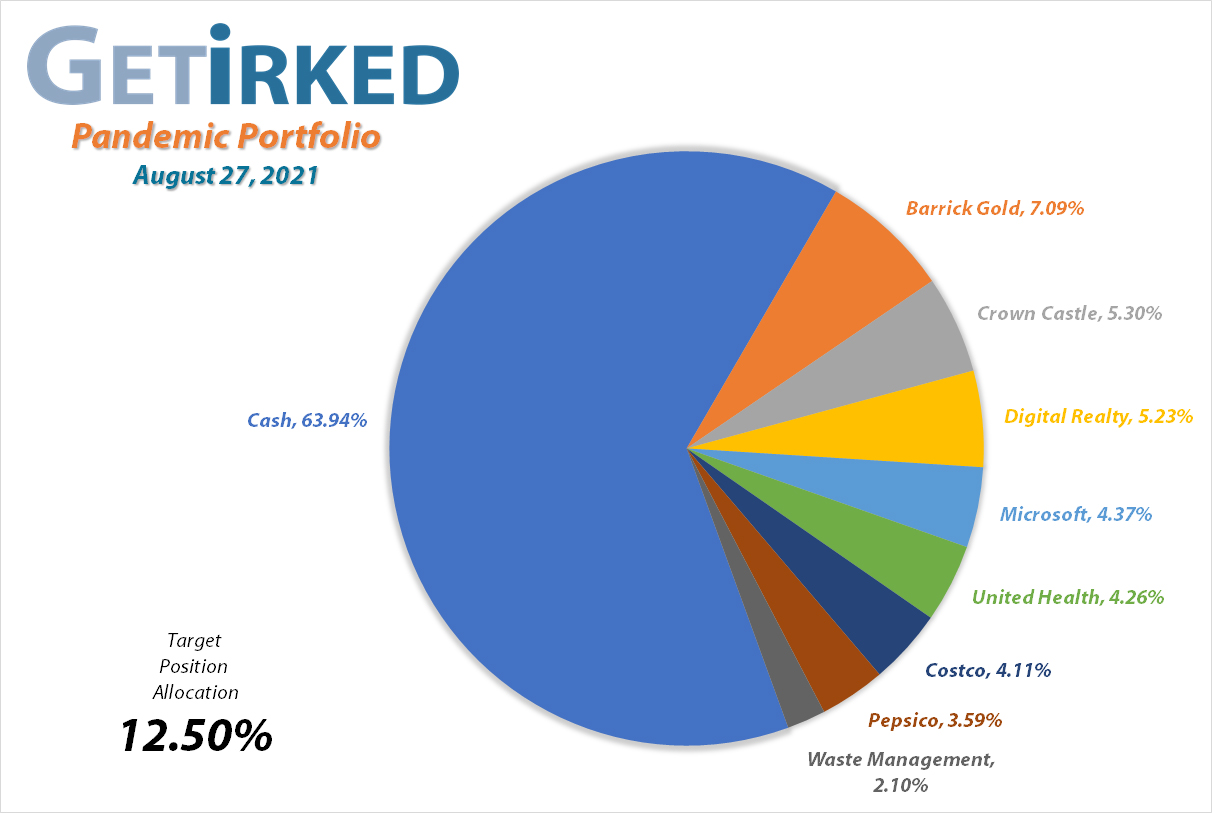

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $20.24

Per-Share Cost: $21.80 (-2.242% since last update)

Profit/Loss: -7.16%

Allocation: 7.093%* (+0.712% since last update)

Next Buy Target: $18.80

The yellow metal came under extreme selling pressure over the past month as the U.S. dollar strengthened following the passage of the infrastructure bill. The drop in gold’s price caused Barrick Gold (GOLD) and the rest of the goldmining sector to sell off. I added to my GOLD position when Barrick dipped below $20 on Thursday, August 12 with a purchase that filled at $19.93. The buy lowered my per-share cost -0.897% from $22.30 to $22.10.

On Friday, August 20, GOLD continued to come under selling pressure, hitting my next buy target which filled at $18.76. The order lowered my per-share cost an additional -1.357% from $22.10 to $21.80, a total reduction of -2.242% since the last update and -16.984% from my first buy at $26.26 on October 28, 2020.

The two orders gave me a combined average buy price of $19.30/share.

GOLD bounced so incredibly hard off of $18.76 (its bottom to the penny over the past month), that I’ve decided to add more at $18.80 should Barrick pull back to that point again. From here, my sell target is around $25.30, a past point of resistance, where I will reduce the allocation enough to get my per-share cost under the key $20.00 mark.

As of this update GOLD is $20.24, up +4.870% since my average buy price.

Costco (COST): Profit-Taking & Dividends

Current Price: $450.34

Per-Share Cost: $249.35 (-20.625% since last update)

Profit/Loss: +80.61%

Allocation: 4.106%* (-1.754% since last update)

Next Buy Target: $411.90

As much as I absolutely love Costco (COST) for the long-term, when it hit an new all-time high on Wednesday, August 11 and became supremely overbought across all time frames on the Relative Strength Index (RSI), I had no choice but to take profits – there has to be a pullback coming at some point (Right???).

My sell order went through on August 11 at $443.97, locking in +14.75% in gains on shares I bought back on November 30, 2020 for $386.89 and lowering my per-share cost -20.418% from $314.14 to $250.00.

On August 16, Costco (COST) paid out its quarterly dividend of $0.79 per share (an annual yield of 0.70% at its $450.43 closing price a the time) which lowered my per-share cost -0.26% from $250 to $249.35.

From here, I have no additional sell targets and my next buy target is $411.90, a recent point of support.

As of this update, COST is $450.34, up +1.435% from where I took profits.

Crown Castle (CCI): Strategy Update

Current Price: $190.97

Per-Share Cost: $143.50 (Unchanged since last update)

Profit/Loss: +33.08%

Allocation: 5.304%* (-0.079% since last update)

Next Buy Target: $180.15

Crown Castle (CCI) continues to perform well, particularly with the potential passage of an infrastructure bill and its billions of funding earmarked for broadband development across the country.

Should the bill pass, that means big things for CCI and the rest of the wireless infrastructure space as many rural areas are unreachable via any methods outside of wireless and the advent of 5G makes broadband speeds over wireless a very real thing.

Digital Realty Trust (DLR): Profit-Taking

Current Price: $160.11

Per-Share Cost: $119.00 (-4.372% since last update)

Profit/Loss: +34.55%

Allocation: 5.233%* (-0.519% since last update)

Next Buy Target: $150.05

On Friday, August 20, Digital Realty Trust (DLR) and the rest of the REIT sector pushed their all-time highs with DLR triggering a sell-order I had in place to reduce the allocation which filled at $163.99.

The sale locked in +23.162% in gains on shares I bought for $133.15 back on December 2, 2020 and lowered my per-share cost -4.372% from $124.44 to $119.00. From here, my next buy target is $150.05 and I have no additional sell targets.

As of this update, DLR is $160.11, down -2.366% from where I took profits.

Microsoft (MSFT): Strategy Update

Current Price: $299.72

Per-Share Cost: $173.75 (Unchanged since last update)

Profit/Loss: +72.50%

Allocation: 4.374%* (+0.202% since last update)

Next Buy Target: $275.90

Microsoft (MSFT) had a very good month after announcing it would be raising the subscription costs on its Office 365 service to which millions and millions rely for their Office needs. Additionally, Microsoft received more positive news after many of the biggest tech CEOs met with President Joe Biden in August and committed billions to invest in cybersecurity on a national level.

Pepsico (PEP): Strategy Update

Current Price: $154.94

Per-Share Cost: $119.70 (Unchanged since last update)

Profit/Loss: +29.44%

Allocation: 3.588%* (-0.060% since last update)

Next Buy Target: $146.90

With high inflation still rearing its head, consumer staples like Pepsico (PEP) performed very well over the last month as investors turned to equities in search of yield as the 10-year treasury rates continued to remain low.

That being said, I still intend to wait for Pepsico (PEP) to pull back a decent amount before I add anything to my position as PEP is uncharacteristically volatile compared to many of its consumer staples competitors.

UnitedHealth (UNH): Added to Position

Current Price: $418.76

Per-Share Cost: $316.48 (+3.938% since last update)

Profit/Loss: +32.32%

Allocation: 4.262%* (+0.495% since last update)

Next Buy Target: $390.90

UnitedHealth (UNH) started to show weakness later in August after making a new all-time high when a few politicians once again turned the topic to the high price of medical costs for Americans.

On Thursday, August 26, UNH started to show a bit of weakness during the small selloff the markets saw before the Federal Reserve meeting so I decided to add a bit to my position with a buy order that filled at $418.11. The order raised my per-share cost +3.938% from $304.49 to $316.48 but also provided me with a larger allocation.

My next buy target is $390.90, slightly above a past point of support, and I have no sell targets at this time.

As of this update, UNH is $418.76, up +$0.65 from where I added August 26.

Waste Management (WM): Strategy Update

Current Price: $154.15

Per-Share Cost: $101.00 (Unchanged since last update)

Profit/Loss: +52.63%

Allocation: 2.102%* (+0.073% since last update)

Next Buy Target: $146.90

Waste Management (WM) continues to outperform, making a new all-time high over the course of the last month. This prompted me to raise my buying price target, despite taking profits in July just slightly below my new $146.90 target at $144.74 on July 15.

While I don’t intend to replace all the shares I sold at that point, I do recognize that WM is just rocking it lately thanks to the focus on reopening, nationwide construction, and the potential infrastructure spending.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.