Investments in Play

Current Holdings

Blue Chip

Alphabet (GOOGL)

The company behind the definitive (and, arguably, only) search engine, Google, Alphabet (GOOGL) is a conglomerate with exposure to a wide variety of sectors including search, video streaming, mobile operating systems, and much more.

As one of the most venerable tech companies in the market, Alphabet isn’t considered a “Disruptor” as much, anymore, seeing as how it has become a stalwart to the investing world.

In this portfolio, GOOGL makes up part of the Old-Spec Basket and does not hold a full allocation due to the notably large number of tech high-growth positions already in the portfolio.

Sectors: Search, Video Streaming, Mobile, Gaming

Apple (AAPL)*

Best-of-Breed consumer electronics manufacturer of cell phones, tablet PCs, computer systems and continually growing its consumer services including AppleTV+, AppleNews+, and AppleArcade+.

Sectors: Tech Consumer Products, 5G, Cloud

Berkshire-Hathaway (BRK.B)

Warren Buffet, considered the greatest value investor of all time, bought Berkshire-Hathaway and transformed it into a conglomerate of a myriad of companies ranging from See’s Candies to GEICO insurance.

Sectors: Real estate, insurance, food, consumer products, and many, many more.

Long-Term Speculative Basket Member = limited allocation size

Boeing (BA)

The world leader in airplane manufacturing, #1 exporter of the United States, maker of military solutions, and dabbler in space travel.

Sectors: Aerospace, Military, Outer Space

Brookfield (BN)

Brookfield Corporation (BN) is a Canadian-based alternative-asset manager with a proven track record of identifying properties and other investments with outstanding long-term potential, procuring those assets, and then growing them to fruition.

Sectors: Financials, Alternative Assets, Property Investing, Privat Capital, Venture Capital

Financials Basket Member = limited allocation size

Disney (DIS)

The Best-of-Breed player in entertainment with divisions in motion pictures, theme parks, vacation resorts, television networks including ABC & ESPN as well as Disney+, Hulu, and ESPN+.

Sectors: Media Entertainment, Streaming, Consumer Services

Dow (DOW)*

Dow is the Best-in-Breed chemical manufacturer producing products for the world market in consumer care, infrastructure and packaging markets, plus it features a 5%+ dividend.

This industrial manufacturer will struggle during a weak economy but may be best-positioned for an evenutal global turnaround as its products are used in practically everything from manufacturing to consumer home goods.

Sectors: Industrials, Basic Materials

JP Morgan (JPM)*

Considered the Best-of-Breed in money-center banking and consumer financial services, JP Morgan has a high valuation and is often considered more expensive than its peers, but its consistent performance proves it deserves the valuation.

Sectors: Financials, Money-Center Banking

Financials Basket Member = limited allocation size

Morgan Stanley (MS)*

Considered the Best-of-Breed in investment banking, taking the title from the likes of Goldman Sachs (GS), Morgan Stanley (MS) has become a standout financial with an excellent dividend.

Sectors: Financials, Investment Banking

Financials Basket Member = limited allocation size

Nike (NKE)*

The historic #1 purveyor of shoes, athletic apparel and equipment in the world, Nike continues to dominate its sector with new technology and innovative ideas, continually outshining its competitors to remain Best-of-Breed.

New-found success in Direct-to-Consumer (DTC) and personalization, Nike has proven that even in a global pandemic, it has what it takes to make the sales and reach its consumers.

Sectors: Consumer Products, Apparel

Schwab (SCHW)*

The leader in the brokerage space, Schwab is most certainly the best-in-breed of all of the different retail brokerages and even many of the larger investment firms.

Sectors: Financials, Stock Brokerages

Financials Basket Member = limited allocation size

Take Two Interactive (TTWO)

The makers of such incredibly popular video game series as Grand Theft Auto, Red Redemption, NBA2K, and Borderlands, Take Two Interactive (TTWO) is one of the leaders in video game development.

Sectors: Gaming, e-Sports

Visa (V)*

The oldest and often considered the best of the credit card processors, Visa (V) is certainly Best-in-Breed. With a decent dividend and relatively decent protection against potential debt crises, Visa rounds out the Financials Basket.

Sectors: Credit Card Payment Processor

Financials Basket Member = limited allocation size

Disruptors

Amazon (AMZN)

The leader in online retail and one of the Best-in-Breed in both cloud services and streaming, Amazon is set up to become one of the biggest companies in American history.

Sectors: Tech, e-Tail, The Cloud, and more!

Long-Term Speculative Basket Member = limited allocation size

Arm Holdings (ARM)

Arm Holdings is a member of an exclusive club – a semiconductor manufacturer who builds CPUs, GPUs, and a variety of other chips used by nearly every industry from automobiles to video games. Taken private in 2016, ARM IPO’ed on September 14, 2023 and became the first “Class of 2023” new investment in this portfolio.

Sectors: Semiconductors, AI

Long-Term Speculative Basket Member = limited allocation size

Block (SQ)

Formerly known as Square (SQ), Block is a mobile payment processor for small-to-medium businesses which has also broken out into capital products including short-term business loans with opportunities in consumer payments; as well as acquiring AfterPay, a Buy-Now-Pay-Later (BNPL) service.

Contact-less payments through their Square Cash app has made Block extremely popular in a world wary of contagion by touching keypads and other devices in public.

Sectors: Fintech, Credit Alternatives

Canopy Growth Corp (CGC)

The #1 consumer purveyor of recreational cannabis in Canada with a $4B investment from Constellation Brands (STZ) with its eyes on dominating the U.S. market in coming years.

Sectors: Consumer Cannabis

Coinbase (COIN)

Currently, the leader in cryptocurrency exchanges (and the only one publicly-traded now that Voyager has gone bankrupt), Coinbase allows users to buy and sell Bitcoin and many other cryptocurrencies in a similar fashion to a stock broker.

Sectors: Cryptocurrency

Long-Term Speculative Basket Member = limited allocation size

Dutch Bros (BROS)

Dutch Bros (BROS) is a hugely-popular coffee chain in the Pacific Northwest that rivals Starbucks (SBUX). With a powerful dedication to its employees and incredibly loyal customers, BROS stands to be an excellent competitor to the big guy in the space.

Sectors: Coffee, Restaurants

IDEXX Laboratories (IDXX)

The #1 purveyor of veterinary equipment, testing, and supplies and the Best in Breed play on the Humanization of Pets thesis.

Thanks to the global pandemic, it seems everyone is becoming a pet parent, and this new trend only benefits IDEXX further.

Sectors: Veterinary Medicine, Veterinary Technology

* IDEXX Labs (IDXX) is part of the Pets Basket and shares an allocation with the other positions in the basket.

Logitech (LOGI)*

Long-time maker of computer and video game peripherals including mice, keyboards, controllers, headsets, speakers, videoconferencing, and much, much more.

Console-agnostic, Logitech makes equipment for Windows, OS/X, Sony Playstation, Microsoft Xbox, Nintendo Switch … everything.

Their line of products makes Logitech the ultimate Work-From-Home (WFH) play.

Sectors: Computer Hardware, Gaming, e-Sports, Work-From-Home (WFH)

Meta Platforms (META)

Owners of perhaps the most notorious social media in the world, Meta Networks (META) runs Facebook, Instagram, WhatsApp, and is investing heavily in trying to become the main creator of the metaverse, the next iteration of the internet.

With Meta burning through billions in a desperate attempt to pivot to the metaverse, this is no longer the reliable social media growth company of that past. According it’s been rolled into the “Disruptors” section of the portfolio and finds a place in the “New Speculative” Basket.

Sectors: Social Media, Metaverse

Nvidia (NVDA)*

Class-leading innovator of chipset technology for the data center, autonomous vehicles, graphics and much more.

Nvidia’s the leader in Graphic Processing Units (GPUs0), processors not only used in gaming and graphics application, but also capable of powering gigantic data servers for use in the Cloud space.

Sectors: Data Center, Gaming, e-Sports, Semis, The Cloud

Palo Alto Networks (PANW)

Best-in-breed developer and provider of state-of-the-art cybersecurity services with visionary CEO Nikesh Arora.

Sectors: Cybersecurity, Technology

Rivian (RIVN)

Yet another Electric Vehicle (EV) maker, Rivian (RIVN) set itself apart by focusing on a multipurpose pickup truck, beating leaders like Tesla (TSLA) to market with a truck so good that it blew all the reviewers away.

Rivian came public in November 2021 to much fanfare and could be “the next Tesla” as so many analysts are calling it. Highly-speculative, this position makes up part of the Speculative Basket in this portfolio.

Sectors: Electric Vehicles, Battery Technology

Roblox (RBLX)

Video game universe and development platform allowing gamers to play, develop, and sell their own games to others.

Roblox (RBLX) came public in 2021 and has been a huge hit with gamers and software developers. Providing a safe place for younger gamers, Roblox also prides itself in being at the forefront of the “metaverse” – the future of the internet where VR and AR permits experiences unlike any seen before.

Sectors: Gaming, e-Sports, Metaverse

Salesforce (CRM)

Considered Best-of-Breed in The Cloud sector, even considered the creator of The Cloud concept to most, Salesforce is the leader in Software As A Service (SAAS) Customer Relationship Management (CRM).

With an amazing CEO who also focuses on Environmental, Social, and Governance (ESG) concerns, CRM has an amazing track record of growth and out-performance.

Sectors: The Cloud, CRM

Long-Term Speculative Basket Member = limited allocation size

Shopify (SHOP)

Shopify (SHOP) is an e-commerce platform responsible for empowering small businesses (as well as medium and large businesses) globally to build an online presence and thrive selling their products internationally.

Sectors: Technology

Old-Spec Basket Member = limited allocation size

Skyworks Solutions (SWKS)*

Skyworks Solutions (SWKS) makes many if not most of the components that go into cell-phones and mobile devices. This semiconductor manufacturer may be the Best-of-Breed play for the 5G mobile data network upgrade internationally with a sizable dividend.

This position makes up part of the Speculative Basket in this portfolio.

Sectors: Semiconductors, Mobile, 5G

Snowflake (SNOW)

Snowflake (SNOW) offers artificial intelligence services to clients who can choose to “pay-as-they-go” meaning they only pay for what they need instead of paying for an entire contract they may not use. As a result, Snowflake has become incredibly popular.

This position makes up part of the New-Spec Basket in this portfolio.

Sectors: AI, Technology

SoFi Technologies (SOFI)

SoFi Technologies (SOFI) provides banking, investing, and loan services using innovative technologies as it tries to become a leader in the financial technology (fintech) sector.

With excellent leadership and a rabid fanbase, SoFi has been able to pull up from its recent death spiral.

Due to its volatility, this position doesn’t receive a full allocation and makes up part of the Financial Basket in this portfolio.

Sectors: Brokers, Banking, Fintech

Tesla (TSLA)

From its enigmatic CEO, Elon Musk, to its iconic cars and battery packs, Tesla (TSLA) may be the most well-known disruptor company, all the way up there with Amazon (AMZN).

Its long-term growth prospects are outstanding, however the stock’s volatility is just as insane. This is a wild-child and the stock is a lightning rod in both rallies and selloffs.

Sectors: Electric Cars, Automation, Battery Technology, Solar Panels, you name it…

Twilio (TWLO)

Twilio (TWLO) provides cloud communications services helping major companies manage customer interaction, GPS location, embedded voice, video, and more into software packages.

A very popular tech startup, TWLO is extremely volatile and is prone to huge swings in price movement with inconsistent performance but exciting prospects.

Sectors: The Cloud, Software-as-a-Service (SaaS), New Tech

Long-Term Speculative Basket Member = limited allocation size

Zoetis (ZTS)*

Zoetis (ZTS) develops medicines and medical treatments for pets and works as a Best-in-Breed play on the Humanization of Pets thesis.

Now that nearly everyone has become a pet parent, this trend only benefits Zoetis further.

Sectors: Veterinary Medicine, Veterinary Technology

* Zoetis (ZTS) is part of the Pets Basket and shares an allocation with the other positions in the basket.

* Indicates a stock that yields a dividend. Reinvested dividends provide significant long-term gains and can also offer solace during periods of market downturns.

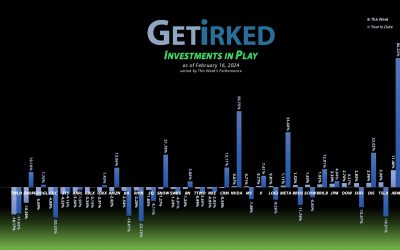

Investments in Play #269

Snowflake Falls from The Cloud! Coinbase (COIN) moons alongside Bitcoin; Snowflake (SNOW) loses its CEO and its edge; I add to Alphabet (GOOGL) and SNOW; and reinvest dividends in Schwab (SCHW).

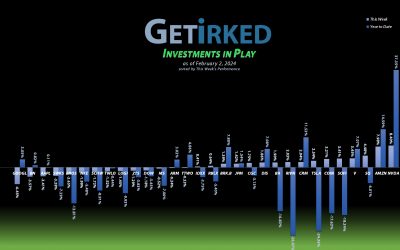

Investments in Play #268

Block (SQ) once again knocks everyone’s block off; Rivian (RIVN) blows a fuse and may never ride again; I reinvest dividends in Apple (AAPL) and Morgan Stanley (MS); take profits in Nvidia (NVDA); open a new position in Palo Alto Networks (PANW); and add to RIVN x 2 as well as Visa (V)!

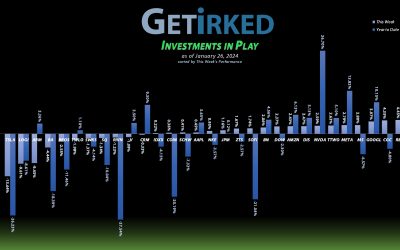

Investments in Play #267

Coinbase (COIN) cashes in on Bitcoin; Twilio (TWLO) falls from the clouds; I beat on Canopy Growth (CGC); introduce the AI Basket; and add two new positions: Shopify (SHOP) and Snowflake (SNOW)!

Investments in Play #266

Arm Holdings (ARM) gets a huge leg up on AI; Canopy Growth Corporation (CGC) remains a stinker; I lock in +4,500% in gains on Nvidia (NVDA); and take profits in ARM, Berkshire (BRK.B), Disney (DIS), and Roblox (RBLX).

Investments in Play #265

Meta (META) blew the socks off EVERYONE; Alphabet (GOOGL) put everyone’s socks back on; and I reinvested dividends in JP Morgan (JPM). Sometimes, it’s just a slow week.

Investments in Play #264

Always bet on Buffett (BRK.B), Tesla (TSLA) completely unplugs; and I take profits in Google (GOOGL), Nvidia (NVDA), and Visa (V) before earnings.